Mutual fund - Columbia University

advertisement

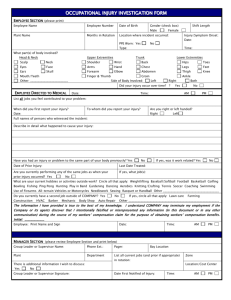

REIT Accounting It’s an Art Not a Science Carl T. Berquist Deputy Director of Arthur Andersen (AA) Real Estate and Hospitality Services Group (REHSG) Worldwide Head of AA Southeastern U.S. REHSG and Metropolitan Wash., D. C. REHSG Practice National Association of Real Estate Investment Trusts (NAREIT) - Associate Board Member Carl T. Berquist Experience • Initial and Secondary Public Offerings • Assisting in various private real estate capital raises • Financial modeling, projections, strategic planning Overview REITs Market Performance Indicators • • • • • FFO AFFO FAD EBITDA Debt to Market Cap Performance Analysis Application of Accounting Policies Real Estate Investment Trust (REIT) Assets are primarily composed of real estate held for the long term Income mainly derived from real estate Pays out at least 95 percent of taxable income to shareholders One level of taxation Mutual fund for real estate REIT Rules Income Tests Asset Tests Widely Held 95% Distribution Requirement How Many REITs Are There? Over 300 U.S. REITs, 216 Publicly Traded 168 33 15 Annual Total REIT Security Offerings $ Billions 70 60 50 40 30 20 10 0 1990 1991 1992 1993 1994 1995 1996 1997 1998 Year-end Market Capitalization $ Billions 180 160 140 120 100 80 60 40 20 0 1990 1991 1992 1993 1994 1995 1996 1997 1998 REIT Advantages and Disadvantages Advantages No corporate income taxes paid Liquidity and access to capital Public market pricing Expert management Strong institutional investor interest Growth opportunities Lower debt levels Corporate governance Independent analyst review Attractive returns Disadvantages Paying out 95%+ of net income reduces internal capital for growth Pay-out requirements force dependence on healthy capital markets Operating businesses must be owned and operated outside of the REIT Being placed into “REIT Box” limits potential investor universe Market expectations limit leverage GAAP accounting issues Dissecting the REIT Income Statement Revenues Operating Expenses EBITDA Interest Expense Funds From Operations Depreciation & Other Net Income Debt Principal Amortization Normalized Cap Exp Tenant Improvements Depreciation & Other Funds Available for Distribution XXXX (XXX) XXX (XX) XXX (XXX) XXX (XX) (XX) (XX) XXX XX Funds From Operations (FFO) Net income (GAAP) excluding gains (or losses) from debt restructuring and sales of property, plus depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures Evolution of FFO NAREIT white paper Net income not a satisfactory measure Conventional P/E multiples not meaningful FFO/Share equivalent to EPS Definition varied in practice Key benchmark statistic Used to compare to peers Key FFO Measurement Benchmarks Growth Rates Payout Ratios (Dividends/FFO) FFO Multiples Growth Rates Done on a Per Share Basis Compared to Peers Quality of Earnings • Core vs. Accounting Gimmicks • Accretive Acquisitions Payout Ratios Safety of Dividend Retained Captial FFO Multiples Similar to PE Ratio Drives Share Price • Share Price/FF0 per Share = Multiple The Industry Average is 10 - 12 Times Several Subjective Variables • • • • • • Management Business Strategy Leverage Quality of Earnings Dividend Growth Payout Ratio Maximum price a REIT can pay for $10 million in FFO and not be dilutive Company FFO Multiple Breakeven Purchase Price Cap Rate A B 10.7 x $107 mill 9.3% C 10.2 x D 9.6 x $102 mill $96.0 mill 9.8% 10.4% E 9.1 x 6.9 x $91.0 mill $69.0 mill 11.0% 14.5% Adjusted Funds From Operations (AFFO) FFO adjusted for straight-lining of rents, as well as a reserve for recurring capital expenditures (including tenant improvements) Similar to FAD Funds Available for Distribution (FAD) Another Type of Payout Ratio • Dividend / FAD Highlights Safety of Dividend Shows Ability to Grow Dividend • The Lower the %, the Greater the Ability to Grow • More than 100% Shows the Dividend Cannot be Sustained Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) EBITDA/Interest Coverage Ignores capital structure The higher the ratio the greater the ability to grow Can always purchase EBITDA Debt to Market Capitalization Total Debt / (Debt + Equity Capitalization) The Lower the Ratio, the Greater the Ability to Grow • Acquisitions can be leveraged • Expansions can be financed • Reduced Refinancing Risk Stock Price Quality Earnings Growing FFO Strong Management Well Defined Growth Strategy Low Debt to Market Cap Ability to Execute Accounting “Gimmicks” Capitalization vs. expense Straight-lining of rental revenue Tenant improvement costs vs. rental rates Off balance sheet financing Off balance sheet ventures One time transactions FFO adjustments • • • • deferred finance fees percentage rent preferred returns unusual items Clarkson Acquisition reserves Leverage (Mark-to-Market) FAD pay out ratio Clarkson “The company continued its innovative policy of renovating apartments to fit specific tenant needs and notes that this is a growing source of revenue for the future.” States Tenant improvements Income from joint ventures Internal development costs Straight-lining of rents American Reserves Other adjustment Performance Indicators Original FFO 1997 % Inc. PER SHARE FAD Payout 1998 1997 1998 EBITDA 1997 Company 1998 Clarkson 0.79 0.60 32% 102 96 1.56 1.09 43% 60% States 0.48 0.42 14% 91 90 0.80 0.62 29% 48% American 0.38 0.32 19% 91 96 0.45 0.40 13% 19% Adjusted Company PER SHARE FFO 1998 1997 % Inc. FAD Payout 1998 1997 1998 EBITDA 1997 % Inc. % Inc. Debt-To-Mkt-Cap Debt-To-Mkt-Cap Clarkson 0.69 0.60 15% 120 96 1.56 1.09 43% 60% States 0.44 0.42 5% 98 90 0.80 0.62 29% 48% American 0.34 0.32 6% 116 96 0.45 0.40 13% 19% American As Reported 1998 Funds From Operations Deduct "Other" Adj. Adjusted FFO Mortgage Principal Pay-downs Normalized FF&E Replacement Normalized Capital Expenditures Funds Available for Distribution FFO Per Share FAD Payout 15,386 As Adjusted 1998 (1,023) (822) (546) 12,995 15,386 (1,456) 13,930 (1,023) (1,919) (546) 10,442 0.38 91 0.34 116 States As Reported 1998 Funds From Operations Tenant Improvements Adj. Internal Leasing Costs Adjusted FFO Mortgage Principal Pay-downs Capital Expenditures and TI Funds Available for Distribution FFO Per Share FAD Payout 6,155 As Adjusted 1998 (407) (106) 5,642 6,155 (100) (380) 5,675 (407) (31) 5,237 0.48 91 0.44 98 Clarkson As Reported 1998 Funds From Operations Mark-to-Market Acquisition Reserves Adj. Adjusted FFO Mortgage Principal Pay-downs Capital Expenditures and Ten. Imp. Funds Available for Distribution FFO Per Share FAD Payout 23,080 As Adjusted 1998 (2,457) (2,802) 17,821 23,080 (2,100) (805) 20,175 (2,457) (2,802) 14,916 0.79 102 0.69 120 REIT Accounting Its an Art Not a Science Summary • There is no easy answer • Understand the numbers • Research is critical