E-Commerce and Accounting Principles

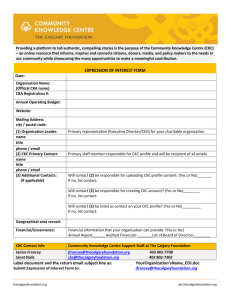

advertisement

E-Commerce and Accounting Principles an observation By Mahender Khari Khari & Co International Accountants 1 E-COMMERCE Accountability Procedures? Banking Travel Gambling Professional Advice 2 E-c shift in buyer behaviour Sell online- e- procurement E-care for customers E-care business partners E- learning The web continues to produce new value models that need to be translated into more appropriate accounting standards for accountability. 3 ACCOUNTING PRINCIPLES CA 1985 Sch 4 requires the preparation of company accounts to be based on the principles of: - going concern - consistence - accrual - prudence Consider: Fundamental changes in the market and/or in technology Forced reductions in operations, e.g. necessitated by outsourcing abroad Loss of key customers 4 ACCOUNTING RULES CA 1985 sets out two alternative sets of accounting rules - the historical cost of accounting rules - the alternative accounting rulesQ: Should we price/capitalise information according to its value or its cost? Q: Could these accounting rules be applied to E-c transactions worldwide? Q: Should we adopt legal approach as opposed to substance-over-form for accountability of financial data? Q. What does the conventional wisdom say? “Mathematically arrived values raise many questions about the reliability of the financial data”. Source AIA journal 5 ACCOUNTING STANDARDS “CA 1985 s 256 defines accounting standard as “statements of standard accounting practice issued by such body or bodies as may be prescribed by regulations” Accounting Standards are developed in the UK by ASB/FRC/FRRP/UITF Financial Reporting Council Financial Reporting Review Panel Accounting Standards Board Urgent Issues Task Force 6 FINANCIAL STATEMENTS Comprise of: Balance Sheet Income Statement Statement of Changes in Equity Cash Flow Statement Notes Accounting Policies Directors Report; NO SPECIFIC REQUIREMENT TO DISCLOSE E-C GENERATED TRANSACTIONS 7 ACCOUNTING QUALITIES Understandability Reliability & Relevance Verifiability Predictability Comparability & Consistency Suitability for decision making=usefulness COMPLEXITY & DECREASE TRANSPERANCY =E-c 8 IAS 1 Presentation of Financial Statements • Basis for Presentation • Comparability – Previous Period and Other Entities • Going Concern Basis • Accrual Basis • Classification • Annually or More Frequently • Current and Non-current Assets • Short and Long-term Liabilities “Fair presentation requires faithful representation of the effects of transactions, events and conditions in accordance with the definitions and recognition criteria for assets, liabilities, income and expenses” 9 FRS 28 CORRESPONDING AMOUNTS The fast pace of E-c is in fact causing first year’s trading results to be different to the second year, the second year’s results to be significantly different to the third year etc… Q: Would it not be misleading to compare results? Many financial statements show in their P&L Account a high cost of digitalisation in year one but low subsequent marginal costs. This is a prime example of non-comparability one year with the next. This is because information is costly to produce but cheap to reproduce. The technology infrastructure makes information more accessible and hence more valuable but its value is difficult to quantify. The accounting practices are in favour of “historic cost basis”. However, the cost of same information, in the world of E-c can and often does fluctuate from one period to the next. 10 …FRS 28 Corresponding Amounts Audit practice ignores the impact of E-c and places too much emphasis on accounts rather than assessment of the E-c-related global risk. The professional judgement accorded to accountants in expressing their opinion on financial statements is proving to be a step behind the fast-paced E-c. Old practice of accountability can produce misleading results when transactions are bundled together regardless of distinction between E-c and non E-c-related activities. The legitimacy of the techniques used by the accounting profession in the E-c world is open to questioning. 11 Comparison not helpful Outsourcing = redundancies, currency risks, lack of direct control, political uncertainties, Net Asset valuations = not reliable Forecast= not reliable Taxation= various mitigating schemes in market Income & expenditure= fluctuates due to market forces 12 Is hamonisation possible? Is there a justification why accounting rules and standards should be fundamentally and vastly different ? US, China, Japan and Taiwan e g differ in their accounting language. Different traditions in accounting and different legal and economic realities of the new E-c world, contribute to varied practices. The objective being, to communicate in a manner that the entrepreneurs of Ec world understand. To make Business life easier use same accounting rules . 13 US FASB and IASB MOU “Shared objective to develop common accounting standard for use in the world’s capital markets. Consistency, comparability, and efficiency of financial statements, enabling global markets to move with less friction Roadmap for the removal for the reconciliation requirement for non-US companies that use IFRS and are registered in the United States. Committee of European Securities Regulators to identify area for improvement of accounting standard.” “First, the Boards will reach a conclusion about whether major differences in focussed areas should be eliminated through one or more short-term standard setting projects, and, if so, the goal is to complete work in those areas by 2008.” “Second, the FASB and the IASB will seek to make continued progress in other areas identified by both boards where accounting practices under US GAAP and IFRSs are regarded as candidates for improvement” (source: International 14 Accountants) EU-HARMONISATION switch to IFRS Variety of legal & tax systems in existence Directives for Company Law harmonisation 4th & 7th Ds adopted into national legislation by EU countries Formats, valuation rules, & preparation & presentation of consolidated accounts Anglo-Saxon= T & F V= as a whole, where as French & German prefer precision EU Directive, not fitting in the global tax philosophy, and having little regard to the practical aspects of the offshore world, is hoping to collect consumer taxes online. Its wishful thinking. 15 IFRS FOR LISTED COMPANIES Wef 2005 global standard for financial reporting except in US Cross border implications/consistency in application National variations in interpretation EU, Australia, China, Switzerland=IFRS Legal issue = who has jurisdiction in cases of conflict = EC of Justice will have busy time ahead 16 COMPLEXITIES OF INTERNATIONAL TRADING Monaco HOLDING COMPANY HOLLAND Beneficiaries Cyprus Subsidiaries Singapore Mauritius UK Via Nominees BVI Buys from China Trading partnership with India Sells to Eastern Europe & Far East Sells to Europe Bank account in Singapore Trust (exotic location) Management Charge Bank account in Mauritius Bank account in India Bank account in Switzerland/UK 17 Taxation Let us take taxation as an expense or cost for example; No consensus is in sight, as to which jurisdiction is entitled to impose taxes on internet transactions e.g digital products such as software and e-books e g VAT. “Nexus,”= deemed presence in the taxing jurisdiction to justify levying of tax- how do you tax an out of state supplier? Opinions and practices differ in US and EU countries. There is no Accounting standard yet that could give us practical guidance on that issue. International Financial Reporting Standards, however sophisticated, in such circumstances will only serve a limited purpose. 18 Transfer of property to foreign corporation 1. 2. 3. 4. 5. 6. 7. 8. 9. A US person transferring property to a foreign corporation has reporting obligations; Connection with foreign foundations/stiftung/trusts. Receipts of gifts from outside US Transactions with foreign corporations/persons Acquiring an interest in foreign corporations =25% Acting as a director/agent of foreign corporations. Nominee relationships Report foreign disregarded entities. Foreign partnerships. Foreign bank accounts. 19 Summary Development of a common accounting language = long way away E-c activities = remain difficult to police Taxation= no accountability, no taxability IFRS & US GAAP harmonisation= a possibility but long way away Next 5 years= exploit the legitimate loopholes 20