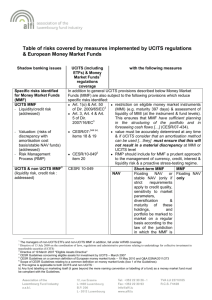

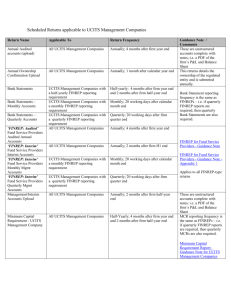

overview_of_funds_legal_framework

advertisement

Overview of legal framework Authorisation process Analysis of main fund managers’ obligations 1 Overview of legal framework Introduction UCITS and AIFs are funds. A fund raises money from a number of investors to invest it as per a predetermined policy for the collective benefit of the investors. UCITS are open funds whereas AIFs can be open or closed funds. AIFM/ MC -managing one or more funds Permitted activities • portfolio management and risk management • administration • marketing 2 The Framework’s benefits Modern framework equivalent to established financial centers(full transposition of European Directives including ESMA Guidelines) European passport Completeness 3 The Framework UCITS Law 78(I)/2012 Regulation 584/2010 implementing UCITS Directive AIFM Law 56(I)/2013 Regulation 231/2013 Regulation 447/2013 implementing AIFM directive (opt-in procedure) Regulation 448/2013 implementing AIFM directive (Member state of reference procedure) Regulation 345/2013 on EuVECA Regulation 346/2013 on Social entrepreneurship funds New AIFs law (pending) CySEC’s directives, circulars and guidelines 4 CySEC’s directives issued upon UCITS Law (78(I)/2012) • • • • • 6 directives regarding Management Companies 25 directives regarding UCITs 1 directive regarding the transfer of registered seat 1 Directive regarding custodians 1 directive regarding Marketing of foreign AIFs. AIFM Law (56(I)/2013 & Regulation 231/2013 • • • Only 5 directives regarding Fund Managers Due to the Regulation The Law regulates The Fund managers and Custodians not the funds 5 New AIFs law (pending) Replaces the current ICIS Law Final stages pending parliament approval A number of directives to complete the framework are WIP Comprehensive framework allowing many different types of funds 6 Authorisation process Highly recommended to have a meeting with CySEC’s authorisation department before submitting the application Submit complete application Initial review for completeness and request for missing documents Thorough review of the application file and letter with comments, suggestions and clarifications Submission of information as per above step Final review and preparation of report to the Board with officer’s recommendation for approval/rejection or conditional approval. 7 Authorisation conditions for MC/Fund manager Capital requirements Fit and proper test of shareholders, directors and other senior management Head office/registered address in the republic Organisational structure Ability to demonstrate adherence to the obligations of the Law (IOM) CySEC requires detailed information about the funds under management or to be managed to evaluate the adequacy of the above. Authorisation does not mean automatically the entity can manage any UCITS/AIF. 8 Authorisation Forms AIFM Form F56/2013/02 - Annex I of Directive DI56-2013-01 AIFM and UCITS MC Form F56/2013/04 - Annex II of Directive DI56/2013/01 AIFM and UCITs MC UCITS MC Form F78-2012-01 - Annex 1 of Directive DI78-2012-01 UCITS fund Form F78-2012-05 – Annex 1 Of Directive DI78-201207 9 Analysis of main fund managers’ obligations • Human and technical resources • Decision Making procedures • Administrative and accounting procedures, control and safeguard arrangements for electronic data processing • Internal control mechanisms (incl. permanent compliance function and internal audit function) • Organisational structure and effective internal reporting 10 Analysis of main fund managers’ obligations Adequate and orderly records Business continuity policy Valuation procedures Code of conduct – Act in the client’s best interest Best execution arrangements and policy Personal transactions rules Conflicts of interest Recording of portfolio transactions Recording of subscription and redemption orders Recordkeeping requirements Exercising voting rights 11 Analysis of main fund managers’ obligations Complaints handling procedures Delegation provisions Remuneration provisions Transparency provisions Risk management identify, measure, manage and monitor appropriately all risks relevant to each AIF market, liquidity and counterparty risks, and operational risks Thank You 12