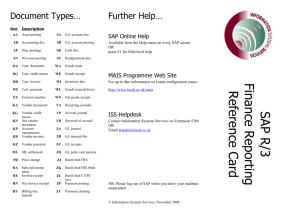

Transaction Data : document types

advertisement

FINANCIAL ACCOUNTING OVERVIEW CONTENT • • • • • • • Chapter 01 - Enterprise structure Chapter 02 - General Ledger Chapter 03 - Accounts Payable Chapter 04 - Accounts Receivable Chapter 05 - Asset Accounting Chapter 06 - Cash Management Chapter 07 - Miscellaneous Enterprise structure Organizational Structures in R/3 Operating Concern CO CO Controlling Area SD Purchasing Organizations Company Codes FI Valuation Areas MM Plants Sales Organizations MM Storage Locations/ Batch/ Special Stocks MM MM Legal entity : company code Organizational Structures in R/3 Overview Organization Entities in Finance Client Chart of Accounts ONTX Deprec Area Belg Deprec Area Nede CoCd 0100 CoCd 0200 Deprec Area De CoCd 0300 Deprec Area TR CoCd 0310 CoCd 0800 General Ledger General Ledger Master Data –G/L Accounts Transaction Data –Document types : header + line items –Postings Closing procedures –Monthly –Yearly Reporting –Group –Legal Master data : Chart of accounts concept Master data : Chart of accounts concept Client G/L Account data Add. G/L Account data Chart of Accounts ONTX Company 0100 Company 0800 G/L Account 1730000 Bal. sheet account Account group Fin. . . Company CurrencyYTL Line item display x 0800Company CurrencyEUR Line item display x bank X 0 Master data : Chart of accounts concept Master data : take over - mapping Approach • Map local accounts to operational accounts • Identify additional local accounts • Translate used accounts in Turkish (short/long) • Copy accounts to company code • Load alternative (local) chart of accounts • Timing : finished at end of blueprint phase Transaction Data : document types One Business Transaction = One Document BT BT BT Transaction Data : document types Structure of a document Header Data Line item Data Transaction Data : document types Document Header Document header Posting date Line item 1 Document number Line item 2 Document type Line item 3 Currency ... Balance = 0 Transaction Data : document types Document type = journal Outgoing invoice Incoming invoice Bank e.g. RX e.g. KR e.g. SB Transaction Data : document types Number Ranges SAP Documents Master Data Internal Assignment External Assignment Number Range Transaction Data : document types Document Line Item Document header Line item 1 Line item 2 Posting keys Special G/L transactions Automatic Line items Additional Account Line item 3 Balance = 0 Additional Assignment Transaction Data : document types Posting keys DEBITS PK 01 CUSTOMERS: 02 Credit Memo 05 Payment PK 21 22 VENDORS: Invoice 25 Payment PK 40 G/L a/c: 60 80 Invoice Reverse CREDITS PK Invoice 11 12 Credit Memo Reverse Outgoing 15 Incoming Credit Memo Payment PK 31 Invoice Reverse 32 Reverse Credit Memo Outgoing 35 Incoming Debit entry Payment PK 50 Debit entry ... ... 70 90 ... ... Transaction Data : document postings Posting periods : central maintenance 16 Transaction Data : document postings • • • • • • • Tax Codes are country specific Taxes on Sales/purchases Tax base for tax calculation All required tax rates defined Determination of due dates for tax payment Tax calculation procedures Tax base for cash discount Dependent taxes as surcharges or deductions Division into deductible and non-deductible taxes Month-end closing General • • • • Balance sheet preparations Block postings to previous month (consollidation dpt.) Advance return for tax on sales & purchases Balance sheet & P+L statement for the month – Financial statement versions • Document and reconcile Posting Data • Create balance audit trail • … Month-end closing Ontex closing & reporting • • • • • • • • Integrity checks Splitting up turnover by product group & country (MCSI) Upload to Frango (ZFR10) VAT declaration Stock list (MRN9) Revaluation (F.05) Splitting wages & salaries (for consolidation purposes) Wages upload Year-end closing • Maintain posting periods • Balance lists for previous fiscal year • Account balances carried forward (Turkish specific) • Reconcile balances • Balance sheet preparations • Block postings to old fiscal year • Create balance sheet & P+L statements • Transaction summaries (compact journal + balance lists) • Balance audit trail Accounts Payable Accounts payable Master Data –General, legal, purchasing view Transaction Data –Logistics Invoice Verification –Payment program Closing procedures –Regrouping Reporting Master data : vendors Vendor master Record General data: Weyerhaeuser (900893) Washington Bank detail: BE 685-0497019-59 Client Company 0100 Company 0800 Company 0100 Reconn.acct 44000000 Pmnt terms ZB01 Sort line items 001 Company 0800 Reconn.acct 44000000 Pmnt terms ZB02 Sort line items 002 Master data : vendors Intercompany • In each company code, others entity of the Group Ontex are identified as a customer account and a vendor account. • In consequence, all internal trade will be done in relation with those numbers. • Those accounts contain specific trading partner number. • All intercompany vendors start with V (e.g. V3400 = Astel)* * Cfr. Customers – but start with I (e.g. I3400 = Astel) Transaction data : LIV Purchase order Logistics Invoice Verification MIRO Goods receipt Invoice receipt Transaction data : LIV Transaction data : payment program Payment Program Customer/ Vendor Master Records Basic payment control data 1 Input parameters Payment proposal run Proposal data 2 Payment run Print program Print data 5 4 Edit Documents Bank Transfer Cheque 3 Summary Report Pay Advice Closing procedures • Intercompany reconciliation (F.2E) • GR/IR clearing : F.13 • GR/IR clearing (incl. tolerances) : MR11 • GR/IR split : F.19 • Regrouping : investment invoices (F101) • Clear down payments (F-44) • Clear customers/Vendors (e.g. rebate agreements) • Balance carry forward Reporting Purchasing journal (ZFPJ) Accounts Receivable Accounts receivables Master Data –General, legal, sales organisation view –Credit management (FD32) Transaction Data –Billing –Noted item (test) –Dunning Closing procedures –Doubtful debtors –Revaluation Reporting –Aging balance –Sales journal –Credit management (f.31) Master data : customers Customer master Record General data: Lidl België (207) Gent Client Company 0100 Company 0800 Company Recon.acct Pmnt terms Sort line items 0100 40000000 A114 002 Company Recon.acct Pmnt terms Sort line items 0800 40000000 A214 001 Transaction data : billing All customer invoices/credit notes are posted via SD – no manual (financial) invoices possible ! Transaction data : noted items Transaction data :dunning Customer Vendor Master Records Dunning notices Basic dunning parameters/data 1 Input parameters Documents Dunning print & update of records Proposed dunning notices Dunning program 2 4 Edit proposal 3 Transaction data :dunning Dunning Configuration Program • Dunning procedure – Dunning interval – No. of dunning levels – No. of grace days • • • • Dunning levels Dunning notice sort fields Dunning blocks Dunning texts Closing procedures Transfer doubtful debtors (F103) to other balance sheet reconciliation account Reporting Aging balance Reporting Sales Journal Asset Management Asset Management Master Data –Master data, default values & asset explorer Transaction Data –Acquisition, transfer, retirement –Assets under construction Closing procedures –Periodic posting –Depreciation run Reporting –Depreciation table/year Master data : assets •Divided in different asset classes : –Per class possibility to assign to different accounts –Specific screen layouts –Default values for depreciation areas •Per country a specific chart of depreciation •Different valuation per depreciation area – possibility to have different APC value, depreciation start date, useful life : –Area 01- Book depreciation –Area 02- Tax depreciation –Area 40- IAS (group depreciation) •Possibility to link multiple sub-assets to a main number •Integration with CO via cost center or internal order Transaction data •Acquisition : –Via MM – purchase order –Via FI – from external vendor/affiliated company •Transfer : –From one asset to another without losing details •Retirement : –Sell with/without gain –scrapping •Assets under contruction : –Gather all costs related : spare parts used, overhead, new parts bought,… –Follow up budget (if applicable) –Capitalize final asset(s) via settlement Closing procedure Periodic posting (ASKBN) Closing procedure Depreciation run Reporting Depreciation details Reporting Link with balance sheet Cash Management SAP is an integrated package Integration in the SAP System Sales and Distribution Materials Management Production Planning Quality Management Financial Accounting SD FI CO MM PP QM AM R/3 for Client/Server PS ABAP/4 HR Human Resources R/3 4.7 : Client/Server : ABAP/4 : Version of the SAP system Architecture used in SAP SAP’s programming language Assets Management Project System WF PM Plant Maintenance Controlling IS Work Flow Industry Solutions Basic Components of the R/3 System… Long-term CO FI Capital Resources Short-term AM Capital Investments Expense costs Cash Financial Accounting: FI •General Ledger •Accounts Receivable •Accounts Payable Controlling: CO AM •Cost Center Accounting •Profitability Analysis •Product Costing Assets Management •Control & Identification of property, plant and equipment Basic Components of the R/3 System… Logistics Process Procurement Production Purchase Orders Supplier Processes Materials Sales Orders Products Services MM Services PP SD Customer Material Resources MM Materials Management Sales & Distribution •Receiving •Inventory Management •Procurement (purchasing) •Vendor evaluation •Order Management •Quotations •Pricing •Credit Management •Delivery/ Invoicing SD Production Planning PP •Forecasting •Master Production Schedule •Materials Requirements Planning (MRP) •Production Reporting •Production Orders SAP is an integrated tool Sales Order Customer Shipment Credit Limit Sales & Distribution Material Availability Check Transfer of Requirements Goods Issue to SO Invoice Sales Forecast / Plan Production Order Production Order Receipt Production Planning Production Cost Materials Management Accounting Document Goods Receipt Invoice Receipt Receivable Accounts / Cash Receipt Finance & Controlling Accounts Payable Vendor Integration Points SD, FI-AR, FI-GL, CO-PA Sales order request (1) Credit Limit check (2,3) Customer DB SD Send goods and Send Invoice (4) Post receivable (5) Release to Accounting Sales cost if.; product, quantity, revenue, costs (7) CO-PA AR Post Sales to revenue account; offset to G/L account receivable post reduction in e.g. inventory offset logs (6) G/L Receive invoice payment (8) Reduce receivable and offset cash account (9’) Integration Points MM, FI-AP, CO, FI-GL Goods receipt from vendor ( 4 ) Purchase order send to vendor ( 3 ) MM/PP Invoice receipt against purchase order (6 ) Open item cost posted to CO-orders or Cost Center ( 2) CO Production order request (internal from SD) ( 1) Vendor DB Post payable to vendor account ( 7 ) AP Invoice payment to vendor ( 9 ) Post payable to G/L account/ offset GR-/ IR account ( 8 ) Reduce payable in G/L reconciliation account/ offset cash account ( 11 ) Post expense on cost center or production order (14 ) G/L Settle order (that can be capitalized) to work in progress account/ offset to expense account (15 ) Questions