採用IFRS之國家如何解決會計問題爭端

勤業眾信會計師事務所

審計部協理 黃桂榮

2009年12月9日

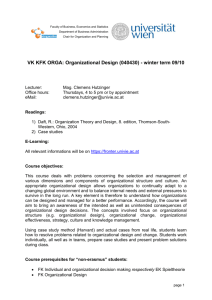

IFRS

SICs and IFRICs

Before 2002 March

After 2002 March

IASB

Standing Interpretations

Committee(

Reporting Interpretations

Committee (IFRIC)

IFRICs(1~19,16)

©2008 Deloitte & Touche. All rights reserved.

©2008 Deloitte & Touche

調查狀況彙總說明

編

號

國家

1

2

3

4

5

6

7

8

9

10

11

12

13

香港

澳洲

新加坡

南非

德國

奧地利

斐濟

英國

義大利

瑞士

西班牙

加拿大

日本

14

15

韓國

中國

16

墨西哥

17

印度

調查完成比例

第一階段:是否制訂或擬制訂處理

會計爭端相關機制

Yes

No/NA

V

V

V

V

V

V

V

V

V

V

V

V(2011)

V(2012, under

consideration)

V(2011)

V(部分採用,仍有

差異)

V(2012)

V(2011)

100%

©2008 Deloitte & Touche. All rights reserved.

第二階段:已採用IFRS且設有處理會

計爭端機制者之實施概況(僅針對第

一階段回覆為”Yes”者再發函)

V

V

V

V

V

V

V

V

100%

©2008 Deloitte & Touche

已採用IFRS 國家

-除IFRIC外另行成立解釋單位者

國別

解釋單位

香港

Financial Reporting Standards Committee of HKICPA

澳洲

Interpretations Agenda Committee (IAC) of Australian

Accounting Standards Board(AASB)

新加坡

南非

德國

奧地利

斐濟

Accounting Standards Council (ASC)

South African Institute of Chartered Accountants (SAICA)/ Accounting

Practices Board (APB)

Accounting Interpretations Committee (AIC) of Accounting

Standards Committee of Germany (ASCG)

Austrian Financial Reporting and Auditing Committee(AFRAC )

(http://www.afrac.at/index_en.php)

Standards Committee of Fiji Institute of Accountants

©2008 Deloitte & Touche. All rights reserved.

©2008 Deloitte & Touche

已採用IFRS 國家

-除發布解釋函以外之正式處理機制

國別

香港

新加坡

歐盟

英國

處理單位

Financial Reporting Standards

Committee of HKICPA

處理機制

提供實務處理意見

European Financial Reporting

Advisory Group(EFRAG)

發布會計實務指引

Statements of Recommended

Accounting Practice (RAPs)

蒐集並研究問題提交IFRIC討論

發布解釋函

EUROPEAN COMMISSION

Internal Market and Services DG

Roundtable for Consistent

Application of IFRSs

Accounting Standards Board

發布 Urgent Issues Task Force

(UITF) Abstracts

Institute of Certified Public

Accountants of Singapore (ICPAS)

©2008 Deloitte & Touche. All rights reserved.

©2008 Deloitte & Touche

已採用IFRS 國家

-非正式處理機制/未成立解釋機構或其他處理機制

國別

處理單位

處理機制

IASB

Financial Crisis Advisory Group (FCAG)

舉行round table meeting

歐盟

四大會計師事務所

不定期會議

香港

四大會計師事務所

不定期會議

義大利

未成立解釋機構或其他處理機制

瑞士

未成立解釋機構或其他處理機制

西班牙

未成立解釋機構或其他處理機制

©2008 Deloitte & Touche. All rights reserved.

©2008 Deloitte & Touche

尚未採用IFRS 國家

-目前討論情形

國別

預計適用年

度

是否擬成立發布解釋單位

the Council of the Institute of Chartered

Accountants of India (ICAI)

說明

發布解釋函及指引

印度

2011

加拿大

2011

否

墨西哥

2012

CINIF

發布解釋令INIF

韓國

2011

目前尚無具體計劃

現行四大有不定期會議

中國

採用部分IFRS , 目前尚無具體計劃

惟仍存在差異

日本

2012年(under

目前尚無具體計劃

consideration)

©2008 Deloitte & Touche. All rights reserved.

加拿大金融主管機關針

對金融業發布會計指引

財政部聲稱其新準則與

IFRS相同,目前其出版刊

物只有解釋新準則如何

適用

©2008 Deloitte & Touche

附件-

各國正式/非正式

解釋機制介紹

©2008 Deloitte & Touche. All rights reserved.

©2008 Deloitte & Touche

香港-除IFRIC外另行成立之解釋單位

HKICPA-Interpretations

•Interpretations collectively refers to following

Interpretations issued by the Hong Kong Institute of

Certified Public Accountants

–Hong Kong (IFRIC) Interpretations (HK(IFRIC)-Int),

–Hong Kong Interpretations (HK-Int),

–Hong Kong (SIC) Interpretations (HK(SIC)-Int)

•Interpretations give authoritative guidance on issues that

are likely to receive divergent or unacceptable treatment, in

the absence of such guidance.

©2008 Deloitte & Touche. All rights reserved.

©2008 Deloitte & Touche

香港-除IFRIC外另行成立之解釋單位

HKICPA-Interpretations(cont’)

Interpretations that are developed locally by the Institute are named

Hong Kong Interpretations.

Interpretation

Number

HK-Int 1

Title

Issue Date

The Appropriate Accounting Policies for

Infrastructure Facilities

Issued in Oct 2004,

reissued in May 2005 and

June 2006

HK-Int 3

Revenue – Pre-completion Contracts for Issued March 2005,

the Sale of Development Properties

reissued in May 2005 and

revised in June 2006

HK-Int 4

Leases – Determination of the Length of Issued May 2005

Lease Term in respect of Hong Kong Land

Leases

Note: HK int 2 related to accounting for Hotel Properties was not “reissued in May 2005”

as the issue is covered by IAS 40 equivalent.

©2008 Deloitte & Touche. All rights reserved.

©2008 Deloitte & Touche

香港-非正式處理機制:四大會計師事務所不定期會議

範例:Financial Reporting Standards Committee Meeting–

HKICPA ( April 2008 )

The Committee considered a referral from the Professional Standards Monitoring

Committee regarding the presentation of the gains and losses on sale of financial

assets arising in the ordinary course of business in the income statement. It was

noted that some preparers show sales proceeds from the sale of financial assets as

revenue (gross), while others present gains and losses on disposal net in the

income statement

.

The Committee agreed that gains and losses arising from the disposal of financial

assets must be presented net in accordance with HKAS 39 Financial Instruments:

Recognition Page 3 of 3 and Measurement - paragraphs 26 and 55 and HKFRS 7

Financial Instruments: Disclosures - paragraph 20(a). The Committee therefore

agreed that it is inappropriate to present gross sales proceeds as revenue.

However, the Committee also noted that the standards do not preclude an entity

providing additional information in the financial statements related to gross sales

proceeds provided that they are not described as “revenue”.

©2008 Deloitte & Touche. All rights reserved.

©2008 Deloitte & Touche

澳洲-除IFRIC外另行成立之解釋單位

•Australia is fully IFRS compliant, and so has issued

Interpretations equivalent to all the SIC and IFRIC

Interpretations.

•Apart from the SIC and IFRIC equivalent Interpretations,

14 local Interpretations have also been issued, 4 of

which have since been superseded by other

Interpretations or Standards.

©2008 Deloitte & Touche. All rights reserved.

©2008 Deloitte & Touche

澳洲- 10

local Interpretations (effective)

Item Interpretation Title

Number

Issue Date Application Date

Interpretation

body

1

1003

Australian

Petroleum

Resource Rent

Tax

Nov 2007

Annual reporting

periods ending on

or after

30 Jun 2008

Australian

Accounting

Standards Board

(AASB)

2

1019

The

Sep 2004

Superannuation

Contributions

Surcharge

Annual reporting

periods beginning

on or after

1 Jan 2005

Urgent Issues

Group

(Predecessor to

the AASB)

3

1030

Depreciation of Sep 2004

Long-Lived

Physical Assets:

Condition-Based

Depreciation

and Related

Methods

Annual reporting

periods beginning

on or after

1 Jan 2005

Urgent Issues

Group

(Predecessor to

the AASB)

©2008 Deloitte & Touche. All rights reserved.

©2008 Deloitte & Touche

澳洲- 10 local Interpretations (effective)

Item Interpretation Title

Number

Issue

Date

4

1031

Accounting for the

Goods and Services

Tax (GST)

Jul 2004 Annual reporting

periods beginning on

or after 1 Jan 2005

5

1038

Contributions by

Dec

Owners Made to

2007

Wholly-Owned Public

Sector Entities

6

1039

Substantive

Enactment of Major

Tax Bills in Australia

7

1042

Subscriber Acquisition Dec

Costs in the

2004

Telecommunications

Industry

©2008 Deloitte & Touche. All rights reserved.

Application Date

Annual reporting

periods beginning on

or after 1 Jul 2008

Jul 2004 Annual reporting

periods beginning on

or after 1 Jan 2005

Annual reporting

periods beginning on

or after 1 Jan 2005

Interpretation

body

Urgent Issues

Group

(Predecessor to

the AASB)

Australian

Accounting

Standards

Board

Urgent Issues

Group

(Predecessor to

the AASB)

Urgent Issues

Group

(Predecessor to

the AASB)

©2008 Deloitte & Touche

澳洲- 10 local Interpretations (effective)

Item Interpretation Title

Number

Issue Date

Application Date Interpretation

body

8

1047

Professional

Nov 2004

Indemnity Claims

Liabilities in Medical

Defence

Organisations

Annual reporting

periods beginning

on or after

1 Jan 2005

Urgent Issues

Group

(Predecessor

to the AASB)

9

1052

Tax Consolidation

Accounting

Jun 2005

Annual reporting

periods ending on

or after

31 Dec 2005

Urgent Issues

Group

(Predecessor

to the AASB)

10

1055

Accounting for Road Sep 2004

Earthworks

Annual reporting

periods beginning

on or after

1 Jan 2005

Urgent Issues

Group

(Predecessor

to the AASB)

©2008 Deloitte & Touche. All rights reserved.

©2008 Deloitte & Touche

澳洲- 4 local Interpretations (superseded)

Interpretation Title

Number

1

1001

Consolidated Financial Jul 2005

Reports in relation to

Pre-Date-of-Transition

Dual Listed Company

Arrangements

[superseded by AASB 3

Business Combinations,

issued March 2008]

Annual

Urgent Issues

reporting

Group

periods ending (Predecessor

on or after

to the AASB

31 Dec 2005

2

1002

Post-Date-of-Transition Dec 2005

Stapling Arrangements

[superseded by AASB 3

Business Combinations,

issued March 2008]

Annual

Australian

reporting

Accounting

periods ending Standards

on or after

Board

31 Dec 2005

©2008 Deloitte & Touche. All rights reserved.

Issue Date

Application

Date

Interpretation

body

Item

©2008 Deloitte & Touche

澳洲- 4 local Interpretations (superseded)

Item Interpretation Title

Number

Issue

Date

Application

Date

Interpretation

body

3

1013

Apr 2005

Consolidated Financial

Reports in relation to PreDate-of-Transition Stapling

Arrangements

[superseded by AASB 3

Business Combinations,

issued March 2008]

Annual

reporting

periods ending

on or after

31 Dec 2005

Urgent Issues

Group

(Predecessor

to the AASB

4

1017

Developer and Customer Nov

2004

Contributions for

Connection to a PriceRegulated Network

[superseded by

Interpretation 18 Transfers

of Assets from Customers,

issued March 2009]

Annual

reporting

periods

beginning on

or after

1 Jan 2005

Urgent Issues

Group

(Predecessor

to the AASB

©2008 Deloitte & Touche. All rights reserved.

©2008 Deloitte & Touche

新加坡-除IFRIC外另行成立之解釋單位

• In Singapore, the accounting standards and

interpretations are prescribed by the Accounting

Standard Council (ASC), and they follow the IFRS.

Currently, the following IFRICs have not been adopted

in Singapore yet:

– IFRIC 2 - Members’ Shares in Co-operative Entities

and Similar Instruments

– IFRIC 15 - Agreements for the Construction of Real

Estate

©2008 Deloitte & Touche. All rights reserved.

©2008 Deloitte & Touche

新加坡-除發布解釋函以外之正式處理機制

•In addition, the Institute of Certified Public Accountants

of Singapore (ICPAS), a professional body, issues some

guidance on topical matters, in the form of Statements

of Recommended Accounting Practice (RAPs). Topics

include:

–Accounting and reporting by Charities

–Reporting framework for unit trusts

–Foreign income not remitted to Singapore

–Pre-completed contracts for sale of development

property

–Merger accounting

©2008 Deloitte & Touche. All rights reserved.

©2008 Deloitte & Touche

南非-除IFRIC外另行成立之解釋單位

Background

• Instances may arise where there is a need for South African specific guidance

for certain aspects, transactions or other issues where no guidance is provided

in either International Financial Reporting Standards as issued by the IASB or in

the interpretations issued by IFRIC.

• The South African Institute of Chartered Accountants (SAICA) acts as the

Secretariat to the Accounting Practices Board (APB) in the standard setting

process. The Accounting Practices Committee (APC) is the technical advisory

body to the APB. The APB is the official standard setting body in South Africa. It

approves and issued Statements of Generally Accepted Accounting Practice

(Statements of GAAP) and Interpretations of Statements of GAAP.

©2008 Deloitte & Touche. All rights reserved.

©2008 Deloitte & Touche

南非-除IFRIC外另行成立之解釋單位(續)

Background (cont’)

• Where guidance is required, the APC would generally first circulate the query

amongst the National Standard Setters. If there is no clarity following this

consultation, SAICA would generally then submit an agenda request to the

IFRIC. If the agenda request does not result in any guidance, SAICA would then

consider whether it is appropriate to issue local guidance.

• Local guidance tends to be issued only when the circumstances are South

Africa specific, for example, recent interpretations have focussed on Black

Economic Empowerment transactions (which are a South African regulatory

issue) and their interaction with IFRS 2, and on South African pension fund

legislation & its interaction with IFRIC 14.

©2008 Deloitte & Touche. All rights reserved.

©2008 Deloitte & Touche

南非-解釋函內容

Interpretation Subject

Issue Date

ISSUED PRIOR TO IFRS ADOPTION IN 2005

Preface to South African Statements and Interpretations November

of Statements of Generally Accepted Accounting

2003

Practice

Accounting for "Secondary Tax on Companies (STC)"

November

2003

ISSUED BETWEEN IFRS ADOPTION AND 2008

Substantively Enacted Tax Rates and Tax Laws

February 2006

ISSUED SUBSEQUENT TO 2008

Accounting For Black Economic Empowerment (Bee)

March 2009

Transactions

IAS 19 (AC 116) The Limit on a Defined Benefit Asset, March 2009

Minimum Funding Requirements and their Interaction in

the South African Pension Fund Environment

©2008 Deloitte & Touche. All rights reserved.

©2008 Deloitte & Touche

德國-除IFRIC外另行成立之解釋單位

• The Accounting Standards Committee of Germany (ASCG) is registered in the

register of Associations in Berlin as a non-profit organisation. The governing

bodies of the Association are the Executive Board and the General Assembly.

The standing committees of the Association are the German Accounting

Standards Board (GASB) and the Accounting Interpretations Committee (AIC).

• ASCG is one of standard setters to work with the International Accounting

Standards Board.

• GASB has the following three duties:

1. the elaboration of recommendations on the application of German accepted group

accounting principles ,

2. the provision of advice to the Federal Ministry of Justice on accounting regulations

and

3. representation of the Federal Republic of Germany in international standardsetting bodies

©2008 Deloitte & Touche. All rights reserved.

Data source: http://www.standardsetter.de/drsc/news/news_eng.php

©2008 Deloitte & Touche

德國-除IFRIC外另行成立之解釋單位(cont’)

• Which enterprises have to apply German Accounting Standards?

– Enterprises preparing consolidated financial statements in accordance with

the German Commercial Code (HGB) should apply German Accounting

Standards (GAS).

– Enterprises whose securities are publicly traded and which have their

domicile in the European Union have to prepare consolidated financial

statements complying with IFRS for financial years beginning after 31

December 2004.

– As from then onwards, all these enterprises are exempted from applying the

German Accounting Standards (GAS). However, enterprises applying

international accounting principles shall continue to apply German

Accounting Standards (GAS) to the extent international accounting

principles do not include any requirements. This holds especially for the

German Accounting Standards concerning risk reporting and management

reporting (GAS 5 and GAS 15).

©2008 Deloitte & Touche. All rights reserved.

Data source: http://www.standardsetter.de/drsc/news/news_eng.php

©2008 Deloitte & Touche

英國- EU-endorsed IFRS

•In the UK, there is the option for non-listed entities to

either apply UK GAAP or EU endorsed IFRS. Listed

entities need to apply EU-endorsed IFRS.

•The only difference between IFRS and EU-endorsed IFRS

is in relation to EU-endorsed carve out version of IAS 39

where there is a difference in relation to Hedge

Accounting.

©2008 Deloitte & Touche. All rights reserved.

©2008 Deloitte & Touche

英國- EU-endorsed IFRS

EU-endorsed IFRS

• There is no interpretation of IFRS in the EU other than endorsed IFRIC interpretations.

• There is a mechanism established to endorse each IFRS and IFRIC for use in EU.

– This process has both a technical level and a political level. The technical merits of

each IFRS and IFRIC interpretation are considered by the European Financial

Reporting Advisory Group (EFRAG) which is a private sector body. EFRAG makes

recommendations to the Accounting Regulatory Committee (ARC).

– The Chairman of the UK Accounting Standards Board participates in the work of the

Technical Expert Group (TEG) of EFRAG, as an observer with full rights to participate

in debates.

– ARC comprises representatives of the member state governments of the EU and

advises the Commission. The UK is represented by BERR (previously the DTI).

– The final decision on endorsement is formally made by the European Commission.

©2008 Deloitte & Touche. All rights reserved.

©2008 Deloitte & Touche

英國-除發布解釋函以外之正式處理機制

UK GAAP

• For the UK, there is no IFRS interpretation body but the UK Accounting

Standards Board(ASB) is moving UK GAAP to an IFRS copy situation (IFRS

convergence). The UK ASB established the Urgent Issues Task Force (UITF) to

assist it in areas where a UK GAAP or Companies Act provision exists, but

where unsatisfactory or conflicting interpretations have developed or seem

likely to develop. The results of the UITF's deliberations on a subject are

promulgated by means of published Abstracts. The UITF is independent from

IFRS body and can make its own decision.

• Financial Reporting Review Panel (FRRP) was established in 1990 as part the

Financial Reporting Council. The Panel seeks to ensure that the provision of

financial information by public and large private companies complies with

relevant accounting requirements The FRRP issues a year end hot issue

report in Autumn. Despite not being an interpretation it would give UK

companies a view of the focus the UK enforcement agency will take in their

review work.

©2008 Deloitte & Touche. All rights reserved.

©2008 Deloitte & Touche

英國- UK UITF

List of UK UITF issued (http://www.frc.org.uk/asb/uitf/abstracts.cfm)

• There are 46 Abstracts issued in all with only 8 issued since 2005.

UITF Abstract

Topic

Issue date

UITF Abstract 46

(IFRIC

Interpretation 16)

Hedges of a Net Investment in a

Foreign Operation

23 October 2008

UITF Abstract 45

(IFRIC

Interpretation 6)

Liabilities arising from Participating 13 February 2007

in a Specific Market - Waste

Electrical and Electronic

Equipment

UITF Abstract 44

(IFRIC Interpretations 11) 'FRS 20

(IFRS 2) - Group and Treasury

Share Transactions’

02 February 2007

UITF Abstract 43

The interpretation of equivalence

for the purposes of section 228A

of the Companies Act 1985

23 October 2006

©2008 Deloitte & Touche. All rights reserved.

©2008 Deloitte & Touche

英國- UK UITF

List of UK UITF issued (http://www.frc.org.uk/asb/uitf/abstracts.cfm)

UITF Abstract

Topic

Issue date

UITF Abstract 42

Reassessment of Embedded

Derivatives

07 April 2006

UITF Abstract 41

Scope of FRS 20 (IFRS 2)

07 April 2006

UITF Abstract 40

Revenue recognition and service

contracts

10 March 2005

UITF Abstract 39

Members' Shares in Co-operative

Entities and Similar Instruments

10 February 2005

UITF Abstract 38

Accounting for ESOP trusts

15 December 2003

UITF Abstract 37

Purchases and sales of own shares

28 October 2003

UITF Abstract 36

Contracts for sales of capacity

27 March 2003

UITF Abstract 35

Death-in-service and incapacity

benefits

©2008 Deloitte & Touche. All rights

reserved.

21 May 2002

©2008 Deloitte & Touche

英國- UK UITF

List of UK UITF issued (http://www.frc.org.uk/asb/uitf/abstracts.cfm)

UITF Abstract

Topic

Issue date

UITF Abstract 34

Pre-contract costs

21 May 2002

UITF Abstract 33

Obligations in capital instruments

14 February 2002

UITF Abstract 32

Employee benefit trusts and other

intermediate payment

arrangements

13 December 2001

UITF Abstract 31

Exchanges of businesses or other

non-monetary assets for an

interest in a subsidiary, joint

venture or associate

18 October 2001

UITF Abstract 30

Date of award to employees of

shares or rights to shares

15 March 2001

UITF Abstract 29

Website development costs

22 February 2001

UITF Abstract 28

Operating lease incentives

22 February 2001

©2008 Deloitte & Touche. All rights reserved.

©2008 Deloitte & Touche

英國- UK UITF

List of UK UITF issued (http://www.frc.org.uk/asb/uitf/abstracts.cfm)

UITF Abstract

Topic

Issue date

UITF Abstract 27

Revision to estimates of the useful

economic life of goodwill and

intangible assets

08 December 2000

UITF Abstract 26

Barter transactions for advertising

09 November 2000

UITF Abstract 25

National Insurance contributions

on share option gains

27 July 2000

UITF Abstract 24

Accounting for start-up costs

22 June 2000

UITF Abstract 23

Application of the transitional

rules in FRS 15

Issued on 18 May 2000

UITF Abstract 22

The acquisition of a Lloyd's

business

11 June 1998

UITF Abstract 21

Accounting issues arising from the

proposed introduction of the euro

05 March 1998

©2008 Deloitte & Touche. All rights reserved.

©2008 Deloitte & Touche

英國- UK UITF

List of UK UITF issued (http://www.frc.org.uk/asb/uitf/abstracts.cfm)

UITF Abstract

Topic

UITF Abstract 20

Year 2000 issues: accounting and

disclosures Withdrawn by UITF

Abstract dated 27 July 2000 (see

UITF Information Sheet 41)

UITF Abstract 19

Tax on gains and losses on foreign 20 February 1998

currency borrowings that hedge an

investment in a foreign enterprise

UITF Abstract 18

Pensions costs following the 1997

tax changes in respect of dividend

income

12 May 1997

UITF Abstract 17

Employee share schemes

15 December 2003

UITF Abstract 16

Income and expenses subject to

non-standard rates of tax

Superseded by FRS 16

©2008 Deloitte & Touche. All rights reserved.

Issue date

©2008 Deloitte & Touche

英國- UK UITF

List of UK UITF issued (http://www.frc.org.uk/asb/uitf/abstracts.cfm)

UITF Abstract

Topic

Issue date

UITF Abstract 15

Disclosure of substantial

acquisitions

30 January 1996

UITF Abstract 14

Disclosure of changes in

accounting policy Superseded by

FRS 18

UITF Abstract 13

Accounting for ESOP Trusts

Superseded by UITF Abstract 38

UITF Abstract 12

Superseded by UITF Abstract 28

UITF Abstract 11

Capital instruments: issuer call

options

UITF Abstract 10

Disclosure of directors’ share

options Withdrawn by UITF

Abstract dated 19 December 2002

(see UITF Information Sheet 57)

©2008 Deloitte & Touche. All rights reserved.

29 September 1994

©2008 Deloitte & Touche

英國- UK UITF

List of UK UITF issued (http://www.frc.org.uk/asb/uitf/abstracts.cfm)

UITF Abstract

Topic

Issue date

UITF Abstract 9

Accounting for operations in

hyper-inflationary economies

09 June 1993

UITF Abstract 8

Repurchase of own debt

Superseded by FRS 4

UITF Abstract 7

Superseded by FRS 18

UITF Abstract 6

Superseded by FRS 17

UITF Abstract 5

Transfers from current assets to

fixed assets

Issued on 22 July 1992

UITF Abstract 4

Presentation of long-term debtors

in current assets

Issued on 22 July 1992

©2008 Deloitte & Touche. All rights reserved.

©2008 Deloitte & Touche

英國- UK UITF

List of UK UITF issued (http://www.frc.org.uk/asb/uitf/abstracts.cfm)

UITF Abstract

Topic

UITF Abstract 3

Treatment of goodwill on disposal

of a business Superseded by FRS

10

UITF Abstract 2

Restructuring costs Superseded by

FRS 3

UITF Abstract 1

Convertible bonds – supplemental

interest/premium Superseded by

FRS 4

©2008 Deloitte & Touche. All rights reserved.

Issue date

©2008 Deloitte & Touche