Martin - Appraising Textile Equipment & Miscellaneous Personal

advertisement

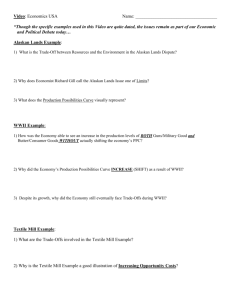

Appraising Textile Equipment & Miscellaneous Personal Property Topics NCDOR Advanced Personal Property Seminars Greensboro, NC September 13-15, 2010 Gregg Martin, Property Tax Division North Carolina Department of Revenue Treatment of Textile Mill Equipment • During the Late 1980s Equipment manufactured prior to 1985 was treated differently than other industries • Residual value was set at 15 % • This was due to significant technology changes in yarn spinning, knitting and weaving Treatment of Textile Mill Equipment • For Tax Year 1990 a modification occurred • The application of 15 % residual value was limited to equipment manufactured prior to 1981 • This treatment continued until Tax Year 2000 Treatment of Textile Mill Equipment • For Tax Year 2000 a modification occurred • Reference to date of manufacture removed • Residual value remained at 15% • A separate section of Schedule A was created for Textile Mill Equipment and Dye and Finish Equipment Treatment of Textile Mill Equipment • For Tax Year 2002 a modification occurred • Residual Value was established at 10% • No reference to year of manufacture Treatment of Textile Mill Equipment • For Tax Year 2003 a modification occurred • Residual Value was set at 5% • New Description of Idle Equipment • The Textile Mill Equipment and Dye and Finishing Equipment section of Schedule A decreased percent good factors by 8-15% per year prior to residual value Treatment of Textile Mill Equipment • For Tax years 2004-2009 there were no modifications to the treatment of Textile Mill Equipment and Dye and Finishing Equipment from guidelines established for Tax Year 2003 Treatment of Textile Mill Equipment • For Tax Year 2010 a modification occurred • Special Sub-schedule for Textile Mill Equipment and Dye and Finishing Equipment was moved to memorandum from Schedule A • Counties encouraged to determine applicability of Special Sub-schedule Analysis of Textile Mill Equipment • Textile mill equipment is used in the manufacture of Spun Yarn and Woven and Knit Fabric • Equipment used in the manufacture of apparel and other finished products utilizing yarn and or fabric are appraised using other guidelines Analysis of Textile Mill Equipment • Two methods of producing yarn • Chemical Process formulates polymer compounds to extrude single filament yarn and cut fiber to be used in the mechanical process • Mechanical process uses a mechanical ‘spinning’ or ‘twisting process’ to manufacture yarn by binding cut fibers through friction Analysis of Textile Mill Equipment • The special schedules address the equipment used in the mechanical process • Ring Spun • Open End • Air Jet • Water Jet • Vortex Analysis of Textile Mill Equipment • Technologies have advanced to increase operating speeds and output • Quality issues have resulted in continued use of Ring Spun technology and actual increases in this production method during recent years • Advance in spinning technology have not resulted in abandoning the oldest technology Analysis of Textile Mill Equipment • Woven fabric is manufactured using mechanical shuttle, air jet and water jet processes • Most weaving technology improvements have been utilized for versatility of manufacturing Analysis of Textile Mill Equipment • Fabrics are knit through the mechanical processes of Circular Knitting or Flat Bed Knitting • Advances have been more for versatility of manufacturing Analysis of Textile Mill Equipment • Non-woven fabrics are manufactured using the latest advances in technology and materials • Tyvek • Handi-wipes • Specialty fabrics • This portion of the industry should be appraised using regular schedules Analysis of Textile Mill Equipment • Dye and Finishing Equipment • Basic mechanical technology has not seen significant change or advances • Most significant change has occurred in the chemical properties of synthetic fibers and the actual dyes and chemicals used in the process Treatment of Textile Mill Equipment • Establish a separate schedule to avoid confusion • Probable that all equipment used in the mechanical processes of Yarn Spinning; Fabric Knitting and Weaving; and Dye and Finishing will receive accelerated depreciation and lower residual values Wind Power Equipment • We are beginning to see limited installation of Wind Turbines used to generate electricity • Most probable locations of equipment are in coastal areas • Study being undertaken by CAMA • NC has 14 % of estimated potential wind power generation capacity in US Wind Power Equipment • Presently recommending the use of schedule T-18 • Generation equipment is very similar to other mechanical generation method • As placement increases, better information on valuation will become available