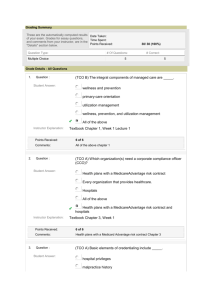

Grading Summary

advertisement

Grading Summary These are the automatically computed results of your exam. Grades for essay questions, and comments from your instructor, are in the "Details" section below. Question Type: Multiple Choice Date Taken: Time Spent: Points Received: 30 / 30 (100%) # Of Questions: 10 # Correct: 10 Grade Details 1. Question : Student Answer: (TCO 7) Major influences of competitors, costs, and customers on pricing decisions are factors of supply and demand. activity-based costing and activity-based management. key management themes that are important to managers attaining success in their planning and control decisions. Instructor Explanation: Points Received: the value-chain concept. Chapter 12, Page 430 3 of 3 Comments: 2. Question : Student Answer: (TCO 7) The first step in implementing target pricing and target costing is choosing a target price. determining a target cost. developing a product that satisfies needs of potential customers. Instructor Explanation: Points Received: performing value engineering. Chapter 12, Page 435 3 of 3 Comments: 3. Question : Student Answer: (TCO 7) The markup percentage is usually higher if the cost base used is the full cost of the product. the variable cost of the product. variable manufacturing costs. total manufacturing costs. Instructor Explanation: Points Received: Chapter 12, Page 441 3 of 3 Comments: 4. Question : Student Answer: (TCO 7) An understanding of life-cycle costs can lead to additional costs during the manufacturing cycle. less need for evaluation of the competition. cost-effective product designs that are easier to service. Instructor Explanation: Points Received: mutually beneficial relationships between buyers and sellers. Chapter 12, Page 443 3 of 3 Comments: (TCO 7) Pritchard Company manufactures a product that has a variable cost of $30 per unit. Fixed costs total $1,500,000, allocated on the basis of the number of units produced. Selling price is computed by adding a 20% markup to full cost. How much should the selling price be per unit for 300,000 units? 5. Question : Student Answer: $49. $43.75. $42. Instructor Explanation: $35. $30 x 300,000 units - $9,000,000 + $1,500,000= $10,500,000 $10,500,000 x 1.20 = $12,600,000 / 300,000 units = $42 Points Received: 3 of 3 Comments: 6. Question : Student Answer: (TCO 8) A product may be passed from one subunit to another subunit in the same organization. The product is known as an interdepartmental product. an intermediate product. a subunit product. Instructor Explanation: Points Received: Comments: a transfer product. Chapter 22, Page 774 3 of 3 7. Question : Student Answer: (TCO 8) Transfer prices should be judged by whether they promote goal congruence. the balanced scorecard method. a high level of subunit autonomy in decision making. Instructor Explanation: Points Received: Both 1 and 2 are correct. Chapter 22, Pages 778-784 3 of 3 Comments: 8. Question : Student Answer: (TCO 8) When an industry has excess capacity, market prices may drop well below their historical average. If this drop is temporary, it is called distress prices. dropped prices. low-average prices. Instructor Explanation: Points Received: substitute prices. Chapter 22, Page 778 3 of 3 Comments: 9. Question : Student Answer: (TCO 8) An advantage of using budgeted costs for transfer pricing among divisions is that it promotes subunit autonomy. the divisions know the transfer price in advance. it usually provides a basis for optimal decision making. Instructor Explanation: Points Received: overall corporate profitability is usually higher. Chapter 22, Page 782 3 of 3 Comments: 10. Question : Student Answer: (TCO 8) The seller of Product A has no idle capacity and can sell all it can produce at $20 per unit. Outlay cost is $4. What is the opportunity cost, assuming the seller sells internally? $4 $16 $20 Instructor Explanation: Points Received: Comments: $24 $20 - $4 = $16 3 of 3