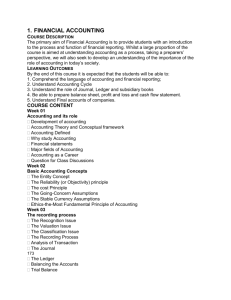

Paper - Kendriya Vidyalaya IIT Chennai

KENDRIYA VIDYALAYA SANGATHAN, CHENNAI REGION

COMMON PREBOARD EXAMINATION 2013-2014

ACCOUNTANCY

Time allowed:3 hrs

CLASS : XII Max.Marks:80

General Instructions:

1.

All the questions are compulsory

2.

Attempt all the questions

3.

Show your workings wherever necessary

4.

All parts of a question should be attempted at one place.

PART A

(Accounting for Partnership Firms and Companies)

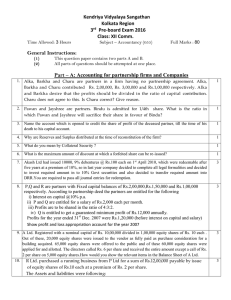

1.In the absence of a Partnership Deed how interest on capital is allowed to partners? (1)

2. List out any two factors affecting goodwill (1)

3. What journal entry will you pass when a partner agrees to pay the realization expenses on behalf of the firm ?

(1)

4. A and B share profits and losses in the ratio of 4:3. They admit C with 3/7 th share, which he gets 2/7 th from A and

1/7 th from B. What is the new ratio ? (1)

5. What is Calls-in-arrears ?

6. What is meant by ‘Under subscription of shares’?

(1)

(1)

7.Give the meaning of ‘Irredeemable debenture’. (1)

8. A firm earns Rs.60,000 as its annual profits, the normal profits being 10%. The assets of the firm amount to

Rs.7,20,000 (excluding goodwill) and Liabilities to Rs.2,40,000. Find out the value of goodwill by Capitalisation

Method. (3)

9. Show by means of journal entry, how you would record the following issue.

B Ltd issues 30,000; 10% Debentures of Rs.100 each at a discount of 5% to be repaid at par at the end of 5years.

(3)

10. X Ltd took over assets of Rs.7,00,000 and liabilities of Rs.60,000 of W Ltd for the purchase consideration of

Rs.6,60,000. X Ltd paid the purchase consideration by issuing debentures of Rs.100 each at 10% premium. Give journal entries in the books of X Ltd. (3)

11.Pass journal entries for the following transactions on the Dissolution of the firm of T and P after the various assets

(other than Cash) and outside liabilities have been transferred to Realisation a/c:

(a) Bank loan Rs.34,000 was paid.

(b) Furniture worth Rs.70,000 was taken over by partner T at Rs.43,000.

(c) Partner P agreed to pay a creditor Rs.7,500

(d) Partner’s loan was paid off Rs.10,000 (1*4=4)

12.A and B are partners in a firm sharing profits and losses in the ratio of 3:2. They admit C into partnership for 1/5 th share. C brings in Rs.30,000 as capital and Rs.10,000 as goodwill. At the time of admission of C, goodwill appears in the Balance sheet of A and B at Rs.3,000. The new ratio of the partners will be 5:3:2. Pass necessary entries.

(4)

13.L ltd forfeited 470 equity shares of Rs.10 each issued at a premium of Rs.5 per share for non-payment of allotment money of Rs.8 per share (including share premium Rs.5 per share) and first and final call of Rs.5 per share.

Out of these 60 equity shares were subsequently reissued at Rs.14 per share.

Give journal entries to record the following transactions of forfeiture and reissue of shares. (4)

14. A company issued 30,000 fully paid equity shares of Rs.100 each for purchase of the following assets and liabilities from S&Co:

Plant Rs.7,00,000

Land and Building Rs.12,00,000

Stock-in-trade Rs.9,00,000

Sundry Creditors Rs.2,00,000

You are required to pass the necessary journal entries: (4)

15. Pass necessary journal entries for the following transaction: i) Issued 1,00,000, 9% debentures of Rs.100 each at a discount of Rs.10 per debenture redeemable at a premium of

Rs.5 per debenture. ii) Issued 100,7% debentures of Rs.100 each at Rs.105 each payable at Rs.100 each. iii) Converted 1,800, 9% debenture of Rs. 100 each into 12% debentures of Rs.100 each at a premium of Rs.25%.

(6)

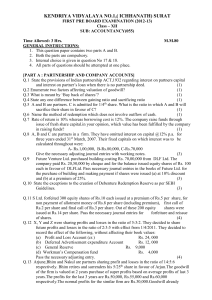

16. A, B and C were partners in a Firm sharing profits in proportion of their Capitals.

On 31.3.2006 their Balance sheet was as follows:

Balance Sheet as on 31.3.2006

Liabilities

Creditors

Reserve

Capitals

A 40000

B 60000

C 1,00,000

Amout

16000

12000

200000

Assets

Buildings

Machinery

Stock

Debtors

Cash

228000

========

Amount

140000

60000

8000

12000

8000

228000

========

B died on 30.6.2006. Under the partnership agreement the executors of the deceased partner were entitled to:

1. Amount standing to the credit of partner’s Capital A/c

2. Interest on Capital at 12% p a.

3. Share of Goodwill. The Goodwill of the Firm on B’s deathwas valued at Rs.2,40,000.

4. Share of profit from the closing of last Financial Year to the date of death on the basis of last year’s profit.

Profit for the year ended 31.3.2006 wasRs.15000.

Prepare B’s Capital A/c to be rendered to his executors.

Which value has been ensured in the firm. (6)

17. Bharat Ltd. invited applications for issuing 2 lakh equity shares of Rs.10 each.

The amount was payable as follows:

On application Rs.3 per share

On allotment Rs.5 per share and

On First and Final call Rs.2 per share

Applications for 3 lakh share were received and pro-rata allotment was made to all the applicants. Bajaj, who

was allotted 3,000 shares, failed to pay the allotment and call money. His shares were forfeited. Out of the

forfeited shares, 2,500 shares were reissued as fully paid up @ Rs.8 per share. Pass the necessary journal entries

to record the above transaction. (8)

OR

Prakash Engineering issued 40000 equity shares of Rs.10 each at a premium of

Rs.2 per share payable as

On application Rs.2 per share

On allotment Rs.5 per share (including premium of Rs.2 )

On first call Rs.2 per share

On final call Rs.3 per share

Applications were received for 75,000 equity shares. The shares were allotted pro-rata to the applicants of

60,000 shares only. The remaining applications wererejected. Money overpaid on application was utilized towards the sum due on allotment. Ashok to whom 3,000 share were allotted failed to pay the allotment money and the two calls. B who applied for 3,000 shares paid the call money along with allotment money.

(i) Pass the journal entries to record the above transactions.

(ii)Which value has been affected due to the rejection of shares?

18. X and Y who were sharing profits and losses in the ratio of 3:1 respectively, decided to dissolve the firm on

31.3.2010 on which date some of the balances were:

X’s Capital – Rs.1,00,000, Y’s Capital Rs.1,00,000(Debit Balance), Profit and Loss A/c-Rs.8,000(Debit Balance), Trade

Creditors- Rs.30,000, Loan from Mrs.X-Rs.10,000, Cash in Bank – Rs.2,000.

The Assets (other than cash in bank) realized Rs.1,10,000 and all Creditors were paid off less 5 % discount.

Realisation expenses amounted Rs.1,000.

Prepare the Realisation Account, Bank Account and the Capital Accounts of the Partners assuming that both the partners were solvent. (8)

OR

A and B were partners in a Firm sharing profits in the ratio 3:2. They admitted C as a new partner for 1/6 th share in the profits. C was to bring Rs.40,000 as his capital and the Capitals of A and B were to be adjusted on the basis of C’s

Capital having regard to profit sharing ratio. The balance sheet of A and B as on 31.3.2006 was as follows:

Liabilities

Creditors

Bills payable

General Reserve

Capital

A 150000

B 80000

Balance Sheet as on 31.3.2006 of A and B

Amount

36000

20000

24000

Assets

Cash

Debtors

Stock

Machinery

Building

Amount

10000

34000

24000

42000

200000

310000

======

230000

310000

======

The other terms of agreement on C’s admission were as follows:

1.

2.

3.

4.

C will bring Rs.12000 as his share of Goodwill.

Building will be valued at Rs.1,85,000 and Machinery at Rs.40,000

A provision of 6% will be credited on Debtors for Bad Debts.

Capital Accounts of A and B will be adjusted by opening current accounts

Prepare Revaluation Account, Partner’s Capital Account and the Balance Sheet of A, B, and C.

Which value is upheld by the Partnership Firm.

PART B

ANALYSIS OF FINANCIAL STATEMENTS

19. What are two major inflow and two major outflows of cash from investing activities?(1)

20. Mutual Fund Company receives a dividend of Rs.25 lakhs on its investments in other Company’s shares. Why is it a cash inflow from operating activities for this Company?(1)

21. What is meant by Financial Analysis? Mention only two tools used for financial analysis. (1)

22. Under which heads the following items appear in the Balance Sheet of a company as per Revised ScheduleVI

Part I of the Companies Act 1956:

(i) Mining rights

(ii) Encashment of employees earned leave payable on retirement

(iii) Vehicles (3)

23. (a)The Current Assets of a company are Rs.1,26,000 and the current Ratio is 3:2 and the inventories are Rs.2000. Find out the Liquid Ratio.

(b) Inventory Turnover Ratio is 3 times. Sales are Rs. 1,80,000, Opening Stock is Rs. 2000 more thanthe closing stock. Calculate the opening and closing stock when goods are sold at 20% profit on cost.

(4)

24. From the following statement of Profit & Loss of S ltd for the years ended 31/03/2011 and 2012 Prepare

Comparative statement of Profit &Loss . (4)

Particulars

Revenue from operations

Other Incomes

Expenses

Note No. 2011-12

25. Following is the Balance Sheet of W Ltd as on 31/03/2012.

20,00,000

12,00,000

13,00,000

2010-11

12,00,000

9,00,000

10,00,000

Particulars

I.

Equity & Liabilities

1.Sharehoder’s Funds

Note No. 2012 2011

(a)Share Capital

(b)Reserves and Surplus

(Profit & Loss Balance)

2. Non-current Liabilities

Long term borrowings

3. Current Liabilities

Trade Payables

TOTAL

II Assets

1.

Non-current assets

(a) Fixed Assets

Tangible Assets

2.Current Assets

(a) Inventories

(b) Trade receivables

(c) Cash & Cash Equivalents

TOTAL

7,00,000

2,00,000

3,00,000

30,000

12,30,000

11,00,000

70,000

32,000

28,000

12,30,000

6,00,000

1,10,000

2,00,000

25,000

9,35,000

8,00,000

60,000

40,000

35,000

9,35,000

Adjustments: During the year a piece of machinery of the book value of Rs. 80,000 was sold for Rs.

65,000.Depreciation provided on Tangible Assets during the year amounted to Rs.2,00,000.

Prepare a Cash Flow Statement. (6)

******************************************************************************