The postwar project: Economic development in practice

advertisement

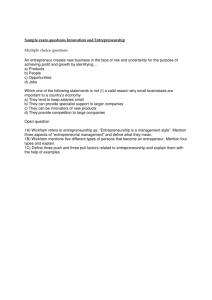

The postwar project: Economic development in practice IS290/IS190 ICT4D: Context, Strategies, and Impacts Fallacies in development theory 1. 2. 3. Underdevelopment has a single cause A single criterion suffices for evaluating development performance Development is a log-linear process Fallacy # 1 Underdevelopment has but a single cause . . .or “panaceas that failed” (Easterly) Classical theorists – Adam Smith, Karl Marx, Joseph Schumpeter had multidimensional historical views of development: resources, technical knowledge, social and institutional structures, diversity of economy, political structures, culture, etc. Mainstream postwar development theory tended to be mono causal and suggest uni-dimensional solutions X-factor as the magic bullet Underdevelopment is due to constraint X; if loosen X, then development will be inevitable result. X=capital, skill, technology, etc. [Each may have limited applicability in particular places at particular times, but not necessary and sufficient for development] X = physical capital, 1940-70 Investment is key to growth: “capital fundamentalism” Soviet model of growth: continuing investment in capital intensive industry, infrastructure Memories of Marshall plan reconstruction Bretton Woods institutions: World Bank (IBRD), International Monetary Fund (IMF), postwar bilateral foreign assistance programs all based on this assumption Digression on growth theory I Harrod-Domar model : Growth depends on the quantity of capital & labor; investment leads to capital accumulation, which generates economic growth (Keynesian.) Developing economies have plentiful labor but scarce physical capital, and low incomes mean low savings/investment. Policy implication: economic growth depends on policies to increase saving and investment Assumes fixed capital-output, capital-labor ratios Growth poles as spatial counterpart “..belief in the power of heavy industrial investment to radically alter the structure of the economy. . . It was argued that sufficient capital could produce instant modernization.” – Lisa Peattie Planning: Rethinking Ciudad Guyana 1987 Big ticket infrastructure: modern steel mills, huge hydroelectric projects. Confidence that “leading sectors” would pull rest of economy along in a march to societal progress. X = entrepreneurship (1958-65) Influenced by Schumpeterian theory “Deficiency of entrepreneurship” need private sector industrialists to lead growth Creation of International Finance Corp (IFC) as part of World Bank Group Government seeks to influence supply of entrepreneurship or to substitute for entrepreneurship Entrepreneurship = private investment IFC, founded 1956: “Our mission is to promote sustainable private sector investment in developing countries, helping to reduce poverty and improve people's lives.” Products: innovative financial arrangements such as loans, equity and quasi-equity investments, guarantees and stand-by finance, etc. Digression on growth theory II Neoclassical (Solow) growth model: Key addition: Capital subject to diminishing returns Long run growth via increase in productivity of labor—not capital accumulation Difference between capital intensity (K/L) and technology (output per worker hour) Solow (1956, 1957) calculated that the “residual” accounted for four-fifths of US economic growth Growth rate depends on technological innovation and so is exogenous (outside model) X = incorrect relative prices (1970-80) ILO observation of growth and industrialization with high unemployment and inequality Economic dualism: capital intensive modern industry v. low productivity, small firms Belief that relative factor prices did not reflect relative economic scarcity; subsidies => capital under priced, labor overpriced relative to availability => inappropriate technology Solution: favor labor intensive prodn via import substitution, raise tariffs for capital intensive X = international trade (1980- ) Inefficiencies of government sponsored industrialization (protection, subsidies, etc.) International trade promoted as substitute for inadequate domestic demand: removing barriers to trade in commodities will automatically => rapid export-led growth Comparative advantage plus domestic and trade liberalization as sufficient (panacea?) X = hyperactive government (1980-96) Government is not the solution to development, it’s the problem: it corrupt & distorts market incentives Solution is to minimize role of government in domestic (as well as international) markets => “Washington consensus” Commentary Growth theory: technology is exogenous Microeconomics: theory of static resource allocation Assumptions for market equilibrium least applicable in developing economies where factors are not mobile, information is not perfect, institutions poorly developed, etc. Market equilibrium depends on initial distribution of wealth; if that is not optimal them won’t achieve welfare maximization Digression on growth theory III New growth theory (1980s): Technological change endogenous to model Increasing (not diminishing) returns to capital investment via virtual cycles of innovation and human capital improvements “spill over” “Learning by doing” and economies of scale Policy: R&D and/or human capital investment X = human capital (1988- ) Low human capital endowments as obstacle “New growth theory” human capital and knowledge magnify productivity of capital & raw labor Multiple growth trajectories: high growth, high factor productivity, econ of scale when have high levels of human capital and knowledge => “Brain drain” and underemployment due to lack of demand, complementary opportunities The limits of growth theory? Emerging consensus that new growth theory no more successful than neoclassical growth theory in explaining income divergence btwn developed and developing economies. (Both predict LT income convergence. . .) Why? Econ factors: institutional arrangements, internal market barriers, trade barriers, etc. What about other factors: “bad” govts, polarization due to ethnic conflict and inequality; excessive red tape, black markets, high levels of debt, inflation, etc. X = ineffective government (1997- ) Reevaluation of optimal role of government: 1. East Asian successes govt role in shift from import-subs to export promotion 2. Backlash against neo-liberalism in advanced economies; focus on corruption 3. Mixed success of market reforms in 1980s lead institutions like WB to see need for capable, committed governments to reform Fallacy #2: Single criterion suffices for evaluating development performance GNP per capita only national potential for improving welfare of majority, not actual Need for multidimensional criteria such as Human Development Index (UNDP) that involve distribution measures and other indicators of human welfare Ideal: battery of disaggregated performance indicators to index national welfare & evolution Fallacy #3: Development is a log-linear process Solow: a single unique production function that characterizes all countries, based on supply of inputs, capital, labor, and natural resources Growth of total output is function of rate of change of physical inputs; rate of growth of per capital output is function of rate of change of capital-labor ratio, natural resources, and residual (technological change) Ignores: initial conditions & history, levels, path dependence Alternative propositions Development process is highly nonlinear 2. Development trajectories not unique 3. Initial conditions shape subsequent devel. 4. Development trajectories can be altered via policy, they are malleable Economic development is a highly multifaceted, non-linear, path-dependent, dynamic process that involves shifting interactions between different aspects of development 1. Additional resources Gerald Meier and Joseph Stiglitz, eds. Frontiers of Development Economics (2001) Lisa Peattie Planning: Rethinking Ciudad Guyana (1987) Jane Jacobs Cities and the Wealth of Nations: Principles of Economic Life(1984)