Externalities

advertisement

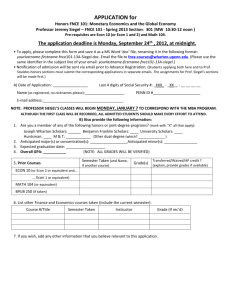

ECON 500

ECON 500 –Microeconomic Analysis and Policy

MARKET FAILURES

Asymmetric Information

Externalities

Public Goods

ECON 500

Markets can and do fail to achieve the efficiency and welfare ideals

that we have presented thus far.

Asymmetric Information prevents the execution of simple efficient

contracts between economic agents and leads to moral hazard and

adverse selection problems.

Externalities where actions of one economic agent affects the well-being

of another agent in a way that is not priced through the market system

leads to misallocation of resources.

Public goods, because of their nonexclusivity and nonrivalry, cannot be

efficiently provisioned through the market system because of free rider

problem.

ECON 500

Asymmetric Information

Markets may not be fully efficient in the presence of asymmetric

information when one side has information that the other side does not.

Market for insurance

Market for credit

Market for used cars

Market for labor

Similar problems also arise when one party to the transaction cannot

monitor the actions of the other party that directly affects her well-being

Manager-worker relationship

CEO compensation

Insurance

ECON 500

ECON 500

Contracts with more complex terms than simple per-unit prices may be

needed to help solve problems raised by such asymmetric information.

In a full-information environment, the principal could propose a contract

to the agent that maximizes their joint surplus and captures all of this

surplus for herself, leaving the agent with just enough surplus to make him

indifferent between signing the contract or not.

This outcome is called the first best, and the contract implementing this

outcome is called the first-best contract.

The outcome that maximizes the principal’s surplus subject to the

constraint that the principal is less well informed than the agent is called

the second best, and the contract that implements this outcome is called

the second-best contract.

ECON 500

ECON 500

Hidden Action Model – Moral Hazard

Imagine a firm with one representative owner and one manager

Suppose the gross profit of the firm is

where e is manager’s effort and ε is a normally distributed random

variable with mean 0 and variance σ2 that affects gross profit and

represents shocks outside of the manager’s control.

Manager’s disutility of exerting effort c(e) is increasing and convex, i.e.,

c’(e) > 0 , c’’(e) > 0

Owners profit is the difference between gross profit and manager’s salary

ECON 500

Hidden Action Model – Moral Hazard

Risk neutral owner wants to maximize expected net profit

Risk averse manager’s utility derived from her salary with constant

absolute risk aversion parameter A is

U(s) = -e-As- c(e)

Manager maximizes the expected utility of from her salary

ECON 500

Optimal Salary Contract – First Best with Observable Effort:

The owner pays the manager a fixed salary s* if she exerts the first-best

level of effort e* and nothing otherwise.

For the manager to accept the contract, her expected utility must exceed

what she would obtain from his next-best job offer (assumed to be 0)

The lowest salary that satisfies this participation constraint is

Owner’s profit is

which is maximized at the effort level satisfying

ECON 500

Optimal Salary Contract – Second Best with Unobservable Effort:

When salary cannot be conditioned on effort, with a constant salary s, the

manager’s expected utility would equals s – c(e), which is maximized by

choosing the lowest level of effort possible: e=0

Suppose the owner offers a salary that is linear in gross profit:

The constant a can be interpreted as the base salary and b can be thought

of as the incentive pay.

We can analyze the relationship in three stages; the owner decides on

a and b, the manager accepts or rejects the contract, and the manager

decides on the level of effort.

ECON 500

Optimal Salary Contract – Second Best with Unobservable Effort:

Manager’s expected utility from the linear salary is

Manager will choose the level of effort that satisfies (IC)

In the second stage, manager will accept the contract if (IR or PC)

The owner can utilize the base salary to induce the manager to accept the

contract, and use the incentive pay to induce her to exert the right effort.

ECON 500

Optimal Salary Contract – Second Best with Unobservable Effort:

In the first stage owner chooses a and b to maximize his expected surplus

subject to the incentive compatibility and individual rationality constraints

since both constraints will hold with equality, owner maximizes:

Therefore the second best level of effort satisfies

ECON 500

Optimal Salary Contract – Second Best with Unobservable Effort:

The optimal effort in the second best case is less than the first best effort

e** < e*

When the owner cannot specify e in a contract, then he can induce effort

only by tying the manager’s pay to firm profit.

However, doing so introduces variation into manager’s pay for which the

risk-averse manager must be paid a risk premium and this risk premium

adds to the owner’s cost of inducing effort.

The fundamental tradeoff that appears in the presence of asymmetric

information is between incentives and risk. As the manager becomes more

risk averse, or as the variance of profit increases, the owner will need to

reduce the dependence of manager’s salary on gross profit which will in

turn reduce her effort.

ECON 500

Hidden Type Model – Adverse Selection

Suppose a consumer of type θ: { θH , θL } obtains the surplus

when she consumes q units of a good and pay a fixed tariff T.

Her marginal benefit is decreasing in q and she can be of high type with

probability β.

Suppose the monopolist’s profit is

Π = T-cq

ECON 500

First Best Pricing with Observable Types

Setting the consumer’s outside option to 0, she will participate if

Monopolist will then set the tariff as high as possible

Monopolist’s profit becomes:

and is maximized at the quantity

First best pricing offers each type consumer a quantity qH , qL that

maximizes their surplus, and extracts that surplus with an appropriate

tariff TH TL.

ECON 500

First Best Pricing with Observable Types

ECON 500

Second Best Pricing with Unobservable Types

If types are unobservable, the Monopolist cannot prevent high types from

obtaining the contract intended for low types.

In order to prevent this adverse selection, the tariff charged to high types

needs to be reduced, and furthermore, the contract for the low types need

to be distorted and made less desirable for high types.

The second best contract is constructed by ensuring that both types

participate voluntarily, and they obtain the contract intended for them. In

other words, the monopoly should offer a menu of contracts that makes it

undesirable for high types to pretend to be low types.

ECON 500

Second Best Pricing with Unobservable Types

The monopolist’s maximizes:

subject to

Note that only the first and the last constraints are binding

ECON 500

Second Best Pricing with Unobservable Types

Using the binding constraints to solve for the tariffs we have:

Monopolist’s problem becomes an unconstrained maximization of

with the FOCs:

ECON 500

Second Best Pricing with Unobservable Types

ECON 500

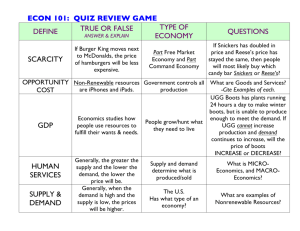

Externalities

Effects of an economic actor’s actions on others

in ways that are not reflected in market transactions.

Interfirm Externalities:

Suppose that the production of some good y depends not only on inputs

but also on the production level of some other good x.

As long as the cross partial with respect to x is different than zero

externalities will be present.

ECON 500

Externalities

Effects of an economic actor’s actions on others

in ways that are not reflected in market transactions.

Externalities in Utility:

Suppose that the utility function of some economic agent S depends not

only on his consumption but also on the utility level of some other

consumer J

As long as the cross partial with respect to UJ is different than zero

externalities will be present.

ECON 500

Externalities is General Equilibrium

The utility function of a representative consumer in an economy is

Consumer has initial stocks of x and y (denoted by x* and y*) and can

either consume these (xc , yc) or use them as intermediary goods (xi , yi)

Good x is produced according to

Good x is produced according to

with g1 > 0 and g2 < 0 and

ECON 500

Externalities is General Equilibrium

The Lagrangean of the society’s utility maximization is

with the FOCs:

ECON 500

Externalities is General Equilibrium

Optimality in production requires

and

If the firms do not take externality into account more x is produced than

the level that is optimal for the society.

ECON 500

ECON 500

Solutions to the Externality Problem

Pigovian Tax:

If firms are found to be disregarding the externality, a per unit tax

that is precisely equal to the marginal harm that x causes to y production

would restore the optimality condition

ECON 500

Solutions to the Externality Problem

Tradable Pollution Rights

Firm y decides on how many rights to sell to firm x by maximizing

The FOC implies that the price for the pollution right will be

ECON 500

Solutions to the Externality Problem

Tradable Pollution Rights

If firm x has the right to pollute, it’s gross profits are:

Firm y’s gross profits are

This profit maximization will yield the same solution as the case where

firm y owns the rights.

ECON 500

Coase Theorem: As long as private property rights are well defined under

zero transaction cost, regardless of their initial assignment, exchange will

eliminate externalities and lead to efficient use of resources.

Public Goods

A good is a (pure) public good if, once produced, no one can be excluded

from benefiting from its availability and if the good is nonrival, i.e., the

marginal cost of an additional consumer is zero.

ECON 500