We have Only Breathing Room, Not an Elixir

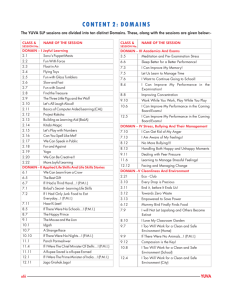

advertisement

Ecotimes20sep13 Nucleus of the Story NUCLEAR LIABILITY ACT The Civil Liability for Nuclear Damage Act, 2010, aims to provide a civil liability for nuclear damage and prompt compensation to the victims of a nuclear incident. FEARS OVER THE ACT A clause that the companies are keen to avoid is Section 17 of the Act, which says that in the event of damage caused by a plant, the operator can seek damages from the equipment provider. NPCIL, which operates all Nplants in India, can seek compensation of a maximum of 1,500 crore from foreign suppliers if their reactors cause disaster. The cap was challenged in the SC through a PIL filed by an NGO. It’s still pending. GOVT’S NEXT COURSE OF ACTION CCS will meet on September 24 to discuss the deal, and whether Westinghouse’s liability can be reduced Use Rally to Build Fx Reserves, Say Experts Reserves to act as defence against eventual withdrawal of bond buying by US, say analysts DILASHA SETH NEW DELHI Economists and policy makers say the government should use the sudden rise in the rupee’s valuation to build dollar reserves as a defence against high current account deficit and to intervene in the foreign exchange market in case of high volatility. The Indian currency dropped more than 20% since the start of this financial year to touch a record low of 68.81 against the US dollar on August 28 but has since bounced back strongly to close at 61.77 on Thursday, largely helped by the US Fed’s decision not to start tapering its monetary stimulus programme. “Rupee appreciating at today’s pace gives enough space for you to buffer up,” Pronab Sen, chairman of the National Statistical Commission, said. He said the Reserve Bank should buy dollars when the rupee looks to strengthen. “Instead of allowing it to go from 62 to 54 (against dollar), let it go from 62 to 61 and then from 61 to 60, so taking off just enough to make a very small appreciation happen,” Sen said. High reserves will give the central bank means to intervene in the market in case of high volatility and also check speculation. India’s foreign exchange reserves fell to $274.80 billion by September first week from $296.57 billion at the start of the calendar year. It’s lower than other markets in the BRIC bloc — China has reserves of $3.3 trillion, Russia has $509 billion and Brazil has $371 billion. India’s forex reserves touched an all time high of $309 billion in 2008. Sen said India should have started to buy dollars as a response to high current account deficit (CAD) in 2012 when the CAD started getting out of hand. India’s current account deficit touched an all time high of 4.8% of the GDP in 2012-13 and the target for 201314 stands at 3.7% of the GDP. Last year, the current account deficit of $88 billion was fully financed by the capital flows. This year, however, the Prime Minister’s Economic Advisory Council (PMEAC) recently warned that the government’s current account deficit target of $70 billion will require a drawdown on the reserves worth about $9 billion, with the assumption of net capital inflows at $61 billion. Some such as Madan Sabnavis, chief economist at CARE Ratings, and Rajiv Kumar, senior economist at Centre for Policy and Research, said it make sense to hold the currnecy at current levels while supporting building up forex reserves. In the past few years we have only seen negative movement of forex reserves, so Reserve Bank of India should rather target depreciation than appreciation,” Sabnavis said. Rajiv Kumar said he had suggested building forex reserves to the RBI governor YV Reddy in 2004-05 as well. “The rupee has overshot on the other side with the natural rate being about . 64-65,” he said. The government may be tempted to let the rupee rise because it would help bring down inflation and lower subsidy burden as, priced in rupees, crude oil will become cheaper. Global ratings agency Moody’s in its latest report said the rupee depreciation will lead to rise in the fuel subsidy burden to . 1.7-1.9 trillion for the fiscal year ending March. Soumya Kanti Ghosh, chief economic adviser at the State Bank of India, in fact, feels the rupee should be allowed to appreciate further. “Imported inflation decelerated marginally to 3.3% in August from 4.0% in July; capital flows will decline getting closer to the elections, so central bank should focus on appreciation of the rupee,” he said. Developing despite global downturn, Dhaka has turned Henry Kissinger’s comment on its head US secretary of state Henry Kissinger had dismissed Bangladesh as a “perpetual economic basket case” almost immediately after it was born. Spite, more than anything else, may have influenced the remark as the birth of Bangladesh was “raw chilly to wounds” sustained by the US in Vietnam. Washington could only blame itself for supporting Yayha Khan’s blood-thirsty military junta in one of the worst genocides in recent history — but unlike China that quickly got over the same hangover for Pakistan and developed relations with Bangladesh, regardless of the party in power, the US could never come to terms with the Awami League that had spearheaded the fight for the country’s independence from Pakistan. But Bangladesh has proved Kissinger wrong with a vengeance. In the last five years, its GDP has grown at an average of 6.3% per year, in the midst of one of the worst global downturns in recent times. It has achieved its 2015 UN Millennium Development Goals two years in advance. In 2013, it had brought the number of poor to less than 30% of its population — a target set for 2015 by the UN. In most indices of human development, especially gender-related, Bangladesh has surged miles (in some cases, yards) ahead of India and other south Asian nations. When India is unable to manage its spiralling current account deficit, Bangladesh sits on a comfortable current account surplus of $2.57 billion for the first time in its independent history. Its revenue collection has risen threefold over the last five years and its tax-GDP ratio has increased to 13.5% from 10.8% during the period. The Awami League, which has been in power since January 2009, has good reasons to take credit for its management of the economy. War Chest Swells with Pride The foreign currency reserves at the Bangladesh Bank have crossed the $16-billion mark, enough to meet import costs of five months. Export earnings have soared to over $27 billion from $10 billion in the last five years. Bangladesh also witnessed a buoyant remittance flow with the amount nearly touching $15 billion. With its expatriates largely from the working class, the tendency is to send a lot of money back home to buy assets for the future as they plan to return home rather than settle overseas. So, regardless of the political turmoil back home, most Bangladeshis abroad believe in a future for south Asia’s youngest nation. For the first time, foreign direct investment has topped the $1-billion mark. It was $1.3 billion in the 2012-13 fiscal year. Foreign aid flow has also increased substantially. However, the agriculture sector has witnessed a decline and investment in the private sector has fallen too, as the State of Economy report published by the Planning Commission in September 2013 indicates. In fiscal year 2005-06, the agriculture sector grew 4.9%. But that came down to 2.2% in the last fiscal year primarily because fresh acreage could not be added to agriculture due to lack of irrigation and other infrastructure. But due to successive bumper harvests, production has gone up and the food import bill has dropped by as much as 16%. Food prices have risen by only 2.8% this fiscal year. This has helped to boost forex reserves. The growth of the services sector has dropped to 5.7% from 6.4%, the report said. But that is attributed to lack of investment, primarily because of the disturbed political situation in the country. David beats Goliath, Again Ayear ago, the Bangladeshi taka was selling at 84 to a US dollar. It is now between 77 and 78. In the same period, the Indian rupee has fallen over 15%: from 47-48 to a dollar to 61-62. In fact, currency traders predict that another nosedive by the rupee and it would be nearly at par with the taka. That may not be good for Bangladesh that seeks to boost exports, but it does indicate the strength of the economy. When Prime Minister Sheikh Hasina lost patience with the World Bank, withdrew the funding request to the global lender and decided to fund the $2.9-billion rail-road bridge on the mighty Padma river, she made a huge statement of national confidence. It is not easy for Bangladesh, once so dependent on foreign aid, to tell the World Bank to pack up. Bridge on the River Padma Then Hasina refused offers from China and Malaysia to fund the 6.15-km bridge — the Malaysian terms were not attractive and Chinese entry would have upset India. But Hasina reasoned that sovereign bonds offering interest a little higher than bank deposits would easily fetch expatriate funds because the remittances were flowing. Finance minister A M A Muhith has already placed taka 68 billion ($0.88 billion at current exchange rates), or about a third of the total cost of the Padma project, in the current 2013-14 national budget. That is some statement of financial confidence. Bangladesh, despite her political turmoil and uncertainties over the next parliamentary polls, seems well on its way to become a middle-income nation before the end of the decade. The writer, a veteran journalist, is now senior editor with We have Only Breathing Room, Not an Elixir For a central bank that has done a remarkable job using non-conventional monetary instruments — asset purchases and forward guidance — to guide market expectations, it must be said that the US Federal Reserve hasn’t had its finest hour. For months, it has been preparing markets on the imminence of “tapering” asset purchases. Then suddenly, it did a volte face and pushed out tapering by at least a few months, possibly more. Why this new-found precaution? Tightening financial conditions. And why have financial conditions tightened? Because the Fed had signalled it was about to start tapering. Talk about a vicious cycle. But this would suggest that the Fed would never be able to exit, for every time it tries to, financial conditions would tighten again, forcing it to postpone tapering. There is an alternative explanation to the Fed’s actions. Perhaps this may not have been only an issue of worsening financial conditions. That, perhaps, with a leadership change imminent at the Fed, the Federal Open Market Committee’s reaction function has become more dovish. That explains why the 2016 median interest rate forecast was only 2%, despite the economy being projected to reach full employment by then. In normal situations, this would warrant a neutral rate of about 4%. Markets had believed that the Fed would have pencilled a rate closer to 3%. So the Fed’s 2% forecast suggests a decidedly dovish bias. So what are the implications for India? In emerging markets, there are two ways to react to the Fed’s dovishness. One is to believe that the good times are here again. Capital flows are expected to surge back. This will ensure that the current account deficit is easily funded, and the rupee will get stronger. That should be enough for the RBI to unwind its tight money stance. Lower rates should boost investment and consumption. And a stronger rupee should reduce diesel under-recoveries. May to August was a bad dream. But we have woken up to a much more pleasant reality. Good times are back again. Such an interpretation would be very dangerous. The capital flows that are expected to come back because US treasuries are 25 basis points (bps) cheaper are precisely those flows that left in May when global rates rose by 50 bps. And they will be exactly the capital flows that run for the exit if, for example, the Fed indicates a desire to taper later this year. The quality of capital inflows matters. We need FDI. Or real money portfolio flows. Not more hot money. Second, a more accommodative Fed means oil and gold prices are likely to rise in the coming weeks. Gold prices have already gapped up nearly 5% over the last 24 hours. This will add pressure to the current account deficit and, therefore, offset some benefits of a more supportive capital account. Higher oil prices mean that some of the benefits from a stronger rupee on inflation and diesel under-recoveries will be lost. Despite the sharp appreciation over the last two weeks, diesel under-recoveries are still running in double digits. The government must raise fuel prices soon. The impact on fiscal credibility and policy confidence — when acting without being forced to — would be immeasurable. So what does all this mean for the RBI? It is tempting to believe that a dovish Fed will induce a dovish RBI response, and the central bank could dismantle the entire interest rate defence. But one thinks the RBI will not be lulled into knee-jerk overreaction. Policymakers have been in a fierce firefight to stabilise the rupee, and are likely not to take a chance by lowering rates by 200-300 bps and risk nervousness in the forex market. One expects incremental easing, making the daily cash reserve ratio less onerous, a symbolic cut in the marginal standing facility, but not much more. Further, when the liquidity tightness is unwound, it may well be accompanied by an increase in the repo rate. With the US yield curve quite steep, it is hard to see how India can sustain an inverted or flat yield curve for long. We have caught a lucky break. To use T20 parlance, we have been granted a free hit. And we need to use that time wisely. Keep narrowing our twin deficits and our external vulnerability. The taper will come sometime. You can be sure of that. And we need to be more prepared than we were in May. The writer is chief India economist, JPMorgan It is up to New Delhi to make the most of it Markets around the world are overjoyed that the US Fed has postponed the inevitable winding down of unconventional monetary policy. This is irrational exuberance, a bit like reaching for champagne because surgery to remove a tumour has been put off. Instead of raising a glass in acquiescence, the government must recognise that what the Fed has done is to give India a three-month window, till its next meeting in December, in which to take further decisive action to get growth going. Growth is the only protection the country will have when the Fed does begin its taper and financial markets go into a tizzy. As bond yields fell in the US after the Fed’s announcement, the dollar has weakened against major currencies and the rupee. This is the time for India to carry out major reform such as decontrol of diesel prices and opening fuel marketing to third parties. This would reduce the fiscal deficit while avoiding Plan expenditure cuts and, thus, protecting growth. To neutralise the impact of such decontrol on inflation, it would make sense to simultaneously dump the government’s excess grain stocks across the country, turning cereal inflation into deflation. Manufacturing inflation is, in any case, below 3%. Extend monitoring of projects from the clearance process at the ministry levels all the way to award of contracts and opening the ground to absorb steel and cement. This is the only way to ensure investment actually goes up. If serious work begins in at least one of the nine industrial clusters planned under the Delhi-Mumbai Industrial Corridor, that would send a positive impulse across the economy. The newly-announced Tata-Singapore Airlines joint venture is further proof of continued investor faith in India’s growth story. Such faith would draw in yet more investment, especially if sensible policy and public investment keep hosannas going in the background. Streamline policy, convert policy into action and kick out dawdlers who clog the administrative machinery, all the while keeping the pressure up on fiscal discipline. Then growth will not taper, even if the Fed does. Train Taxmen on Transfer Pricing The government has done well to firm up simple rules that software and other MNCs can follow in pricing services when they do business with their parent outfits or subsidiaries. It has fixed a mark-up on costs, known as safe harbour, for six sectors, including information technology (IT), IT-enabled services (ITeS), automobiles and pharmaceuticals. That taxmen will accept transfer prices declared by companies opting for safe harbour and free them from audits is welcome. It will lower disputes, curb arbitrary tax demands and lend certainty to their tax outgo. This would boost India’s appeal as a software and R&D hub. However, India’s tax officers would need intensive training to deal with the new regime as transactions within group companies are becoming increasingly complex in a globalised economy and transfer pricing rules now apply to transactions between domestic companies within the same group. Most of industry’s demands have been met in the final rules, with which all IT, ITeS, knowledge process outsourcing (KPO) units, contract R&D in IT and pharma, and MNCs extending corporate guarantees to whollyowned subsidiaries can avoid audits. A more liberal regime will encourage more MNCs to opt for safe harbour rules. A lower mark-up for KPOs will soften their tax blow as well. MNCs can follow these rules for five years, against two years proposed in the draft rules. A longer tenure will lend more certainty to the taxpayer. Today, MNCs can choose between safe harbour rules and advance pricing agreements to compute transfer prices for transactions within group companies. This is progress. A modern tax administration without arbitrariness, clear tax rules and low tax rates will accelerate growth. MNCs will then have no incentive to shift profits out of India.