Process Costing

advertisement

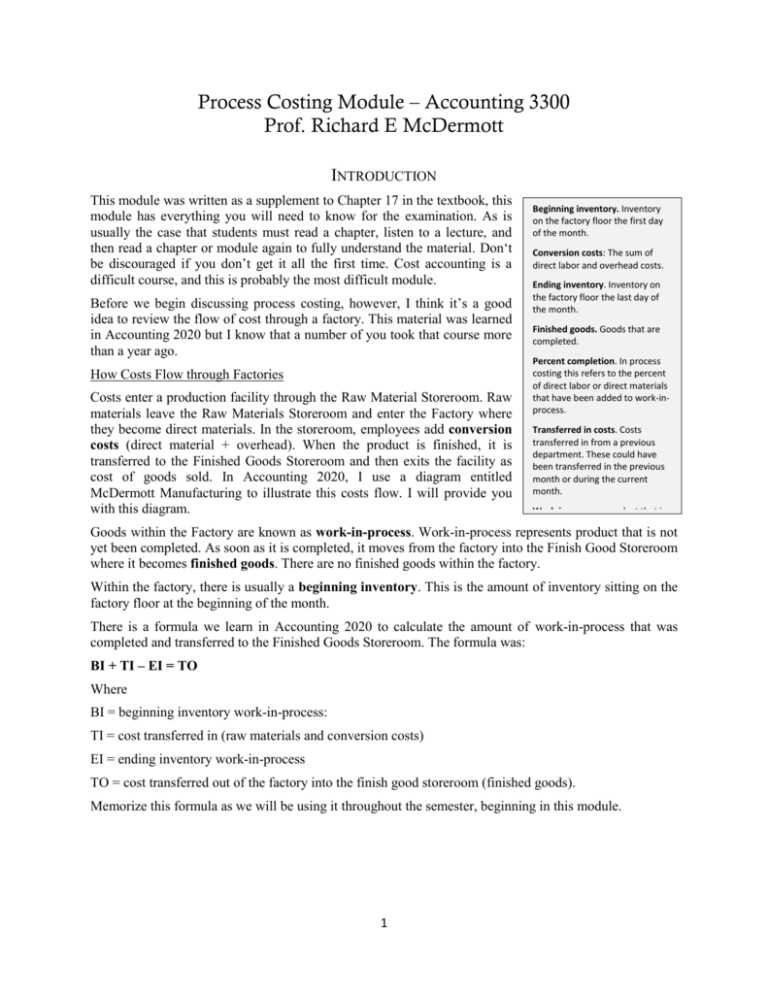

Process Costing Module – Accounting 3300 Prof. Richard E McDermott INTRODUCTION This module was written as a supplement to Chapter 17 in the textbook, this module has everything you will need to know for the examination. As is usually the case that students must read a chapter, listen to a lecture, and then read a chapter or module again to fully understand the material. Don‘t be discouraged if you don’t get it all the first time. Cost accounting is a difficult course, and this is probably the most difficult module. Before we begin discussing process costing, however, I think it’s a good idea to review the flow of cost through a factory. This material was learned in Accounting 2020 but I know that a number of you took that course more than a year ago. How Costs Flow through Factories Costs enter a production facility through the Raw Material Storeroom. Raw materials leave the Raw Materials Storeroom and enter the Factory where they become direct materials. In the storeroom, employees add conversion costs (direct material + overhead). When the product is finished, it is transferred to the Finished Goods Storeroom and then exits the facility as cost of goods sold. In Accounting 2020, I use a diagram entitled McDermott Manufacturing to illustrate this costs flow. I will provide you with this diagram. Beginning inventory. Inventory on the factory floor the first day of the month. Conversion costs: The sum of direct labor and overhead costs. Ending inventory. Inventory on the factory floor the last day of the month. Finished goods. Goods that are completed. Percent completion. In process costing this refers to the percent of direct labor or direct materials that have been added to work-inprocess. Transferred in costs. Costs transferred in from a previous department. These could have been transferred in the previous month or during the current month. Work-in-process: product that is not yet completed. Goods within the Factory are known as work-in-process. Work-in-process represents product that is not yet been completed. As soon as it is completed, it moves from the factory into the Finish Good Storeroom where it becomes finished goods. There are no finished goods within the factory. Within the factory, there is usually a beginning inventory. This is the amount of inventory sitting on the factory floor at the beginning of the month. There is a formula we learn in Accounting 2020 to calculate the amount of work-in-process that was completed and transferred to the Finished Goods Storeroom. The formula was: BI + TI – EI = TO Where BI = beginning inventory work-in-process: TI = cost transferred in (raw materials and conversion costs) EI = ending inventory work-in-process TO = cost transferred out of the factory into the finish good storeroom (finished goods). Memorize this formula as we will be using it throughout the semester, beginning in this module. 1 CLASSIFICATION OF COSTING SYSTEMS – JOB COSTING AND PROCESS COSTING In Accounting 2020, we were told that there are two types of cost accounting systems. The first is job costing. Job costing is used for products that are unique one from another. Products that might be manufactured under a job costing system would include custom homes and battleships. You were also told that the cost objective for job costing was the job cost sheet. A cost objective is anyplace that we accumulate costs. You were not taught much about process accounting in Accounting 2020, but you were told that process costing is used for products that are homogeneous. Examples of products that would be costed using a process costing system include gallons of paint, batches of ball bearings, and so on. We should mention here that the cost objective in process costing is the factory department. Some factories have only one department; some have many. For example, in a manufacturing plant for furniture we might have three departments: cutting, assembly, and painting. Cost objective. Anyplace costs are assigned for a specific purpose. FIFO costing. A cost accounting system that separates the equivalent units and cost of the previous month from those of the current month. Job costing. A cost accounting system used for products that are different one from another. Process costing. A cost accounting system used for products that are homogeneous. Standard costing. A process or job costing system that uses standard cost instead of actual costs. We will not study standard costing process costing systems in this module. Weighted average costing. A process costing system that combines the equivalent units and costs of the previous month with those up of the current month.per unit. come with a cost And process costing costs are charged to specific production departments. At the end of the month, these costs are divided by the number of homogeneous units manufactured during the month in that department to For example, if we manufactured 100,000 gallons of paint, and had $1,000,000 of direct materials and conversion costs that had been charged to the production department during the month, we would divide the $1,000,000 by 100,000 gallons to get a per unit cost of $10 per gallon. Now it would seem that process costing will be a fairly simple process. This would be the case if there were no beginning or ending inventories. However, this is usually not the case. Reasons that process costing is more difficult job costing include: 1. There are inventories on the floor at the beginning of the month (known of course as the beginning inventory). All inventories in the factory are incomplete. In addition the cost elements (direct materials and conversion cost) for the inventories may be at different stages of completion. For example, some of the beginning inventory might be 50% complete for direct materials but only 20% complete for conversion costs. This makes it impossible to divide the cost for the month by physical units in the factory, since some of the units are only partially completed. 2. The cost of direct materials and conversion costs may have been different last month and they are this month. 3. Materials may enter the production line at different times in the production process. This would especially be true for a pharmaceutical company where different chemicals are added at different points in the production process. 4. By name, there may be more than one production department. 2 Within process costing, there are three subgroups. 1. Weighted average process costing 2. First-in-first-out costing (FIFO) and 3. Standard cost process costing In this module we will only study the first two. The primary teaching objectives in this model is the completion of a Cost of Production Report. This report has one objective and that is to provide an accurate cost of goods transferred out and ending inventory. Preparing the cost of production report involves five steps: 1. 2. 3. 4. 5. Summarize the flow of physical units Compute output (production) in terms of equivalent units Summarize total cost to account for Compute cost per equivalent unit Assign total cost to units completed and to units and ending work-inprocess You should memorize the steps as we will be using them over and over again as we go through the process costing module. I don’t expect you understand fully what he steps mean at this point, but I will illustrate each step and by the time we finish the example problem, the steps should be perfectly clear. At this point, it makes sense to define several terms. The first is physical unit. A physical unit is simply a unit of product. It may be finished, or may only be in a partial stage of completion. Physical unit. A unit of product that may or may not be complete. Equivalent unit. An equivalent a unit of material is the amount of material it would take into complete one product. An equivalent unit of conversion cost is the amount of conversion costs it would've taken to complete one product. The second term is equivalent unit. An equivalent unit is basically a relative value unit (RVU) similar to what we studied in the service industry cost accounting module. No one in manufacturing accounting calls if that, but having had the benefit of service industry cost accounting you understand what an RVU is. One equivalent unit of material is the amount of material it would have taken to complete one unit of product during the month. To illustrate: if we have three automobiles on an assembly line at the end of the month, and each are 1/3rd complete for direct materials, then we have one equivalent unit of direct materials but three physical units of raw materials in ending inventory. See the diagram above. Okay, the best way to illustrate the preparation of a cost of production report is to work one. PREPARATION OF A COST OF PRODUCTION REPORT – WEIGHTED-AVERAGE We will first prepare a Cost of Production Report for a company that uses the weighted average method. When preparing a cost of production report, you will always be given a table with the following information. Let’s assume that we are dealing with month of April. 3 Information Given The company has two departments Materials are added when conversion costs are 80% Complete Conversion costs are added evenly The company uses the weighted average method This is the second production department In the production process A 1 2 3 4 5 6 7 Beginning work in process Degree of completion beginning work in process Transferred in during April Completed and transferred out during April Ending work in process Degree of completion ending work in process Total costs added during April B C Physical units Transferred in Costs 600.00 $21,850 100% 1,800.00 2,000.00 400.00 100% $96,000 D Direct Materials E Conversion Costs 0 $10,000 0% 40% 0% $17,800 60% $46,000 Let’s discuss what we have here. This is a manufacturer that has two departments. This problem is concerned with the second department only. We assume that during the production process that conversion costs are added evenly throughout the process. In this problem there is only one direct material and it is added when 80% of the conversion costs have been added. One question you might have is: “What were the workers working on before they added the material at 80% of the production process? Since this is the second department, they were working on material transferred in from the first department! For ease of calculation, I have named the columns in the table A, B, C, D and E. I have numbered the rows (in the above example 1 through 7). Column B Let’s explain each of the figures in column B. At the beginning of the month, the company had 600 physical units of product in the beginning inventory. These 600 physical units were only not complete for direct materials in conversion costs (specifically they were 0% complete for direct materials and 40% complete for conversion costs). During the month, the company transferred in 1,800 physical units of product from the previous department. The company finished and completed 2,000 physical units and transferred them to the Finished Goods Department. At the end of the month, the company still had unfinished product sitting on the floor which is known as ending inventory. The table shows us we had 400 physical units of ending inventory partially complete 4 for direct materials and conversion costs. Specifically ending inventory was 100% complete for transferred in costs, 0% complete for direct materials and 60% complete for conversion costs). Column C Now let’s look at Column C which gives us information about transferred in costs. Transferred in costs are those cost that came from a previous department. There was $21,850 of transferred in costs in the beginning inventory. Row 2 tells us that transferred in costs were 100% complete. Transferred in costs are always 100% complete. Moving down to cell C6, we see that the transferred in costs for ending inventory were also 100% complete. I should note that transferred in costs are simply another category of direct material. Let me illustrate this, as some students have trouble with this concept. Transferred in costs. The cost of a product started in the previous department and transferred to a subsequent department. These costs may include direct labor and conversion costs, but upon their transfer are grouped into a category known as transferred in costs. If I were building automobiles and purchased carburetors from an outside manufacturer, these carburetors would be classified as direct materials. If I manufactured these carburetors in-house, however, (in Department One), and then transferred them to Department Two, they would be known as transferred in costs. In either case they are essentially the same thing – only with different names. Cell C7 tells us during the month of April, $96,000 of costs were transferred from Department One to Department Two. Column D Now let’s move to column D which deals with direct materials. Cell D1 has a balance of $0. This means that we had yet to any direct materials to beginning inventory from Department Two. Cell D6 addresses the amount of direct materials Department Two had in ending inventory. Again, there is none. Cell D7 tells us that $17,800 of direct materials were added during the month of April. Column E Let’s move to Column E which gives us information on conversion costs. At the beginning of the month there was $10,000 of conversion costs from Department two. Exactly 40% of the total conversion costs that would be added during the month had been added. Conversion costs were, therefore, 40% complete. Ending inventory conversion costs were 60% complete. During the month we added $46,000 of conversion costs. PREPARATION OF FLOW PRODUCTION SECTION OF PRODUCTION COST REPORT Flow of Production Section The first section of the Cost of Production Report is The Flow of Production section. In the first column, we are going to verify that the number of units in beginning inventory plus the number of units transferred in equals the number of units transferred out plus the number of units in ending inventory. Let’s take the equation given above, and use a little algebra to illustrate this. BI + TI – EI = TO Rearranging through the use of algebra BI + TI = TO + EI 5 The Flow of Production section is shown below. A B C Flow of Production 8 9 10 11 12 13 14 Physical Units 600.00 1,800.00 2,400.00 2,000.00 400.00 2,400.00 Beginning work in process Transferred in To account for Completed and transferred out Ending work in process Accounted for Equivalent units D E Equivalent Units Transferred in Direct Conversion Costs Materials Costs 2,000.00 400.00 2,000.00 - 2,000.00 240.00 2,400.00 2,000.00 2,240.00 Column A Rows 1 through 13 simply duplicate the formula given above. Beginning inventory + transferred in = transferred out + ending inventory. If the numbers in sales B10 and B13 do not equal each other, then we have A units that are unaccounted for. Beginning work in process Column B In Column B we essentially copy the information given to us in a slightly different format. Compare the numbers and you’ll see what I’m talking about. Transferred in during April Completed and transferred out during April Ending work in process Degree of completion ending work in process Total costs added during April BI + TI TO + EI Column C, D and E In columns C, D, and E we calculate equivalent units. We will do this by multiplying physical units by percent of work completed and the current month. For beginning inventory we take (100% minus beginning inventory percent of completion) and then multiply that by physical units. For ending inventory, we take percentage of completion and multiply it by physical units. We are concerned about is the amount of work done this month. The amount of work done to complete beginning work-in-process is represented by 100% minus the work done in the previous month. We assume that all ending inventory was started this month. Therefore if it inventory is 40% for conversion costs, that 40% was completed this month. Once again we are working a problem that uses weighted-average. The format for the Flow of Production section will change slightly when we get to FIFO. Let’s go to cell 11C, 11D and 11E and calculate the equivalent units of work for all of the units transferred out during the month. Remember with weighted-average, we are combining the work done last month with work done this month. Since the units are complete, they must be 100% complete for transferred in costs, direct material cost, and conversion cost. The number of physical units equals the number of equivalent units for each of these three categories. Simple calculation! Now let’s move to Row 12 where we calculate equivalent units for ending work-in-process for these three cost categories. If we go back to the data that was given, and look at cell 6C, we can see that ending work-in-process was 100% done. If 100% of the work was done, then the way to calculate equivalent units in ending work-in-process is to multiply 100% by the number of physical units which is 400. That 6 will give us a figure of 400. There are, therefore, 400 equivalent units of transferred in cost in ending inventory. If we go back to the data that was given, and look at cell D6, we see that ending work-in-process was 0% completed for direct materials. Moving down to Cell D12, we calculate the equivalent units of direct materials in ending work-in-process by multiplying 0% by 400 physical units which gives us zero equivalent units. Now let’s do the same thing for conversion costs. Going back to the data given, we can see in cell E6, that ending work-in-process was 60% completed for conversion costs. How do we calculate, therefore, the number of equivalent units in ending work-in-process? We multiply 60% by the physical units which are 400 to get 240 equivalent units. Now let’s go down to Row 14. Here we are going to calculate the total number of equivalent units of work done last month for each of our three cost categories (transferred in costs, direct materials costs, and conversion costs). We do that by totaling rows 11 and 12 for each column. We had 2,400 equivalent units (relative value units or units of work done) for “transferred in costs,” 2,000 equivalent units for direct material costs, and 2,240 equivalent units for conversion costs. We have now finished the flow of production section of the production cost report. FLOW OF COST SECTION OF THE PRODUCTION COST REPORT Remember a moment ago we used the formula BI + TI = TO + EI to account for physical units? Now we are going to do the same thing for dollars. The amount of money we invested in beginning inventory, plus the amount of money we added during the month, should equal the amount of money transferred out, plus the amount of money in ending inventory. If not, we have a problem. Someone may have defrauded us! As a reminder, in our formula: BI = beginning inventory TI = transferred in TO = transferred out EI = ending inventory We have already been given the dollar amount in beginning inventory and the dollar amount transferred in during the month. In this section of the report, we will distribute this amount of money to the goods transferred out and to ending inventory. The first few rows of the Flow of Cost section are shown below: A B C D E Total Production Transferred in Direct Conversion Costs Costs Materials Costs $ 31,850.00 $ 21,850.00 $ $ 10,000.00 159,800.00 96,000.00 17,800.00 46,000.00 117,850.00 17,800.00 56,000.00 Flow of Cost 15 Beginning work in process 16 Cost added in current. 17 Costs incurred to date Where do we get the numbers for Row 15? This data was given to us! Transferred in costs of $21,850 plus direct material costs of $0 plus conversion costs of $10,000 are equal to $31,850. Where do we get the numbers for Row 16? Again this data was given at the beginning of the problem. Totaling the columns in rows 15 and 16 gives us the amounts in the columns of Row 17 four columns C, D, and the. At this point, we do not calculate a total for column B. That will be done further down the cost report. 7 The next thing we are going to do is to divide the total costs for the three categories (transferred in costs direct material costs and conversion costs) as found in column C, D and E by the equivalent units we calculated in the flow production section. This will give us a cost per equivalent unit for transferred in costs, direct materials costs, and conversion costs. What are we going to do with these three figures? We are going to use them to distribute costs to the product that was transferred out and the ending inventory. Let’s expand the flow of cost production report to illustrate this calculation. A B C D E Total Production Transferred in Direct Conversion Costs Costs Materials Costs $ 31,850.00 $ 21,850.00 $ $ 10,000.00 159,800.00 96,000.00 17,800.00 46,000.00 117,850.00 17,800.00 56,000.00 2,400.00 2,000.00 2,240.00 49.10 8.90 25.00 191,650.00 Flow of Cost 15 16 17 18 19 20 Beginning work in process Cost added in current. Costs incurred to date Divide by equivalent units Cost per equivalent unit Total cost to account for In row 20, we now calculate the total cost to account for. Put another way, this is the cost for BI + TI. This is the amount that we will allocate to goods that are transferred out plus ending inventory (TO + EI). Now we continue to the second portion of the flow of cost statement by adding rows 21 through 24. Here we are going to allocate the $191,650 to goods transferred out and the ending inventory. We’re going to do this using the equivalent units for each of these categories times the cost per equivalent unit calculated above. A B C D E Total Production Transferred in Direct Conversion Costs Costs Materials Costs $ 31,850.00 $ 21,850.00 $ $ 10,000.00 159,800.00 96,000.00 17,800.00 46,000.00 117,850.00 17,800.00 56,000.00 2,400.00 2,000.00 2,240.00 49.10 8.90 25.00 191,650.00 Flow of Cost 15 16 17 18 19 20 21 22 23 24 Beginning work in process Cost added in current. Costs incurred to date Divide by equivalent units Cost per equivalent unit Total cost to account for Assignment of costs: Completed and transferred out Ending working process Total costs accounted for 166,008.33 25,641.67 191,650.00 98,208.33 19,641.67 17,800.00 - 50,000.00 6,000.00 Let’s start with cell C22 which lists the amount of transferred in costs in goods that were completed and transferred out... How do we calculate this? We multiply the cost per equivalent unit times the number of equivalent units for costs that were completed and transferred out (cell D1 × D11). Thus, $49.10 times sign 2,000 equivalent units = 98,208.33. That’s the dollar amount of “transferred in” costs in the product that was completed and transferred out during the month. Do the same thing for direct materials and conversion costs. All of those costs are then totaled in cell B22. Thus, $166,008.33 is the cost of goods that were transferred out during the month. 8 Now the live allocated cost to the goods that were transferred out, all that remains is to allocate costs to ending inventory. Let’s go to cell C23 and follow the same procedure. The cost per equivalent unit is $49.10 for transferred in costs. There are 400 equivalent units in ending inventory for transferred in costs (cell C12). Multiplying these two figures we get it $19,641.67. We follow the same procedure to get the costs in ending inventory for direct materials and for conversion costs. Totaling these three figures, we have $25,641.67 in ending inventory. The amount thus allocated is $166,008.33 + $25,641.67 = $191,650 which is the same amount that we had to allocate in column B21. We had been successful! PREPARATION OF A COST OF PRODUCTION REPORT – FIFO The production report for FIFO is similar but not identical to that of weighted-average. The information given is the same. So that you don’t have to flip back to many pages I repeat the information given in the table below. Transferred in Costs, FIFO Information Given (Same as Above) The company has two departments Materials are added when the spinning process is Conversion costs are added evenly The company uses the weighted average method This is the second department 80% Complete A 25 26 27 28 29 30 31 B C D E Physical Transferred in Direct Conversion Units Costs Materials Costs 600.00 $ 21,850.00 $ $ 10,000.00 100% 0% 40% 1,800.00 2,000.00 400.00 100% 0% 60% $ 96,000.00 $ 17,800.00 $ 46,000.00 Beginning work in process Degree of completion beginning work in process Transferred in during April Completed and transferred out during April Ending work in process Degree of completion ending work in process Total costs added during April In the flow of production report, the first section (rows 25 through 27) is identical to the weighted-average report. A B C D E Physical Transferred in Direct Conversion Units Costs Materials Costs 600.00 $ 21,850.00 $ $ 10,000.00 100% 0% 40% 1,800.00 25 Beginning work in process 26 Degree of completion beginning work in process 27 Transferred in during April Beginning with row 27, “Completed and Transferred out”, however, the FIFO report begins to change. 9 You will remember with weighted-average we had one line in the flow production report “completed and transferred out.” This is shown below. 11 Completed and transferred out 2,000.00 2,000.00 2,000.00 2,000.00 Since we are now using FIFO, however, we must separate the units of last month from units of this month. Later we will do the same thing for costs. Let’s focus on units first. A B Flow of Production 28 29 30 31 32 33 Physical Units 600.00 1,800.00 2,400.00 Beginning work in process Transferred in during the current. To account for Completed and transferred out during the current. From beginning work in process Started and completed 600.00 1,400.00 C D Equivalent Units Transferred in Direct Costs Materials 1,400.00 600.00 1,400.00 E Conversion Costs 360.00 1,400.00 Go to Row 31st. Notice that completed and transferred out during is divided into two categories: “from beginning work-in-process” and “started and completed.” How do we calculate the physical units (600 units) from beginning work-in-process? That figure is given to us (cell B25). How do we calculate the 1,400 units that were started and completed? We take the total number transferred out (Cell B28) and subtract the number that was completed from the beginning inventory. How do we calculate equivalent units? In the same way we were taught under the weighted average method. We multiply the physical units by the percent completion given above. Let’s use cell E33 as an example. In cell E 26 we see that the beginning work-in-process was 40% complete. That means that during this month we had to add 60% to complete the product (40% +60% = 100%). Multiplying 60% work done this month by 600 physical units in beginning inventory gives us 360 (Cell E32) equivalent units of work done in this month. Once again we must emphasize that equivalent units in FIFO are calculated only on the work done this month. In the same way, costs in FIFO only include those costs incurred this month. Later, when we calculate the cost per equivalent unit in FIFO, we will divide only the costs incurred this month, by the equivalent units of work done this month. The completed Flow of Production Section is shown below. Notice that the equivalent units for FIFO are different than the equivalent units for weighted-average. This is because the FIFO figures do not include work done in the previous accounting month. 10 A B Flow of Production 28 29 30 31 32 33 34 35 36 Physical Units 600.00 1,800.00 2,400.00 Beginning work in process Transferred in during the current. To account for Completed and transferred out during the current. From beginning work in process Started and completed Ending work in process Accounted for Equivalent units 600.00 1,400.00 400.00 2,400.00 C D Equivalent Units Transferred in Direct Costs Materials E Conversion Costs 1,400.00 400.00 600.00 1,400.00 - 360.00 1,400.00 240.00 1,800.00 2,000.00 2,000.00 Now let’s turn to the Flow of Costs Report. Let’s begin by considering only the first row of that report (row 37) since an important difference between weighted-average and five full appears here. A Flow of Costs 37 Beginning work in process B C D E Total Production Transferred in Direct Conversion Costs Costs Materials Costs $ 31,850.00 Costs done in prior period!!! Unlike weighted-average, we put no dollar figures in column C, D, and E. These costs were incurred in the previous month and should not be included when calculating cost per equivalent unit. Let’s continue down the report. A Flow of Costs 37 38 39 40 41 Beginning work in process Costs added during the current period Divide by equivalent units Cost per equivalent unit Total cost to account for B C D E Total Production Transferred in Direct Conversion Costs Costs Materials Costs $ 31,850.00 Costs done in prior period!!! $ 159,800.00 $ 96,000.00 $ 17,800.00 $ 46,000.00 1,800.00 2,000.00 2,000.00 $ 53.33 $ 8.90 $ 23.00 $ 191,650.00 On row 38 we do show costs for Columns C, D, and E. These costs were incurred in the present month. Remember we are only going to divide costs incurred in the present month by equivalent units of work done in the present month. Thus we divide row 38 by the figures in row 39 to calculate cost per equivalent unit shown in row 40. Okay, now we have the Total Cost to Account for. It is $191,650. Now we are going to allocate these costs to (1) goods that were transferred out and (2) ending inventory, just as we did in weighted-average, but with one modification. When we calculate the cost of goods transferred out we’re going to have to break them into cost from the previous month and cost from the present month. Let’s focus first on allocating costs to the goods transferred out during the current month nth. Remember that under weighted-average, the allocation looked like this. 22 Completed and transferred out 166,008.33 11 98,208.33 17,800.00 50,000.00 Pretty simple. Only one line. The costs completed and transferred out include both the cost from last month and from this month combined. With FIFO we are going separate last month’s cost from this month’s cost. Let’s see what that schedule looks like. Again we are only dealing with one section of the flow of cost report. We will show the entire section later. 43 44 45 46 47 48 Completed and transferred out From beginning work in process $ 31,850.00 Costs added to beginning work in process 13,620.00 Total from beginning inventory $ 45,470.00 Started and completed 119,326.67 Total costs of goods completed and transferred out $ 164,796.67 0 5,340.00 8,280.00 74,666.67 12,460.00 32,200.00 Now instead of one row for “completed and transferred out” we have six. Let’s examine each individually. Row 44 gives us the cost incurred in beginning work-in-process last month. Row 45 gives us the cost to complete this beginning work in process. Row 46 adds the costs in the beginning inventory to the costs to complete the beginning inventory. Now we know the cost of the completed inventory when it was shipped. However, that was not all we shipped. To meet demand, we had to start and complete additional units of product. That is shown on Row 47. All of those costs were incurred in this month. Now we can calculate the total cost of all goods transferred out of Department two during the month. This consists of the total of beginning inventory goods transferred out, plus goods that were started and completed. This total is shown on Row 48. There is now one more allocation we must make. We must allocate costs to inventory. The completed flow of cost report is therefore shown below. A Flow of Costs 37 38 39 40 41 42 43 44 45 46 47 48 49 50 Beginning work in process Costs added during the current period Divide by equivalent units Cost per equivalent unit Total cost to account for Assignment of costs: Completed and transferred out From beginning work in process Costs added to beginning work in process Total from beginning inventory Started and completed Total costs of goods completed and transferred out Ending work in process Total costs accounted for B C D E Total Production Transferred in Direct Conversion Costs Costs Materials Costs $ 31,850.00 Costs done in prior period!!! $ 159,800.00 $ 96,000.00 $ 17,800.00 $ 46,000.00 1,800.00 2,000.00 2,000.00 $ 53.33 $ 8.90 $ 23.00 $ 191,650.00 $ 31,850.00 13,620.00 $ 45,470.00 119,326.67 $ 164,796.67 26,853.33 $ 191,650.00 12 0 5,340.00 8,280.00 74,666.67 12,460.00 32,200.00 21,333.33 - 5,520.00 Note that the total goods shipped of $164,796.67 plus the cost of ending work-in-process of $26,853.33 equals “costs accounted for” of $191,650. How did we calculate the equivalent units for Rows 45 through 49 (columns C, D and E)? In the same way we did for weighted-average. We multiply the cost per equivalent by the number of equivalent units. Total report is shown below. A Cost of Production Report B Flow of Production 28 29 30 31 32 33 34 35 36 Physical Units 600.00 1,800.00 2,400.00 Beginning work in process Transferred in during the current. To account for Completed and transferred out during the current. From beginning work in process Started and completed Ending work in process Accounted for Equivalent units 600.00 1,400.00 400.00 2,400.00 A Flow of Costs 37 38 39 40 41 42 43 44 45 46 47 48 49 50 Beginning work in process Costs added during the current period Divide by equivalent units Cost per equivalent unit Total cost to account for Assignment of costs: Completed and transferred out From beginning work in process Costs added to beginning work in process Total from beginning inventory Started and completed Total costs of goods completed and transferred out Ending work in process Total costs accounted for C D Equivalent Units Transferred in Direct Costs Materials E Conversion Costs 1,400.00 400.00 600.00 1,400.00 - 360.00 1,400.00 240.00 1,800.00 2,000.00 2,000.00 B C D E Total Production Transferred in Direct Conversion Costs Costs Materials Costs $ 31,850.00 Costs done in prior period!!! $ 159,800.00 $ 96,000.00 $ 17,800.00 $ 46,000.00 1,800.00 2,000.00 2,000.00 $ 53.33 $ 8.90 $ 23.00 $ 191,650.00 $ 31,850.00 13,620.00 $ 45,470.00 119,326.67 $ 164,796.67 26,853.33 $ 191,650.00 13 0 5,340.00 8,280.00 74,666.67 12,460.00 32,200.00 21,333.33 - 5,520.00