MONTHLY FUND REVIEW

All data as at 31 October 2012 unless otherwise stated

Eastspring Investments

– Asian Property Securities Fund

FUND UPDATE

Investment objective

Eastspring Investments – Asian Property Securities Fund (the “Fund”) aims to maximize income and longterm total return by investing primarily in listed closed-ended Real Estate Investment Trusts and securities

of property-related companies, which are incorporated, listed in or have their area of primary activity in the

Asia Pacific Region. The Fund may also invest in depository receipts including American Depository

Receipts (ADRs) and Global Depository Receipts (GDRs), debt securities convertible into common shares,

preference shares and warrants.

COMMENTARY

Market overview2

Australia’s REITs extended gains in October as investors continued to seek for yield and the sector's yield

spread to government bonds proved attractive. The Reserve Bank of Australia eased the cash rate by 25

basis points to 3.25% in October, ending a three-month pause, citing in part the slowdown in global

economic growth. The 16-member S&P/ASX 200 A-Reith index rose 5.19% in October, its second

consecutive month-on-month gain. It outperformed the broader S&P/ASX 200 index, which rose

2.96% during the month. All stock constituents of the A-REIT index ended October in positive territory.

Expectations of additional monetary easing by the Bank of Japan and healthy first-half earnings prompted

Japan’s REITS and property indices to outperform the broader Topix benchmark in October.

The Bank of Japan's policy board voted unanimously for further easing in the form of an 11 trillion yen

addition to the Asset Purchase Program and the creation of new funding to stimulate bank lending. It was

the first time since April-May 2003 that the Bank of Japan has eased for two months in succession.

The Topix Real Estate Index (TPREAL) advanced 5.54% in October from September's

7.89% while the Topix Real Estate Investment Trust (TSREIT) rose 3.07% in October, its third months

of gains The market’s broader Topix index was up 0.67% during the month.

In Singapore, property developers and real estate investment trusts extended gains for a

fifth consecutive month in October despite another round of property curbs. The FTSE Straits

Times Real Estate Investment Trust (FSTREI) rose 2.23% in October while the FTSE Straits Times Real

Estate Index (FSTRE) gained 2.17%, rising for the fifth month in a row. The two indices were ahead of

the broader Straits Times Index (FSSTI) which was down 0.72%.

Hong Kong’s property stocks underperformed the broader market in October due to the announcement of

property tightening measures by the government. Property developers lagged REITS during the month. The

Hang Seng REIT rose for a fifth consecutive month in October, up 3.79% from September. It outperformed

the nine-member Hang Seng Property Index, which fell for the first time in five months. It was down 1.06%

in October from the previous month's 11.72% surge. Both indices underperformed the broader Hang Seng

Index, which advanced 3.85% in October.

1

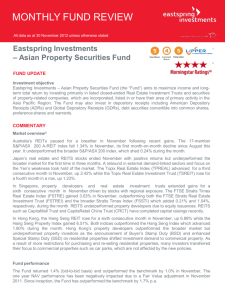

Fund performance

The Fund returned 3.3% (Bid-to-Bid) and underperformed the benchmark by 0.70% in October. Since

inception, the Fund has outperformed the benchmark by 1.60% p.a.

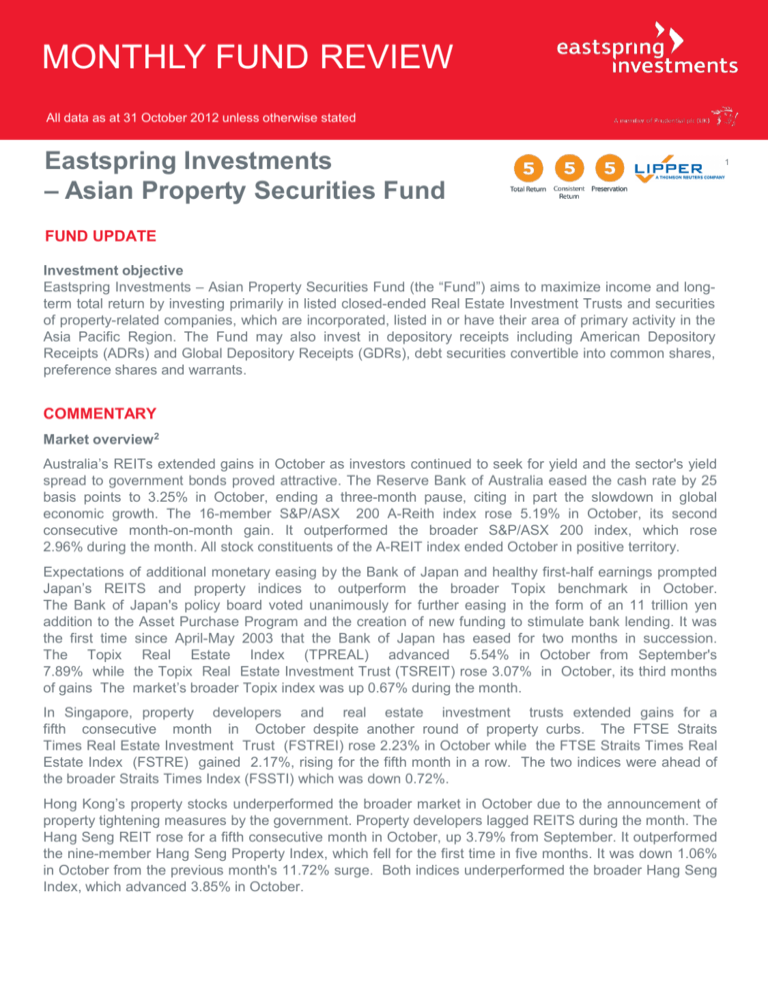

FUND PERFORMANCE

Total return, USD (%)

45

1 month

3 months

1 year

35

3 year*

21.1

15.3

15

9.7

3.3 4.0

5

-15

Since Inception*

28.5 28.7

25

-5

5 years*

17.6 16.9

7.0

3.3

0.8

-1.8

-3.4

Fund (Offer-to-bid)

Fund (Bid-to-bid)

-2.2

-3.8

-0.3

-0.8

MSCI AC Asia Pacific REIT Index

Source: Eastspring Investments (Singapore) Limited and RIMES. Class A share class; USD; net income

reinvested; Offer-bid includes 5.0% Initial Sales Charge w.e.f. 01 Aug 12 and 5.75% Initial Sales Charge

prior to 01 Aug 12. Inception Date: 28 Feb 07 *Annualised. Benchmark: MSCI AC Asia Pacific REIT Index.

Past performance is not necessarily indicative of the future or likely performance of the Fund.

Key contributors to performance

Lend Lease traded higher during the month and was a key contributor. The fund manager remains

comfortable with project pipeline and earnings trajectory for the next couple of years. CapitaRetail China

Trust reported good results for Q3 2012 on the back of strong sales growth of tenants and rental reversion

across its portfolio. Longfor Properties also continued to do well in October as sales performance is

expected to improve.

Key detractors from performance

Hong Kong property stocks were adversely impacted as more property tightening measures in the form of

purchase and resale taxes were introduced in October. Among the Hong Kong names in the Fund, Sino

Land was among the key detractors for the month. Conversely, most names in Australia did well given the

yield differential versus government bonds. The Fund does not invest in Westfield Retail Trust which hurt

relative performance. Ciputra Development traded slower ahead of its Q3 2013 results that were released at

the end of the month. Post event, investors’ concerns were unfounded as the results were better than

expected.

Changes to the portfolio

Among the larger transactions during the month, the fund manager trimmed less attractively valued names

such as Goodman Group and Mirvac Group to add to Stockland and CapitaRetail China Trust which were

viewed as offering better value.

Strategy and outlook

The fund manager continues to keep a strong eye on relative valuations which have tended to outperform in

the medium term. The fund manager remains convinced that the underlying residential prices in Hong Kong

will continue to be robust, and developer balance sheets are strong enough to take advantage of

landbanking and healthy asset turns. This is despite the negative noise around policies – which has had

limited fundamental impact. As a result, the Fund remains weighted in Hong Kong. For Singapore, the Fund

continues to stay invested in resilent high dividend names but is underweight residential property due to the

downside risks in residential prices. Regionally, the Fund will continue to recycle out of defensive more

expensive REIT names regionally to selective residential and landlord plays. The fund manager may build

up more positions in Asean property names where economic growth is more supportive, consumer debt is

lower and provides more opportunity for sustained long term growth.

TOP TEN HOLDINGS

%

COUNTRY* ALLOCATION

%

LEND LEASE GROUP

6.5

SINGAPORE

29.4

NIPPON BUILDING FUND REIT

5.9

AUSTRALIA

27.1

CHEUNG KONG (HOLDINGS)

5.4

JAPAN

17.2

GOODMAN GROUP CLOSED FUND

5.4

HONGKONG

12.9

JAPAN REIT

4.6

PHILIPPINES

4.4

CAPITARETAIL CHINA REIT

4.6

INDONESIA

2.6

MIRVAC GROUP UNITS

4.5

CHINA

2.2

FILINVEST LAND

4.4

THAILAND

2.0

WESTFIELD GRP REIT

4.1

MALAYSIA

1.5

SINO LAND

3.9

OTHERS

0.7

* Country classification by MSCI

Notes:

1. Lipper Leaders fund ratings do not constitute and are not intended to constitute investment advice or an offer to sell or

the solicitation of an offer to buy any security of any entity in any jurisdiction. As a result, you should not make an

investment decision on the basis of this information. Rather, you should use the Lipper ratings for informational

purposes only. Certain information provided by Lipper may relate to securities that may not be offered sold or delivered

within the United States (or any State thereof) or to, or for the account or benefit of, United States persons. Lipper is

not responsible for the accuracy, reliability or completeness of the information that you obtain from Lipper. In addition,

Lipper will not be liable for any loss or damage resulting from information obtained from Lipper or any of its affiliates. ©

Thomson Reuters 2011. All rights reserved. Data as at 31 October 2012.

2. Market data from Bloomberg, 31 October 2012

CONTACT DETAILS

Eastspring Investments (Singapore) Limited (UEN: 199407631H)

10 Marina Boulevard, #32-01 Marina Bay Financial Centre Tower 2, Singapore 018983

Tel: 6349 9711 Fax: 6509 5382

www.eastspringinvestments.com.sg

Important Information

This document is solely for information and may not be published, circulated, reproduced or distributed in whole or part

to any other person without the prior written consent of Eastspring Investments (Singapore) Limited (“the Manager”)

(UEN: 199407631H). This document is not an offer or solicitation of an offer for the purpose of investment units in the

Fund and nothing herein should be construed as a recommendation to transact in any investment product. Please note

that the securities mentioned are included for illustration purposes only. It should not be considered a recommendation to

purchase or sell any particular security. The securities discussed do not represent the fund's entire portfolio and in the

aggregate may represent only a small percentage of the Fund's portfolio holdings.

The fund(s) mentioned in this document is(are) sub-fund(s) of Eastspring Investments (“the SICAV”), an open-ended

investment company with variable capital (société d’investissement à capital variable) registered in the Grand Duchy of

Luxembourg on the official list of collective investment undertakings pursuant to part I of the Luxembourg law of 17

December 2010 relating to undertakings for collective investment (the "2010 Law") and the Directive 2009/65/EC of the

European Parliament and of the Council of 13 July 2009 (the "UCITS Directive").

Investors should be aware that investment in property is a long-term undertaking and there are specific risks associated

with investment in real estate investment trusts and property related securities of companies. These include the cyclical

nature of the real estate market, exposure to domestic and global macroeconomic cycles, increases in interest rates,

fluctuations in security prices owing to stock market movements and changes in investor sentiment, increases in property

taxes and operating expenses, depreciation in the value of buildings over time, variations in property prices and rental

income, changes in district values, changes in government policies with regards to real estate, regulatory limits on rents,

changes in zoning laws, environmental risks, related party risks, losses generating from casualty and natural

catastrophes (e.g. earthquakes), and changes in other real estate capital market factors.

Investors should note that the net asset value of this Fund is likely to have a high volatility due to its investment

policies or portfolio management techniques. The Fund may use derivative instruments for efficient portfolio

management or hedging purposes.

A prospectus in relation to the Fund is available and a copy of the prospectus may be obtained from the Manager and its

distribution partners. Investors should read the prospectus before deciding whether to subscribe for or purchase units in

the Fund. All application for units in the Fund must be made on the manner described in the prospectus. The value of

units in the Fund and the income accruing to the units, if any, may fall or rise. Past performance of the Fund/manager is

not necessarily indicative of the future performance of the Fund. The prediction, projection or forecast on the economy,

securities markets or the economic trends of the markets targeted by the Fund are not necessarily indicative of the future

or likely performance of the Fund. An investment in the Fund is subject to investment risks, including the possible loss of

the principal amount invested. Investors may wish to seek advice from a financial adviser before making a commitment

to invest in units of the Fund Whilst the Manager has taken all reasonable care to ensure that the information contained

in this document is not untrue or misleading at the time of publication, the Manager cannot guarantee its accuracy or

completeness. Any opinion or estimate contained in this document is subject to change without notice. The Manager is

an ultimately wholly-owned subsidiary of Prudential plc of the United Kingdom. Eastspring Investments (Singapore)

Limited and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal

place of business is in the United States of America.

MM272/211112