18.Chapter Seventeen 2009

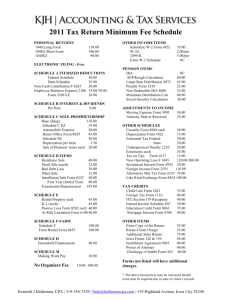

advertisement

Liberty Tax Service Online Basic Income Tax Course. Lesson 17 1 Chapter 16 Homework HOMEWORK 1: Prepare the requested forms or worksheets for each of the following situations. 1. In 2008, Amos and Luanne paid interest of $2,700 on a student loan for their dependent son. This was the first year interest was due on the loan. Their filing status is MFJ. Line 22 of their Form 1040 is $120,000. They have no other adjustments to income. Complete a Student Loan Interest Deduction Worksheet. 2 Chapter 16 Homework 3 Chapter 16 Homework 2. Phil G. (SSN 357-49-6901, born 2/5/1955) and Kate A. Darian (SSN 301-23-4621, born 5/7/1959) are married and are filing a joint return. Phil’s salary for 2008 was $49,000. Kate’s salary was $46,000. They had no other income. They are both covered by a retirement plan at work. Phil contributed $4,000 to his traditional IRA and Kate contributed $3,000 to hers. Phil made nondeductible contributions of $1,500 in 2007 and $800 in 2006. Kate has never made a prior nondeductible contribution. They had no other adjustments to income. Complete an IRA Deduction Worksheet and Form 8606. 4 Chapter 16 Homework 5 Chapter 16 Homework 6 Chapter 16 Homework 7 Chapter 16 Homework 8 Chapter 16 Homework 9 Chapter 16 Homework 10 Chapter 16 Homework 3. In 2008, Bill (521-11-2233) and Linda Jones paid $6,200 in tuition and fees for their dependent son, Ken (521-78-8899), to attend university. Bill claimed an IRA deduction of $3,000 and Linda, who is a teacher, claimed $250 in educator expenses. They have no other adjustments to income. Their Form 1040, line 22, total income is $68,000. Complete Form 8917. 11 12 Chapter 16 Homework HOMEWORK 2: Use the following information to complete a 2008 tax return. Francisco P. Martinez (born 11/17/1959) is a computer technician. He is single and lives alone at 17 Lockwood Lane, Henderson, NJ 08649. In August 2008, he left his job at Modern Tech and he reported to work at his new job at Run Time, Inc. on September 12, 2008. In December 2008, Francisco moved because he now had to drive 58 miles to work from his old home instead of the 7 miles he used to drive to Modern Tech. His new home is 22 miles from Run Time and is 80 miles from his old home. He has worked full time since starting his job and expects to continue working for Run Time until at least the end of 2009. 13 Chapter 16 Homework He had the following expenses related to his move: West’s Moving and Storage......................................... $1,200 PetSafe (for shipping his dog Fido).................................. 400 Realtor’s commission for sale of his old home .............. 4,900 Down payment on his new home................................... 7,000 Fix-up costs for his old house to help sell it .................. 1,500 Refitting his drapes for the windows in his new house..... 600 Fees for disconnecting electric and gas service.................. 85 Francisco drove his car the 80 miles from his old home to his new home. He does not use actual expenses. He had to pay tolls of $5 to reach his new home. Francisco contributed $3,000 for 2008 to his traditional IRA on April 2, 2009. Francisco has been divorced for 3 years. Under his divorce decree, Francisco pays his former wife, Lorraine T. Cassini (SSN 375-74-7610), cash payments of $110 per month. 14 The payments will cease upon her death. Chapter 16 Homework 15 Chapter 16 Homework 16 Chapter 16 Homework 17 Chapter 16 Homework 18 Chapter 16 Homework 19 Chapter 16 Homework 20 Chapter 16 Homework 21 Chapter 16 Homework 22 Chapter 16 Homework 23 Chapter 16 Homework 24 Chapter 16 Homework 25 26 Chapter 17: Other Taxes Chapter Content Alternative Minimum Tax Social Security and Medicare Tax on Tip Income Not Reported to Employer Tax on Qualified Plans, Including IRAs, and Other Tax-Favored Accounts Advance Earned Income Credit Payments from Form W-2 Household Employment Taxes Additional Other Taxes Key Ideas 27 Chapter 17: Other Taxes Objectives Determine How to Figure Alternative Minimum Tax and Complete Form 6251 Be Able to Enter Social Security and Medicare Tax on Tip Income Not Reported to Employer and How to Use Form 4137 Learn How to Determine Tax on IRAs, Other Retirement Plans, and How to Use Form 5329 Know How to Report Advance Earned Income Credit Payments from Form W-2 Understand How to Figure Household Employment Taxes and How to Use Schedule H 28 Other Taxes After calculating from taxable income and subtracting total credits from the first section of page 2 of Form 1040: Add in various other taxes to arrive at your total tax. Other taxes that need to be considered are: Self-employment tax (line 58) (Chapter 14) Alternative minimum tax (line 45) Social security and Medicare tax on tip income not reported to your employer (line 59) Tax on qualified plans, including IRAs and other tax-favored accounts (line 60) Advance earned income credit payments from FormW-2 (line 61) Household employment taxes (line 62) 29 Other Taxes Form 1040, Page 2 30 ALTERNATIVE MINIMUM TAX (AMT) A. Alternative minimum tax ensures that taxpayers with substantial economic income pay at least a minimum amount of tax on economic income. 1. May need to pay AMT if taxable income combined with certain adjustments and tax preference items is more than: a. $69,950 for MFJ or Q/W b. $46,200 for single or H/H c. $34,975 for MFS. B. AMT is figured using Form 6251. 1. Use the worksheet to see if you need to complete Form 6251. C. AMT amount is entered on line 45 of Form 1040. D. Use exemption worksheet in instructions to figure exemption amount. 31 ALTERNATIVE MINIMUM TAX (AMT) 32 ALTERNATIVE MINIMUM TAX (AMT) 33 ALTERNATIVE MINIMUM TAX (AMT) 34 ALTERNATIVE MINIMUM TAX (AMT) 35 ALTERNATIVE MINIMUM TAX (AMT) 36 SELF- EMPLOYMENT TAX You pay self-employment tax (covered in chapter 14) when your net earnings from selfemployment are $400 or more. You are selfemployed if you carry on a trade or business as a sole proprietor or as a general partner in a partnership. Schedule SE is used to figure selfemployment tax and the tax is then reported on line 57 of Form 1040. The Self-Employment Contributions Act of 1954 requires that you claim all allowable deductions related to self-employment in computing net earnings from self-employment. 37 SOCIAL SECURITY AND MEDICARE TAX ON TIP INCOME NOT REPORTED TO EMPLOYER A. If you received $20 or more in cash and charge tips in a month from any one job and did not report all of those tips to your employer, you must report the social security and Medicare taxes on unreported tips as additional tax on return. 1. Use Form 4137 to figure tax. B. Report tax on line 58 of Form 1040 and attach Form 4137 to return. 38 SOCIAL SECURITY AND MEDICARE TAX ON TIP INCOME NOT REPORTED TO EMPLOYER Sam S. Malone (SSN 155-22-1111) works as a bartender. He lives at 375 Frasier Lane, Boston, MA 02203. He started working for “Cheers” on June 15. During the month of June, he received $475 in tips that he did not report to his employer. In October, he was given two deluxe box tickets to an ice hockey game valued at $200 that he also did not report to his employer. For July through December, he reported all his cash tips to his employer. His Form W-2, box 1 income for the year was $29,100. His completed Form 4137 is shown on the following slide. 39 SOCIAL SECURITY AND MEDICARE TAX ON TIP INCOME NOT REPORTED TO EMPLOYER 40 SOCIAL SECURITY AND MEDICARE TAX ON TIP INCOME NOT REPORTED TO EMPLOYER Allocated Tips If your employer allocated tips to you, they are shown separately in box of your Form W-2. They are not included in box 1 with your wages and reported tips. Allocated tips are tips that your employer assigned to you in addition to the tips you reported to your employer for the year. You must report allocated tips on your tax return unless certain record keeping exceptions apply. If you must report allocated tips on your return, add the amount in box 8 of your Form W-2 to the amount in box 1. Report the total as wages on line 7 of Form W-2. Because social security and Medicare taxes were not withheld from the allocated tips, you must report those taxes as additional taxes on your return. Complete Form 4137 and include the allocated tips 41 on line 1 of the form. TAX ON QUALIFIED PLANS, INCLUDING IRAs, AND OTHER TAX-FAVORED ACCOUNTS A. Violation of rules limiting withdrawal and use of IRA assets generally results in additional taxes in year of violation. 1. Use Form 5329 to report tax on premature distributions, excess contributions, and excess accumulations 2. Do not use Form 5329 if any of following conditions exist: a. Distribution code 1 is shown in box 7 of 1099-R; instead enter 10% of taxable distribution on line 59 of Form1040 and write “no” next to line 59 b. You properly rolled over all distributions you received during year. 3. If do not have to file Form 1040, send IRS completed Form 5329. 42 TAX ON QUALIFIED PLANS, INCLUDING IRAs, AND OTHER TAX-FAVORED ACCOUNTS Premature Distributions Or Early Withdrawals B. Withdrawals before you are age 59 1/2 are called premature distributions or early withdrawals. 1. Tax is 10% of part of distribution that you have to include in gross income 2. Does not apply to nontaxable part of distribution 3. For exceptions to age 59 1/2 rule, refer to Publication 590. Some exceptions include: a. You are disabled b. You have un-reimbursed medical expenses more than 7.5% of AGI c. You are receiving distributions in form of annuity d. You use IRA distributions to buy, build, or rebuild first home (up to $10,000 and not owned home in previous 2 years ending on the date of acquisition of the home) e. You are the beneficiary of a deceased IRA owner f. The distributions are not more than your qualified higher education expenses 43 TAX ON QUALIFIED PLANS, INCLUDING IRAs, AND OTHER TAX-FAVORED ACCOUNTS Don Muller, who is 35 years old, makes a $3,000 withdrawal from his traditional IRA account. Don does not meet any of the exceptions to the age 59½ rule, so the $3,000 is a premature distribution. Don never made any nondeductible contributions to his IRA. He must include the $3,000 in his gross income for the year of the withdrawal and pay income tax on it. Don must also pay an additional tax of $300 ($3,000 x 10%). 44 TAX ON QUALIFIED PLANS, INCLUDING IRAs, AND OTHER TAX-FAVORED ACCOUNTS Excess Contributions C. An excess contribution is an amount contributed to traditional IRA that is more than the smaller of either your taxable compensation for year or $5,000 ($6,000 if age 50 or older). 1. Excess contribution subject to 6% excise tax. 45 TAX ON QUALIFIED PLANS, INCLUDING IRAs, AND OTHER TAX-FAVORED ACCOUNTS For 2008, Mark N. Peters (SSN 003-01-3214) is single and under 50 years old, his compensation is $31,000 and he contributed $5,500 to his IRA. Mark has made an excess contribution to his IRA of $500 ($5,500 minus the $5,000 limit). He does not withdraw the $500 by the due date of his return, including extensions. Mark figures his excess contribution tax for 2008 by multiplying the excess contribution ($500) shown on line 16 of Form 5329 by 0.06 (6%), giving him an additional tax liability of $30. He enters the tax on line 17 of Form 5329 and on line 59 of Form 1040. Mark’s completed Form 5329 is shown on the following slide. 46 TAX ON QUALIFIED PLANS, INCLUDING IRAs, AND OTHER TAX-FAVORED ACCOUNTS 47 TAX ON QUALIFIED PLANS, INCLUDING IRAs, AND OTHER TAX-FAVORED ACCOUNTS 48 TAX ON QUALIFIED PLANS, INCLUDING IRAs, AND OTHER TAX-FAVORED ACCOUNTS Excess Accumulations D. Excess accumulations are insufficient distributions. 1. Must begin receiving distributions by April 1 of year following year you reach age 70 1/2 2. If distributions are less than required minimum distribution for year, may have to pay 50% excise tax for that year on amount not distributed as required 3. Can request that tax be waived by filing Form 5329 with an explanation. 49 ADVANCE EARNED INCOME CREDIT PAYMENTS FROM FORM W-2 A. If you work for someone and expect to qualify for EIC, you can choose to get part of credit in advance. 1. Give employer Form W-5 2. Must have at least one qualifying child 3. Must file return. B. Enter amount of advance EIC payment on line 60 of Form 1040. 50 ADVANCE EARNED INCOME CREDIT PAYMENTS FROM FORM W-2 Roger T. (SSN 051-33-8164) and Anita L. Radcliff have one child. Roger works as a musician and earns $20,000 per year. Anita stays home to care for the child. Since the EIC income limit for 2008 is $36,995, they are eligible for the EIC. Roger’s completed Form W-5 is on the next slide. His employer will give him up to $1,750 in advance credit based on tables provided by the IRS to all employers. The actual amount he receives for the year is reported in box 9 of his Form W-2. 51 ADVANCE EARNED INCOME CREDIT PAYMENTS FROM FORM W-2 52 HOUSEHOLD EMPLOYMENT TAXES A. A household employee is any person who does household work where you control what will be done and how it will be done. B. You must complete Schedule H if any of following apply: 1. You paid any one household employee cash wages of $1,600 or more in calendar year 2. You withheld federal income tax at request of any household employee 3. You paid total cash wages of $1,000 or more in any one calendar quarter to all household employees. C. Enter household employment taxes on line 60 of Form 1040. Attach Schedule H. D. Do not include amounts paid to employee who was under age 18 at any time during year and was also a student. 53 HOUSEHOLD EMPLOYMENT TAXES Harriet N. Nelson hires Merry Maids to clean her house for $75 per week. Since Merry Maids provide their own tools and control how the work is done, they are independent contractors and Schedule H is not needed. Marge H. Simpson employs Nanny Nancy to care for her children while she does volunteer work. She pays Nancy $300 per month. Since Marge leaves specific instructions on what to do and pays Nancy $3,600 per year, she must file Schedule H. See the example on the following slide. 54 HOUSEHOLD EMPLOYMENT TAXES 55 HOUSEHOLD EMPLOYMENT TAXES 56 OTHER ADDITIONAL TAXES A. Enter on line 61 of Form 1040 the added total of all taxes B. Also include on line 61 the following less common additional taxes: 1. Additional tax on HSA distribution (Form 8889) 2. Additional tax on Archer MSA distributions (Form 8853) 3. Additional tax on Medicare Advantage MSA distributions (Form 8853) 4. Recapture of investment credit (Form 4255) 5. Recapture of low-income housing credit (Form 8611) 6. Recapture of qualified electric vehicle credit (Form 8834) 7. Recapture of Indian employment credit (Form 8845) 57 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19. 20. OTHER ADDITIONAL TAXES Recapture of new markets credit (Form 8874) Recapture of credit for employer-provided child care facilities (Form 8882) Recapture of the alternative motor vehicle credit (Form 8910) Recapture of alternative fuel vehicle refueling property credit (Form 8911) Recapture of federal mortgage subsidy (Form 8828) Section 72(m)(5) excess benefits tax Uncollected social security and Medicare or RRTA tax on tips or group term life insurance (Form W-2, box 12, code A, B, M, or N) Golden parachute payments (Form W-2, box 12, code K) Tax on accumulation distribution of trusts (Form 4970). Excise tax on insider stock compensation plan from an expatriated corporation Additional tax on nonqualified deferred compensation plan (Form W-2, box 12, code Z Interest on the tax due on installment income from the sale of certain residential lots and timeshares. Interest on the deferred tax on gain from certain installment sales with a sales price over $150,000 58 OTHER TAXES KEY IDEAS ♦ The alternative minimum tax ensures that some taxpayers with substantial economic income will pay at least a minimum amount of tax. The alternative minimum tax is figured on Form 6251 and the result is entered on line 45 of Form 1040. ♦ If you receive $20 or more in cash and charge tips in a month from any one job and did not report all of those tips to your employer, you must report the social security and Medicare taxes on the unreported tips as additional tax on your return. You use Form 4137 to figure these taxes and enter the tax on line 58 of Form 1040. You must also include the tips in the income on line 7 of Form 1040. ♦ Allocated tips are shown separately in box 8 of form 59 W-2. They are not included in box 1 with your wages and reported tips. OTHER TAXES KEY IDEAS ♦ If you are required to report allocated tips, add the amount in box 8 of Form W-2 to the amount in box 1 and report the total as wages on Form 1040, line 7. Then complete Form 4137 including the allocated tips on line 1. ♦ You may have to pay additional taxes on a traditional IRA if you have early withdrawals, excess contributions, and excess accumulations. You use Form 5329 to report these taxes and if you have to file Form 1040 report these taxes on line 59. ♦ If you work for someone and expect to qualify for EIC, you can choose to get part of the credit in advance. Enter advance EIC payments received on line 60 of Form 1040. ♦ Use Schedule H to report household employment taxes. 60 OTHER TAXES CLASSWORK 1: True or False. (1) An excess contribution is the amount contributed to your traditional IRA that is more than the smaller of either your taxable compensation for the year or $5,000 ($6,000 if age 50 or older). (2) You give your employer a Form W-5 if you want part of your earned income credit taken out of your pay. (3) You enter the amount of alternative minimum tax on line 45 of Form 1040. (4) You figure social security and Medicare tax on unreported tip income not reported to an employer on Form 4137. 61 OTHER TAXES CLASSWORK 1: True or False. (5) You report additional income from unreported tips on Schedule H. (6) You may have to report an early withdrawal from a traditional IRA on Form 5329. (7) If any part of your IRA contributions is an excess contribution for 2008, it is subject to a 10% tax. (8) The alternative minimum tax is designed to prevent you from not paying your “fair share” of taxes due to excessive use of certain tax breaks. 62 OTHER TAXES CLASSWORK 1: True or False. (9) If you receive advance EIC payments, you may not have to file a federal income tax return. (10) A household employee is any person who does household work where you control what is done and how it will be done. 63 OTHER TAXES CLASSWORK 1: True or False. (1) An excess contribution is the amount contributed to your traditional IRA that is more than the smaller of either your taxable compensation for the year or $5,000 ($6,000 if age 50 or older). T (2) You give your employer a Form W-5 if you want part of your earned income credit taken out of your pay. F (3) You enter the amount of alternative minimum tax on line 45 of Form 1040. T (4) You figure social security and Medicare tax on unreported tip income not reported to an employer on Form 4137. T 64 OTHER TAXES CLASSWORK 1: True or False. (5) You report additional income from unreported tips on Schedule H. F (6) You may have to report an early withdrawal from a traditional IRA on Form 5329. T (7) If any part of your IRA contributions is an excess contribution for 2008, it is subject to a 10% tax. F (8) The alternative minimum tax is designed to prevent you from not paying your “fair share” of taxes due to excessive use of certain tax breaks. T 65 OTHER TAXES CLASSWORK 1: True or False. (9) If you receive advance EIC payments, you may not have to file a federal income tax return. F (10) A household employee is any person who does household work where you control what is done and how it will be done. T 66 OTHER TAXES CLASSWORK 2: What form (other than Form 1040) is used to figure and/or report the following? 1. 2. 3. 4. 5. 6. 7. 8. 9. self-employment tax business profit or loss moving expenses non-cash charitable contributions over $500 earned income credit household employee taxes mortgage interest paid on personal residence excess accumulations in traditional IRAs education credits 67 OTHER TAXES CLASSWORK 2: What form (other than Form 1040) is used to figure and/or report the following? 10. 11. 12. 13. 14. 15. 16. 17. 18. alternative minimum tax business use of home (self-employed) ordinary dividend income of more than $1,500 depreciation and amortization social security and Medicare taxes on unreported tip income dental expenses child and dependent care expenses early distribution from traditional IRA additional child tax credit 68 OTHER TAXES CLASSWORK 2: What form (other than Form 1040) is used to figure and/or report the following? Answers in ( ) optional 1. 2. 3. 4. 5. 6. 7. 8. 9. self-employment tax SCHEDULE SE business profit or loss SCHEDULE C moving expenses FORM 3903 non-cash charitable contributions over $500 FORM 8283 (and SCHEDULE A) earned income credit SCHEDULE EIC household employee taxes SCHEDULE H mortgage interest paid on personal residence SCHEDULE A excess accumulations in traditional IRAs FORM 5329 education credits FORM 8863 69 OTHER TAXES CLASSWORK 2: What form (other than Form 1040) is used to figure and/or report the following? 10. alternative minimum tax FORM 6251 11. business use of home (self-employed) FORM 8829 (and SCHEDULE C) 12. ordinary dividend income of more than $1,500 SCHEDULE B 13. depreciation and amortization FORM 4562 (and SCHEDULE C or E) 14. social security and Medicare taxes on unreported tip income FORM 4137 15. dental expenses SCHEDULE A 16. child and dependent care expenses FORM 2441 17. early distribution from traditional IRA FORM 5329 18. additional child tax credit FORM 8812 70 OTHER TAXES CLASSWORK 3: Complete the requested forms for the following. 1. Lydia Bennett (SSN 155-22-1112), born 2/16/1959, took an early distribution in 2008 of $5,000 from her IRA. She used the distribution to pay part of her unreimbursed medical bills of $6,000. Complete Part I of Form 5329 for Lydia. Her AGI is $40,000. 71 OTHER TAXES 72 OTHER TAXES 2. Gomez P. Adams (SSN 155-12-1111) pays Debbie to be a nanny for his two children. She worked from August to December for $325 per month. He paid no state unemployment taxes. Gomez’s EIN is 221234567. Complete Schedule H for Gomez. 73 OTHER TAXES 74 OTHER TAXES 75 Questions & Answers 76