Distribution of Natural Gas

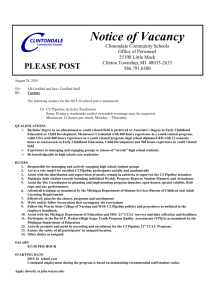

advertisement