UCITS and the use of leverage

advertisement

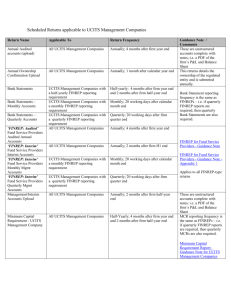

Innovation JULY 2012 Asset Management and Investment Funds Briefing UCITS and the use of leverage On 9 July 2012 ESMA issued a question and answers document1 in relation to its risk measurement guidelines for UCITS2. The Q&A document is intended to address the divergent approaches which had developed across the EU on particular issues and seeks to ensure that a common supervisory approach and common practices are followed throughout the EU. In response to the issue of the ESMA Q&A the Central Bank has issued a letter to the Irish funds industry addressing its requirements where leverage is used by UCITS. The purpose of this client briefing is to explain the Central Bank’s requirements on the calculation of leverage and the disclosure required in a UCITS prospectus relating to leverage. Gross Notional Leverage The ESMA Q&A states that for any UCITS using Value at Risk (“VaR”) to calculate global exposure the leverage disclosed by that UCITS must be calculated as the sum of the notionals of the derivatives used. Leverage must not be calculated on a net basis (i.e., leverage calculated after any netting/hedging arrangements are taken into account). This leverage figure (based on the sum of the notionals) can be supplemented by also disclosing the leverage calculated on the basis of the commitment approach. However, the commitment approach cannot be used as an alternative to the sum of the notionals figure. Whilst it is acknowledged that there are limitations on the use of the sum of the notionals as a measure of the risk profile of a UCITS, this clarification of the disclosure requirement is welcome if for no other reason than it should ensure that a consistent approach is now taken by regulators across the EU. Minimum Subscription Amount This document contains a general summary of developments and is not a complete or definitive statement of the law. Specific legal advice should be obtained where appropriate. For UCITS funds established since July 2011 with leverage limits in excess of 500% the Central Bank has generally imposed both a minimum subscription requirement and a restriction on the limit of leverage employed by the fund. The application of this policy by the Central Bank presented various practical issues for a number of promoters who employed significant leverage in their UCITS. However, as a consequence of the publication of the ESMA Q&A the Central Bank has agreed that it will no longer impose a minimum 1 2012/ESMA 429 2 CESR/10/788 - Guidelines on Risk Measurement and Calculation of Global Exposure and Counterparty Risk for UCITS ............................................................................................................................................ Earlsfort Centre, Earlsfort Terrace, Dublin 2, Ireland | tel: +353 (0)1 618 0000 | fax: +353 (o)1 618 0618 | email: dublin@arthurcox.com | web: www.arthurcox.com UCITS AND THE USE OF LEVERAGE JULY 2012 subscription requirement or limit the level of leverage employed by Irish authorised UCITS. For those UCITS which had included a minimum subscription amount in their prospectus and a limit on the level of leverage to be used by the fund amendments to the prospectus deleting these requirements will be required if they wish to avail of the new rules. Reporting It is also worth noting that the Central Bank had required those UCITS whose global exposure may be in excess of 500% based on the sum of the notionals to report the actual levels of leverage in a written report to the Central Bank on a six monthly basis. The Central Bank has confirmed that it will no longer require this six monthly report from these UCITS. Conclusion The clarification of the way in which the leverage is to be calculated in the ESMA Q&A provides the certainty the funds industry needed to ensure that all UCITS using VaR, irrespective of domicile, calculate and disclose the leverage figure in the same way. The decision by the Central Bank to dispense with the minimum subscription requirement and limit on the level of leverage employed by an Irish authorised UCITS is also a welcome change. Contacts If you would like further information on the information in this bulletin please contact one of the partners in the Asset Management and Investment Funds Group. Carl O’Sullivan Partner Asset Management and Investment Funds Group Kevin Murphy Partner Asset Management and Investment Funds Group +353 (0)1 618 0525 carl.osullivan@arthurcox.com +353 (0)1 618 0515 kevin.murphy@arthurcox.com Sarah Cunniff Partner Asset Management and Investment Funds Group Dara Harrington Partner Asset Management and Investment Funds Group +353 (0)1 618 0508 sarah.cunniff@arthurcox.com +353 (0)1 618 0559 dara.harrington@arthurcox.com Dublin Belfast Earlsfort Centre, Earlsfort Terrace, Dublin 2, Ireland tel: +353 (0)1 618 0000 | fax: +353 (o)1 618 0618 email: dublin@arthurcox.com Capital House, 3 Upper Queen Street, Belfast BT1 6PU, Northern Ireland tel: +44 (0)28 9023 0007 | fax: +44 (0)28 9023 3464 email: belfast@arthurcox.com London 12 Gough Square, London EC4A 3DW, England tel: +44 (0)20 7832 0200 | fax: +44 (0)20 7832 0201 email: london@arthurcox.com New York Silicon Valley One Rockefeller Plaza, 15th Floor, New York NY 10020, USA tel: +1 (1)212 782 3294 | fax: +1 (1)212 782 3295 email: newyork@arthurcox.com 800 West El Camino Real, Suite 180, Mountain View, California, 94040, USA tel: +1 (1)650 943 2330 | fax: +1 (1)650 962 1188 email: siliconvalley@arthurcox.com www.arthurcox.com 02