GCL SCAN Feb 2012 final - Global Counsel Leaders Circle

advertisement

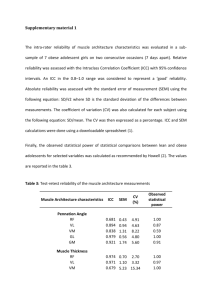

Global Counsel Leader Scan February 2012 This is the first of what will be a regular (every 4-8 weeks) compilation of articles and excerpts from newsletters, magazines and presentations, compiled specifically for Global Counsel Leaders Circle members. The first heading is a category for our index—we will maintain a compilation of the pieces here for each category. We will only include what we find potentially timely, useful and clearly written. We do not intend to promote law firm or other providers’ publications that are included here. None are clients of ELD International (unless noted). If you have articles, briefs, presentations (written by you, your team, or that you’ve found) or website resources that you find excellent, please forward to me for possible inclusion as part of this communication. – Leigh Dance, Editor Table of Contents Crisis Management A Short Rule Book for Your Next Crisis page 2 Law Dept Management Study on General Counsel and Value page 3 International Legal Developments Fundamental Overhaul of EU Data Protection Regime page 4 International Legal Developments New ICC Rules on Arbitration and ADR page 7 International Legal Developments Managing in a Time of Economic Uncertainty page 9 Worthwhile websites Transparency International: www.transparency.org This useful site has the oft-quoted Corruption Perceptions Index and useful data such as the Global Corruption Report. International Mediation Institute www.imimediation.org Good, clearly presented resources for mediation, and a search tool for mediators. Independent, not affiliated with one arbitration center. February 2012 Global Counsel Leader Scan Page 1 A Short Rule Book for Your Next Crisis A General Counsel gave to me this advice on crisis response, explaining it had come from a colleague, and had proved remarkably pertinent. To keep in your back pocket. Don't panic - do something Be prepared to demonstrate human concern for what has happened Never underestimate genuine concerns of customers Faced with disaster, consider the worst possible outcome Communicate at all times at all levels Beware the obsequiousness of advisers Don't believe that writing the "procedures" will prevent it from happening Don't believe it can't happen because it hasn’t happened before I’ll add another one to the list: Always make new mistakes February 2012 Global Counsel Leader Scan Page 2 Nabarro’s Report on General Counsel and Value Nabarro law firm issued their second study on this topic in November 2011—I’d rate it 7.5 on a scale of 1-10. It’s good data and the concepts are useful, though the guidance on actions is not as specific as it might be. This chart is of interest, as one way of looking at the corporate counsel value pyramid. Contact Leigh for a pdf of the study. Nabarro’s report identifies a number of barriers they believe that General Counsels have to overcome to move up the pyramid. For example: • Routine tasks at the bottom level of the pyramid still need to be performed and these need to be resourced efficiently. • expected of Many lawyers are perceived to lack the behavioral characteristics senior commercial executives. • various board-level Even if they have such characteristics, they need to win the trust of stakeholders. For lawyers aspiring to the top of the pyramid, influence is critical. Source: Nabarro report, General Counsel: Vague About Value? A study and discussion paper, November 2011 February 2012 Global Counsel Leader Scan Page 3 From TAYLOR WESSING Contacts Fundamental overhaul of EU data protection regime unveiled A package of draft measures aimed at fundamentally overhauling and harmonising the EU’s data protection regime has been published by the European Commission. If passed in its current form, the new data protection framework will introduce enhanced rights for individuals and tough penalties for non-compliance. Why do we need new data protection laws? With the explosion of the internet, volumes of personal data held by organisations have increased dramatically and data now flows much more easily between organisations and jurisdictions. The EU believes that the current regime is in need of updating and that harmonising the regimes across Member States will bring greater security for individuals, greater clarity and (arguably) lower compliance costs for organisations which process personal data. To that end, it has published a draft framework of legislation which will entirely replace current European data protection laws. Who will have to comply with the new laws? Data controllers and data processors with legal entities in the EU will have to comply. In addition, organisations which process personal data of EU individuals in relation to the offering of goods and services or monitoring of behaviour irrespective of the location of the controller or processor, will also be subject to the new laws. > Vinod Bange +44 (0)20 7300 4600 Email > Sally Annereau +44 (0)20 7300 4994 Email > Chris Jeffery +44 (0)20 7300 4230 Email > Graham Hann +44 (0)20 7300 4839 Email | LinkedIn | Twitter > Glyn Morgan +44 (0)20 7300 4652 Email www.taylorwessing.com What are the key changes? The draft framework is lengthy and detailed. While the data protection principles and some (but not all) of the defined terms remain largely unchanged, there are a number of key changes proposed including: Regulation by one Member State – all EU based data processing activities of data controllers and data processors will be regulated by a single Member State which will be determined by the location of the main establishment of the relevant organisation or, if there is no EU establishment, by the place where the bulk of the processing takes place. Consent – consent is defined as “any freely given, specific, informed and explicit indication” of the data subject’s wishes. It cannot be automatically implied where there is a significant imbalance of power between the data subject and the data controller, for example, in respect of the processing of employee data. In some instances, consent may not be capable of being obtained and other means of making the processing of personal data lawful will have to be relied on. February 2012 Global Counsel Leader Scan Page 4 Data controllers and data processors – these roles have been re-defined and for the first time, the data processor has a direct liability for compliance as well as enhanced administrative obligations. Right to be forgotten – the right to be forgotten and to have all personal data removed from records under certain circumstances is provided for under Article 17 of the draft Regulation. There are exceptions to this right including where the personal data is necessary for exercising freedom of expression or is held for historical, statistical and scientific research purposes. This is a completely new right which is liable to prove one of the most controversial elements of the draft package. Right to data portability – where personal data is processed electronically and in a commonly used, structured format, data subjects will have the right to obtain a copy of their data in that format in order to be able to transfer the data to another service provider. Right not to be profiled – individuals have an enhanced right not to be subject to any measures based on automated processes which use personal data to analyse, evaluate or predict their performance at work, economic situation, location, health, personal preferences, reliability or behaviour. Additional enforcement powers and sanctions – Data Protection Authorities will have an increased set of duties as well as enhanced enforcement powers. Penalties for intentional or negligent breaches of data protection law will reach a maximum of 2% of annual global turnover for "enterprises" or fines of up to 1 million Euros in other cases. The definition of what constitutes an "enterprise" is likely to be looked at closely prior to enactment. Mandatory security breach notification – data protection authorities must be informed of a data security breach by the data controller “without undue delay and, where feasible, not later than 24 hours of becoming aware of it”. Data subjects must then be informed “without undue delay” of the breach unless the relevant data protection authority is satisfied that the data was sufficiently protected from being accessed by an unauthorised user, for example, by encryption. Data transfers outside the EU – there is considerably more detail on how to effect compliant data transfers outside the EU including a set of Binding Corporate Rules and the acknowledgment that authorisation of a non-standard data transfer contract by one Member State will validate it across the EU. New requirement to have a Data Protection Officer – data controllers and data processors with over 250 employees will be required to have a designated Data Protection Officer to help ensure the organisation’s compliance with data protection law (subject to limited exceptions). Additional administrative requirements – There are a number of new administrative requirements which data controllers and, in most cases, data processors will have to comply with (although the general obligation February 2012 Global Counsel Leader Scan Page 5 to notify has gone). These include the obligation to maintain a form of compliance register and to conduct privacy impact assessments "where processing operations present specific risks to the rights and freedoms of data subjects" before data processing or data transfers are permitted. SMEs - Organisations with fewer than 250 employees are exempt from many of the administrative requirements. When will the new laws come into force? The published framework is in draft form and may change before it becomes law. However, the EU intends that the framework will be enacted this year. The bulk of the reforms are in the form of a Regulation. Unlike Directives, EU Regulations have direct effect. This means they come into Member State Law exactly as drafted without any room for manoeuvre (although the Regulation does give Member States scope to introduce their own measures under limited circumstances). The proposed Regulation will repeal the current Data Protection Directive and is likely to come into force two years after enactment so we are potentially looking at the end of 2014. What happens next? Essentially, a great deal of lobbying and wrangling as well as several rounds of amendments while the legislation passes through the necessary hoops towards enactment. How can I learn more? Over the coming weeks, we will be sending out more detailed information about the proposals and regular updates will follow as the framework progresses towards enactment. Taylor Wessing will be launching a new monthly webinar series on key issues around Data Protection. Our first webinar will be on 6 March and will look at the new data protection framework. On 28 March, we will also be hosting a seminar on the new framework at our London office. If you would like to receive more information about our webinar series or the seminar, please register your interest at events@taylorwessing.com. If, in addition, you would like one of our data protection specialists to come and talk to you or if you have specific questions or concerns, please send us an email. Taylor Wessing's international offices operate as one firm but are established as distinct legal entities. For further information about our offices and the regulatory regimes that apply to them, please refer to http://www.taylorwessing.com/regulatory.html This publication is intended for general public guidance and to highlight issues. It is not intended to apply to specific circumstances or to constitute legal advice. February 2012 Global Counsel Leader Scan Page 6 New ICC Rules on Arbitration and ADR The new provisions in the 2012 Rules and their emphasis on efficiency are in keeping with similar trends in amendments to civil procedure rules and arbitration rules around the world. FROM LINKLATERS: Introduction On 1 January 2012 an updated version of the Rules of Arbitration of the International Chamber of Commerce (“ICC”) come into force (the “New ICC Rules”). These replace the ICC Rules that have been in force since 1 January 1998. The changes made in the New ICC Rules are intended to reflect the institution’s experience in administering arbitrations since then and to improve efficiency and to take into account, in particular, the growing complexity of arbitration. At the same time, the revision is not a radical overhaul. Many of the changes are cosmetic and the distinguishing features and processes of ICC Arbitration remain in place, so practitioners with experience of the institution’s workings will find much to be familiar. When will the New ICC Rules apply? The New ICC Rules come into force on 1 January 2012 and will, in general, apply to any ICC arbitration commenced on or after that date. Key Amendments There are a number of changes contained in the New ICC Rules. Some key ones are: Case Management/Efficiency The New ICC Rules contain a number of provisions designed to streamline the progress of an ICC arbitration. For example: The arbitral tribunal and the parties are obliged to make every effort to conduct the arbitration in a cost-effective manner (article 22(1)) (a matter which is to be taken into account by the arbitral tribunal when making any costs award - article 37(5)). The arbitral tribunal is obliged to convene a case management conference to consult the parties on the procedure to be adopted during the arbitration and to establish a procedural timetable (article 24). In order to ensure effective case management the tribunal may adopt such procedural measures as it considers appropriate (article 22(2)). Under the previous ICC Rules, decisions on jurisdictional objections are considered by the ICC Court, a feature which has attracted criticism for causing potential delay. Under the New ICC Rules, the default position is for such matters to be determined by the arbitral tribunal – unless the Secretary General decides that it should be referred to the ICC Court (article 6(3)). Where the ICC Court is to appoint an arbitrator there is provision, unlike the usual case under the previous ICC Rules, for it to bypass the recommendation of a National Committee if that body fails to make the same or the ICC Court considers it to be inappropriate (article 13(3)). This is intended to deal with criticism that the use of National Committees has caused delay. February 2012 Global Counsel Leader Scan Page 7 Emergency Arbitrator (article 29) A party that requires urgent interim or conservatory relief before the tribunal has been or is able to be constituted can apply for such measures from an “Emergency Arbitrator” under a new procedure introduced into the New ICC Rules. Such an application can be made only prior to the transmission of the file to the Arbitral Tribunal. The latter is not bound by the emergency arbitrators order and may modify or terminate it. The Emergency Arbitrator procedure will not apply in all cases. Most notably if the parties have chosen to contract out of it or the arbitration agreement was concluded before the New ICC Rules came into force (article 29(6)). Complex Arbitrations Articles 7-10 of the New ICC Rules are a suite of provisions intended to provide a framework for the conduct of multi-party or multi-contract arbitrations. The areas which they cover are as follows: Joinder (article 7) – these rules permit a party to submit a request to the Secretariat, before any arbitrator has been confirmed or appointed, for an additional party to be joined to the arbitration (assuming that an ICC arbitration agreement exists between it and the party making the joinder request). Claims between multiple parties (article 8) – these complement the rules on joinder by making provision, in an arbitration with multiple parties, for any party to assert claims against any other. Multiple contracts (article 9) – this rule clarifies that claims arising in connection with more than one contract referring disputes to ICC Arbitration may be made in a single arbitration. Consolidation (article 10) – provision is made for a party to be able to request that two or more arbitrations conducted under the New ICC Rules are consolidated into one. These provisions can only be activated where the parties have agreed to it (10(a)), all of the claims are made under the same arbitration agreement (10(b)); or, if the claims are made under different arbitration agreements, the arbitrations involve the same parties, the disputes are in connection with the same legal relationship and the ICC Court finds the arbitration agreements to be compatible (10(c)). End February 2012 Global Counsel Leader Scan Page 8 Managing in a Time of Economic Uncertainty It’s not business as usual by E. Leigh Dance, for Legal Management magazine, March 2012 issue note to GCLC members: this article is written for administrators and operational managers in law departments and law firms, but the concepts apply broadly. It is taken partly from the panel discussion held on Nov. 17 as part of the GCLC New York meeting. For most of us, today’s business climate is less stable than it ever has been in our careers. We’ve seen remarkable bouts of drama in the markets (and in governments) in recent months. The only certain thing about the global economy this year, the pundits tell us, is that it will remain very uncertain. In the short term, things may get a bit better. And they could also get much worse. It is not all bad; destabilization creates opportunity. And in some parts of the world, the economy is growing at double or triple the rate of the U.S. and Europe. In this uncertain environment, it’s important to re-think how you approach your management responsibilities. Certain issues may require special attention. How can managers in a law firm or law department of a company or institution best protect assets and add value today? How can we all improve our resilience in what could be a fairly long period of instability? Economic uncertainty comes in many shapes and sizes. It can be very general, or it can be specific to an industry, to a country, or to a specific organization or firm. Because the general uncertainty we see today is so amorphous, it tends to breed insecurity and fear in the workplace and among customers. Different types of uncertainty require different management responses, and so managers should take a hard look at what is called for. Of utmost importance is to identify the potential financial difficulties that could affect your organization. This requires a fundamental understanding of your firm’s business and operations, its suppliers and its clients. You may want to adapt your leadership style and communications approaches to manage most effectively in this environment. Among the most important responsibilities for managing in an uncertain economy are: 1. Understand the risks and liabilities of your business partners, your suppliers, and your clients that may run into financial difficulties. 2. Manage and allocate resources wisely, keeping in mind that instability not only creates risks but also opportunities. 3. Communicate frequently and clearly to motivate employees to keep their focus on meeting business objectives and rising to the challenges. 4. Be vigilant in monitoring for wrongdoing, since pressures to perform are particularly high and may raise risks. February 2012 Global Counsel Leader Scan Page 9 5. Stay positive while you prepare for a range of possible outcomes, and have contingency plans ready. This article addresses these five areas and suggests tips for managing in times like these. 1. Understand the risks and liabilities of your business partners, your suppliers, and your clients that may run into financial difficulty. In companies, law departments often deal with financial distress. Since so many companies are interconnected in the business world today, the impact of financial difficulties may affect your organization more quickly or more profoundly than you might imagine. In-house counsel will often have had the experience of a provider, a client or a partner going through financial difficulty. In law firms, restructuring lawyers and litigators deal with financial distress most often. Your own organization may be very healthy, but financial distress among business partners can raise serious risks. Some law firms learned with the fall of Enron, Bear Stearns, or Lehman Brothers how a major client’s demise could seriously affect their overall financial performance, due to loss of fee income. The risks may also be legal or operational (for example, if a partner or supplier is unable to provide required services). It’s important to perform diligence to clarify the clients, providers, business partners and suppliers that you count on the most, and determine which have the highest potential to have financial problems that could affect your organization. You can then better assess how you might respond if a problem develops. As you look at key suppliers, partners and clients, consider: if one of them becomes insolvent, what would you do? Distressed situations have three common denominators: (a) legal complexities; (b) high legal risks; (c) time as a key factor. Distressed situations particularly test organizations’ legal functions on often unfamiliar grounds. However, the managers in a law firm or law department will be expected to play a key role. You want to be ready to respond quickly and effectively. 2. Manage and allocate resources wisely, keeping in mind that instability not only creates risks but also opportunities. In uncertain times, it’s essential to keep your eyes and ears tuned not only to the present but also to the future. In the present, some people will react by rejecting the possibility of change and behaving in ‘business as usual’ mode, while others will seek out opportunities, and have many ideas for new business ventures and new services to generate income. Every new ventures or service will need resources to support it effectively, and due diligence is required. If you proceed with a new venture, you’ll want to determine if resources are available internally or need to be acquired or outsourced. You can reallocate resources more nimbly if you are able to anticipate potential needs and issues based on how your business is developing today. If you consider your organization’s February 2012 Global Counsel Leader Scan Page 10 primary investments today, there may be critical elements to address in two years. Conversely, you may have big demands today that will require far less attention down the road. Learn to anticipate future risks, not only those that are already on your radar screen. Try to understand how the business as it exists will change under stress. Business drivers can be an important guide to understand where to cut and where to strengthen capabilities. Look at the potential risks outlined in (1) above. Map them against a matrix of other key issues that may affect operations and financial performance. In an uncertain economy it is critical to consider the interrelationships of many factors and dynamics, and manage actively. 3. Communicate frequently and clearly to motivate employees to work towards meeting business objectives and rising to the challenges. Experts in crisis management will tell you that the single most important factor in a crisis is leadership. From a management perspective, the economic instability we face is in many ways similar to approaching a crisis. Communication is paramount. People want someone to tell them what to do, to explain the situation and the decisions being made. Without that communication, fear tends to take over and distraction rises, causing a drop in productivity. Work quality may drop or go unfinished as employees lose their focus. Valuable human assets will leave. Teamwork is threatened when people spend so much time predicting possible outcomes and worrying about losing their jobs. This behavior is contagious, and one way to cure it is regular communication. In economic uncertainty, managers who are good leaders will inspire their people to be resilient and rise to the challenge. Leaders and managers must be far more communicative than they would normally be, and in an earnest, transparent way. In times of uncertainty, both false promises and saying nothing will make matters worse. Take it from Churchill: speaking directly to your people helps. Hearing a manager’s confident, decisive voice will make a big difference. You may hesitate to communicate frequently, since you can’t say what you don’t know, and you can’t make it up. Divide challenges into short-term steps and report on progress. Use humor to lighten the tension, and remember to say and repeat, “Stick with it, stay the course. We know you are working hard, we are all working hard. We are going to get through this.” 4. Be vigilant in monitoring for wrongdoing, when pressures to perform are particularly high and may raise risks. Studies show that when income or sales goals are harder to meet and people are under a lot of pressure and concerned about job security, there is a greater tendency to ‘fudge’ the numbers or ‘cook’ the books. Auditors find problems in financial reporting more frequently during downturns, or when a company is recovering from a bad year or a crisis. For every organization, an increase in wrongdoing is a very real risk in an uncertain economy. Nothing can create more distraction and stress for a company than regulatory inquiries or investigations into suspected fraudulent financial reporting. Vigilance is critical. February 2012 Global Counsel Leader Scan Page 11 The primary way to avoid these problems is to carefully monitor accounts and financial reports, and investigate abnormalities. If a result seems too good to be true, it may well not be true. Be careful of grey areas where financial results can be interpreted subjectively. 5. Stay positive while you prepare for a range of possible outcomes, and have contingency plans ready. Being positive should not be confused with putting your head in the sand. While everyone is hoping and working for the best outcomes, it is a manager’s responsibility to contemplate worst-case scenarios. What has happened to a number of law firms and businesses in the last few years was likely unimaginable to its managers only months earlier. In the face of economic instability, you must have the courage occasionally to think the unthinkable, and consider what the response could be. It is better to know what lurking problems you may have, take time for a self-evaluation, and take action if your assessment suggests it. Preparing contingency plans is integral to managing in an uncertain economy. While the problem that may actually arise will ofteny be different than the one for which your contingency plan was designed, it still helps to map out necessary responses in an emergency. When things go wrong with a supplier, a provider, a major client, or within your own organization, the issue can move astonishingly quickly. Contingency plans will help you prepare for the unexpected. As the title says, it’s not business as usual. While I’ve focused on demanding and serious aspects of managing in a time of economic uncertainty, you also must remember to sometimes just lighten up. I’ll never forget a great cartoon of a front-page headline I saw in 2008: World Ends: Worse to Come. To be a voice of calm in the storm means knowing how to get people to laugh, take time to celebrate a win, or go for a walk around the block. We’ll all get through this. For the valuable insights they provided on this topic at a recent roundtable of global corporate counsel, Dance thanks Peter Beshar, General Counsel, Marsh & McLennan Companies; Bruno Cova, Partner, Paul Hastings; Tom Sabatino, General Counsel, Walgreen; and John Suckow, Managing Director, Alvarez & Marsal and acting President & COO, Lehman Brothers Holding. February 2012 Global Counsel Leader Scan Page 12