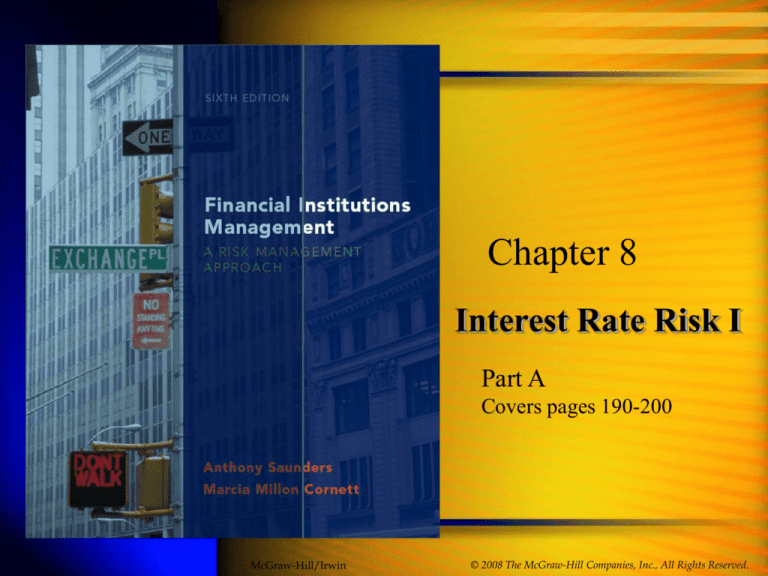

Chapter 8

Interest Rate Risk I

Part A

Covers pages 190-200

McGraw-Hill/Irwin

© 2008 The McGraw-Hill Companies, Inc., All Rights Reserved.

Overview

8-2

This chapter discusses the interest rate risk

associated with financial intermediation:

Federal Reserve monetary policy

Interest rate risk models

*Term structure of interest rate risk

*Theories of the term structure of interest

rates

Interest Rate Risk Models

Repricing model

Maturity model

Duration model

In-house models

Proprietary

Commercial

8-3

Loanable Funds Theory

8-4

Interest rates reflect supply and demand for

loanable funds

Shifts in supply or demand generate interest

rate movements as market forces establish

a new equilibrium

Determination of Equilibrium Interest Rates

8-5

8-6

Note that

y-axis is

bond

PRICE

Increase in Demand for Bonds

8-7

8-8

Factors

that

impact

bond

demand

Bond Supply Shift – Increase in Supply

8-9

8-10

Factors

that

impact

bond

supply

8-11

Level & Movement of Interest Rates

Federal Reserve Bank: U.S. central bank

Open market operations influence money

supply, inflation, and interest rates

Actions of Fed in response to 2001 attacks on

World Trade Center

June 2004- August 2006

Lowered interest rates 11 times during the year

inflation concerns take prominence

17 consecutive increases in interest rates

2008/2009 Short rates lowered to virtually zero

Central Bank and Interest Rates

Target is primarily short term rates

Focus on Fed Funds Rate in particular

Interest rate changes and volatility

increasingly transmitted from country to

country

Statements by Ben Bernanke can have

dramatic effects on world interest rates.

8-12

Fed Funds Rate

20

3Mo CD

15

8-13

Short-Term Rates 1954-2009

25

3 Mo T-bill

10

5

0

08

Jul 06

Jul 04

Jul 02

Jul 00

Jul 98

Jul 96

Jul 94

Jul 92

Jul 90

Jul 88

Jul 86

Jul 84

Jul 82

Jul 80

Jul 78

Jul 76

Jul 74

Jul 72

Jul 70

Jul 68

Jul 66

Jul 64

Jul 62

Jul 60

Jul 58

Jul 56

Jul 54

Jul -

Short-Term Rates 1997-2009

3Mo CD

5

Fed Funds

3Mo T-Bill

6

8-14

8

7

4

3

2

1

0

9

n-0

Ju 9

b-0

Fe 8

t-0

Oc 8

n-0

Ju 8

b-0

Fe 7

t-0

Oc 7

n-0

Ju 7

b-0

Fe 6

t-0

Oc 6

n-0

Ju 6

b-0

Fe 5

t-0

Oc 5

n-0

Ju 5

b-0

Fe 4

t-0

Oc 4

n-0

Ju 4

b-0

Fe 3

t-0

Oc 3

n-0

Ju 3

b-0

Fe 2

t-0

Oc 2

n-0

Ju 2

b-0

Fe 1

t-0

Oc 1

n-0

Ju 1

b-0

Fe 0

t-0

Oc 0

n-0

Ju 0

b-0

Fe 9

t-9

Oc 9

n-9

Ju 9

b-9

Fe 8

t-9

Oc 8

n-9

Ju 8

b-9

Fe 7

t-9

Oc 7

n-9

Ju

Short-Term Rates 2007-2009

3Mo CD

4

Fed Funds

3Mo T-Bill

5

8-15

7

6

3

2

1

0

9

7/0

8/2

9

7/0

7/2 9

7/0

6/2

9

7/0

5/2 9

7/0

4/2

9

7/0

3/2 9

7/0

2/2

9

7/0

1/2

/0 8

/27

12

/0 8

/27

11

/0 8

/27

10

8

7/0

9/2

8

7/0

8/2

8

7/0

7/2

8

7/0

6/2

8

7/0

5/2 8

7/0

4/2

8

7/0

3/2 8

7/0

2/2

8

7/0

1/2

/0 7

/27

12

/0 7

/27

11

/0 7

/27

10

7

7/0

9/2

7

7/0

8/2

7

7/0

7/2

7

7/0

6/2

Rate Changes Can Vary by Market

8-16

Note that there have been significant

differences in recent years

If your asset versus liability rates change by

different amounts, that is called “basis risk”

May not be accounted for in your interest rate

risk model

Repricing Model

8-17

Repricing or funding gap model based on book

value.

Contrasts with market value-based maturity and

duration models recommended by the Bank for

International Settlements (BIS).

Rate sensitivity means time to repricing.

Repricing gap is the difference between the rate

sensitivity of each asset and the rate sensitivity of

each liability: RSA - RSL.

Refinancing risk

However, theoretically could be reinvestment risk

(positive gap)

Repricing Model

8-18

We are interested in the Repricing Model as

an introduction to the importance of Net

Interest Income

Variability of NII is really what we are trying to

protect

NII is the lifeblood of banks/thrifts

Maturity Buckets

Commercial banks must report repricing

gaps for assets and liabilities with maturities

of:

8-19

One day.

More than one day to three months.

More than 3 three months to six months.

More than six months to twelve months.

More than one year to five years.

Over five years.

Note the cut-off levels

Repricing Gap Example

Assets

1-day

$ 20

>1day-3mos.

30

>3mos.-6mos. 70

>6mos.-12mos. 90

>1yr.-5yrs.

40

>5 years

10

Liabilities

$ 30

40

85

70

30

5

Gap Cum. Gap

$-10

$-10

-10

-20

-15

-35

+20

-15

+10

-5

+5

0

8-20

Repricing Gap Example

Assets

1-day

$ 20

>1day-3mos.

30

>3mos.-6mos. 70

>6mos.-12mos. 90

>1yr.-5yrs.

40

>5 years

10

Liabilities

$ 30

40

85

70

30

5

8-21

Gap Cum. Gap

$-10

$-10

-10

-20

-15

-35

+20

-15

+10

-5

+5

0

Note this example is not realistic because asset =

liabilities

Usually assets > liabilities, final CGAP will be +

Applying the Repricing Model

8-22

DNIIi = (GAPi) DRi = (RSAi - RSLi) DRi

Example:

In the one day bucket, gap is -$10 million. If rates

rise by 1%,

DNII(1) = (-$10 million) × .01 = -$100,000.

Applying the Repricing Model

Example II:

If we consider the cumulative 1-year gap,

DNII = (CGAPone year) DR = (-$15 million)(.01)

= -$150,000.

8-23

Rate-Sensitive Assets

8-24

Examples from hypothetical balance sheet:

Short-term consumer loans. If repriced at yearend, would just make one-year cutoff.

Three-month T-bills repriced on maturity every

3 months.

Six-month T-notes repriced on maturity every 6

months.

30-year floating-rate mortgages repriced (rate

reset) every 9 months.

Rate-Sensitive Liabilities

8-25

RSLs bucketed in same manner as RSAs.

Demand deposits and passbook savings

accounts warrant special mention.

Generally considered rate-insensitive (act as

core deposits), but there are arguments for their

inclusion as rate-sensitive liabilities.

FOR NOW, we will treat these as though they

reprice overnight

Text assumes that they do not reprice at all

CGAP Ratio

May be useful to express CGAP in ratio

form as,

CGAP/Assets.

8-26

Provides direction of exposure and

Scale of the exposure.

Example- 12 month CGAP:

CGAP/A = $15 million / $270 million = 0.056, or

5.6 percent.

8-27

Equal Rate Changes on RSAs, RSLs

Example: Suppose rates rise 2% for RSAs

and RSLs. Expected annual change in NII,

DNII = CGAP × D R

= $15 million × .02

= $300,000

With positive CGAP, rates and NII move in

the same direction.

Change proportional to CGAP

![[#STRATOS-256] HTTP 500 page returned if user click on the cloud](http://s3.studylib.net/store/data/007375298_1-8a1d7dac356409f0d3c670b454b6d132-300x300.png)