MCR Guidance Note UCITS 09.01.13 Final

advertisement

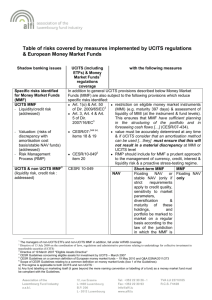

2012 Minimum Capital Requirement Report – Guidance Note for Non UCITS Management Companies, Administration Companies and Trustee Companies 2 Minimum Capital Requirement Report– Guidance Note for UCITS Management Companies Minimum Capital Requirement Report – Guidance Note for UCITS Management Companies Contents Introduction 2 Reporting Financial Information 2 Detailed Information on Minimum Capital Requirement Report 3-7 Appendix I – Minimum Capital Requirement Template 8-9 Appendix II – Comparison Table between FINREP and MCR 10-13 1 Minimum Capital Requirement Report – Guidance Note for UCITS Management Companies Introduction The Minimum Capital Requirement (“MCR”) Report must be submitted to the Central Bank of Ireland (“Central Bank”) by a UCITS management company with the unaudited semi-annual financial statements and annual audited financial statements at the reporting periods detailed in UCITS Notice 2 paragraph 20 and UCITS Notice 5 paragraph 19. The MCR must be signed by a director or senior manager of the UCITS management company. The Directors have ultimate responsibility for ensuring returns are completed correctly and on time. The purpose of this Guidance Note is to provide an explanatory guide for persons completing the MCR on the Central Banks Online Reporting System (“ONR”). The Guidance Note may be updated periodically and the most up-todate version will be available on the Central Bank’s website1. The unaudited semi-annual financial statements and annual audited financial statements data should be submitted on the FINREP tables on the ONR. The FINREP contains six core tables – (i) Table A Questionnaire, (ii) Table 1.1 Assets, (iii) Table 1.2 Liabilities, (iv) Table 1.3 Equity, (v) Table 2 Income Statement and (vi) Table 34 Supplementary Financial Reporting Return. These six core tables are mandatory for all FINREP submissions and data should be taken directly from the UCITS management company’s unaudited semi-annual financial statements or audited annual financial statements for each reporting period. Reporting Financial Information Financial information reported in the FINREP tables and MCR should be transposed directly from the financial statements at each reporting period. Figures entered into the FINREP tables and MCR must be reconcilable to the unaudited semi-annual financial statements or the audited annual financial statements at the reporting date. All fields on the MCR must reconcile to the fields on the FINREP tables which in turn must reconcile to the financial statements. The Central Bank recommends that the FINREP tables are completed prior to the MCR to aid the reconciliation between data sources. 1 http://www.centralbank.ie/regulation/industry-sectors/investment-firms/mifidfirms/documents/FINREP%20for%20irish%20investment%20firms%20-%20guidance%20note.pdf 2 Minimum Capital Requirement Report – Guidance Note for UCITS Management Companies The below diagram illustrates the flow of information that the UCITS management company should follow when filing the FINREP and MCR returns on the Central Bank ONR system. Annual Audited Financial Statements/ Unaudited Semi-Annual Financial Statements ↓ FINREP Tables ↓ Minimum Capital Requirement Report All figures in the FINREP and the MCR return must be presented in EURO thousand’s (€000’s) e.g. three hundred thousand euro (€300,000) would be input as 300. UCITS management company’s should ensure that all the data provided in the MCR report is accurate, complete and reconciles to the financial statements and FINREP data. UCITS management companies that submit incorrect/late or non-reconciling returns to the financial statements will be required to resubmit. Persistent incorrect/late filings may result in enforcement action being taken by the Central Bank against the UCITS management company and the Directors. The below information details each section in the MCR return as presented. See Appendix 1 for MCR table reference. 1. Initial Capital Requirement – As per UCITS Notice 2 paragraph 26 the initial capital requirement is €125,000. Where the Net Asset Value of the Collective Investment Schemes under management exceeds €250,000,000, a UCITS management company must provide an additional amount of capital equal to 0.02% of the amount by which the net asset value exceeds €250,000,000. A UCITS management company need not provide up to 50% of the additional amount if it benefits from a guarantee of the same amount given by a credit institution or insurance undertaking and the form of guarantee is approved by the Central Bank. Non EURO base currency UCITS management company’s should use the reporting period end exchange rate, taken from the Central Bank of Ireland’s website2, when translating both their unaudited semi-annual financial statements or audited annual financial statements into EURO. UCITS management company’s should use the reporting period end exchange rate when translating both Balance Sheet and Income Statements (Company’s should not use average rates when translating their Income statement into euro – company’s should use reporting period end rates only). 2 http://www.centralbank.ie/polstats/stats/exrates/Pages/default.aspx 3 Minimum Capital Requirement Report – Guidance Note for UCITS Management Companies It is the responsibility of UCITS management company to ensure that sufficient capital is maintained in the company’s base currency at all times in order to satisfy the applicable EURO capital requirement equivalent. 2. Expenditure Requirement – This is calculated as one quarter of a UCITS management company’s total expenditure taken from the annual audited financial statements. However, the Central Bank reserves the right to adjust this amount should it be deemed not to reasonably reflect the current position of the UCITS management company. Note: When submitting semi-annual interim MCR returns, the figures in the expenditure requirement should be that of the most recent annual audited financial statements. 2.1.1.1 Total Expenditure – this figure is taken from the Income Statement and includes all expenditure incurred by the UCITS management company at the reporting date. The following items may be deducted from the total expenditure figure to arrive at the Net Qualifying Expenditure figure: - 2.1.1.2 Depreciation - 2.1.1.3 Profit Shares, Bonuses etc. - 2.1.1.4 Net losses on translation of foreign currency balances Note: This field should only contain Net foreign currency losses; gains on foreign currency should not be reported under this heading. - 2.1.1.5 Shared Commissions paid. (Annex I UCITS Notices Note 4.2 (d)) Note: Shared Commissions are payments other than to officers and staff of the UCITS management company. Deductions in this line must be pre-approved by the Central Bank. - 2.1.1.6 Exceptional and extraordinary items (Annex I UCITS Notices Note 4.2 (e)) Note: General expenses or other expenses should not be input on this line. Pre-approval must be sought by the Central Bank in order to include expenditure under this line item. - 2.1.1.7 Any other non-recurring expense items (Annex I UCITS Notices Note 4.2 (e)) Note: This is an expense that should reflect the same categorisation of expense as presented in the annual audited financial statements. No other expenses should be included in this line item. All deductions from the total expenditure figure should be clearly identified in the most recent annual audited financial statements or supported with a letter from the auditors confirming the figures. All figures input into the expenditure requirement section of the MCR should be reconcilable to the FINREP figures. 4 Minimum Capital Requirement Report – Guidance Note for UCITS Management Companies 3. Minimum Capital Requirement – The UCITS management company’s Minimum Capital Requirement is the higher of: the Initial Capital Requirement plus the Additional Amount ( if required); or the Expenditure Requirement 4. Financial Resources – A UCITS management company is required to have Financial Resources at least equal to its Minimum Capital Requirement. Financial Resources for a UCITS management company will be based on the data contained in the unaudited semi-annual financial statements or the audited annual financial statements at the reporting date. Financial resources are calculated as the aggregate of: - 4.1.1.1 Equity Capital fully paid up - 4.1.1.2 Perpetual Non-cumulative Preference Shares - 4.1.1.3 Eligible Capital Contributions (Annex I UCITS Notices 6.4 (a & b)) - 4.1.1.4 Qualifying Subordinated Loan Capital (Annex I UCITS Notices 6.4 (a & b)) - 4.1.1.5 Share Premium Account - 4.1.1.6 Disclosed Revenue and Capital Reserves Note: These figures exclude the revaluation reserve and are to be taken from the most recent unaudited semi-annual financial statements or audited financial statements at the reporting date. - 4.1.1.7 Audited interim net profits Note: This figure is only allowable as a deduction if audited. - 4.1.1.8 Other reserves less interim dividends The following item should be deducted from the aggregated Financial Resources figure: - 5 4.1.2 Current year losses not included in disclosed revenue and capital reserves above. Note: If this figure is already included in the Disclosed Revenue and Capital Reserves at line 4.1.1.6 then the loss figure should not be included again on this line as this will be double counting. Minimum Capital Requirement Report – Guidance Note for UCITS Management Companies 5. Eligible Assets – A UCITS management company is required to hold the higher of the Expenditure Requirement or the Initial Capital Requirement in the form of Eligible Assets. Eligible Assets must be easily accessible and free from any liens or charges. In addition Eligible Assets must be maintained outside the UCITS management company’s group. Note: The Central Bank requires Eligible Assets to be held in an account that is separate to the account(s) used by a UCITS management company for the dayday running of its business. Eligible Assets are calculated as follows: Total Assets – Non-current assets plus current assets. These figures should be taken from the Balance Sheet or notes to the unaudited semi-annual financial statements or annual audited financial statements at each reporting date. All figures deducted as eligible assets in the MCR return should be reconcilable to the FINREP tables. The following items may be deducted from the Total Assets figure to arrive at the Eligible Assets figure: - 5.1.2.01 Fixed Assets - 5.1.2.02 Intangible Assets - 5.1.2.03 Cash or cash equivalents held with group companies - 5.1.2.04 Debtors - 5.1.2.05 Bad debt provisions - 5.1.2.06 Prepayments - 5.1.2.07 Intercompany amounts (gross) - 5.1.2.08 Loans - 5.1.2.09 Collective Investment Schemes which are not daily dealing (Annex I UCITS Notices Note 7.4) - 5.1.2.10 Any other assets which are not easily accessible. 6. Compliance Test – A UCITS management company must be in a position to demonstrate its on-going compliance with the capital adequacy requirements outlined in this document. Where a UCITS management company’s financial position changes at any time between reporting intervals, which would impact on its compliance with its regulatory capital requirements, it must notify the Central Bank immediately and take any necessary steps to rectify its position. 6 Minimum Capital Requirement Report – Guidance Note for UCITS Management Companies Note: Please ensure that the answers provided in the compliance test section correspond correctly to the numerical data provided in the MCR return. If an answer to any of these questions is “No”, the Central Bank must be notified immediately. 7. Qualifying Subordinated Loan Capital UCITS management companies must detail the qualifying Subordinated Loan Capital at the reporting interval. The following must be disclosed: 7 - 7.2 Remaining term to maturity (months) - 7.1.1 Gross amount - 7.1.2 Less amortisation - 7.1 Qualifying amount Minimum Capital Requirement Report – Guidance Note for UCITS Management Companies Appendix I - Minimum Capital Requirement Template Online Reporting System for Report for UCITS Management Companies Minimum Capital Requirement Report - UCITS Management Company 1. INITIAL CAPITAL REQUIREMENT PLUS ADDITIONAL AMOUNT All monetary amounts are in €000's 1.1 What base currency was the below financial data prepared in? (Note all data entered on this return must be in €000's) 1.2 Exchange Rate used in CCY/EUR format if functional currency is not Euro (Note - Central Bank of Ireland rate must be used) 1.3 Initial Capital Requirement(A) 1.4 Assets under Management at Reporting Date 1.5 Excess over €250,000,000 (if applicable) 1.6 Additional Amount (if applicable) [0.02% of excess over €250m](B) 1.7 Initial Capital Requirement(A) plus Additional Amount(B) (if applicable). (The amount to be included(C) here is not required to exceed €10,000,000.) 2. EXPENDITURE REQUIREMENT 2.1.1.1 Total Expenditure (taken from Profit and Loss account) LESS 2.1.1.2 (Depreciation) 2.1.1.3 (Profit Shares, Bonuses, etc) 2.1.1.4 (Net losses on translation of foreign currency balances) 2.1.1.5 (Shared Commissions paid) - Note 4.2(d) 2.1.1.6 (Exceptional and Extraordinary Items) - Note 4.2(e) 2.1.1.7 (Any other non-recurring expense) - Note 4.2(e) 2.1.1 Net Qualifying Expenditure 2.1 EXPENDITURE REQUIREMENT [One quarter of Net Qualifiying Expenditure](D) 3. MINIMUM CAPITAL REQUIREMENT UCITS MANAGEMENT COMPANY Higher of Initial Capital Requirement plus Additional Amount (if applicable) and Expenditure Requirement 3.1 MINIMUM CAPITAL REQUIREMENT [Higher of (C) and (D)](E) 4. FINANCIAL RESOURCES 4.1.1.1 Equity Capital fully paid up 4.1.1.2 Perpetual Non-cumulative Preference Shares 4.1.1.3 Eligible Capital Contributions 4.1.1.4 Qualifying Subordinated Loan Capital (See 'Note on Qualifying Subordinated Loan Capital' below) 4.1.1.5 Share Premium Account 4.1.1.6 Disclosed Revenue and Capital Reserves (excluding Revaluation Reserves)(from most recent audited figures) 4.1.1.7 Audited Interim Net Profits - Note 6.3 4.1.1.8 Other Reserves 4.1.1 Total 4.1.2 LESS: Current Year Losses not included in Disclosed Reserves and Capital Reserves above 4.1 FINANCIAL RESOURCES(F) 8 Minimum Capital Requirement Report – Guidance Note for UCITS Management Companies 5. ELIGIBLE ASSETS (must be held outside the Group) 5.1.1.1 Total Non-current Assets (taken from Balance Sheet) 5.1.1.2 Current Assets (taken from Balance Sheet) 5.1.1 TOTAL ASSETS Less: Ineligible Assets 5.1.2.01 (Fixed Assets) 5.1.2.02 (Intangible Assets) 5.1.2.03 (Cash held with group companies) 5.1.2.04 (Debtors) 5.1.2.05 Bad Debt Provisions 5.1.2.06 (Prepayments) 5.1.2.07 (Intercompany Amounts (gross)) 5.1.2.08 (Loans) 5.1.2.09 (Collective investment schemes which are not daily dealing) - Note 7.4 5.1.2.10 (Any other assets which are not easily accessible) 5.1.2 Total Ineligible Assets 5.1 ELIGIBLE ASSETS(G) 6. COMPLIANCE TEST 6.1 Are Financial Resources(F) at least equal to Minimum Capital Requirement(E)? 6.2 Are Eligible Assets(G) at least equal to Minimum Capital Requirement(E)? 6.3 Where are Eligible Assets held? - Note: Upload relevant bank statements through the Online Reporting System 6.4 Was the firm in compliance with the capital adequacy requirements throughout the period under review? 7. Note on Qualifying Subordinated Loan Capital The qualifying amount of redeemable subordinated debt is calculated as follows: 7.1 Remaining term to maturity (Months) 7.1.1 Gross Amount 7.1.2 (Less Amortisations) 7.1 = Qualifying Amount 9 Minimum Capital Requirement Report – Guidance Note for UCITS Management Companies Appendix II – Comparison table between MCR and FINREP MCR 2 Expenditure Requirement 2.1.1 Total Expenditure FINREP Audited Accounts 2.1.1.02 Interest Expense + 2.1.1.03 Expenses On Share Capital Repayable On Demand + 2.1.1.06 Fee And Commission Expenses + 2.1.1.07 Realised Gains-Losses On Financial Assets And Liabilities Not Measured At FV Through PL Net (loss only) + 2.1.1.08 Gains - Losses On Financial Assets And Liabilities Held For Trading Net (loss only) + 2.1.1.09 Gains-Losses On Financial Assets And Liabilities Designated At FV Through PL Net (loss only) + 2.1.1.10 Gains - Losses From Hedge Accounting Net (loss only) + 2.1.1.11 Exchange Differences Gain Loss Net (loss only) + 2.1.1.12 Gains - Losses On De-recognition Of Assets Other Than Held For Sale Net (loss only) + 2.1.1.14 Other Income Expenses From Insurance And Reinsurance Contracts Net (loss only) + 2.1.1.16 Other Operating Expenses + 2.1.1.17 Administration Costs + 2.1.1.18 Depreciation + 2.1.1.20 Impairment On Financial Assets Not Measured At FV Through PL + 2.1.1.21 Impairment On Non-Financial Assets 2.1.2 Depreciation 2.1.3 Profit Shares, Bonuses, etc. 2.1.4 Net losses on translation of foreign currency balances 2.1.5 Shared Commissions paid 2.1.6 Exceptional and Extraordinary Items 2.1.7 Any other non-recurring expense 2.1 Net Qualifying Expenditure 2.2 Expenditure Requirement 3 Minimum Capital 10 2.1.1.18 Depreciation 34.A.1.2 Bonuses Profit Shares Benefit In Kind 2.1.1.11 Exchange Differences Gain Loss Net (loss only) No FINREP comparison 34.A.2.19 Exceptional And Extraordinary Items 34.A.2.20 Any Other Non Recurring Expense Shared Commissions paid is taken from MCR as there is no FINREP equivalent Net Qualifying Expenditure * 25% Audited Accounts Minimum Capital Requirement Report – Guidance Note for UCITS Management Companies Requirement 3.1 Minimum Capital Requirement 4 Financial Resources 4.1.1.1 Equity Capital fully paid up 4.1.1.2 Perpetual Noncumulative Preference Shares 4.1.1.3 Eligible Capital Contributions 4.1.1.4 Qualifying Subordinated Loan Capital 4.1.1.5 Share Premium Account 4.1.1.6 Disclosed Revenue and Capital Reserves Higher of the (i) initial capital requirement (ii) expenditure requirement (iii) initial capital requirement plus additional amount Accounts received with MCR 1.3.1.1 Paid In Capital No FINREP comparison 34.D.1.2 Capital Contribution No FINREP comparison 1.3.2 Share Premium 34.D.1.1 Retained Earnings + 1.3.7 Profit - Loss Attributable To Equity Holders Of The Parent 4.1.1.7 Audited Interim Net Profits 4.1.1.8 Other Reserves (less Interim Dividends) 1.3.7 Profit (loss) attributable to equity holders of the parent (interim profits should be audited) 1.3.5.1 Reserves Accumulated Losses of Investments In Entities Accounted For Using The Equity Method + 34.D.1.3 Other Unrecognised Reserves + 1.3.3 Other Equity + 1.3.4 Revaluation Reserves And Other Valuation Differences - 1.3.8 Interim Dividends 4.1.1 Total 4.1.2 LESS: Current Year Losses not inlcuded in Disclosed Reserves and Capital Reserves above 4 Financial Resources 11 Perpetual Non-cumulative Preference Shares, Qualifying Subordinated Loan Capital and Audited Interim Net Profits are taken from MCR as there are no FINREP equivalents 2 Total Profit - Loss (loss only) (if not already included in Disclosed Revenue and Capital Reserves calculation) (if difference between 4.1.1.6 MCR and FINREP calculations equals 2 Total Profit - Loss in FINREP, this field will show zero)(profit included in this line at interim reporting must be audited) Total minus Current Year Losses and unaudited profits(previous 2 cells) Minimum Capital Requirement Report – Guidance Note for UCITS Management Companies 5 Eligible Assets 5.1.1.1 Total Non-current Assets 5.1.1.2 Current Assets 5.1.1 TOTAL ASSETS 5.1.2.01 Fixed Assets 5.1.2.02 Intangible Assets 5.1.2.03 Cash held with group companies 5.1.2.04 Debtors Accounts received with MCR 1.1 Total Assets NonCurrent 1.1 Total Assets Current 1.1 Total Assets Total 1.1.09 Tangible Assets 1.1.10 Intangible Assets No FINREP comparison, should be included from MCR if difference in Total Eligible Assets matches this field 34.B.1.1.1 Trading Book Debtors Gross + 34.B.1.2.1 Non Trading Book Debtors Gross 5.1.2.05 Bad Debt Provisions 34.B.1.1.2 Trading Book Debtors Provision + 34.B.1.2.2 Non Trading Book Debtors Provision 5.1.2.06 Prepayments 5.1.2.07 Intercompany Amounts (gross) 5.1.2.08 Loans 5.1.2.09 Collective investment schemes which are not daily dealing 5.1.2.10 Any other assets which are not easily accessible 34.B.1.3 Prepayments 34.B.1.4 Inter Company Debtors 1.1.02.4 Loans And Advances + 1.1.03.3 Loans And Advances + 1.1.04.3 Loans And Advances + 1.1.05.2 Loans And Advances + 1.1.06.2 Loans And Advances No specific FINREP comparison, should be included at most appropriate field in the FINREP 1.1.02.1 Derivatives Held For Trading + 1.1.02.2 Equity Instruments + 1.1.02.3 Debt Securities + 1.1.03.1 Equity Instruments + 1.1.03.2 Debt Securities + 1.1.04.1 Equity Instruments + 1.1.04.2 Debt Securities + 1.1.05.1 Debt Securities 12 Minimum Capital Requirement Report – Guidance Note for UCITS Management Companies + 1.1.06.1 Debt Securities + 1.1.07 Derivatives - Hedge Accounting + 1.1.11 Investments In Entities Accounted For Using The Equity Method + 1.1.12 Tax Assets + 1.1.13 Assets Under Insurance And Reinsurance Contracts + 1.1.15 Non-Current Assets And Disposal Groups Classified As Held For Sale + 34.B.1.5 Paye Prsi Vat + 34.B.1.6 Investments At Cost + 34.B.1.7 Other Unrecognised Assets 5.1.2 Total Ineligible Assets 5.1 Eligible Assets 6 Compliance Test 6.1 Are Financial Resources at least equal to Minimum Capital Requirement? 6.2 Are Eligible Assets at least equal to Minimum Capital Requirement? 6.3 Where are Eligible Assets held? 6.4 Was the firm in compliance with the capital adequacy requirements throughout the period? 13 Addition of Ineligible Assets fields from FINREP Total Assets minus Total Ineligible Assets Accounts received with MCR Calculated from FINREP figures Calculated from FINREP figures No FINREP comparison No FINREP comparison Bosca PO 559, Sráid an Dáma, Baile Átha Cliath 2, Éire PO. Box No 559, Dame Street, Dublin 2, Ireland