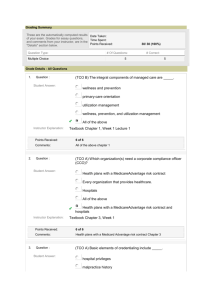

Grading Summary

advertisement

Grading Summary These are the automatically computed results Date Taken: of your exam. Grades for essay questions, Time Spent: and comments from your instructor, are in the Points Received: "Details" section below. 170 / 170 (100%) Question Type: # Of Questions: # Correct: Multiple Choice 25 25 Short 1 N/A Essay 2 N/A Grade Details - All Questions Page: 1 2 3 1. Question : Student Answer: (TCO 1) Which of the following is not a difference between financial accounting and managerial accounting? Financial accounting is primarily concerned with reporting the past, while managerial accounting is more concerned with the future. Managerial accounting uses more nonmonetary information than is used in financial accounting. Managerial accounting is primarily concerned with providing information for external users while financial accounting is concerned with internal users. Financial accounting must follow GAAP while managerial accounting is not required to follow GAAP. Instructor Explanation: Points Received: Chapter 1, Page 7 4 of 4 Comments: 2. Question : Student Answer: TCO 1) Which of the following statements regarding fixed costs is true? When production increases, fixed cost per unit increases. When production decreases, total fixed costs decrease. When production increases, fixed cost per unit decreases. When production decreases, total fixed costs increase. Instructor Explanation: Points Received: Chapter 1, Page 9 4 of 4 Comments: 3. Question : Student Answer: (TCO 1) You own a car and are trying to decide whether or not to trade it in and buy a new car. Which of the following costs is an opportunity cost in this situation? the trip to Cancun that you will not be able to take if you buy the car the cost of the car you are trading in the cost of your books for this term the cost of your car insurance last year Instructor Explanation: Points Received: Chapter 1, Page 9 4 of 4 Comments: 4. Question : Student Answer: (TCO 1) Shula’s 347 Grill has budgeted the following costs for a month in which 1,600 steak dinners will be produced and sold: materials, $4,080; hourly labor (variable), $5,200; rent (fixed), $1,700; depreciation, $800; and other fixed costs, $600. Each steak dinner sells for $14.00 each. How much is the budgeted variable cost per unit? $5.80 $7.74 $6.68 $3.25 Instructor Explanation: Chapter 1, Page 8 ($4,080 + $5,200) / 1,600 = $5.80 Points Received: 4 of 4 Comments: 5. Question : Student Answer: (TCO 1) Which of the following is an example of a manufacturing overhead cost? security at the manufacturing plant fabric used to produce shirts cost of shipping product to customers the salary of the president of the company Instructor Explanation: Points Received: Chapter 2, Page 37 4 of 4 Comments: 6. Question : Student Answer: (TCO 1) Product costs are also called manufacturing costs. are considered an asset until the finished goods are sold. become an expense when the goods are sold. All of the above answers are correct. Instructor Explanation: Points Received: Chapter 2, Page 38 4 of 4 Comments: 7. Question : Student Answer: (TCO 1) At December 31, 2010, WDT Inc. has a balance in the Work in Process Inventory account of $62,000. At January 1, 2010, the balance was $55,000. Current manufacturing costs for the year are $292,000, and cost of goods sold is $284,000. How much is cost of goods manufactured? $292,000 $299,000 $277,000 $285,000 Instructor Explanation: Chapter 2, Page 43 $55,000 + $292,000 - $62,000 = $285,000 Points Received: 4 of 4 Comments: 8. Question : (TCO 2) BCS Company applies manufacturing overhead based on direct labor hours. Information concerning manufacturing overhead and labor for August follows: Overhead cost Direct labor hours Direct labor cost Estimated $174,000 Actual $171,000 5,800 5,900 $87,000 $89,975 How much overhead should be applied in total during August? Student Answer: 177,000 179,950 171,100 168,200 Instructor Explanation: Chapter 2, Page 54 ($174,000 / 5,800) x 5,900 = 177,000 Points Received: 4 of 4 Comments: 9. Question : Student Answer: (TCO 2) Citrus Company incurred manufacturing overhead costs of $300,000. Total overhead applied to jobs was $306,000. What was the amount of overapplied or underapplied overhead? $7,000 overapplied $6,000 overapplied $6,000 underapplied $13,000 underapplied Instructor Explanation: Chapter 2, Page 55 $306,000 - $300,000 = $6,000 overapplied Points Received: 4 of 4 Comments: 10. Question : (TCO 3) Companies in which of the following industries would not be likely to use process costing? Student Answer: cereals paints cosmetics auto body shop Instructor Explanation: Points Received: Chapter 3, Page 84 4 of 4 Comments: 11. Question : Student Answer: (TCO 3) The Blending Department began the period with 20,000 units. During the period the department received another 80,000 units from the prior department and at the end of the period 30,000 units remained, which were 40% complete. How much are equivalent units in The Blending Department’s work in process inventory at the end of the period? 12,000 28,000 40,000 52,000 Instructor Explanation: Chapter 3, Page 88 30,000 x 40% = 12,000 Points Received: 4 of 4 Comments: 12. Question : (TCO 3) Ranger Glass Company manufactures glass for French doors. At the start of May, 2,000 units were inprocess. During May, 11,000 units were completed and 3,000 units were in process at the end of May. These inprocess units were 90% complete with respect to material and 50% complete with respect to conversion costs. Other information is as follows: Work in process, May 1: Direct material Conversion costs Costs incurred during May: $36,000 $45,000 Direct material Conversion costs $186,000 $255,000 Calculate the cost per equivalent unit for conversion costs. Student Answer: $24.00 $4.09 $21.43 $20.40 Chapter 3, Page 89 Instructor Explanation: ($45,000 + $255,000) / [11,000 + (3,000 x 50%)] = $24.00 Points Received: 4 of 4 Comments: 13. (TCO 4) Clearance Depot has total monthly costs of $8,000 when 2,500 units are produced and $12,400 when 5,000 units are produced. What is the estimated total monthly fixed cost? Question : Student Answer: $4,400 $6,580 $3,600 $8,800 Instructor Explanation: Chapter 4, Page 127 Estimated variable cost = ($12,400 - $8,000) / (5,000 - 2,500) = $1.76 per unit Estimated fixed cost = $8,000 - ($1.76 x 2,500) = $3,600 Points Received: 4 of 4 Comments: Page: 1 2 3 Page: 1 2 3 1. Question : (TCO 4) Which of the following will have no effect on the break-even point in units? Student Answer: The selling price increases The variable cost per unit increases The sales volume increases Total fixed costs increase Instructor Explanation: Points Received: Chapter 4, Page 131 4 of 4 Comments: 2. (TCO 4) Circle K Furniture has a contribution margin ratio of 16%. If fixed costs are $176,800, how many dollars of revenue must the company generate in order to reach the break-even point? Question : Student Answer: $1,105,000 $282,880 $1,060,800 $208,476 Instructor Explanation: Chapter 4, Page 133 $176,800 / 16% = $1,105,000 Points Received: 4 of 4 Comments: 3. Question : Student Answer: (TCO 4) Randy Company produces a single product that is sold for $85 per unit. If variable costs per unit are $26 and fixed costs total $47,500, how many units must Randy sell in order to earn a profit of $100,000? 1,735 618 890 2,500 Instructor Explanation: Chapter 4, Page 132 ($100,000 + $47,500) / ($85 - $26) = 2,500 units Points Received: 4 of 4 Comments: 4. Question : Student Answer: (TCO 5) In full costing, when does fixed manufacturing overhead become an expense? In the period when other fixed costs are at the highest level In the period when the product is sold In the period when the expense is incurred When the controller decides that the expense should be recognized Instructor Explanation: Points Received: Chapter 5, Page 168 4 of 4 Comments: 5. Question : Student Answer: (TCO 5) Variable costing income is a function of: Units sold only. Units produced only Both units sold and units produced. Neither units sold nor units. produced Instructor Explanation: Points Received: Chapter 5, Page 169 4 of 4 Comments: 6. Question : (TCO 5) Peak Manufacturing produces snow blowers. The selling price per snow blower is $100. Costs involved in production are: Direct Material per unit Direct Labor per unit Variable manufacturing overhead per unit Fixed manufacturing overhead per year $20 12 10 $148,500 In addition, the company has fixed selling and administrative costs of $150,000 per year. During the year, Peak produces 45,000 snow blowers and sells 30,000 snow blowers. How much fixed manufacturing overhead is in ending inventory under full costing? Student Answer: $0 $49,500 $148,500 $99,000 Instructor Explanation: Chapter 5, Pages 172-174 ($148,500 / 45,000) x (45,000 - 30,000) = $49,500 Points Received: 4 of 4 Comments: 7. Question : Student Answer: (TCO 6) Which of the following is not a reason that companies allocate costs? To calculate the full cost of products for financial reporting purposes To discourage managers from using external suppliers To reduce the frivolous use of company resources To provide information needed by managers to make appropriate decisions Instructor Explanation: Points Received: Chapter 6, Page 198 4 of 4 Comments: 8. Question : Student Answer: (TCO 6) Which of the following statements about cost pools is not true? The costs in each of the cost pools should be homogeneous or similar. Managers must make a cost-benefit decision when determining how many cost pools are appropriate. Only four different kinds of costs may be included in a single cost pool. More cost pools usually provide more accurate information, but are more expensive. Instructor Explanation: Points Received: Chapter 6, Page 202 4 of 4 Comments: 9. Question : (TCO 6) The building maintenance department for Jones Manufacturing Company budgets annual costs of $4,200,000 based on the expected operating level for the coming year. The costs are allocated to two production departments. The following data relate to the potential allocation bases: Square footage Direct labor hours Production Dept. 1 15,000 Production Dept. 2 45,000 25,000 50,000 If Jones assigns costs to departments based on square footage, how much total costs will be allocated to Production Department 1? Student Answer: $1,400,000 $1,050,000 $1,575,000 $2,100,000 Instructor Explanation: Chapter 6, Pages 213-214 Cost per square foot = $4,200,000/ ($15,000 + $45,000) = $70 Production Department I Cost = $70 x 15,000 = $1,050,000 Points Received: 4 of 4 Comments: 10. Question : (TCO 7) A company is currently making a necessary component in house (the company is producing the component for its own use). The company has received an offer to buy the component from an outside supplier. A machine is being rented to make the component. If the company were to buy the component, the machine would no longer be rented. The rent on the machine, in relation to the decision to make or buy the component, is: Student Answer: sunk and therefore not relevant. avoidable and therefore not relevant. avoidable and therefore relevant. unavoidable and therefore relevant. Instructor Explanation: Points Received: Chapter 7, Pages 252-254 4 of 4 Comments: 11. Question : Student Answer: (TCO 7) Ricket Company has 1,500 obsolete calculators that are carried in inventory at a cost of $13,200. If these calculators are upgraded at a cost of $9,500, they could be sold for $22,500. Alternatively, the calculators could be sold "as is" for $9,000. What is the net advantage or disadvantage of reworking the calculators? $13,000 advantage $4,000 advantage $9,200 disadvantage $200 disadvantage Instructor Explanation: Chapter 7, Pages 251-252 ($22,500 - $9,000) - ($9,500 - $0) = $4,000 Points Received: 4 of 4 Comments: 12. Question : (TCO 7) YXZ Company’s market for the Model 55 has changed significantly, and YXZ has had to drop the price per unit from $275 to $135. There are some units in the work in process inventory that have costs of $160 per unit associated with them. YXZ could sell these units in their current state for $100 each. It will cost YXZ $10 per unit to complete these units so that they can be sold for $135 each. When the incremental revenues and expenses are analyzed, what is the financial impact? Student Answer: $25 per unit profit if the units are completed $125 per unit if the units are completed $65 per unit loss if the units are completed $150 per unit loss if the units are completed Instructor Explanation: Chapter 7, Pages 251-252 ($135 - $100) - ($10 - $0) = $25 Points Received: 4 of 4 Comments: Page: 1 2 3 Page: 1 2 3 1. Question : Student Answer: Instructor Explanation: 2. (TCO 3) What are transferred-in costs? Which departments will never have transferred-in costs? Transferred-in costs are those costs that are incurred in one department then transferred to the next processing department.The department where processing begins would never have transferred-in costs. Transferred-in costs are costs incurred in one processing department that are transferred to the next processing department. The department where the processing begins will never have transferred-in costs. Points Received: 20 of 20 Comments: right Question : (TCO 7) Computer Boutique sells computer equipment and home office furniture. Currently, the furniture product line takes up approximately 50% of the company's retail floor space. The president of Computer Boutique is trying to decide whether the company should continue offering furniture or just concentrate on computer equipment. If furniture is dropped, salaries and other direct fixed costs can be avoided. In addition, sales of computer equipment can increase by 13%. Allocated fixed costs are assigned based on relative sales. Equipment $1,200,000 Home Office Furniture $800,000 Total $2,000,000 700,000 500,000 1,200,000 500,000 300,000 800,000 Computer Sales Less cost of goods sold Contribution margin Less direct fixed costs: Salaries Other Less allocated fixed costs: Rent Insurance Cleaning President's salary Other Total costs Net Income 175,000 60,000 175,000 60,000 350,000 120,000 14,118 3,529 4,117 9,882 2,471 2,883 24,000 6,000 7,000 76,470 53,350 130,000 7,058 340,292 $159,708 4,942 380,708 ($ 8,708) 12,000 649,000 $151,000 Prepare an incremental analysis to determine the incremental effect on profit of discontinuing the furniture line. Student Answer: Incremental Decrease in Revenue ($800,000) Incremental cost savings: Cost of sales $500,000 Salaries $175,000 Other $60,000 Incremental Increase in computer equipment($1,200,000*13%) $156,000 Incremental Decrease in computer equipment VC ($700,000*13%) ($91,000) Incremental Increase in profit $0 Instructor Explanation: Incremental drop in revenue Incremental cost savings: Cost of sales Salaries Other Incremental increase in computer equipment (13% x $1,200,000) Incremental increase in computer equipment variable costs (13% x $700,000) Incremental increase in profit 3. ($800,000) 500,000 175,000 60,000 156,000 $ (91,000) 0 Points Received: 25 of 25 Comments: on target! Question : (TCO 4) The following monthly data are available for RedEx, which produces only one product that it sells for $84 each. Its unit variable costs are $28 and its total fixed expenses are $64,960. Sales during April totaled 1,600 units. (a) How much is the breakeven point in sales dollars for RedEx? (b) How many units must RedEx sell in order to earn a profit of $24,640? (c) A new employee suggests that RedEx sponsor a company softball team as a form of advertising. The cost to sponsor the team is $1,792. How many more units must be sold to cover this cost? Student Answer: Instructor Explanation: a) BEP in sales dollars =Fixed costs/Contribution margin ratio (CMR) Unit contribution margin (UCM) =($84-$28)=$56 CMR=$56/$84=66.67% BEP in sales dollars =$64,960/66.67%=$97,440 b) =($64,960/$24,640) /UCM =($64,960/24,640) /$56 =$1,600 Units c) =$1792/$56 =32 Units (a) 84X – 28X – 64,960 = 0 X = 1,160 units X = 1,160 × $84 = $97,440 (b) ($24,640 + $64,960) / ($84 - $28) = 1,600 units (c) $1,792 / ($84 - $28) = 32 units Points Received: 25 of 25 Comments: perfect!