Presentation

advertisement

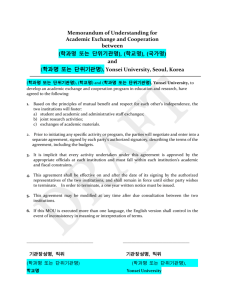

The Outbreak of the 1997 Financial Crisis and Its Recovery Doowon Lee Professor of Economics Yonsei University, Seoul, Korea Doowon Lee, School of Economics, Yonsei University I. Outbreak: Causes of Crisis IMF Bail Out & Sharp Depreciation of e Absence of International Crisis Management System Korean Gov.'s Effort to Defend Exchange Rate Failed Failure to Roll over ShortTerm Foreign Debts (kind of Bank run) Losing International Credibility Financial Sector *Mounting Bad Loans Corporate Sector *Losing Competitiveness *Excessive Investment (I>S) *Poor Corporate Governance System Doowon Lee, School of Economics, Yonsei University External Sector *Current Account Deficits Financed by Foreign Borrowing (carry trade?) *Unprepared Financial Market Liberalization I. Outbreak: International Comparison of Debt-Equity Ratios of Mfg Industry South Korea (1997) South Korea (2004) Germany (1966) 3.96 1.04 0.98 Japan (1999) Taiwan province of China (1995) U.S. (1999) 1.74 0.86 1.64 * Sources : Krueger and Yoo (2001). Bank of Korea, Bank of Korea Information (June, 2001, p.66) Doowon Lee, School of Economics, Yonsei University I. Outbreak: Debt Service Burden of Manufacture Company (%) Financing Cost of Manufacture Co. 10 9 8 7 6 5 4 3 2 1 0 1996 1997 1998 1999 Ratio of Financial Cos t to Sales * source: The Bank of Korea website (www.bok.or.kr) Doowon Lee, School of Economics, Yonsei University 2000 2001 I. Outbreak: International Comparison of NPL (unit: %) South Korea (1997) South Korea (1999) 6.0 8.3 → 13.6* South Korea (June, ’01) 5.7 U.S.** (2000) Japan** (2000) Germany *** (1999) U.K.*** (1999) 1.21 5.44 1.3 2.17 Sources : Korea Financial Supervisory Service (www.fss.or.kr) ; The Banker (July 2000, July 2001), recited From www.seri.org (2001.6) and www.bok.or.kr Note : * Average of all the commercial banks’ NPL. Korea has changed its criteria of NPL in 1999 according to international standard. The ratio of NPL to total loans increased after the adoption. Thus ‘13.6’ is value derived from new criteria and ‘8.3’ is based on previous criteria. ** Average of ten biggest commercial banks’ NPL. *** Average of five biggest commercial banks’ NPL. Doowon Lee, School of Economics, Yonsei University II. Crisis Recovery Corporate and financial sector restructured Three party agreement between labor, manager, and government Export led recovery -> current account surplus Exchange rate stabilized Doowon Lee, School of Economics, Yonsei University II. Recovery: General Review Domestic Economy Support by Government Budget Financial Sector Restructuring Corporate Sector Restructuring • M&A or Liquidation (Applying BIS criteria) • Lower Debt/Equity Ratio • Liberalization • Improving Corporate Governance • Removing Bad Loans • M&A Establishment of Social Safety Net • Calm Labor Dispute • Create Jobs • Help the Unemployed Attracting Foreign Capital External Economy • FDI • Portfolio Investment • Increase Foreign Exchange Reserve • Decrease Foreign Debt Current Account Surplus Doowon Lee, School of Economics, Yonsei University Recovery of Korean Economy II. Recovery: Summary of Reforms in Four Major Areas 1) Financial Sector Pre-Crisis Situation ① 14 of the 27 commercial banks below BIS ratio of 8%* ② Troubled loans are estimated to be W 118 trillion as of March 1998 ③ Lack of proper supervision Reform Measures ① FSC and FSS established. ② Initially W64 trillion of public fund was thought to be needed. As of the end of 2005, total of W168 trillion was injected and W76 trillion retrieved. Changes and Achievements ① Number of financial institution dropped from 2,102 to 1,341 between 1997 and 2007. ② Impaired loans (substandard or below) as of June 2001 estimated to be W 65 trillion, estimated to be W 49.8 trillion. • Note : * BIS(bank of International Settlements) ratio measures the ratio of bank’s equity over a weighted average of risky assets. The higher this ratio is, the more financially sound is the bank. • sources : Bank of Korea website (www.bok.or.kr); Korea Financial Supervisory Commision website (www.fss.or.kr); Korea National Statistical Office website (www.nso.go.kr); Korea Development Institute website (www.kdi.re.kr); Fair Trade Commission website (www.ftc.go.kr) Doowon Lee, School of Economics, Yonsei University II. Recovery: The Number of Financial Institutions Fianacial Sector End of 1997 March, 2007 Change Commercial Banks 26 13 -13 Specialized and Development Banks 7 5 -2 Merchant Banks 30 2 -28 Securities Firms* 36 54 +18 Insurance Companies 50 51 +1 Investment Companies 31 51 +20 Leasing Companies 25 35 +10 Mutual Savings & Finance Companies 231 110 -121 Credit Unions (Credit Cooperatives) 1,666 1,020 -646 Total 2,102 1,341 -761 • Note : * The number of security firms increased due to the establishment of foreigners-owned security firms. Also, some merchant banks are transformed into security firms. • Sources : Recited from Figure 5 of Jones (2002), Financial Supervisory Service of Korea Doowon Lee, School of Economics, Yonsei University BIS ratio of Commercial Banks in Korea BIS(%) BIS ratio 14 13 12 11 10 9 8 1997 1998 1999 2000 Domestic 2001 Foreign 2002 2003 2000 Compounded * Sources : Bank Management Statistics of Financial Supervisory Service of Korea Doowon Lee, School of Economics, Yonsei University 2005 Year ROE ratio of Commercial Banks in Korea ROE(%) ROE ratio 30 20 10 0 -10 1997 1998 1999 2000 2001 2002 2003 2004 -20 -30 -40 -50 -60 Domestic Foreign Compounded * Sources : Bank Management Statistics of Financial Supervisory Service of Korea Doowon Lee, School of Economics, Yonsei University 2005 Year ROA ratio of Commercial Banks in Korea ROA(%) ROA ratio 2 1 0 1997 1998 1999 2000 2001 2002 2003 2004 -1 -2 -3 -4 Domestic Foreign Compounded * Sources : Bank Management Statistics of Financial Supervisory Service of Korea Doowon Lee, School of Economics, Yonsei University 2005 Year II. Recovery: Summary of Reforms in Four Major Areas 2) Corporate Sector Pre-Crisis Situation Reform Measures ① Highly leveraged firms with debt/equity ratio of 396.3% for manufacturing firms in the end of 1997 ② Poor corporate governance : cross-debt guarantees, crossshareholdings Changes and Achievements ① Debt/equity ratio dropped : 100.9% for manufacturing firms by 2005. ① Five guidelines ② Big Deals ③ Lack of transparency and tricky accounting practice ② Cross-debt guarantee decreased from W 11 trillion of 1998 to W 0.2 trillion of 2001 for the largest 5 conglomerates • sources : Bank of Korea website (www.bok.or.kr); Korea Financial Supervisory Commision website (www.fss.or.kr); Korea National Statistical Office website (www.nso.go.kr); Korea Development Institute website (www.kdi.re.kr); Fair Trade Commission website (www.ftc.go.kr) Doowon Lee, School of Economics, Yonsei University II. Recovery: International Comparison of Debt-Equity Ratios of Mfg Industry South Korea (1997) South Korea (2005) Germany (1996) 3.96 1.01 0.98 Taiwan provinc Japan e of (1999 -> 2003) China (1995) 1.74 -> 1.45 0.86 U.S. (1999 -> 2004) 1.64 -> 1.41 * Sources : Krueger and Yoo (2001). Bank of Korea, Bank of Korea Information (June 2001, Sep 2005) Bank of Korea, Principal Economic Indicators (May 2007) Doowon Lee, School of Economics, Yonsei University The Volume and Composition of Corporate Finance (Unit : bn Kr\, %) Average of 1990~1997 1998 2000 2002 2004 115.9 59.6 128.7 167.2 176.6 Internal Source 33.9 (29.3) 31.6 (53.0) 62.9 (48.9) 83.9 (50.2) 110.8 (62.7) External Source 82.0 (70.7) 28.0 (47.0) 65.8 (51.1) 83.3 (49.8) 65.8 (37.3) Corporate Finance * Note : Numbers in parentheses are % ratios. * Source : A periodical, “경제포커스 (in Korean)” No.112, Samsung Economic Research Institute Doowon Lee, School of Economics, Yonsei University Proportion of Direct Finance Out of External Sources •Source : Hahm, Joon-Ho(2007), “금융시스템의 변화와 평가” presented at 『A Decade after Financial Crisis : Process and Problem』, 2007 Seminar of Korean Economic Association (June 11th, 2007) Doowon Lee, School of Economics, Yonsei University II. Recovery: Summary of Reforms in Four Major Areas 3) Labor Market Pre-Crisis Situation ① Rigid and militant labor union ② Average nominal wage increase rate (13.45%) higher than average labor productivity growth rate(10.37%) from ’92~’96 ③ Absence of social safety net Reform Measures ① Tripartite Commission established. Changes and Achievements ① More flexible labor market ② Average labor productivity growth rate (18.73%) ② Social safety net hastily set higher than average up (employment insurance nominal wage increase system, public works rate (5.87%) from ’98~’00. program, national basic livelihood security act). ③ Productive welfare system • sources : Bank of Korea website (www.bok.or.kr); Korea Financial Supervisory Commision website (www.fss.or.kr); Korea National Statistical Office website (www.nso.go.kr); Korea Development Institute website (www.kdi.re.kr); Fair Trade Commission website (www.ftc.go.kr) Doowon Lee, School of Economics, Yonsei University Painful Process of Laying-Off * Sources : Recited figure 3 of An article on East Asian Economies “Gold from the Storm”, Economist, June 28th 2007 Doowon Lee, School of Economics, Yonsei University II. Recovery: Unemployment Rate 8 7 7 6.6 6 % 5 4.4 4 4 3 3.3 3.6 3.7 3.7 3.5 3.3 2.6 2 1 0 1997 1998 1999 2000 2001 2002 * source : Bank of Korea (http://www.bok.or.kr) Doowon Lee, School of Economics, Yonsei University 2003 2004 2005 2006 2007 II. Recovery: Summary of Reforms in Four Major Areas 4) Government Sector Pre-Crisis Situation Reform Measures Changes and Achievements ① Total number of civil servants decreased from 919,404 to 885,164 between Feb 1998 and Feb 2003. ① Regulation ① Administrative reform ② Inefficient public enterprises ② Deregulation ③ Privatization ② Number of regulations decreased from 10,717 of August 1998 to 7,156 of July 2001. ③ Privatized 6 public enterprises and plan to privatize 5 more as of Jan. 2001.website (www.fss.or.kr); • sources : Bank of Korea website (www.bok.or.kr); Korea Financial Supervisory Commision Korea National Statistical Office website (www.nso.go.kr); Korea Development Institute website (www.kdi.re.kr); Fair Trade Commission website (www.ftc.go.kr) Doowon Lee, School of Economics, Yonsei University The Number of Public Officials by Successive Administrations The Total Number of Public Officials (unit : persons) 5th Administration 6th “Civilian” “A People” “Participation” * Sources : Maeil Business Newspaper, July 11th 2007. Doowon Lee, School of Economics, Yonsei University II. Recovery: Growth Rates of Macroeconomic Indices 2000 1998 2001 1999 1/4 2/4 3/4 4/4 1/4 2/4 3/4 4/4 Growth Rate(%) * GDP -6.7 10.9 12.6 9.7 9.2 4.6 3.7 2.7 1.8 3.7 Consumption -11.7 11.0 10.8 8.9 5.7 3.2 1.5 4.1 4.8 6.6 Investment(equipment) -38.8 36.3 62.6 41.6 31.9 8.1 -8.4 -11.2 -15.7 -3.1 Investment(construction) -10.1 -10.3 -6.8 -4.2 -3.5 -2.5 1.5 1.1 8.2 10.7 -4.2 -2.7 40.4 24.5 1.6 2.9 4.2 3.5 2.8 3.8 1.0 1.1 Inflation rate 7.5 0.8 2.0 1.6 3.0 2.5 3.6 5.0 4.2 3.4 Unemployment rate 6.8 6.3 5.1 3.8 3.6 3.7 4.8 3.5 3.3 3.2 Consolidated budget / GDP(%)** Current account balance (bn $) 1.3 1.0 • Note : * The growth rates are compared to the same quarter of the previous year. ** Figures for 2000 and 2001 are annual figures. • sources : Major Indicators of Korean Economy, Korea Development Institute, 2002. 3. 9., p.41 Bank of Korea website (www.bok.or.kr) Doowon Lee, School of Economics, Yonsei University II. Recovery: Exports Have Been the Main Driver for Growth 45 40 45 Merchandise Exports (Percent change, y/y, two-month average) 40 35 35 30 30 25 25 20 20 15 15 10 10 Sep02 Dec02 Mar03 Jun03 Sep03 Doowon Lee, School of Economics, Yonsei University Dec03 Mar04 Jun04 Sep04 II. Recovery: Exchange Rate Fluctuation (monthly) II. Recovery: Exchange Rate Movement (annual) (won) 1,600 1,400 1,399 1,291 1,200 1,189 1,000 800 1,251 1,131 1,192 1,145 1,024 951 771 956 805 600 400 200 0 1995 1996 1997 1998 1999 2000 2001 * source : Bank of Korea (http://www.bok.or.kr) Doowon Lee, School of Economics, Yonsei University 2002 2003 2004 2005 2006 II. Recovery: Movement of KOSPI after the Crisis 1200 1000 800 600 400 200 0 1998-01-03 1999-01-03 2000-01-03 KO S P I 2001-01-03 2002-01-03 III-1. Role of Foreign Capital in the Outbreak of Crisis Withdrawal of foreign capital, but in what channel? - Little FDI before 1997 - Stock market partially opened - Borrowing from foreign banks - Especially the loan from the Japanese banks Doowon Lee, School of Economics, Yonsei University Inflow & Outflow of Portfolio Investment (bn, US$) 5 Inflow & Outflow of Portfolio Investment 4 3 2 1 0 -1 1997 1Q 2Q 3Q 4Q 1998 1Q 2Q 3Q -2 -3 -4 -5 (Year, Quarter) Outflow of Portfolio Investment Inflow of Portfolio Investment * Source : Economic Statistic System, Bank of Korea Doowon Lee, School of Economics, Yonsei University 4Q Composition of Foreign Liabilities (mn, US$) Total Foreign Liabilities Government Monetary Authority Commercial Banks Excetra (NBFI) * Source : Economic Statistic System, Bank of Korea Doowon Lee, School of Economics, Yonsei University III-1. Role of Foreign Capital in the Outbreak of Crisis Were there no crisis if capital market was not liberalized? Even before capital market liberalization, there existed insatiable demand for capital by conglomerates. Excessive investment caused chronic trade deficit and increasing NPLs Foreign exchange crisis could have been avoided if e was allowed to depreciate, which was politically difficult Even if capital market was not liberalized, mounting NPLs would have caused domestic financial crisis. Doowon Lee, School of Economics, Yonsei University III-2. Role of Foreign Capital in the Recovery: Positive Aspect Initially, it provided much-needed liquidities. It boosted stock market, and partially eliminated the so-called ‘Korea Discount’ Structural reforms and improved profitability Protection of minority shareholders’ right Improved transparency (case of SK) Doowon Lee, School of Economics, Yonsei University Inflow of Foreign Capital Inflow of Foreign Capital (bn, US$) 350 325 300 275 250 225 200 175 150 125 100 75 50 25 0 -25 -50 1997 1998 1999 FDI 2000 2001 2002 Portfolio Investment * Source : Economic Statistic System, Bank of Korea Doowon Lee, School of Economics, Yonsei University 2003 2004 Foreign Debt 2005 2006 (Year) Price Earning Ratio, August 10 2005 30 25 PER 20 15 10 5 0 Japan U.S. Hong Kong Singapore Taiwan Thailand Korea Price Earning Ratio, Apr 18 2006 40 35 30 PER 25 20 15 10 5 0 Japan U.S Singapore Taiwan Hong Kong Korea Thailand Price Earning Ratio (PER) MSCI World Average PER (left scale) MSCI Korea PER (left scale) ( times) Korea PER / World PER (right scale) year * source : Maeil Business Newspaper (June the 4th, 2007) Doowon Lee, School of Economics, Yonsei University Proportion of Foreign Possession in Stock Market (%) Institutes Corporate Individuals Foreigners * Sources : A Periodical “Securities & Futures, the May 2007 issue, Korea Exchange Doowon Lee, School of Economics, Yonsei University III-3. Role of Foreign Capital in the Recovery: Negative Aspect 1 Consumer loans increased, and HH debt (fueled by the government policy of easy credit) accumulated that dampened consumption Doowon Lee, School of Economics, Yonsei University Proportion of Corporate Loan and Household Loan Out of Commercial Bank Credit Corporate Loan Household Loan •Source : Hahm, Joon-Ho(2007), “금융시스템의 변화와 평가” presented at 『A Decade after Financial Crisis : Process and Problem』, 2007 Seminar of Korean Economic Association (June 11th, 2007) Doowon Lee, School of Economics, Yonsei University Household Debt & Credit (percentage of GDP) 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 Household debt Doowon Lee, School of Economics, Yonsei University Household credit HH Debt Suppress Consumption 14 12 10 8 6 4 2 0 1999 2000 2001 2002 2003 2004 -2 -4 Consumer Expenditure * source : ecos.bok.or.kr Doowon Lee, School of Economics, Yonsei University GDP 2005 2006 1/4 III-3. Role of Foreign Capital in the Recovery: Negative Aspect 2 Growth potential deteriorated Less investment as banks are reluctant to lend Threat of hostile take-over has prevented big companies from making large-scale and long-term investment: cash-hoarding, increased divident payment, buying its own shares. But, it is difficult to generalize. Increased regulation, rapidly aging population, and instable labor relation are also responsible for deterioration of growth potential Doowon Lee, School of Economics, Yonsei University Falling Growth Rate 12 10 8 GDP Growth Rates 6 4 2 0 1991 1992 1993 1994 1995 1996 1997 1998 1999 -2 -4 -6 -8 Years 경제성장률 잠재성장률 2000 2001 2002 2003 2004 Falling Growth Rate Five Asian Economies’ Investment ratio & Growth rate * Sources : Recited figure 1 of An article on East Asian Economies “Gold from the Storm”, Economist, June 28th 2007 Doowon Lee, School of Economics, Yonsei University III-3. Role of Foreign Capital in the Recovery: Negative Aspect 3 PEF: Short-term speculative gains that were non-taxable: Case of Lone Star’s take over of Foreign Exchange Bank of Korea in 2003 As part of the banking sector is under foreign ownership, public good nature of banking industry is under threat. Also, it is difficult to carry out the old-style industrial policy (case of The First Bank w.r.t. Hynix), which is not always a bad thing. Some myths about foreign capital: herd behavior? Increased volatility? Increased divident/profit? Doowon Lee, School of Economics, Yonsei University Invasion of Private Equity Fund * source : Maeil Business Newspaper (June the 23rd, 2007) Doowon Lee, School of Economics, Yonsei University IV. Lessons of the Korean Crisis Fixed e with capital market liberalization is difficult to maintain After all, it was sound fundamentals of the Korean economy that enabled the recovery Foreign capital is a two-edged sword. Also, it is difficult to define ‘foreign capital’ in one word as they are not homogeneous. Sequential liberalization of capital market is necessary Too much foreign exchange reserve can also be a problem Doowon Lee, School of Economics, Yonsei University V. Side Effects and Remaining Agenda Low investment growth rate Credit bubble and household debt -> weak consumption growth Government owned financial institutions Ballooning government debt: public fund and budget deficit Worsened income distribution and poverty problem Bi-polarization of the economy Set back of reforms in labor market and government Doowon Lee, School of Economics, Yonsei University Resulting in Unbalanced Growth 200 200 180 180 160 160 140 140 120 120 100 100 80 80 60 60 40 40 1997 1998 1999 2000 Industrial Production Index 2001 2002 Export Doowon Lee, School of Economics, Yonsei University 2003 2004 2005 2006 1/4 * source : kosis.nso.go.kr Private consumption & Export % change 35 30 25 20 % change 15 10 5 0 -5 1997 1998 1999 2000 2001 2002 2003 2004 -10 -15 -20 p r i v a t e c o n s u mp t i o n * source : Bank of Korea (http://www.bok.or.kr) Doowon Lee, School of Economics, Yonsei University e xport 2005 2006 Recipient of Basic Livelihood Guarantee (thousand) 1,550 1,513 1,500 1,450 1,424 1,420 1,400 1,374 1,351 1,350 1,300 1,250 2001 2002 2003 Doowon Lee, School of Economics, Yonsei University 2004 2005 Gini's coefficient 0.33 0.32 0.320 0.316 0.317 0.319 0.312 0.31 0.310 0.310 0.306 0.30 0.29 0.28 0.283 0.27 0.26 1997 1998 1999 2000 2001 * source : Bank of Korea (http://www.bok.or.kr) Doowon Lee, School of Economics, Yonsei University 2002 2003 2004 2005 Recent movement of Korean labor market: • Anglo Saxon8to Europe 1998 7 1999 Unemployment (%) 6 5 2000 4 2004 2003 2001 2002 3 1997 1996 2 1 0 0 2 4 Labour Regulation Index Doowon Lee, School of Economics, Yonsei University 6 450 1800 400 1600 350 1400 300 1200 250 1000 200 800 150 600 100 400 50 200 0 0 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 participans(left scale) * source: Korea Labor Institute (https://www.kli.re.kr) Doowon Lee, School of Economics, Yonsei University cases(right scale) the number of cases the number of participants(thousand) Conflicts between Labor and Capital Deregulation Index (2004) 9 8 7.9 7.4 7.3 6.9 7 6.8 6.8 6.3 6.1 6 5.7 5.1 5 % 4.7 4 3.5 3 2 1 0 Singapore Hong Kong Canada USA Japan UK France country Germany Italy Korea India China Number of Regulations Year 1998 2000 2002 2004 2007 Regulations 10190 7156 7723 7846 8083 Korea of 2004 and the reference years of advanced countries Reference Years for Advanced Economies Countries Finland France German Ireland Italy Japan Years 1997 1986 1990 1995 1987 1987 Countries Netherlands Norway Spain Sweden U.K. U.S.A. Years 1989 1978 1999 1987 1989 1974 Doowon Lee, School of Economics, Yonsei University Government role and size: G/Y, social security/G, index of aging Country Reference Year Government Size (%, G/Y) Social Security and Welfare out of GDP (%) Index of Aging unemployment rate Japan1) 1987 16.48 9.79 11.5 2.8 USA 1974 19.4 8.1 10.11 5.59 Spain 1999 20.64 11.34 16.4 15.88 Korea 2004 25.18 6-7 (2005) 7.28 3.49 Germany 1990 29.46 13.78 15 6.21 Ireland 1995 30.63 10.31 11.4 14.1 UK 1989 33.93 10.6 15.5 5.99 Finland 1997 34.54 13.52 14.5 16.35 Norway 1978 35.35 17.26 14.8 1.65 Italy 1987 38.63 17.84 14.1 11.9 Sweden 1987 39.63 18.4 17.7 2.1 France 1986 43.4 19.41 13.5 10.4 Netherlands 1989 54.08 18.61 13 5.8 Doowon Lee, School of Economics, Yonsei University Decomposition of Sectoral Output per Worker Growth, Average of 1970-2001 12 10 Capital-labor Human capital Productivity 5.3 8 6 3.9 4 2.7 2 0.5 0.3 5.8 2.9 3.0 0.6 0.6 0.1 0.5 1.7 1.9 1.9 2.6 1.5 0 3.6 -0.1 0.3 -0.2 -0.1 -0.4 -1.6 -2 All industry Manuf. Elec.,gas,water Construct. Wh.,retail trade T ransport Finance Other serv.