TelecomIndustry

advertisement

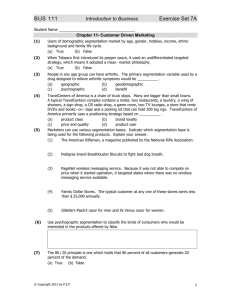

Modeling and Segmentation Telecommunications Industry 2007 GSU-MGS8040 Presentation Subtopics • • • • • • Telecom History Scope of Presentation Modeling Scoring & Tracking Segmentation What’s Next? 1 Telecom History Telecom History • Pre-divestiture AT&T – Little innovation – No competition – No price pressure • Divestiture 1974-1982 – USDoJ split AT&T in return for entry into computers – AT&T split into 7 Regional Bell Operating Companies (RBOC) • • • • • • • Ameritech Corporation Bell Atlantic Corporation BellSouth Corporation NYNEX Corporation Pacific Telesis Group Southwestern Bell Corporation U S West, Inc. 3 History (continued) • Divestiture 1974-1982 (continued) – Surge in long distance competition • Sprint, MCI, AT&T, BellSouth, Verizon, Quest • LD prices drop – Local monopolies remained • local prices rise/static • Telecommunications Act 1996 – State-by-state Uniform national law – Meant to promote competition – Incumbent Local Exchange Carriers (ILECs) made network elements available to Competitive LECs (CLECs) at cost plus regulated wholesale – LECs gained ability to provide LD services – Lead to consolidation of major media companies (80 > 5) 4 Evolution of Telecom Companies From Wikipedia 5 New Competitive Challenges • New Technologies - Convergence – Cellular Phone – Messaging, E-mail, Ring Tones, TV/Video feeds – Wireless Communication/Data – VoIP – Internet Access – ISDN, DSL, T1 – Cable – Cable/Wireless partnerships – Television/Video (new) – Bundle strategies 6 Presentation Scope Presentation Scope • Single ILEC providing B2B landline products and services – – – – – ~1.2M business customers, ~ 2.4M lines 1 - 200 employees 1 - 50 lines 1 - 10 locations Top 5 industries: Retail, Wholesale, Business Services, Manufacturing, Healthcare – ILEC uses a three channel approach to the market including Inbound centers, Outbound sales and Sales Agents. 8 Modeling Why Model • Increase Profitability – Ameliorate line losses • CLEC competition • Cellular – Sales targeting: outbound and Inbound, based on customer behavior/attributes – New product development and advertising strategies – Efficient use of marketing and sales resources – Segmentation Strategies: Identify groups of customers based on predictions of their possible business needs 10 Line Loss History # Lines Lost 2000 2000 2000 2000 2000 2000 2000 2000 2000 2000 2000 2000 2001 2001 2001 2001 2001 2001 2001 2001 2001 2001 2001 2001 Jan Feb Mar Apr 60,000 May Jun Jul 50,000 Aug Sep 40,000 Oct Nov Dec 30,000 Jan Feb Mar 20,000 Apr May 10,000 Jun Jul Aug 0 Sep Oct Jan-00 Nov Dec 21,164 Jan-00 21,738 Feb-00 25,736 Mar-00 24,613 Apr-00 26,798 May-00 29,116 Jun-00 30,848 Jul-00 38,264 Aug-00 32,600 Sep-00 35,156 Oct-00 34,744 Nov-00 31,481 Dec-00 37,699 Jan-01 33,393 Feb-01 41,828 Mar-01 38,389 Apr-01 42,138 May-01 46,963 Jun-01 45,912 Jul-01 48,386 Aug-01 37,835 Sep-01 43,826 Jan-01 Oct-01 37,795 Nov-01 39,086 Dec-01 36526 36557 36586 36617 36647 36678 36708 36739 36770 36800 36831 36861 36892 36923 36951 36982 37012 37043 37073 37104 37135 Jan-02 37165 37196 37226 Competitive Line Loss Jan-03 Jan-04 Jan-05 Jan-06 Month 11 Line Loss History Competitive Line Loss 50000 45000 40000 # Lines Lost 35000 30000 25000 20000 15000 10000 5000 0 Jan-00 Jan-01 Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Month 12 Telecom Modeling • Statistical propensity modeling is the backbone of telecom segmentation and offer strategy • Every customer is scored by each model (probability and L, M, H score) • Models have been built and continuously updated for all key products (Bundles, DSL, Lines, Line Add-ons, LD, T1, Direct Internet Access, complex data, complex voice, wireless, hosting, inert customers, customer vulnerability/churn, and growth index) • Predominantly logistic regression models - 70 variables initially, with 5-10 in the final model • Sales improvement from the use of models varies from 20-50%, over no targeting 13 Automated Data Sourcing/Flow Billing Sales Quotas and Targets Modeling & Reporting Datamart List Generation Product Usage Service, Maintenance Trouble Reports Campaign Tracking Contracts Monthly Processing • • • • Automated Acquisition Unit of Analysis Matching Cleaning • • • • Conflict Resolution Business Rules History Summarize Targeting Tracking New Product Strategy Reporting – Scheduled, Ad hoc Data Views • Calculated Variables 3rd Party D&B, InfoUSA Advertising & Sales Campaigns Modeling & Scoring Scores, Segments 14 Modeling & Scoring Flow Modeling & Reporting Datamart Views Store, Clean, Dummy variables, Categorize, Standardize, Calculate new variables, Summarize SAS Enterprise Miner Refresh Models, New Models, Ad hoc Models Score Customers Monthly 15 Data for Modeling • Snapshot of customer data for the most current month • Total of 350-400 variables – Customer history (3-6 months) for some variables – Aggregated with summary functions (mean, min, max, etc.) • Data cleaning – – – – – – Null, 0, Missing, Blanks Impute Bad values (out of range, wrong type, subjectivity) Outliers Transformations Offsets • Calculated variables • Other pre-processing – decision trees, factor analysis, etc. • SAS Enterprise Miner 16 SAS Modeling Interface 17 Dataset Drill-Down Variable labels intentionally covered 18 Logistic Drill-Down 19 Neural Net Drill-Down 20 Model Flow - Sample 21 Logistic Results Drill-down (Confusion Matrix) 22 Logistic Results Drill-down (T-scores) 23 Cumulative Response (Lift) 24 Scoring Automated Scoring • • • Score ~1.2M customers for each of ~ 25 models x 2 variants/model x 1-4 updates/refreshes per year > 120 models/year Customers scored with 2 values: probability (0.0-1.0) & score (L, M, H) for each model/variant SAS code (32,354 lines ) - modularized, optimized for ease of maintenance and to some degree, speed – Declare global macro variables • Date • Product mean revenue – Declare Libnames • Establish OLEDB connection with remote database (SQL Server 2005) • Connection/references to local subdirectories – Code – Raw Data – Scores – Prep for new data – delete datasets from previous month’s processing – Retrieve data • Connect to views and read data from remote server into local datasets • Clean data, create calculated variables – Launch scoring modules • Score customers for ~50 models – Store scores locally – Save scores to remote server 26 Scoring Process (%include files) Model 1 Scoring Code File Master File SAS Pseudo-Code SAS Processing Flow Pre-scoring Code Model 1 Scores * Data scores.model1; set raw_data.cust; … run; Model 2 Scores Model 3 Scores … Model N Scores Post-scoring Code Model 2 Scoring Code File Modeling Platform Data scores.model2; set raw_data.cust; … run; * %include “code.Score_Model_1.sas”; 27 Probability/Propensity vs Score Score Abbreviation Probability Range Population Size High H 0.50 ≤ H ≤ 1.00 ~20% Medium M 0.25 ≤ M ≤ 0.75 ~30% Low L 0.00 ≤ L < 0.50 ~50% 28 Tracking Model Effectiveness Average for Base 4.50 4.00 Effectiveness Index 3.50 3.00 2.50 2.00 1.50 1.00 0.50 0.00 A B C D E Product Low High F G H • Monthly tracking with updating as needed • Effectiveness Index (EI): actual sales compared to average sales rate • EI: multiplier showing how effective the model is. E.g. Product B model shows that a customer scored “high” is ~3 times more likely to buy the product than an average customer • Model differentiation: compare High vs Low EI values. E.g. For Products C-E, a customer scored “high” is more than 7 times more likely to buy that product than one scored “low” 29 Model Performance Improvement - Refresh Product X 9.00 8.00 Effective Index 7.00 6.00 H 5.00 M 4.00 L 3.00 2.00 1.00 - Nov_06 Oct_06 Sep_06 Aug_06 Jul_06 Jun_06 May_06 Apr_06 Mar_06 Feb_06 Jan_06 Dec_05 Nov_05 Oct_05 Sept_05 Tim e Period 30 Segmentation Why Segment • Increase Profitability – Targeting • efficient use of marketing and sales resources by targeting inbound and outbound sales – Messaging • development of targeted marketing communications (i.e., Hispanic language direct mail, women owned businesses) ensures messages reaches customers effectively – Future Needs • Identification of groups of customers based on their business needs, not bound by traditional telecom products 32 Segmentation Evolution The segmentation process was continually evolved - moving from one dimensional models to multi dimensional schemes. Along the way, predictive modeling was added to the process to ensure the segmentation scheme was always actionable. Seg 1 Seg 2 Seg 3 Seg 4 Seg 5 Seg 6 Customer Complexity • • • • • • High B2B Technology Retail/Service Small Stable Low • • • • Vulnerability Value Vulnerability Industry Location One Dimensional 1997 Product Targeted Customer Size Multi Dimensional 2001 2006 33 Product Based Segmentation D E F A B C Products Complex Simple Low Size High 34 Segment Profiles Slide deliberately left blank. 35 Segmentation with Propensity Modeling • Add propensity modeling to the “static” segmentation scheme • Re-categorize customers into Segments – – – – – Identify migrations from one segment to another Identify customer growth areas/products Promote stewardship for customer growth Anticipate new needs Develop new products 36 Needs Based Segmentation (Product Migration Paths) D E F A B C Products Complex Simple Low Size High 37 Additional Dimensions D2 E2 F2 Products Complex D1 E1 F1 A1 B1 C1 Simple Low High Third Dimension Size 38 What Next? What’s Next? • Accommodate increased customer base (due to merger) and increased geographic footprint • More products, more new product development – Bundles – Television/Video – Etc. • Shifting competitive landscape – Cable – New partnerships • Revisit segmentation complexity (product) and size axes • Evolve segmentation strategies – Growth Index Lifetime value • Other 40 Growth Potential/Index Customer’s Current Products and Value • Product A x Revenue for A + • Product B x Revenue for B + Current Value • Product F x Revenue for F = X Customer’s Potential Products and Value • Product A x Revenue for A + • Product B x Revenue for B + • Product C x Revenue for C + • Product F x Revenue for F + Potential Value • Product G x Revenue for G = Y Y – X = Growth Potential/Index 41 Customer Lifetime Value • CLV - value of a customer over the entire history of customer's relationship company – – – – – – – Acquisition cost Churn rate Discount rate Retention cost Time period Periodic Revenue Profit Margin • Possibly include Satisfaction & Loyalty ? 42 Acknowledgements • Special thanks to Tim Barnes & Sam Massey, AT&T - 2007 43 Contact Information David Pope, Ph.D. Intelligent Strategies and Information Solutions, Inc. www.intelligentstrategies.com 770.271.9159 44