P04-Challenges in Cross-Border Supervision

advertisement

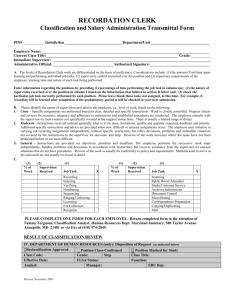

Challenges in cross-border supervision Ian Tower Workshop on Cross-Border Supervision and Consolidated Supervision June 2-4, 2015 Beirut, Lebanon Objectives of this session • To understand the main elements and key challenges of effective cross-border supervision • To cover: – foreign bank business models and legal forms – key expectations of home/host cooperation – key challenges, including effective information exchange and using Memoranda of Understanding (MoUs) – the particular challenges of foreign bank branch supervision as a host supervisor 2 2 Language and definitions To avoid confusion…. • Group supervision – oversight of risks within group • Consolidated supervision – assessment of total/aggregate group position • Conglomerate supervision – supervision of a group active in more than one sector • Cross-border supervision – supervision of a firm or group operating in more than one jurisdiction (branch or subsidiary) • Home and host supervision – roles in relation to cross-border supervision Cross-border Banking – Understanding the Business Model and Key Risks for Supervisors 4 Cross-border banks – what is the business model? • Domestic business: – compete with domestic institutions for local retail customer business – wholesale business (corporate lending, treasury and trading etc.) • International business: – services for foreign bank’s customers with business in host country – services for local customers with foreign business – transactions with wide range of customers, e.g., forex, trade finance • Offshore business (i.e., no local customer or counterparty) – sometime also acting as “booking vehicle” for the foreign bank • Traditional foreign bank business model in many markets is domestic wholesale and international, but they also do retail business in some countries 5 Foreign banks – legal form • Subsidiaries of foreign banks – legally independent institutions subject to local company law – wholly-owned or majority-owned by the foreign bank, which is incorporated in a country different from that of its subsidiary – separately capitalized – depositor claims are on the subsidiary, not the foreign bank • Branches of foreign banks – operating entities without separate legal status and which are therefore integral parts of the foreign bank – no capital of their own but, as part of the foreign bank, are backed by its capital; may not produce separate audited accounts – depositor claims are on the foreign bank itself 6 Why do banks sometimes prefer branches? • Increased efficiency, e.g: – flexibility of capital & liquidity allocation to branches (as in home market) – can be managed on business line basis • Regulatory advantage, e.g.: – may be lower capital requirements in home than host country – absence of large exposures limitations; may also be tax advantages • Lower risk: – protection against economic/political risks (e.g., cannot so easily be ring-fenced by host regulator), but branch also exposes whole bank’s capital • Business model advantages: – e.g., customers may prefer either to deal with foreign bank directly or with a local legal entity; some foreign banks have both branch and subsidiary in some countries 7 Branches – significance varies by jurisdiction • (from Bank of England, CP4/14, February 2014) 8 Foreign banks– how are they managed? • There is a wide variety of approaches preferred by banks: – local management, even for braches a “board of directors” – on a “matrix” basis – local management but reporting to business line managers at foreign bank – managed by the foreign bank direct with little real local management (maybe a “country officer”) – outsourced entirely – “managed banks” • Subsidiaries and (especially) branches are likely to rely on (or outsource to) foreign parent for services, including financial management • Retail operations are often managed locally and usually in a subsidiary 9 What can go wrong? • • • • BCCI Royal Bank of Scotland/ABN-AMRO Dexia Landsbanki/Icesave 10 What can go wrong: Landsbanki Collapse of Landsbanki HF in October 2008: failure of branch supervision model and deposit insurance in EU/EEA single market • • • • • • • In UK a branch supervised by Icelandic authorities for capital, whole bank liquidity UK FSA had limited powers relating to the supervision of local liquidity. Bank raised retail internet deposits under the Icesave brand Collected about £4.5 billion in retail deposits at time of failure Deposits legally covered by the Icelandic deposit insurance scheme up to a value of €20,887 In addition, deposits were covered on a top-up basis by the UK Financial Services Compensation Scheme (FSCS), to which Landsbanki had chosen to opt in. As a top-up member, Landsbanki would have been liable to meet a share of the costs in the event of the default of another bank covered by the UK scheme. 11 What can go wrong: Landsbanki (2) Collapse of Landsbanki HF in October 2008 • Icelandic Government decides not to pay deposits for non-Icelandic branches under the Icelandic deposit insurance scheme immediately • Extended dispute about meeting these obligations by Iceland (referenda, negotiations, formal proceedings against Iceland in EFTA Court) • In addition, there were £800 million of retail deposits (above £ 50,000) covered neither by the Icelandic scheme nor by the FSCS top up 12 What can go wrong: Landsbanki (3) Collapse of Landsbanki HF in October 2008 • • • • UK government decided to protect these deposits to underpin depositor confidence in the banking system. More than 400,000 depositors with Icesave accounts in UK and NL unable to access their money for at least 6 to 8 weeks Total initial costs of retail depositor protection of UK branch met by UK government and the FSCS. LESSON: depositors in one country (or their government) vulnerable to the failure of banks in another country if: – the home country concerned lacks the supervisory resources to ensure bank solvency, or/and – the fiscal resources or willingness to fund bank rescue is low; and – deposit insurance cover is unfunded What could the UK FSA have done differently? 13 International Regulatory Standards on Home-Host Supervision 14 Principles of Home-Host Supervision • All international banks should be supervised by a home country authority that capably performs consolidated supervision • The creation of a cross-border banking establishment should receive the prior consent of both the host country and home country authority • Home country authorities should possess the right to gather information from their cross-border banking establishments • If the host country authority determines that any of these three standards is not being met, it may impose restrictive measures or prohibit the establishment of banking offices. 15 Basel Core Principles • Principle 13 – Home-host relationships: – “Home and host supervisors of cross-border banking groups share information and cooperate for effective supervision of the group and group entities, and effective handling of crisis situations. – Supervisors require the local operations of foreign banks to be conducted to the same standards as those required of domestic banks.” 16 Basel on Home-Host cooperation • The supervision of banks’ foreign establishments – Concordat (1975, revised 1983): – “The principle of consolidated supervision is that parent banks and parent supervisory authorities monitor the risk exposure - including a perspective of concentrations of risk and of the quality of assets - of the banks or banking groups for which they are responsible, as well as the adequacy of their capital, on the basis of the totality of their business wherever conducted.” • Consolidated Supervision of Banks’ International Activities (1979) • Principles for the supervision of banks’ foreign establishments (1983) • Essential elements of a statement of cooperation between banking supervisors (2001) • Core Principles of Effective Banking Supervision (1997, 2006, 2012) – Principles on Home-Host and Consolidated Supervision 17 Basel on Home-Host cooperation (2) • Home-host information sharing for effective Basel II implementation (2006) • Financial Stability Forum Principles for Cross-border Cooperation on Crisis Management (2009) • Good practice principles on supervisory colleges (2010, revised 2014) • Report and Recommendations of the Cross‐border Bank Resolution Group, Basel (2010) – but see also FSB Key Attributes of Effective Resolution Regimes for Financial Institutions (revised version October 2014) Joint Forum • Principles on the supervision of financial conglomerates (2012) 18 International standards: summary Home supervisor Host supervisor Identification of groups/conglomerates Joint Forum/BCP12 Awareness and assessment of group risk Functions as lead regulator or coordinator Joint Forum Recognises role of lead regulator Licensing powers, including supervisability Joint Forum/BCP5 Licenses solo entity Powers to regulate and supervise group BCP 12 and 13 - including assessment of impediments Regulation of solo entity - cannot just rely on home supervisor - equal treatment for domestic and foreign banks Capital, liquidity etc for groups BCP 12 Capital, liquidity etc for solo Capital, liquidity etc for conglomerates Joint Forum/BCP 12 Capital, liquidity etc for solo Supervisory cooperation - includes chairing college(s) BCP 13 Sharing and use of information Participation in colleges meetings etc Supervisory work on the group - Includes visits to solo entities BCP Cooperation with home supervisors - gives access to home, joint visits Lead on group recovery and resolution - and crisis management FSB KAs Aware of group plan. Solo plan 19 Home/host supervisors: different perspectives and potential for conflict 20 Home/host different perspectives Home and host may have different views on the significance of the foreign operation (and of the parent) leading to differing demands on each other. Home country Host country Non-material operation Small, not systemic Material operation Large, maybe from group systemic perspective and bank systemic in Home country Non-material operation Large, maybe from group systemic perspective bank Material operation from group perspective and systemic in Home country Small, not systemic bank Comment Both Home and Host share a similar perspective – no material risk for Home or Host country Both Home and Host likely to have a similar view on the risk for Home and Host banking system and their interests are aligned. Host supervisor will want to cooperate with home closely. Different perceptions from Home and Host supervisor perspective; Home might underestimate challenge for Host, may prefer not to devote resources to meeting host supervisor’s needs; a common situation where major global banks operate in smaller or less developed countries. Different outcomes possible: home supervisor may be uninterested or may want information and input as part of intensive supervision of its systemic group 21 Home/host different perspectives Three dimensions: In relation to the foreign operation: • Significance of foreign operation relative to parent/group • Significance of foreign operation in host country In relation to the home supervisor: • Significance of the group in relation to the home supervisor’s market and regulatory objectives 22 Home/host: possible conflicts • Home supervisor: – may want to conduct joint inspections in host jurisdiction when host has other priorities – may expect host supervisor to conduct inspections, when host supervisor lacks resources to do so under risk-based approach – may not share information with host in case of crisis affecting the bank (to safeguard confidentiality) • Host supervisor: – may impose local financial or other requirements (e.g. governance) inconsistent with home supervisor’s requirements on bank/group – may expect the home supervisor to ensure support for host entity in case of stress – may take own measures (attempt to ring-fence) in case of stress, damaging home supervisor's management of crisis 23 23 Home/host conflicts - solutions • Some tensions probably inevitable but home and host supervisors are now expected to: – exchange information with due regard for confidentiality – cooperate on supervision of the bank/group • …with the objective of delivering more effective, better coordinated supervision of cross-border banks as well as avoiding conflicts etc. • Tools are available to help meet expectations, including MoUs and colleges of supervisors 24 24 Key Tools of Cross-Border Supervision: Exchange of information/MoUs Supervisory Colleges Cooperation – Ongoing and in Crisis 25 Exchange of information/MoUs • Essential precondition of home/host cooperation • Basel Core Principle 3 – Cooperation and collaboration: “Laws, regulations or other arrangements provide a framework for cooperation and collaboration with relevant domestic authorities and foreign supervisors. These arrangements reflect the need to protect confidential information.” • Two key questions: – can you share your own confidential information without onerous preconditions? – can you protect other supervisors’ confidential information? 26 Exchange of information/MoUs • Many countries have signed statements of cooperation (also known as MoUs), covering: – – – – sharing of information onsite inspections confidentiality of information ongoing cooperation • Statements are non-binding – i.e., they are statements of intent to share; they cannot override bank secrecy laws, which may need revision, if they constrain sharing with other supervisors. 27 MoUs: Basel Principles Basel Principles for establishing statements of cooperation for the sharing of confidential supervisory information: • Statements of cooperation are not necessarily legally binding but act as a promise of intent • Statements of cooperation represent a shared understanding of a process by which information flows can be enabled and cross-border supervisory cooperation can be facilitated • Statements of cooperation can be specifically tailored to detail, for example, actions to be taken in crises or with respect to supervision arrangements for specific firms 28 MoUs: Basel Principles (2) • Supervisory statements of cooperation must meet appropriate criteria for maintaining standards, protecting confidential information and using supervisory resources efficiently. • These criteria include: – Materiality: refers to the existence of expectation of reasonable and/or sufficient cross-border business – Equivalence: refers to one counterparty’s legal treatment of information meeting confidentiality requirements equivalent to those imposed in the other counterpart jurisdiction; and – Reliability: refers to an assessment of the counterparty’s ability in practice to protect and share information, such as judicial and political credibility and regulatory track record 29 Examples of sharing of information • – Host Home to host • tAHost toof control Home Change Host to home Change in local management Parent/group downgrading Local downgrading Major capital-raising Local capital issuance Breach of minimum capital etc Breach of minimum capital etc Enforcement action Enforcement action Action to constrain exposure to subsidiary Action to ring-fence subsidiary Change in strategy Change in local business model Change in business environment and regulation Change in local environment and regulation 3030 Supervisory colleges – what are they? (more in future session) “Working groups of supervisors of the parent company and key branches or subsidiaries of an international banking group” (Basel Committee, Good Practice Principles for Supervisory Colleges, June 2014) 31 Supervisory Colleges (2) • Mechanism for sharing information and coordinating work • Not decision-taking (except in Europe) • Different formats, including: – Universal college: all or most supervisors – Core college: supervisors of largest elements of group – Regional colleges: just supervisors from one region • Risk of being bureaucratic/resource-intensive: needs commitment and investment from home and host supervisors. 32 Home-Host ongoing cooperation • Licencing of foreign subsidiaries and branches, mergers and acquisitions etc. • Ongoing supervision (taking account of significance of operations): – – – – ad hoc communication on key developments input into group risk assessment etc. joint working, e.g. onsite supervision advance notice of sanctions etc. 33 Home-Host ongoing cooperation (2) • Cooperation on Basel II implementation: – assessment of advanced approaches, especially if methodology is shared across the group • Crisis management: – Cooperation on crisis prepardeness – more intensive exchange of information – coordination of actions, including communication to the market 34 Cross-border bank resolution (more in future session) • Each authority to act to achieve a cooperative solution with foreign resolution authorities: – as a minimum, they should consider the impact of their actions on financial stability in other jurisdictions – they should seek to minimize resolution costs in all jurisdictions & creditor losses • In the case of foreign bank branches: – base scenario: host uses its powers to support a resolution carried out by a foreign home authority – in exceptional cases: host takes its own measures, but it should give prior notification and consult the foreign home authority • Host supervisors should give effect to foreign resolution measures 35 Foreign Bank: Branches and Subsidiaries 36 Foreign Bank Branches • Branches of foreign banks: – depending on legal framework, license may apply to whole foreign bank, but host supervisor cannot supervise the whole bank in practice – responsibility for prudential supervision (capital adequacy, good governance etc.) therefore falls to the home supervisor for the whole bank – limited host supervisor prudential supervision role, but branches may be subject to host “endowment capital” and local governance etc. should be appropriate – treatment in case of insolvency depends on host country regime; deposit insurance, where available, usually under host country arrangements • Role of host supervisor of branches is inevitably limited. Some countries prefer foreign banks to operate only as subsidiaries. 37 Foreign-owned Subsidiaries • Subsidiaries of foreign banks: – regulated and supervised by the host supervisor (local to the subsidiary) … but also supervised on a consolidated basis by home supervisor (in the country of the foreign bank itself) – required to have local corporate governance, including board of directors, risk functions, internal audit etc.; audited accounts – subject to local insolvency and deposit insurance laws • Subsidiaries of foreign banks can be regulated in largely the same way as domestic banks (i.e., banks incorporated in the jurisdiction of the supervisor and not owned by a foreign bank) – but in addition the host supervisor must maintain contact and coordinate supervision with the home regulator. 38 Branches – the key issues for regulators Potential advantages: • branch business supported by parent bank capital and other resources – potentially higher transfer of expertise/commitment of credit? • banks cannot walk way from branch as from a subsidiary? – but may be same reputational issues with failure of subsidiaries? • supervision responsibilities shared with home regulator Potential disadvantages: • • • cannot apply same prudential standards, including governance (who is responsible for management?) dependence on strength of parent bank and effectiveness of home supervision less host supervisory control/harder to resolve in case of failure 39 9 key questions for branch supervisors • • • • • • • • Why does the foreign bank want to operate as a branch? What is the business model and risks arising? Will the branch do retail (or other similarly economically sensitive) activities? How significant will the branch be in relation to the parent bank? Will the foreign bank’s resources be available to the branch in practice? How will the branch operations be managed and by whom? What access will I have to the responsible management in practice? What happens to the branch if the foreign bank fails? Maybe most important – what is the extent and quality of home regulation and supervision and the nature of the relationship that I can expect with the home supervisor (e.g., will I be informed of problems?) 40 Options for the branch supervisor • Spectrum of possible approaches, based on degree of reliance on home supervisor: • Most supervisors want mixed approach with scope to vary according to the quality of the home regulation 41 Branches – developing a supervisory approach 42 Branches – elements of an approach Most approaches based on four key elements: • limitations on scope of business of foreign bank branches (e.g., no retail) • assessment of the home regulator; allow branches if: – prudential regulation and supervision broadly equivalent – likely to be an open, cooperative relationship – clarity on implications for crisis management and resolution • application of appropriate elements of the host supervisor’s own regulatory and supervisory regime • cooperation with home regulator (e.g., via a college of supervisors) 43 Branches – prudential requirements • Application of appropriate elements of regulatory and supervisory regime: – local governance requirements – local management, local “board”? – local liquidity requirements, especially in domestic currency (“standalone” basis) or reliance on home supervisor based on whole bank liquidity – local “endowment capital” (net assets, localization requirement etc.) depending on local insolvency regime – adequacy of systems and controls, management of local risks, IT and other operational support, application of “three lines of defense” – continuing supervision, including reporting and onsite work – risk-based approach as for domestic banks • Special measures if needed, e.g. limits on exposure to foreign bank/home country • Also local business conduct and AML/CFT regulation 44 Summary – Key Challenges in CrossBorder Supervision 45 Key challenge (1): understanding the risks All supervisors involved in cross-border supervision need to evaluate the risks arising from cross-border business • Recognise that all such business has risk • Do not just rely on others, e.g., home supervisor • Incorporate risk in risk-based supervision program 46 Understanding risks: home supervisors • Understand the group structure • Ensure access to consolidated financial information – no black holes • Understand intra-group transactions and exposures (ITEs) • Group management should account for group risk in all countries • Know the key foreign regulators, strengths and limitations 47 Understanding risks: host supervisors • The place of the local operation in the group structure • The financial position of whole group and risks to local operation • Relevant intra-group transactions and exposures (ITEs) • How the local operation is managed in relation to the group management structure • Know the home (and other key foreign) regulators 48 Key challenge (2): Being an assertive supervisor All supervisors involved in cross-border supervision need to satisfy themselves that risks are being managed and mitigated 49 Being an assertive home supervisor • Develop strategy of college/bilateral relations and crisis management colleges and coordination • Seek regular information from host supervisors • Carry out on-site work in key jurisdictions • Intervene to control the expansion of the bank, as necessary • Challenge on transparency/supervisability of group structure and require change 50 Being an assertive host supervisor • Develop strategy of college/bilateral relations and crisis management college participation • Seek regular information and supervisory assessments from the home supervisor • Use home supervisor for leverage on local issues • Propose joint work and participate in home supervisor’s on-site work - and seek reports 51 Key challenge (3): Crisis preparedness All supervisors involved in cross-border supervision need to make plans for their involvement in crisis management: • Contact information and other practical prepardeness • Adequate powers to take action and cooperate with other supervisors • Recovery and resolution plans that reflect the needs of home and host supervisors • Cooperation in practice More in future session 52