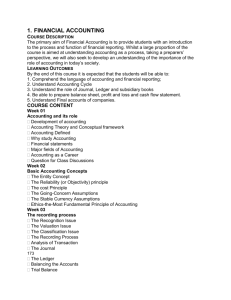

accounts pre board 1. 2012-13 - Kendriya Vidyalaya No.1 Ichhanath

KENDRIYA VIDYALAYA NO.1,( ICHHANATH) SURAT

FIRST PRE BOARD EXAMINATION (2012-13)

Class – XII

SUB: ACCOUNTANCY(055)

Time Allowed: 3 Hrs.

GENERAL INSTRUCTIONS:

1.

This question paper contains two parts A and B.

2.

Both the parts are compulsory.

3.

Internal choice is given in question No 17 & 18.

4.

All parts of questions should be attempted at one place.

M.M.80

[PART A : PARTNERSHIP AND COMPANY ACCOUNTS]

Q.1 State the provisions of Indian partnership ACT,1932 regarding interest on partners capital and interest on partner’s loan when there is no partnership deed. (1)

Q.2 Enumerate two factors affecting valuation of goodwill?

Q.3 What is meant by ‘Buy back of shares’?

(1)

(1)

Q.4 State any one difference between gaining ratio and sacrificing ratio (1)

Q.5 A and B are partners. C is admitted for 1/4 th

share. What is the ratio in which A and B will sacrifice their share in favour of C?

Q.6 Name the method of redemption which does not involve outflow of cash.

(1)

(1)

Q.7 Rate of return is 10% whereas borrowing cost is 12%. The company raise funds through issue of fresh share capital.in your opinion, which value has been fulfilled by the company in raising funds? (1)

Q.8 A, B and C are partners in a firm. They have omitted interest on capital @12% p.a. for three years ended 31 st

March, 2007. Their fixed capitals on which interest was to be calculated throughout were:

A- Rs.1,00,000, B-Rs.80,000, C-Rs.70,000

Give the necessary adjusting journal entries with working notes. (3)

Q.9 Future Venture Ltd. purchased building costing Rs. 70,00,000 from DLF Ltd. The company paid Rs. 20,50,000 by cheque and for the balance issued equity shares of Rs. 100 each in favour of DLFLtd. Pass necessary journal entries in the books of Future Ltd. for the purchase of building and making payment if shares were issued (a) at 10% discount and (b) at a premium of 25%.

Q.10 State the exceptions to the creation of Debenture Redemption Reserve as per SEBI

(3)

Guidelines. (3)

Q.11 S Ltd. forfeited 300 equity shares of Rs.10 each issued at a premium of Rs.5 per share, for non payment of allotment money of Rs.8 per share (including premium), first call of

Rs.2 per share and final call of Rs.3 per share. Out of these 200 equity shares were issued at Rs.14 per share. Pass the necessary journal entries for forfeiture and reissue of shares. (4)

Q.12 X, Y and Z were sharing profits and losses in the ratio of 5:3:2. They decided to share future profits and losses in the ratio of 2:3:5 with effect from 1/4/2011. They decided to record the effect of the following, without affecting their book values:

(a) Profit and Loss Account (cr.) Rs. 24, 000

(b) Deferred Advertisement expenditure Account

(c) General Reserve

(d) Workman’s Compensation fund

Rs. 12, 000

Rs. 9,000

Rs. 4,000

Pass the necessary adjusting entry. (4)

Q.13 Arjune,Bhim and Nakul are partners sharing profit and losses in the ratio of 14:5:6 respectively. Bhim retires and surrenders his 5/25 th

share in favour of Arjun.The goodwill of the firm is valued at 2 years purchase of super profits based on average profits of last 3 years.The profits for the last 3 years are Rs.50,000, Rs.55,000 and Rs.60,000 respectively.The normal profits for the similar firm are Rs.30,000.Goodwill already

appears in the books of the firm at Rs.75,000.the profit for the first year after Bhims retirement was Rs.1,00,000.Give the necessary journal entries to adjust Goodwill and distributes profits showing your workings. (4)

Q.14 X Ltd. Purchased machinery for Rs.5,00,000 from y ltd. Half of the amount was paid by accepting a Bills of Exchange drawn by Y Ltd.payable after three months.The balance was paid by issue of equity shares of Rs.10 each at a premium of 25%. Pass necessary journal entries in the books of X Ltd.for these transactions. (4)

Q.15 (a) A,B and C are partners sharing profit and losses in the ratio of 5:3:2 from 1 st

April, 2012, they decide to share profit and losses equally.the partnership deed provides that in the event of any change in profit sharing ratio,the Goodwill should be valued at three year’s purchase of the average of five years profits.the profits and losses of the preceding five years are:

Profit 2007-08- RS.60,000, 2008-09- Rs.1,50,000, 2009-10-Rs.1,70,000, 2010-11 –

Rs.1,90,000 loss 2011-12 Rs.70,000.

Give the necessary journal entry to record the above changes. (4)

(b) X,Y,and Z are partners in a firm sharing profit in the ratio of 3:2:1.they decide 10% out of yearly profit shall be given to workers as a bonus.

Give two human values which are involved in this decision.

Q.16 Following is the balance sheet of A and B on 31 st

December 2010:

Liabilities Amount

Rs.

Assets

Sundry Creditors

Mrs. A’s Loan

General Reserve

Bank loan

60,000

10,000

20,000

10,000

Cash

Stock

Investments

Furniture

Investments fluctuation fund

A’s Capital

B’s Capital

2,000

20,000

20,000

Debtors 40,000

Less: Provision 4,000

Plant

1,42,000

The firm was dissolved on 31 st

December 2010 on following terms:

(a)

A promised to pay Mrs. A’s Loan and took over stock at Rs. 8,000.

(2)

Amount

Rs.

26,000

10,000

20,000

10,000

36,000

40,000

1,42,000

(b) Debtors realized Rs. 38,000.

(c) Creditors payable after one month were paid immediately at 6% discount.

(d) Plant realized Rs. 50,000, furniture realized at book value and investments Rs. 19,000.

(e) Old typewriter completely written off, estimated to realize Rs. 600 is taken over by B.

(f) Realisation expenses, Rs. 2,000 paid by A.

Prepare necessary ledger accounts to close books of the firm. (6)

Q.17 (a) A Company issued for public subscription 40,000 equity shares of RS.10 each at a premium of Rs.2 per share payable as under:

On application

On allotment

On first call

On second call

Rs.2 pe share

Rs.5 per share (including premium)

Rs.2 per share

Rs. 3 per share

Applications were received for 60,000 shares allotment was made on pro-rata basis to the applicants for 48,000 shares,the remaining applications being refuse money over paid on application was utilized towards sums due on allotment.Ram whom 1,600 shares were allotted failed to pay the allotment money and shyam to whom 2,000 shares were allotted failed to pay the two calls.these shares were subsequently forfeited after the second call was made.all the forfeited shares were reissued as fully paid at Rs.8 per share.

Give the necessary journal entries for the above transactions. (6)

(b) Which value has been affected by rejecting the applications of the applicants who had applied for 12,000 shares ? suggest a best alternative for the same. (2)

OR

Swarna Limited invited application for issuing 60,000 shares of Rs. 10 each at par. The amount was payable as follows :

On Application Rs. 2 per share

On Allotment Rs. 3 per share

On First and Final Call Rs. 5 per share

Applications were received for 92,000 shares. Allotment was made on the following basis:

(i) To applicants for 40,000 shares - Full

(ii) To applicants for 50,000 shares - 40%

(iii) To applicants for 2,000 Shares - Nil

Rs. 1,08,000 was realised on account of allotment (excluding the amount carried from application money) and Rs. 2,50,000 on account of call.

The directors decided to forfeit shares of those applicants to whom full allotment was made and on which allotment money was overdue.

Pass journal entries in the books of Swarna Limited to record the above transactions.

Q.18 Anjali and Trisha were partners in a firm sharing profits in the ratio of 3:2. They admitted

Sabby as a new partner for l/6th share in the profits. Sabby was to bring Rs. 50,000 as his capital and the capitals of old partners were to be adjusted on the basis of sabby’s capital having regard to profit sharing ratio.

Balance Sheet of Anjali and Trisha as on 31.3.2006

Liabilities

Creditors

Amount

Rs.

36,000

Assets

Cash

Debtors

Amount

Rs.

10,000

34,000

Bills Payable

General Reserve

Capitals : Rs.

Anjali 1,50,000

20,000

24,000

Stock

Machinery

Building

24,000

42,000

2,00,000

Trisha 80,000 2,30,000

3,10,000

The other terms of agreement on Sabby’s admission were as follows :

(i) Sabby will bring Rs. 18,000 for his share of goodwill,

3,10,000

(ii) Building will be valued at Rs. 1,85,000 and machinery at Rs. 40,000.

(iii) A provision of 6% will be created on debtors for bad debts,

(iv) Capital accounts of old partners will be adjusted by opening Current Accounts.

Prepare Revaluation Account, Partners Capital Accounts and the Balance Sheet of New firm. (8)

OR

A,B and C were partners sharing profits in the proportion of 1/2, 1/3,and 1/6 respectively.

The balance sheet of the firm on 31.03.2007 was as follows:

LIABILITIES Rs.

ASSETS Rs.

Creditors 12,600 Cash at bank 4,100

Provident fund 3,000 Debtors 30,000

Reserve fund

Capitals:

A

B

C

9,000

40,000

36,500

20,000

121,100

Less provision - 1,000

Stock

Investments

Patents

Plant &Machinery

29,000

25,000

10,000

5,000

48,000

121,100

C retired on the above date on the following terms:

1) Goodwill of the firm was valued at Rs. 27,000 , but no goodwill a/c to be raised in the books of the firm.

2) Value of the Patents to be reduced by 20%, and that of Plant &Machinery by 10%.

3) Provision for doubtful debts was to be raised to 6%

4) Investments were valued at Rs.16,000

Prepare Revaluation a/c., Capital a/cs of partners and the Balance Sheet of A and B after C’s retirement.

[PART B : ANALYSIS OF FINANCIAL STATEMENTS]

Q.19 Current ratio of M Ltd. Is 2:1.State whether purchase of goods for cash will improve, decline or will have no change in the ratio.

Q.20 Briefly explain any 1 objective of Cash Flow Statement.

(1)

(1)

Q.21 Priya Agro Industries Ltd. is engaged in the export of readymade garments. The company purchased a machinery of Rs. 10, 00,000 for the use in packaging of such garments. State giving reason whether the cash flow due to the purchase of machinery will be cash flow from operating activities, investing activities or financial activities? (1)

Q.22 Name three items which are shown under ‘long term Borrowings’ under the head Noncurrent Liabilities in a Companies’ Balance sheet.

Q.23 Prepare Comparative Income statement from the following information:

(3)

(4)

PARTICULARS 2006 (Rs) 2007 (Rs)

SALES

COST OF GOODS SOLD

2,00,000

60% of sales

3,00,000

70% of sales

INDIRECT EXPENSES 50% of gross profit 40% of gross profit

INCOME TAX 50% of net profit before tax

50% of net profit before tax

Q.24 Calculate any two of the following ratios from the given information:

1) Operating Ratio

2) Stock Turnover Ratio

3) Quick Ratio

Sales-Rs.25,00,000, Cost of Goods Sold-Rs.19,00,000 , Operating Expenses-

Rs.2,40,000, Profit before Tax Rs.2,70,000, Current Assets- Rs.4,87,500, Current

Liabilities- Rs.3,00,000, Fixed Assets-Rs.2,62,500, Opening Stock-

Closing Stock- Rs.3,50,000.

Rs.2,50,000,

(4)

Q.25 Calculate the cash flow from operating Activities from the following information by the indirect method. (6)

Particulars

Statement of profit And loss

General reserve

Provisions for Depreciation on plant

Outstanding expenses

Goodwill

Sundry debtors

31-03-2011(Rs.) 31-03-2012(Rs.)

30,000 35,000

10,000

30,000

5,000

20,000

40,000

15,000

35,000

3,000

10,000

35,000

An item of plant costing Rs.20, 000 having book value of Rs.14, 000 was sold Rs.18, 000 during the year.

*****************