PowerPoint Template

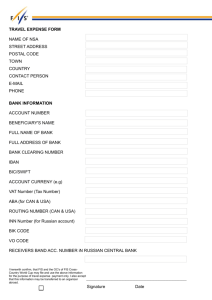

advertisement

2010 IADI ARC Conference Arusha, Tanzania Deposit Insurance System in Korea & Actions in Response to the Global Financial Crisis July 29, 2010 Yangig Cho (Team Leader of Korea Deposit Insurance Corporation) (Leopards on Kilimanjaro) Executive Summary Korea, as an SOE (small open economy), has achieved the fastest industrialization since 1960's Over the last decade and a half, Korea has experienced two financial crises in 1997 and in 2008 Korea successfully managed the crises thanks to efficient Financial Safety Net (FSN) including the Deposit Insurance System (DIS) (Coat of arms of Tanzania) 2 Agenda I. Deposit Insurance System in Korea II. Impact of Global Financial Crisis on Korean Economy III. Actions in Response to the Global Financial Crisis IV. Lessons Learned (The flag of Tanzania) 3 I-1. Components of the Financial Safety Net MoSF FSC BOK (Fiscal /Foreign Currency Policy) (Financial Policy) (Monetary Policy) KDIC KDIC (Deposit Protection (Deposit Protection Resolution) && Resolution) FSS FSS (Financial (Financial Supervision) Supervision) KAMCO KAMCO (NPL Cleanup) (NPL Cleanup) * MoSF : Ministry of Strategy and Finance FSC : Financial Services Commission BOK : Bank of Korea FSS : Financial Supervisory Service KAMCO : Korea Asset Management Corporation 4 I-2. Cooperation within the FSN FSC BOK KDIC Financial Services Commission Monetary Policy Committee Deposit Insurance Committee •Chair & Vice Chairperson •Vice Minister of MoSF •Senior Deputy Governor of BOK •President of KDIC •Governor of FSS •Two experts recommended by FSC and KCCI •Governor & Senior Deputy Governor of BOK •Five experts recommended by BOK, MoSF, FSC, KFB, and KCCI •President of KDIC •Vice Minister of MoSF •Senior Deputy Governor of BOK •Vice Chairperson of FSC •Three experts recommended by FSC, MoSF, and BOK Cross participation through joint committees, financial information sharing, joint investigation, etc. * KCCI : Korea Chamber of Commerce and Industry KFB : Korea Federation of Banks 5 I-3. Introduction of the KDIC Establishment in 1996 Integrated deposit insurer since 1998 Highest decision-making body : Deposit insurance committee Coverage Sectors (6 sectors) Banks, financial investment companies, life and non-life insurance companies, merchant banks, mutual savings banks 321 FIs Total amount of insured deposits 1,001 tr won ($864 bn.) Coverage Limit 50 mil. won($43,178) * 2.2 times of GDP Per Capita($19,690) Insured Depository Products Insured Non-insured Bank deposits, customer’s deposit of securities trade account, individual insurance policies, etc. CDs, RPs, Securities, CPs, etc. * Excluding deposits by government and insured FIs, etc. DI Premiums Rate (%) Banks Fin. Invest. Ins. Co. Merch. Banks MSBs 0.08 0.15 0.15 0.15 0.35 (As of Dec. 31, 2009; KRW/USD=1,158) 6 I-4. Major Functions of the KDIC Identify troubled FIs through on and off-site monitoring and request FIs or supervisory authorities to take appropriate actions for preventing failure Deposit insurance policies / Management of the Deposit Insurance Fund Ongoing Risk Surveillance Policy & Fund Management KDIC Investigation Investigate persons accountable for insolvency of FIs to file a civil damage suit against them Number of staff : 577 (including 7 executive directors) Recovery Recovers funds injected into the resolution of failed institutions by receiving bankruptcy dividends or by monetization of assets (eg. Shares) Resolution In the event of failure, KDIC not only resolves the troubled FIs in an orderly and timely manner through various methods such as OBA, P&A, liquidation, etc., but also provides insurance coverage to depositors 7 I-5. Progress of Financial Restructuring in Korea (Number of transactions, 1997-2008) Resolution Type Banks Insurance Co. Securities Co. Merchant Banks Credit Union MSBs Total Disposal 1 1 3 0 0 0 5 Merger 6 6 0 5 0 0 17 Nationalization 8 3 0 0 0 0 11 Subtotal 15 10 3 5 0 0 33 P&A 5 10 0 22 30 0 67 Bridge Bank 0 0 0 0 11 0 11 Deposit payoff 0 0 4 0 71 327 402 Subtotal 5 10 4 22 112 327 480 20 20 7 27 112 327 513 OBA Closure Total 1) 2) 3) 4) OBA : Open Bank Assistance MSB : Mutual Savings Bank Credit Union : excluded from insurance coverage from 2004 Including only FIs to which public funds were injected from KDIC or KAMCO (Source: Public Fund Oversight Committee) In order to minimize loss to Deposit Insurance Fund, KDIC adopts various resolution schemes such as OBA, P&A, and bridge bank, in addition to deposit payoff 8 Agenda II. Impact of Global Financial Crisis on Korean Economy (The flag of Tanzania) 9 II-1. Transmission of Financial Crisis Crisis in Developed Countries Impact on Emerging Market Equity, Bond Market Deleveraging Credit Crunch Financial Path Confidence Crisis Foreign Currency Market Psychological Path Economic Slowdown Real Economy Path Foreign capital outflow, Increased credit risk → plummeted equity and bond price, increased risk premium Worsened conditions for foreign borrowing → foreign currency shortage, soaring exchange rate and CDS premium Export Rapid Inventory adjustment Export financing contraction → Sharp drop in export Domestic Demand Consumption and investment Sentiment shrinking → decrease in domestic demand SOEs are inherently vulnerable to global financial crisis development (Source : Korea Development Institute) 10 II-2. Impact on Korean Economy Sudden Reversal of Capital Flows Concern over Credit Crunch, Foreign Currency Shortage Sharp Drop in Export Concern over Economic Recession • Dependence on trade : 90.5% (trade/GDP, 2006-2008) * G7 average of trade/GDP: 56.1% • Share of foreign-investor-owned stocks in total market capitalization : 30.9% (Dec.’07) Korean economy, open and highly integrated to global market, was hit hard by recent crisis 11 II-3. Reversal of Capital Flows ($ bn.) Jan. 95 Nov.97- Mar.98 Apr.98 Sep.08 - Dec.08 Jan.09 - Oct.10 Asian - Aug.08 Global - Apr.10 Financial Crisis 2) Financial crisis 2) Amount 781 △214 2,219 △695 816 Equity 134 21 8 △74 366 Bond 386 △16 1,238 △134 310 S.T. Borrowing 1) 261 △220 973 △487 140 1) S.T. Borrowing : short-term borrowing due in less than 1 year 2) “Crisis” means a period in which the capital account recorded deficits in succession. Resulting from the deleveraging process, foreign capital suddenly began to outflow during the crises 12 II-4. Tighter Domestic Financial Conditions 41.9% 32.4% 1 4 2008 7 10 1 2009 4 7 10 1 4 2010 1 4 2008 7 10 1 2009 4 7 10 1 4 2010 13 II-5. Sharp Drop in Export and GDP Growth Export Volume GDP Growth Rate (YoY) Monthly : -43.6% (b/w Sep.’08 and Jan.’09) 5.1% (’07) → 2.3% (’08) → 0.2% (’09) Compared to the same period a year ago : -25.2% (1Q ’09) 45 Monthly Export Volume ($ bn.) 40 36.6 37.4 37.1 35 30 25 28.8 27.1 25.4 27.9 30.3 35.0 34.0 32.6 32.0 28.1 29.0 21.1 20 15 10 5 0 Aug Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Sep Oct 2009 14 Agenda III. Actions in Response to the Global Financial Crisis (The flag of Tanzania) 15 III-1. Measures Following the Lehman Bankruptcy Measures Initial – Stabilizing F/X market Actual Government’ s payment guarantee for foreign currency borrowings by domestic banks $100 bn. (3 years) $1.3bn. Currency swap lines with U.S., Japan, and China $30 bn. (U.S.), $20 bn. (Japan), 180 RMB bn. (China) $16.4 bn. (U.S.) Foreign liquidity provision to banks $50 bn. $26.8 bn. Midterm – Fiscal stimulus package1) Boosting real economy Policy rate3) cut 1) 2) 3) Commitment 7% of GDP2) Tax Cuts Public Spending $57.9 bn. $28.8 bn. $29.1 bn. 5.25% (Aug.’08) → … → 2.0% (Feb.’09) For the period of 2008 to 2012 $832.9 bn. in 2009 BOK Base Rate : reference rate applied in transactions such as RP Initial and midterm measures were executed promptly and preemptively 16 III-2. FSC – Stabilization of Financial Market Improve asset soundness of FIs Preemptive recapitalization measures Restructuring Fund (KAMCO) Bank Recapitalization Fund Acquiring NPLs Recapitalization Non-Bank FIs Banks Financial Stabilization Fund (KoFC) Recapitalization, etc. (Equity, loan, guarantee, etc) Non-Bank FIs Normal Insolvent Resolution of Insolvent FIs Deposit Insurance Fund (KDIC) Public-private joint measures enhanced soundness of capital & assets 17 III-3. FSC - Strong Regulation over Mortgage Lending Trend of Housing Prices LTV, DTI Regulation was adjusted according to changes in housing price LTV(Bank) : 60% (Apr.’03) → 40% (Apr.’05) * U.S. 76.60%, Japan 70~80%, UK 70% (2008) DTI(Bank) : 40% (Mar.’06, Special zone) → 40% (Nov.’06, All cities) •LTV : Mortgage Loan to Value (official value of house or APT) ratio •DTI : Monthly Debt Burden of Mortgage To Monthly Income ratio Loan-to-deposit ratio (excluding CD) ≤ 1 (grace period until 2014) Korean housing price remained stable relative to international market Proactive control of asset bubbles and excessive asset growth were the factors most critical to overcoming the recent crisis 18 III-4. KDIC’s Role in Crisis Management – 1997 Crisis Actions Blanket Coverage Coverage Expansion Integrated DIS Financial Restructuring (513 resolved ’97-’08) Outcomes Results Preventing Bankrun Boosting Financial Competitiveness Restoring Real Economy Improving Foreign Confidence 1997 2007 BIS ratio 7.04% 11.94% NPL (ratio) $31.6 bn. (6.70%) $5 bn. (0.64%) ROA -1.06% 1.08% ROE -14.18% 16.17% In 1997, F/X and financial crisis arose from weak fundamentals both in the sector of corporates and FIs KDIC’s decisive response was crucial to overcome the crisis 19 III-5. KDIC’s Role in Crisis Management – Recent Crisis Public have a strong confidence in DIS from ’97 experience KDIC provides perfect protection for depositors during emergencies KDIC has a well equipped system for resolving failed Fis KDIC established contingency plan in preparation for possible crisis Sign of Crisis Beginning of Crisis Partial Protection → Deepening of Crisis Blanket Coverage → Expansion of Covered Products KDIC was prepared for another crisis 20 III-5. KDIC’s Role in Crisis Management – Recent Crisis Only 5 mutual savings banks failed during the recent crisis (2008-2009) No sign of bankrun Partial protection scheme was maintained Foreign-currency deposits were newly insured (Nov. 3, 2008~) KDIC’s role was limited to minimum ; standby for action 21 Agenda IV. Lessons Learned (The flag of Tanzania) 22 IV-1. Key Success Factors for SOE Korea as an SOE • has been highly vulnerable to the fluctuations of the global economy and the consequent capital flows • has nevertheless successfully avoided the damage from recent crisis based upon following lessons; 1. Prompt and preemptive response 2. Prudent management of financial sector soundness Coordination among relevant ministries to promptly prepare countermeasures in key areas : Tight LTV/DTI regulation to maintain total loan delinquency rate at a stable 1% level Support banks to raise BIS ratios through F/X liquidity, Fiscal Stimulus Package, Policy a variety of recapitalization programs rate cut, etc. Purchase of troubled assets improved the asset soundness of banks Conveyed accurate and detailed information to investors to avoid misunderstanding and Possibility of massive bank defaults are restore market confidence minimized by maintaining high quality of loans and low growth of assets 23 IV-1. Key Success Factors for SOE 3. Strong Fiscal Position of the Korean Government 4. Lessons and Experience from ’97 Asian Financial Crisis Relatively low level of public debt Timely response with manuals enabled a large-scale stimulus package when necessary - Institutional framework (e.g., KDIC and KAMCO) - Legal framework (e.g., Act on the Structural Improvement of the Financial Industry, Consolidated Insolvency Act, and Corporate Restructuring Promotion Act) 24 Korea’s Knowledge Sharing Program(KSP) An Official Development Assistance (ODA) offered by Korean govt. A comprehensive policy consultation program to share Korea’s development experience - Together with experts from govt., research inst., international organization Consulting area selected upon discussion - Economic development strategy - Industrialization and export promotion - Economic crisis management - Human resources development 17 countries participated in KSP (2004-2010) * Please visit http://www.ksp.go.kr/ for more information. KDIC is willing to facilitate application for KSP 25 Thank You! Email : yicho@kdic.or.kr Phone : 82-2-758-1122 Fax : 82-2-758-1120 (Kibo summit of Kilimanjaro)