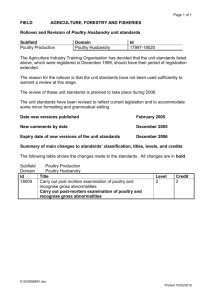

Lean or agile: A solution for supply chain management

advertisement