PPT

advertisement

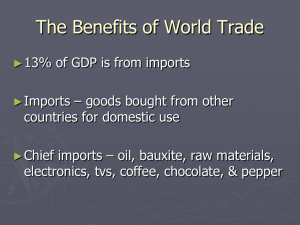

The International Economy Higher Economics 1 The International Economy – Topic 1 International Trade and Payments 2 GAINS FROM INTERNATIONAL TRADE International trade happens when different countries specialise in the production of a product and then trade with each other. There are two theories to explain why this happens: 3 THEORY OF ABSOLUTE ADVANTAGE This theory states that if 2 countries are each more efficient in a product, then each should specialise in producing the product they are best at and then trade with each other. 4 E.g. UK JAPAN CARS 10 5 TV’s 4 10 In this example the UK should produce cars and Japan should produce TV’s 5 WHY DO COUNTRIES HAVE ABSOLUTE ADVANTAGE 1. Some countries have supplies of certain natural resources e.g. the UK has oil and Japan doesn’t 2. Some countries have climatic advantages e.g. Spain can grow oranges, the UK can’t 3. Some countries have the workers with the skills and know how. 6 THEORY OF COMPARATIVE ADVANTAGE This theory states that even if a country has an absolute advantage in all products, it would benefit it to specialise in those products in which its advantage is greatest. 7 UK JAPAN CARS 7 21 TV’s 5 10 E.g. In this example Japan should produce cars as they are three times better than the UK at producing that product. The UK should produce TV’s because the disadvantage is not so great. 8 GAINS FROM INTERNATIONAL TRADE Can gain economies of scale due to increased efficiency, output and quality Increased choice for consumers Increased competition for producers may lead to increased efficiency and lower prices for consumers Closer political links between countries 9 Time to Calculate… Further reading (and the answers) can be found here: Shortcut Link: gorf.it/absolute-comparative 10 Answers 1 – Japan 2 – Japan 3 4 2 units of TV sets (20/10) 11 Answers 5 - 1.25 units of cameras (50/40) 6 - 0.5 units of cameras (10/20) 7 - Australia has a comparative advantage in the production of TV sets since it gives up less units of cameras (0.5 units) to produce one unit of TV sets. 8 - Japan has a comparative advantage in the production of cameras since it gives up less TV sets (0.8 units) to produce one unit of cameras. 12 The International Economy: Topic 1 TRADE RESTRICTIONS 13 TRADE RESTRICTIONS These are the barriers that are put up by countries to stop trade even though it may have advantages. Those who support trade restrictions see it as a way of: 1. Protecting employment in industries affected by foreign competition 2. Protecting employment in new or “infant” industries which are not large enough to compete 14 3. Maintaining industries that are considered strategic e.g. defence supplies 4. Reducing imports to improve a weak Balance of Payments 5. Retaliation against countries that have trade restrictions on our products 6. Prevent dumping (the selling of goods by foreign producers at prices below the cost of production) 7. Help the environment e.g. Ivory Trading 8. Exerting political pressure e.g. USA embargoes on Iraq or sanctions 15 on Cuba METHODS OF PROTECTION 1. Tariffs – this is a tax on imported goods. This will raise their price and reduced competitiveness. 2. Quota – this restricts the quantity of an import allowed into a country. 3. Voluntary Export Restraint – an agreement between two countries to limit exports …continued 16 4. Embargos – complete band on certain goods from certain sources or exports to certain destinations. 5. Subsidies – these are given to domestic producers to allow them to compete more strongly. It makes it cheaper for them to produce their product. (Wind Farm Subsidies) 6. Soft Loans – governments may give loans to foreign buyers at a lower rate of interest. Or they may guarantee credit that is offered by exporters to boost exports 7. Favouring – government may favour home producers with government contracts. 8. Imposing strict health and safety standards on imported goods 17 Import Controls in the UK There are 3 types of control: bans – where no import is allowed quotas - where the volume of goods is restricted surveillance – where the import of goods is monitored with licences Eg currently there are: EU quotas on textiles and clothing from Belarus and North Korea EU quotas on steel products from Kazakhstan More information here 18 EFFECTS OF RESTRICTIONS Can lead to retaliatory action from another country Volume of trade is reduced which can lead to unemployment Lack of competition allows inefficiency, rising costs and prices Reduces consumer choice Political ill-will can occur 19 REMOVING TRADE BARRIERS The EU Has a single market between member states. Still has trade restrictions for nations outwith the EU. World Trade Organisation Replaced the General Agreement on Tariff and Trade (GATT). It seeks to reduce and remove trade barriers between member states 20 Task: Fill in the blanks Using the document provided, and the following words…then answer true/false… Quota Voluntary export restraint Government Imports Dumping Protectionism Comparative advantage Trade 21 Importer Absolute advantage Raise (x2) Increase Decrease Balance Tariff Exports Concept Review Answers: 1 – imports; exports; balance; trade 2 – comparative advantage; absolute advantage 3 – protectionism; tariff; increase; decrease 4 – quota; raise; importer 5 – voluntary export restraint; raise 6 - dumping 22 The International Economy: Topic 1 BALANCE OF PAYMENTS 23 BALANCE OF PAYMENTS This is a statement of the flows of foreign currency into and out of a country in a year. It is collected by the government from business in the country who must have details of any trade and financial dealings with anyone abroad. `This is split into the “current account” and the “capital and financial account” 24 Latest Current Account Information: Click here 25 THE CURRENT ACCOUNT – TRADE IN GOODS exports and imports of goods. eg. exporting oil is a credit item whereas importing Japanese cars is a debit item In the UK Trade in Goods is usually a DEFICIT. This means we import more than we export. In the 1980’s we did have a SURPLUS largely due to exports of North Sea Oil. 26 THE CURRENT ACCOUNT – TRADE IN SERVICES exports and imports of services. eg Foreign tourist spending in the UK is a CREDIT ITEM whereas UK spending on foreign financial services is a DEBIT ITEM Trade in Services is usually a SURPLUS. THIS MEANS THAT UK EXPORTS MORE SERVICES THAN IT IMPORTS 27 Includes: 1. Government Services – e.g. spending on embassies 2. Transportation Services – e.g. rail and road spending 3. Travel Services – e.g. tourist spending 4. Financial Services – e.g. fees and commissions given to foreign banks from UK citizens and given to UK banks from foreigners 28 The Current Account: Goods and Services Compared 29 The Capital and Financial Account Capital Account: Shows the transfer of ownership of fixed assets. Financial Account: records short and long term monetary transactions between the UK and abroad. These are classified into 3 areas: Direct investment Portfolio investment Other investments Reserve Assets: foreign currency held by the BoE used to balance the overseas accounts, and less so today, to deal in the foreign exchange markets. 30 POLICIES FOR BALANCE OF PAYMENTS DEFICITS 31 TEMPORARY DEFICIT Temporary deficits do not need to be a serious problem if it is caused by unusual imports e.g. installation of North Sea oil platform It is usually financed by the government. This can be done by drawing on its reserves of foreign currency. 32 If the deficit is large or more persistent the government could finance it by: Borrowing from the International Monetary Fund (IMF) Borrowing from the central banks of the G8 countries. Increase interest rates to attract hot money or discourage money leaving the UK. 33 POLICIES FOR MORE PERSISTENT DEFICITS Persistent deficits are a problem because it reduces aggregate demand in the economy. An increase in demand for imports and reduced demand for exports will lead to UK output falling and rising unemployment. 34 MEDIUM TERM POLICIES Reduce aggregate demand – use fiscal or monetary policy to reduce the demand for imports. However, could lead to increased unemployment if demand for home produced goods fall as well. Devaluation – allowing the value of sterling to fall to increase the price of imports and reduce export price. Could be a problem if producers don’t alter price. Also could lead to higher inflation. The price elasticity of imports will also have an effect. Impose trade restrictions - the aim here is to reduce imports coming into the country. 35 LONG TERM POLICIES A long term deficit can only be reduced by improving on the competitiveness of its firms. This can be achieved by: Reducing inflation to below that of major competitors Increasing productivity Developing new products Improving marketing, delivery times and after-sales service 36 DOES A CURRENT ACCOUNT DEFICIT MATTER? Hotly debated topic with economists. Some argue that is shouldn’t be a problem because the deficit can be financed by incoming capital. However, the deficits reflect poor competitiveness in manufacturing. The government can play its part by implementing anti-inflation policies or having supply side policies such as education and training or help fund R&D. This is the present governments policy to improve Balance of Payments. 37 Problems of a Surplus Effect on Trade Large trade surplus usually arises from a protectionist approach to the economy. This then limits imports in to their country. Effect on Exchange Rate Surplus leads to a rise in exchange rates, making exports dearer and imports cheaper. This is ok from a macroeconomic perspective, but individual exporters will be harmed as a result. 38 The International Economy: Topic 1 EXCHANGE RATE SYSTEMS: EXCHANGE RATES AND POLICIES 39 What is an Exchange Rate? The exchange rate of a currency is it’s price in terms of other currencies, or a basket of currencies. Exchange rates are determined by the foreign exchange market by the forces of demand and supply for a particular currency. 40 Whiskey and Wine Examples T0 see the effects of differences in exchange rates between GBP and EUR on imports and exports look at the diagrams below (notes pp20-22) 41 THE DEMAND FOR STERLING This is determined by three factors: 1. The demand from foreigners who want to buy British goods and services 2. The demand from foreign companies wanting to invest in the UK 3. The demand from speculators, foreign firms and governments who want to hold surplus funds in sterling. 42 THE SUPPLY OF STERLING This is determined by three factors: 1. The supply of £s from UK firms converting into other currencies to buy foreign goods and services. 2. The supply of £s from UK firms converting into other currencies to invest in foreign countries. 3. The supply of £s from speculators, companies and government wishing to hold funds in foreign currencies. 43 FLOATING EXCHANGE RATES This is a free market and has no government intervention. The exchange rate is allowed to find it’s equilibrium level. This is where the demand for a currency equals the supply of it. At this level would be the exchange rate. 44 FLOATING EXCHANGE RATES Demand Curve Supply Curve The demand curve would be a normal downward sloping curve. The supply curve is a normal upward sloping curve. This is because if there is a fall in the value of sterling it makes UK exports cheaper. This is because a fall in the value of sterling will make imports more expensive. This attracts foreign buyers, increases the demand for exports and increases the demand for sterling to pay for them. The demand for imports falls and therefore less £s are coming into the exchange market to be changed for foreign currency. 45 An exchange rate will change when there has been a change in either the demand or supply of the currency. For example demand for sterling would increase if: UK exports are attractive to foreign buyers UK interest rates rise and attracts more hot money There is an inflow of funds for long term investment There is an increase in speculative activity in favour of the £. Any of these things would increase demand for a currency and would cause the demand curve to shift to the right. This would cause the exchange rate to rise in value. 46 Exchange rate of sterling D1 S D P1 P D1 S D Quantity of £s 47 In the short term it is speculative activity that is dominant in the day-to-day changes in an exchange rate. In the long term is determined more by things such as the competitiveness of UK goods. The advantage to a floating exchange rate is that it will automatically correct an imbalance in the Balance of Payments meaning that governments don’t need to intervene. 48 DISADVANTAGES OF FLOATING EXCHANGE RATES Speculators are often attracted to markets where prices move freely and where they make profits by guessing future prices correct. This can destabilise the exchange market. Because there is uncertainty about future exchange rates, and therefore profitability it may put firms off trading internationally. Inflation can result from a sharp fall in the exchange rate. Imported raw materials become more expensive, which increases costs of production. Imports of manufactured goods also increase which leads to demands for increased 49 wages. FIXED EXCHANGE RATES This is when the exchange rate with another currency always says the same. Downward pressure on sterling would result in the government buying sterling using its reserves of foreign currencies. Increasing demand for sterling. Between 1949 and 1967 the price of sterling was fixed at £1=$2.80 Upward pressure on sterling would result in the government selling sterling and buying foreign currencies. Increasing supply of sterling. The government had to intervene in the foreign exchange market to maintain the rate. 50 MANAGED EXCHANGE RATE (DIRTY FLOAT) Between 1967 and 1992, sterling was in a number of managed exchange rates. These allow sterling to float with specified limits. When sterling nears the upper or lower limit the government will intervene. The most famous managed exchange rate was the Exchange Rate Mechanism (ERM) 51 THE EXCHANGE RATE MECHANISM This was an agreement among the countries of the EU to promote stability between their exchange rates. Each country was given a central parity rate for its currency. Sterling had a central parity of £1=DM2.95. Each currency could float around the central parity by plus or minus 2.25%. The UK was allowed to float plus or minus 6%. Set up in 1979 and ended when the single currency was introduced in 1999. Britain was only in the ERM from 1990 until 1992. 52 THE EXCHANGE RATE MECHANISM If a currency strayed too much away from the central parity then: The country’s central bank would intervene. They would buy their currency to push up the value or sell it to push its value down. They could change interest rates. Increased interest rates would attract hot money, decreasing the rates would make short term investment less attractive. If all else failed they central parity rate was reset. 53 ADVANTAGES TO ERM MEMBERSHIP It made exchange rates more stable, reducing uncertainty for traders. Promoted international trade. It imposed discipline on industry and government to keep inflation rates in line with the lowest rates in the EU. This is because if inflation is higher and the rate is fixed it makes exports less competitive. 54 STERLING’S HISTORY IN THE ERM Britain left the ERM in 1992 when the value of sterling crashed through the floor of its parity rate. Since then it has been allowed to float freely. Until 1996 it floated downwards helping UK manufacturers to be more competitive. Since 1996 the value rose considerably. This benefited UK tourist going to Europe but harmful to the competitiveness of UK manufacturers. Since 2002 the value of sterling has been falling again against the Euro. 55 The International Economy – Topic 2 The International Economic Climate 56 The International Economy: Outcome 2 THE EUROPEAN UNION 57 The EU is one of a number of international economic associations of countries. Formed by 6 countries in 1957, it now consists of many more countries. Find out which countries are members of the EU and who the most recent members have been. The EU has a common market or, as it is now called, the Single European Market. 58 THE SINGLE MARKET A single market has 3 key features: 1. A free trade area – free movement of goods and services. 2. A customs union – COMMON EXTERNAL TARIFF 3. A single factor market – free movement of labour and capital. 59 ADVANTAGES OF THE SINGLE MARKET Creates more trade with the removal of trade barriers. Economies of scale can be gained. The size of the market has increased hugely. Competition has increased. Has led to more efficient use of resources. More innovation. Mobility of resources has allowed labour and capital to move where they may be efficiently employed 60 DISADVANTAGES OF THE SINGLE MARKET Common external tariff has diverted trade away from the entire EU. Firms have moved to the more prosperous areas of the EU which has widened the gap between the rich and poor regions. 61 REMAINING PROBLEMS VAT – variations in VAT rates between countries which can distort prices. Differences in Excise Duties – alcohol and petrol are cheaper in some Eu countries than others Taxes on company profits. UK has a low corporation tax level making it successful in attracting investment. Income tax levels Adoption of the single currency and full monetary union. Some countries have yet to join the Euro. 62 The International Economy: Outcome 2 THE SOCIAL CHAPTER 63 THE SOCIAL CHAPTER This was included as part of the Maastricht Treaty of 1992. Agreement for all countries of the EU to have a common social policy. UK opted out of signing The Social Chapter in 1992 but signed up in 1997. By signing the Social Chapter the UK must apply EU law on things such as the Works Council Directive and the Working Time Directive 64 THE WORKS COUNCIL DIRECTIVE This gives employees of multinationals the right to a WORKS COUNCIL. Allows for consultation between employees and management on major changes in business strategy. 65 THE WORKING TIME DIRECTIVE This give workers the right to a number of things: A maximum working week of 48 hours At least one day of per week Four weeks annual holiday A rest period of 11 consecutive hours A maximum working day of 8 hours for night shifts WORKERS CAN OPT OUT OF THESE RULES 66 PART-TIME WORKERS DIRECTIVE This gives part-time and casual workers the same rights as full-time workers in terms of training and holidays THE PARENTAL LEAVE DIRECTIVE This allows fathers and mothers three months unpaid leave after the birth or adoption of a child 67 The International Economy: Outcome 2 EUROPEAN AND MONETARY UINION (SINGLE CURRENCY) 68 ECONOMIC AND MONETARY UNION (EMU) Economic Union – all economic policies of member states should be converged and all barriers to the movement of products and resources removed. Monetary Union – aims to achieve a single currency and common monetary policy. 69 The EU launched the Euro in 12 member states in January 2002. There is a European Central Bank (ECB) which is responsible for: Issuing Euros Conducting monetary policy Acting as lender of last resort for member states Managing the exchange rate of the Euro 70 CONVERGENCE CRITERIA In order to join the single currencies member states had to meet the following. Matching inflation rates Have a stable exchange rate for at least two years prior to joining Matching interest rates Government budget deficits not exceeding 3% of GDP Government debt not allowed to exceed 40% of GDP 71 ADVANTAGES OF EMU 1. Lower transaction costs – save money as firms no longer need to pay to change currencies when they trade with a foreign firm. 2. Reduce exchange rate uncertainty – should lead to more trade as firm do not worry about unfavourable exchange rates making payments more expensive 72 ADVANTAGES OF EMU 3. Greater price transparency – easier to compare prices across Europe 4. Independent ECB which is a major factor in controlling inflation as they will work for the good of the economy and not to win elections. 5. Increased foreign investment 73 DISADVANTAGES OF EMU 1. Risk of deflation and higher unemployment. 2. Loss of independent monetary policy which is decided by the ECB 3. Reduced independence on fiscal policy as governments need to keep budget deficits within the criteria. 4. High transitional costs – cost of changing tills and accounting systems. 5. Misalignment – not all policies decided by ECB will suit all member states. 74 Britain’s Position The UK has not signed up for the single currency. The UK government has set five economic tests to determine when would be the best time for us to join. They also want to hold a referendum. 75 THE FIVE ECONOMIC TESTS 1. Sustained convergence between the UK and Eurozone in terms of economic cycles. 2. Sufficient flexibility for the system to cope with economic change. 3. Joining must create better conditions for companies investing in the UK 76 4. The effect on the UK financial services industry should be beneficial. 5. Joining the Euro must be good for employment and economic growth. The International Economy: Outcome 2 THE COMMON AGRICULTURAL POLICY 77 BACKGROUND TO CAP A free market for agricultural products tends to be highly unstable. Supply is sensitive and demand is price inelastic. CAP is applied to all EU farmers and its original aims were to: Increase farmers productivity; Ensure a fair standard of living for farmers Stabilise the market Guarantee reasonable prices for consumers. This can lead to wild swings in prices and farm incomes. 78 HOW DID CAP WORK? An intervention price was set, which was a guaranteed price for different farm products. If the free market price was below this then the EU bought and stored any surplus output. EU farmers were also protected from outside competition by tariffs on imported farm products. This would make these imports more expensive. This was often called the THRESHOLD PRICE. If farmers could export their surplus at the world price they received a subsidy for the difference between that price and the intervention price. 79 PRICE D S SURPLUS INTERVENTION PRICE WORLD PRICE S D QUANTITY PER YEAR 80 BENEFITS OF CAP Benefits Costs Prevented food shortages. Farmers were encouraged to produce more. Reduced price fluctuations for farm products Intervention price is above world price resulting in overproduction of certain products, e.g. wine lakes and butter mountains. European taxpayers had to pay to buy and store these surpluses. Prices charged to consumers were high Import tariffs and export subsidies distort world market and are harmful to developing nations Harmful to the environment. Farmers encouraged to over produce and so use intensive production e.g. pesticides, factory farming of animals. CAP was expensive to run. Stabilised farm incomes. 81 REFORMS 1992 1999 In 1992 CAP accounted for 75% if the EU budget. Had created overproduction and high prices. Further cuts in intervention price for cereals, beef and milk. The reforms here started by cutting the intervention price and introducing a set-aside scheme, which paid farmers to leave some land empty. The hope was to stop overproduction in these goods. An early retirement scheme was set up. 82 2003 REFORMS Further pressure to change CAP came in the late 1990s. The EU agreed to: Freeze the CAP budget. Give income support to farmers based on the size of their farms. The World Trade Organisation wanted the EU to remove subsidies and Subsidies only to be given if tariffs. farmers improve welfare, look after countryside or diversify. Prospect of the 2004 EU enlargement of 10 countries Farmers now have to plan what to 83 produce based on world prices. BENEFITS OF REFORM Lower prices for consumers Reduced production and removal of surpluses More environmentally friendly farming methods. 84 The International Economy: Outcome 2 EU ENLARGEMENT 85 CONDITIONS OF ADMISSION All applicants for EU accession must have: A commitment to democracy A commitment to the mixed economy A willingness to accept all EU standards, rules and regulations. This is called the acquis communautaire 86 BENEFITS OF ENLARGEMENT New Entrants Existing Members Gain from EU funding to help prepare for entry. Increased political stability Larger market with no trade barriers creating lower prices and more choice for consumers Will be part of a huge single market An increase in Foreign Direct Investment as Western firms look to invest. 87 COST OF ENLARGEMENT Increased demand for help from these new entrants. This means that areas of existing members will lose out on funding e.g, The Scottish Highlands. Wealthier members worried that firms will relocate to the cheaper new entrants in the East. Also a concern about a influx of cheap labour from Eastern Europe because of free movement of labour. 88 The International Economy: Outcome 2 FUNDING THE EU BUDGET 89 SOURCES OF EU FINANCE 1. A VAT-based contribution – each member state gives 1% of its VAT receipts 2. 1.2% of the countries Gross National Product. 3. Receipts from tariffs on certain agricultural goods 4. Custom duties on imports from non-EU states. 90 Since the mid 1980s the UK has received a budget rebate. It was agreed that the UK was paying more than its fair share as it has a efficient agricultural sector and received less subsidies than other members. 91 BUDGET REFORMS Germany, Austria, Netherlands and Sweden say that their contributions are too much. They have also argued that the UK should no longer get a budget rebate. More finance is needed to help new entrants modernise eg the poorer countries of Eastern Europe. 92 The International Economy: Outcome 2 DEVELOPING AND NEWLY INDUSTRALISED COUNTRIES 93 GROUPS OF COUNTRIES In terms of economics there are 3 groups of countries: First World – small group of rich industrialised nations e.g. Western Europe, N. American, Australasia and Japan. Second World – not as rich as first world, normally former communist nations e.g. Russia, Poland and Hungary 94 GROUPS OF COUNTRIES: THIRD WORLD Large group of poor countries in Asia, Africa and Latin America These countries are often called developing countries or less developed countries (LDCs). Although there are some countries that are quite prosperous. These are the newly industrialised countries (NICs) e.g. Hong Kong, Malaysia, Thailand, South Korea. Called the Asian Tigers. They have experienced rapid economic growth in recent years. 95 CHARACTERISTICS OF DEVELOPING COUNTRIES 1. Poverty – over ¾ of the world’s population have incomes lower than those in the first world. There are however even in the poorest countries a rich elite. 2. High population growth – birth rates and death rates are higher than most developed nations. However, death rates are falling causing more people in these countries. 96 4. Agricultural Dominance – around 70% of the population in LDCs live off the land. They have subsistence level economies. 5. Unemployment and underemployment – rural areas have underemployment due to the seasonal nature of the work. 6. Urban areas have high unemployment 7. Lack of industrial capital – there is little investment in factories, offices and machinery. 97 8. Lack of infrastructure – shortage of good roads, schools, railways etc. These things are vital to economic development. 9. High dependence on 1 or 2 exports – these are usually primary products. 98 DOMESTIC CONTRAINTS ON ECONOMIC GROWTH Problems with investment Growth of an economy is dependant on investment. However, to get investment the country would need to divert resources from the production of basic goods and services. In the short run standard of living needs to worsen in order for it to improve. Investment needs finance but little money available. 99 DOMESTIC CONTRAINTS ON ECONOMIC GROWTH Population Growth Inefficiency Industry is inefficient due to lack of investment in capital and infrastructure. Rapid growth rates in population are not always matched by an increase in output Labour force is inefficient because of lack of training and education. This means lower output and lower income per head of population 100 DOMESTIC CONTRAINTS ON ECONOMIC GROWTH Migration to urban areas Social and cultural factors Movement of the underemployed from rural to urban areas to find work has resulted in the supply of labour not being matched by job opportunities. People are just unwilling to change and are attached to the traditional ways of life. Increasing unemployment further and overcrowding occurs. Added to pollution and congestion 101 EXTERNAL CONTRAINTS TO ECONOMIC GROWTH Falling export earnings Trade barriers LDCs are not earning as much from the export of agricultural products Some developed countries have erected trade barriers to protect domestic food producers. Demand for these products are price inelastic and world prices are falling – resulting in lower income Demand is income inelastic and so the developed world, although having more income does not demand more agricultural products. An example of this is the EU’s CAP 102 EXTERNAL CONTRAINTS TO ECONOMIC GROWTH Multinational activity – although they can benefit an LDC, they do cause problems: Have great power and can use resources to their benefit rather than for the country’s. Production methods used could be harmful to the environment Profits are sent back to the home country Tax can be avoided through the use of transfer pricing 103 EXTERNAL CONTRAINTS TO ECONOMIC GROWTH Debt crisis – LDC don’t have the ability to repay debts. 4 options available. 1. 2. 3. 4. borrow more not pay debts and risk not getting future loans reduce imports to reduce demand appeal to the IMF for help. 104 DEVELOPMENT STRATEGIES 105 INCREASING PRODUCTIVITY IN AGRICULTURE This would mean increased food supplies and rising incomes in rural areas. This would mean that there would be lower demand for imported food stuff. Increased productivity might mean there will be extra to export. 106 ENCOURAGE SAVINGS If more people save there will be more funds available for investment. This has been successful in NICs like the Asian Tigers. 107 EXPORT-LED GROWTH This means that LDCs swapping from low earning primary goods to industrial products in which they have comparative advantage. Early stages tend to concentrate on labour intensive, low technology methods. Exports tend to be cheap textiles, shoes, televisions, toys etc. 108 INVESTING IN INFRASTRUCTURE As incomes have increased in NICs the governments have invested in better infrastructure. For LDCs to achieve better infrastructure they need aid. 109 POPULATION CONTROL In some LDCs they have programmes to limit the family size. They also provide cheap birth control facilities. 110 The International Economy: Outcome 2 AID FROM THE DEVELOPED WORLD 111 MOTIVES FOR GIVING AID 1. Humanitarian – to help those in needs. Normally foodstuffs, medicine. 2. Political – to win friends. 3. Economic – if LDCs and NICs become more productive and prosperous they will be able to contribute more to the world economy and provide new markets. 112 TYPES OF AID Writing off debt – the US and UK have written off debts of certain countries on the condition that the money saved is used to relieve poverty. LIVE 8! Gifts of foodstuff Grants and Loans – grants don’t need to be repaid and can be used for any reason. Due to corruption in many LDCs there is a reluctance to give grants. Loans are sometimes given with interest rates below commercial rates. These are SOFT LOANS Tied aid – this is grants or loans that need to be used to purchase equipment from the donor country. 113 TYPES OF AID Technical assistance and education – technical experts may go to LDCs to give advice. Wealthier nations may provide facilities to overseas students to attend college or university. Aid can either be BILATERAL – given from one country to another or MULTILATERAL – given by the main international agencies i.e. World Bank and the IMF. 114 DISADVANTAGES OF AID It may not reach those in need Corrupt governments can intercept much assistance Aid can lead to LDCs being dependent on rich countries and give no incentive for the LDC to grow from its own resources. Donors may finance the capital expenditure e.g. new roads but not support the current expenditure e.g. repairs and maintenance. Food aid can destroy local farmers if it drives the prices down. Tied aid forces a LDCs to buy equipment from the donor when it could be cheaper to borrow and look for a cheaper supplier 115 CHARACTERISTICS OF NICS NEWLY INDUSTRALISED COUNTRIES High economic growth rates – these countries have been experience growth within there economies. Rising export sales Little reliance on agriculture – most of the production is now in manufactured goods. Rising standards of living. Increasing levels of education and training. 116 REASONS FOR RAPID DEVELOPMENT High rate of capital investment financed by consumer savings and high export sales. Large investment in education and training. Movement of labour from low productivity industries to high productivity ones. 117 The International Economy: Outcome 2 INTERNATIONAL TRADING AND MONETARY ORGANISTIONS 118 WORLD TRADE ORGANISATION (WTO) Consists of around 120 countries. Formed in 1995 and replaced the General Agreement on Tariffs and Trade (GATT) Its purpose is to negotiate reducing and removing trade barriers. Countries can complain if they think there are unfair restrictions. 119 THE INTERNATIONAL MONETARY FUND (IMF) IMF was set up in 1947. Has over 160 members. IMF has been criticised for propping up inefficient economies. Aims to: encourage the growth of world trade provide conditional financial support for members with Balance Of Payment difficulties help members facing currency collapses offer assistance on economic matters Has recently tried to improve by giving loans on the condition that governments impose tight economic controls on their expenditure. 120 WORLD BANK International Bank for Reconstruction and Development (IBRD) Set up at the same time as the IMF. The World Bank provides long-term assistance for development. Largest source of multilateral aid. 121 Member states contribute funds in proportion to their national income. Loans then given to LDCs. Used to be only for development of infrastructure but now targeting projects that relieve poverty e.g. healthcare and education. 122 The International Economy Higher Economics 123