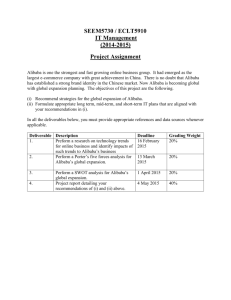

Document 9259455

advertisement

Alibaba Group Holding Ltd. NYSE: BABA Vivek Vinayak Patrick Leake Company History 1999: Alibaba is founded by 18 founders, including Jack Ma 2000: Raises US $25 MM from Softbank, GS, Fidelity, etc. 2002: Becomes profitable 2003: Taobao created C2C (eBay and Amazon) 2004: Alipay is launched – online payment system (PayPal) 2005: Yahoo invests $1 billion in cash for 40% stake in Alibaba 2009: Alibaba Cloud Computing is established 2010: Taobao Mall, or Tmall launches (Amazon). 2014: Alibaba IPO – largest global IPO How big is Alibaba? “In 2013, two of Alibaba’s websites handled $240 billion in sales.” 2x Amazon, 3x eBay Alibaba accounts for 60% of packages delivered in China 80% of China’s e-commerce “Alibaba’s Taobao is one of the 20 most-visited websites globally.” Anticipated to handle $1 trillion a year in transactions in 2018 Revenue Sources Marketing services to merchants on its marketplaces: ◦ Alibaba’s online platform bid for specific keywords, which upon being typed in a browser, display product listings. ◦ Alibaba charges the sellers on a cost-per-click basis and offers this service on its own platform, as well as thirdparty affiliates. ◦ The company also charges sellers on a cost-per-thousand impressions basis in exchange for an attractive display position on its platform (one of its marketplaces) or with third-party affiliates. Transaction fees; primarily from Tmall and Juhuasuan ◦ Sellers pay a certain transaction fee to Alibaba for goods that are sold through Alibaba. This fee typically ranges between 0.3% to 5% of gross merchandise volume. Alibaba offers premium subscriptions and value-added services. ◦ Cloud services, Alipay, Subscription Video & Music, etc…… Business Segmentation Segment Descriptions Revenue Sources China e-commerce retail 78% Taobao Marketplace Largest C2C online and mobile shopping marketplace in China. eBay and Amazon. P4P or display marketing fees; subscriptions fees for storefront software Tmall Largest B2C online and mobile platform for brands and retailers in China. Amazon. P4P or display marketing fee; commissions based on percentage of MV; annual upfront services fees Juhuasuan Daily deal sites that leverages Taobao Marketplace. Groupon. Placement fees for promotional slots; commissions based on percentage of GMV China e-commerce wholesale 1688.com 5% B2B, online wholesale marketplace in China. Fees from memberships and value-added services; P4P and keyword bidding marketing fees Int’l e-commerce retail Alibaba.com Rev. Contr. 7% Leading global wholesale platform focusing on export trades between suppliers in China and buyers globally Fees from membership and value-added services; P4P marketing fees Investment Thesis Ridiculous Growth & aggressive management Great fundamentals & balance sheet for high-growth company China’s growing middle class in a growing economy Recommendation Purchase shares before earnings report (1/29) Hold period: 6 to 12 months Exit: If it trades below IPO price ($92) – Political and interest rate risk Sell: $120 Profit? Price Chart Jan 21. Closing Price: 103.29 52 week Range: 82.81 – 120.00 Competitor Comparison BABA AMZN BIDU Market Cap 248.67B 134.01B 77.29B Revenues 10.25B 85.25B 7.20B Net Income 4.71B -215.00M 2.06B P/E 50.2 N/A 37.55 Rev. Growth 54% 20% 52% EBAY 66.69B 17.51B -127.00M N/A 12% China Growth Potential Online Shipping RMB 128 Million (2008) to RMB 1.9 Trillion (2013) to RMB 5.6 Trillion (2017) Consumption is 36% of GDP (US is 67%) Growing mobile internet penetration, smartphone usae and tablets, and improving wireless telecommunication infrastructure in China. Food and beverages, health goods, and medical services are under-penetrated in online retailing. Alibaba’s Chinese Dominance China’s E-commerce Potential China US Consumption % of GDP 36% 67% Internet Penetration 46% 82% Online Shopper Penetration 49% 64%