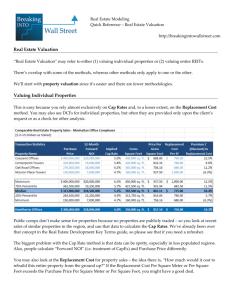

Real Estate Investment Trusts (REITs)

advertisement

Real Estate Investment Trusts (REITs) 1 What is it? • Securitized real estate investment • Ownership form created by IRS code 20:2 Requirements • Assets – 75% of assets must be real estate, cash, and govt. securities • other REIT shares are considered real estate assets – not more than 5% of assets can be from 1 issuer if not covered under above test – may not have more than 10% of voting securities of 1 issuer if not covered under 1st test 20:3 Requirements • Income – 95% of gross income must be from dividends, interest, rents, or gains from sale of certain assets (real estate, cash, or govt securities). – 75% of gross income must be derived from rents, interest on mortgages, gains from sale of certain assets, or income from other REITs 20:4 Requirements • Income – No more than 30% of gross income can be derived from • sale or disposition of securities held less than 6 months • sale or disposition of real estate held for less than 4 years, except those involving foreclosures. • properties held for sale in the normal course of business (anti-dealer provision) 20:5 Requirements • REIT Modernization Act of 1999 (effective 2001) – REITs allowed to own 100% of a Taxable REIT Subsidiary (TRS). TRS can provide services to REIT tenants and others (previously, this was not allowed). Debt and rental payments from TRS to REIT are limited to ensure that the TRS actually pays income taxes. 20:6 Requirements • Distribution – must distribute 90% of all taxable income to investors • mandates fairly low retained earnings policy • has important implications for firm size 20:7 Requirements • Management – REIT managers must be passive • REIT trustees, directors or employees may not actively engage in managing or operating REIT properties (includes providing service and collecting rents from tenants). • Managers may set policy: rental terms, choose tenants, sign leases, make decisions about properties. 20:8 Requirements • Anti-concentration rule – 5 or fewer entities may not own 50% or more of the outstanding shares – Exceptions: • ‘look-through’ provision for US pension funds • UPREIT structure (umbrella partnership) 20:9 Tax Treatment • Accelerated depreciation is allowed for determining taxable income • 40 year asset life required for calculating income available for distribution to investors 20:10 REIT Types • Equity • Mortgage • Hybrid 20:11 Equity REITs • Blank Check – does not disclose investments to shareholders prior to acquisition. • Specified Trusts – purchase a specific property (Rockerfeller Center Properties) • Mixed Trusts – invests in both blank check and specific properties 20:12 Equity REITs • Leveraged v. Unleveraged • Finite-life v. Nonfinite-life – finite-life is self-liquidating 20:13 Equity REITs • Closed-End v. Open-End – closed-end protect shareholders from future dilution • Exchange Trusts – tax-free exchange of property for shares in the REIT 20:14 Equity REITs • Developmental-Joint Venture – funds construction costs – lower cost of capital for developer 20:15 Mortgage REITs • Invests in mortgages – earn the spread between costs of funds and mortgage loan rates 20:16 UPREIT • REIT formed by consolidating limitedpartnerships • partnerships allocated REIT shares based on appraised value of partnership property 20:17 Taubman UPREIT 20:18 REIT Benefits • invest in a diversified RE portfolio managed by professionals • higher liquidity 20:19 REIT Disadvantages • possible conflicts of interests between sponsor and REIT shareholders 20:20 REIT Market Capitalization $160,000 $140,000 200 180 160 $120,000 140 $100,000 $80,000 $60,000 120 100 Market Cap Equity REITs 80 60 $40,000 40 $20,000 0 19 71 19 72 19 73 19 74 19 75 19 76 19 77 19 78 19 79 19 80 19 81 19 82 19 83 19 84 19 85 19 86 19 87 19 88 19 89 19 90 19 91 19 92 19 93 19 94 19 95 19 96 19 97 19 98 19 99 20 00 $0 20 20:22 Structural Changes Influencing the REIT Market • 1986 Tax Reform Act – Reduced incentives to hold real estate in private/partnership form (leveled playing field) – Still, no move to public market financing until late 1992 • TRA was necessary, but not sufficient condition for the rise of equity REITs 20:23 Structural Changes • End of High LTV Nonrecourse Financing – By early 1990s, commercial banks and insurance companies had reduced exposure to real estate • Regulatory pressure on banks • Regulatory pressure and changing business conditions on insurance companies 20:24 Structural Changes • With high LTV nonrecourse loans, real estate owners had no need to raise equity • made them abnormal compared to other capital intensive businesses in the US 20:25 Structural Changes • Debt Rollover Timing – Industry refinanced with 5-7 year miniperms following bond market rally of 1986 20:26 Structural Changes • End of high LTV financing and debt rollovers created a capital squeeze in 1992 that forced many real estate owners to consider raising equity in the public markets for the first time • UPREITs created – allowed original owners to maintain effective control of assets 20:27 Size of Equity REIT Market • In the third quarter of 1995, 119 firms included in the Wilshire Real Estate Securities Index – $42 billion in equity market capitalization – With roughly 40% average leverage level, the value of real estate owned by equity REITs is about $100 billion • compares to the $120-$150 billion owned by taxexempt institutions acting as fiduciaries for 20:28 beneficiaries REIT Liquidity • Research finds that equity REITs have the same liquidity as firms in other industries, holding constant firm size and exchange listing – liquidity measured as the bid-ask spread 20:29 REIT Liquidity • Bid-Ask does not decrease during down real estate markets relative to that for all stocks – very different from liquidity conditions in private markets – must remember that bid-ask is for a marginal change in ownership, transactions in the private market typically involve whole properties or portfolios of properties (control issues arise) 20:30 REIT Growth • REITs have limited ability to grow through retained earnings (little free cash flow) • Most expand through additional stock offerings (follow-on offerings) 20:31 EPS v. FFO • earnings per share (EPS) is a fictional accounting number – REIT must distribute at least 95% of EPS • funds from operations (FFO) is REIT cash flow (no depreciation) 20:32 Funds From Operations (FFO) • FFO means net income (computed in accordance with GAAP), excluding gains (or losses) from debt restructuring and sales of property, plus depreciation and amortization of assets uniquely significant to the real estate industry, and after adjustments for unconsolidated entities in which the REIT holds an interest. Adjustments for these entities are to be calculated to reflect FFO on the same basis. Moreover, NAREIT believes that items classified by GAAP as extraordinary or unusual are not meant to either increase or decrease reported FFO. 20:33 How to Calculate FFO Revenues minus: – – – – Operating expenses Depreciation & amortization Interest expense General & Administrative expense = NET INCOME (GAAP) 20:34 Reported FFO? Net Income minus: – Profit from real estate sales plus: – Real Estate Depreciation = FFO 20:35 Analyst FFO? FFO minus: – – – – Recurring capital expenditures Amortization of tenant improvements Amortization of leasing commissions Adjustment for rent straight-lining = Adjusted FFO (AFFO) 20:36 • Payout Ratio = Dividend / FFO 20:37 Key Parts of FFO • Depreciation and Amortization – Old definition allowed add-back of D&A for non-real estate items • allowed firms to increase FFO in prospectuses via debt buydowns and deferred financing 20:39 Key Parts (Nonrecurring Items) • Focus FFO as a measure of recurring operations – restrict ability to affect FFO due to special events 20:41 Key Parts (Nonrecurring Items) • Focus attention on recurring maintenance and capital expenditures that are necessary to maintain the relative economic position of the property – reflect true economic depreciation – probably should be subtracted, not added back to determine FFO • issue of whether capital expenditure is revenueenhancing 20:42 Impact on FFO • Tenant Improvements (TI) – landlord allowance to cover costs of reconfiguring space for tenant – TI are capitalized and depreciated - cash flow from TI not included in FFO – Implication: • Mgt can use TI’s to raise occupancy and rent revenue 20:44 Impact on FFO • Leasing Commissions – usually paid in cash when lease is signed – cost is capitalized over life of lease, may not show up in FFO – 2 issues: • leasing costs are an operating cost • commissions are occasionally paid over lease term 20:45 Impact on FFO • Straight-line Rents (REITS with long term leases) – count average rental rates over lease life in FFO • over states revenue in early years and under state in later years 20:46 Impact on FFO • Lease guarantees – REIT sponsor guarantees income on currently vacant space using master lease (WHY?) • may be for limited period - short term solution to long term problem • should have recourse to sponsor • sponsor may be charging the REIT guarantee fees 20:47 Impact on FFO • 3rd Party Income – income from managing other properties – highly variable • Leased space v. Occupied space 20:48 Impact on FFO • Ground Leases – encumber the land underneath buildings (long term) – REITs may own buildings subject to a ground lease or REITs may own the ground lease (spread investing) 20:49 Impact on FFO • Depending upon management’s strategy with respect to capitalizing or expensing items, calculated FFO and percentage of payout of net income can vary widely • Kimco Realty (KIM) expenses everything they can - reduces measured NOI -- increases amount they can retain (65% payout ratio - lowest in industry) • Large group of about 10 has payout ratios over 95% -- capitalize aggressively -- raises FFO -- reduces what they can retain 20:50 REIT Debt Usage • Modest leverage levels compared to those taken on by private real estate firms in mid80s. – However, 20%-50% leverage levels are not low when compared to other capital intensive industries such as auto, chemical, etc.. 20:53 FFO Growth FFO Growth = Internal Growth + External Growth 20:54 FFO Growth Internal Growth – – – – – Rental Increases % Rent, Rent Bumps, etc. Tenant Upgrades Property Refurbishments Sale & Reinvestment 20:55 FFO Growth External Growth – Acquisitions • Accretive = yield on investment is below cost of capital – Example: REIT raise $100m from stock and bond at 10% WACC -- acquire property with a 12% yield == 2% increase in FFO • Deccretive = yield is below WACC – Development & Expansion 20:56 REIT Debt Usage • Use of secured debt – Mortgaging properties one-by-one has been the standard – New realization that levering up via slices of secured debt may not leave enough flexibility for firms to take advantage of targets of opportunities 20:57 REIT Debt Usage • Use of unsecured debt – real estate firms rapidly moving in this direction – other corporate entities raise such debt against aggregate firm cash flows, not specific assets 20:58 Minimum Efficient Firm Size • Typical REIT IPO from 1993 – $100,000,000 firm with 50/50 debt-equity ratio, yielding 8% on equity – implies roughly $4,000,000 in income – even with relatively low payout ratio of 75% of earnings, can retain only $1,000,000 20:60 What will $1,000,000 buy? – for apartment REIT, good-sized garden apt. complex costs $20-$25 million, retaining the added $1,000,000 adds little flexibility with respect to acquiring properties for portfolio. – from broad capital market perspective, this firm probably should increase payout ratio (this is what happened in reality) • shareholders received high dividend yield, firm had to repeatedly go to the capital markets to fund acquisitions 20:61 Now consider $10 billion firm • Some now exist: – same 50/50 debt-equity ratio and 8% yield on equity – implied income of about $400,000,000 20:62 $10 billion REIT – if firm chooses not to aggressively expense, it will have a relatively high payout ratio • if that ratio is 95%, implies the firm can retain $20,000,000 • that’s a good-sized garden apt complex, 1/5th of a large regional mall, or a couple of decent-sized warehouses or industrial sites. 20:65 $10 billion REIT – if firm chooses to aggressively expense items to reduce accounting earnings and lower its required payout under the REIT tax law, the situation is markedly different • assume its payout ratio falls to 75%: – ratio implies retention of $100,000,000 – which will buy a portfolio of any property type except regional malls and downtown office buildings 20:66 • If you can retain this amount, you do not have to go to Wall Street to fund every portfolio purchase – increases flexibility so that you can quickly take advantage of targets of opportunity and avoid investment banker fees 20:67 – achieving such internal financing capabilities is goal of many firms • given REIT tax law, fairly large scale is required • average firm size is too small at the moment – suggests that consolidation in the public markets will continue in the next few years 20:68 – how consolidation occurs still is unknown • REIT management's have implemented various types of anti-takeover provisions – 5 or fewer rule itself provides a natural defense mechanism • lack of truly independent boards a problem 20:69 • mergers difficult because acquired firm inevitably has to be willing to hold the paper of acquiring firms – requires common vision to make it work in the absence of aggressive board intervention • most likely path is continued acquisition of private portfolios by public firms – still occurring at rapid pace – more that 80 firms with $1 billion equity market caps – 25 largest firms have mean equity market cap of about $5.5 billion (7/14/98) 20:70 What could stop consolidation in the public markets? • Discovery of fundamental diseconomies of scale – if real estate is inherently small scale business because of the need to master local market details, then really large firms are not feasible • they will have lower returns on average than local firms 20:71 REIT Research Q: Are REITs real estate or stocks? – important implications for portfolio diversification – do REITs provide a real estate index A: REIT returns lag real estate cap rates REIT returns and unsecured real estate returns share a common component that reflects real estate fundamentals REIT returns are noisy. 20:72 REIT Research • Corporate Finance Issues – Dividend policy – Capital structure 20:73 REIT Research • Risk and diversification – REIT returns highly correlated with stocks (corr = .65 .8) – real estate returns have low correlation with stocks (corr=.1 - .3) – REIT betas < 1 • Real estate portfolio allocation – optimal allocation 10% to 19% real estate – historic real estate allocation = 3%-5% (pension funds) 20:74 REIT Research • REITs and Inflation Hedging – depend on the time period under study • 1970s - REITs are negatively correlated with inflation • 1980s - REITs are positively correlated with inflation 20:75