Government Assistance to Micro, Small and

Government Assistance to

Micro, Small and Medium

Enterprises (MSMEs)

Financial and Promotional

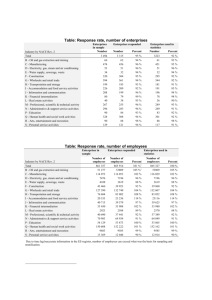

Definition of MSMEs

Type Mfg.Enterprise

Service Enterprise

Micro Up to Rs.25 lakh Up to Rs.10 lakh

Small Rs.25 lakh to Rs.10 lakh to

Rs.5.0 cr. Rs.2.0 cr.

Medium Rs.5.0 cr. to Rs.2.0 cr. to

Rs.10.0 cr. Rs.5.0 cr.

(Values indicate investment in plant & machinery)

Thrust Areas for Promotion of

MSMEs

• Adequate and Timely Credit (Term loans and

Working Capital)

• Modernization & Technological Up gradation

• Integrated Infrastructure

• Quality Improvement

• Market Promotion

• Export Promotion

• Entrepreneurship Development & Management

Development

• Capacity Building

Apex Organizations for MSMEs

• Separate Ministry for Micro, Small and

Medium Industries formed in 1999 for policy formulation and implementation

• National Board for MSMEs – Representatives from Ministry, Financial Institutions, Industry

Associations, etc.

National Level Organisations for

Support to MSMEs

• Small Industries Development Organisation (SIDO).

• Has 10 other Institutes under it for Training and

Development in Marketing, Quality Promotion,

Technology Up gradation, Product Testing,

Designing, Incubation, Financing, Guarantees, etc.

• National Small Industries Corporation (NSIC)

• National Entrepreneurship Development Institutes

(EDI, NISIET, NIESBD, IIE)

• Small Industries Development Bank of India

• SIDBI Venture Capital Ltd. (SVCL)

• SME Rating Agency of India (SMERA)

National Manufacturing Competitiveness

Program (NMCP) of SIDO

• Marketing Support Assistance to MSMEs

• Support for Entrepreneurial and Managerial

Development (Incubators)

• Quality Mgt. Standards and Quality Tools

• National Campaign for Investment in

Intellectual Property Rights (IPRs)

• Mini Tool Rooms with Foreign collaborations

• Others being developed

Schemes for New and Existing

Enterprises

SIDO

• Entrepreneurial & Management Development

Incubators- Business skills Development, Technology

Identification, Project/Product Selection, Opportunity

Guidance, Commercial Aspects, etc.

• Investment and Training in IPRs

• MSE Cluster Development Program-Finance for Dev.

Of New Clusters and Infrastructure in Existing ones,

Common facilities, Cost Sharing on Utilities,

Marketing, etc.

• Credit Linked Capital Subsidy Scheme – For

Technology Up gradation

Schemes for New and Existing

Enterprises

SIDO

• Credit Guarantee for MSEs by CGTMSE

• Purchase & Price Preference Scheme for MSMEs for

Govt. Stores and Central Govt. Undertakings

• Market Development Assistance Scheme for Export

Promotion - Participation in International

Exhibitions/Fairs, Study Tours, Trade Delegations,

Bar Coding Certification, etc.

Schemes for New and Existing

Enterprises

NSIC

• Marketing Assistance Scheme- International and

Domestic Exhibitions and Fairs, Consortia Marketing

• Exports – Recognised Export House- Exports of

Handicrafts, Leather goods, Hand tools, IT solutions,

SSI Projects, etc.

• Bank Credit Facilitation Scheme- Term Loan &

Working Capital - Preference to Credit Rated

Companies

• Term Loan Scheme-For Machinery & Equipment -

Maximum limit Rs.5.0 lakh

• Bills Discounting Scheme

Schemes for New and Existing

Enterprises

NSIC

• Raw Material Assistance Scheme – 90 days credit, bulk purchases, cash discounts

• Financial Support for Credit Rating

• Technical Support and Technology Transfers -

Technical Service Centres, Technology Transfer

Centres

• Software Technology Parks Scheme for 100%

Exports of Software

• NSIC Training-cum-Incubation Centres

• Infomediary Services

• Techmart Exhibition – Annual International Tech Fair

SME Financing and Development

Project (SMEFDP) of SIDBI

• World Bank-led multi agency / multi activity Project on Financing and

Development of SMEs

• IBRD, Department for International Development (DFID) UK, KfW

Germany and GTZ Germany are the international partners in the Project

• Project is aimed at making SME lending an attractive and viable financing option & facilitate increased turnover and employment in the sector.

• Technical Assistance given for strengthening credit information system, credit rating, credit scoring, structuring of innovative products, capacity building of the participating banks, policy and regulatory issues and promotion of market oriented business development services for the sector.

• There are three main components of the Project

• Credit Facility

• Risk Sharing Facility

• Technical Assistance

Schemes for New & Existing

Enterprises

Small Industries Development Bank of India-SIDBI

• Direct Credit Scheme – Small and Medium Sectors

• Marketing Assistance Scheme - Term Loans

• Vendor Development – Term loans, Wkg. Cap. &

Bills Discounting

• Guarantee Scheme for SSIs and Service Sector Units

• SME IT Loans

• Refinance Scheme through Banks and

SFCs/SIDCs

• Technology Up gradation, ISO Certification, Single

Window, Composite Loan , Small Road Transport , etc.

Schemes for New & Existing

Enterprises

SIDBI

• International Finance- PCFC, PSCFC, Forex Term

Loans, Letters of Credit, Forward Contracts, etc.

• Marketing Assistance for Women-Indirectly through

Corporates/Co-operatives/NGOs for market promotion activities

• Collateral Free Loans- Guarantee by CGTMSE

• Credit Linked Capital Subsidy Scheme

• Risk Capital

• Credit Rating Services - SMERA

• Venture Capital – Software & IT

- Selected Growth-oriented Sectors

Schemes for New & Existing

Enterprises

Maharashtra State Financial Corporation-MSFC

Term Loan assistance to medium & small enterprises Loan limit, Rs.5.0 cr

For fixed assets like land, building, plant & machinery.

Expansion,Diversification, Technology development, Enlarging product mix/product range, Quality improvement including ISO 9000 series

Certifications

Eligible activities i) Industrial activities such as manufacturing, assembling, servicing, processing, preservation, transportation ii) Services like nursing homes, hotels, restaurants, tourism related activities iii) Medical practitioners are eligible for loan for acquiring electro medical and other equipment for professional use iv) Qualified professionals in management. engineering, architecture, accountancy etc. desiring to undertake expansion of their professional practice/consultancy ventures v) Other service activities declared as eligible under the MSME Act

Schemes for New Enterprises

MSFC-Proposed Schemes

Term Loan assistance for:

– Commercial Complexes, Multiplexes, marriage

Halls, Group Housing/Residential complex, etc.

Small scale Industrial units should have SSI registration while Service enterprises should be registered with the appropriate authority

Credit Guarantee Fund Trust for

Micro and Small enterprises

(CGTMSE)

• Credit available without collateral security

• Available to micro and small enterprises for setting up new enterprises or expansion/ modernizations/ technological up gradation/ diversification of existing enterprises in the manufacturing & services excluding retail trade

• Guarantee for Loans(Term loans and working capital) up to Rs.100 lakh per borrower

• Credit given through Member Lending Institutions

(MLIS) including banks and branches of SIDBI

Features of the Credit Guarantee

Scheme

• CGTMSE stands guarantee up to 75%-85% of the loan amount to the MLI depending on the Status of the borrowing unit (

(Micro, Small or Women entrepreneurs) and Size of Credit

• Guarantee cover higher at 85% for Micro Enterprises with loans up to Rs.5.0 lakh, at 80% for MSE’s owned/operated by women and MSEs in the north-eastern region

• In case of default by the borrower, CGTMSE pays off 75% /

80% of the loan amount of the lending MLI

• Guarantee fee of 1.5% and service fee of 0.75% of the loan amount is payable by the borrower

• Guarantee fee lower at 1% and service fee lower at 0.5% for loans up to Rs.5.0 lakh