Completing the Accounting Cycle

Chapter 4

PowerPoint Editor:

Beth Kane, MBA, CPA

Wild, Shaw, and Chiappetta

Fundamental Accounting Principles

22nd Edition

Copyright © 2015 McGraw-Hill Education. All

rights reserved. No reproduction or

distribution without the prior written consent of

McGraw-Hill Education.

1

04-P1: Benefits of a Work

Sheet

2

The Worksheet

• An internal document that serves as a useful

tool for organizing accounting information.

• Not a required report

3

Benefits of a Work Sheet

Aids the

preparation of

financial

statements.

Reduces

possibility of

errors.

Links accounts

and their

adjustments.

P1

Assists in

planning and

organizing an

audit.

Not a

required

report.

Helps in

preparing

interim financial

statements.

Shows the

effects of

proposed

transactions.

4

Steps to prepare a worksheet

1. Enter unadjusted trial balance

• From current balances on the ledger

2. Enter the adjustments

3. Prepare the Adjusted Trial balance

4. Sort the adjusted trial balance amounts to the

appropriate financial statement columns

5. Total statement columns, compute net income/loss

5

NEED-TO-KNOW

The following 10-column work sheet contains the year-end unadjusted trial balance for Magic Company

as of December 31, 20X2. Complete the work sheet by entering the necessary adjustments, computing the adjusted

account balances, extending the adjusted balances into the appropriate financial statement columns, and entering

the amount of net income for the period. Note: The Magic, Capital account balance was $75,000 at December 31, 20X1.

No.

101

106

183

201

251

301

302

401

622

650

Unadjusted

Trial Balance

Dr.

Cr.

Cash

13,000

Accounts receivable

8,000

Land

85,000

Accounts payable

10,000

Long-term notes payable

33,000

Magic, Capital

75,000

Magic, Withdrawals

20,000

Fees earned

70,000

Salaries expense

54,000

Office supplies expense

8,000

Totals

188,000 188,000

Adjustments

Dr.

Cr.

Adjusted

Trial Balance

Dr.

Cr.

Income

Statement

Dr.

Cr.

Balance Sheet

and Statement of

Owner's Equity

Dr.

Cr.

1. Prepare and complete the work sheet, starting with the unadjusted trial balance and including adjustments

based on the following.

a. The company has earned $9,000 in fees that were not yet recorded at year-end.

b. The company incurred $2,000 in salary expense that was not yet recorded at year-end.

(Hint: For simplicity, assume it records any salary not yet paid as part of accounts payable.)

c. The long-term note payable was issued on December 31 this year. Thus, no interest has yet accrued

on this loan.

P1

6

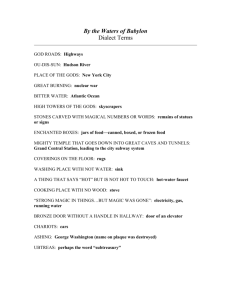

No.

101

106

183

201

251

301

302

401

622

650

Unadjusted

Adjusted

Trial Balance

Trial Balance

Adjustments

Dr.

Cr.

Dr.

Cr.

Dr.

Cr.

Cash

13,000

13,000

Accounts receivable

8,000

(a) 9,000

17,000

Land

85,000

85,000

Accounts payable

10,000

(b) 2,000

12,000

Long-term notes payable

33,000

33,000

Magic, Capital

75,000

75,000

Magic, Withdrawals

20,000

20,000

Fees earned

70,000

(a) 9,000

79,000

Salaries expense

54,000

(b) 2,000

56,000

Office supplies expense

8,000

8,000

Totals

188,000 188,000

11,000

11,000 199,000 199,000

Net income

Totals

Income

Statement

Dr.

Cr.

Balance Sheet

and Statement of

Owner's Equity

Dr.

Cr.

13,000

17,000

85,000

12,000

33,000

75,000

20,000

79,000

56,000

8,000

64,000

15,000

79,000

79,000 135,000 120,000

15,000

79,000 135,000 135,000

a. The company has earned $9,000 in fees that were not yet recorded at year-end.

b. The company incurred $2,000 in salary expense that was not yet recorded at year-end.

(Hint: For simplicity, assume it records any salary not yet paid as part of accounts payable.)

c. The long-term note payable was issued on December 31 this year. Thus, no interest has yet accrued

on this loan.

P1

7

No.

101

106

183

201

251

301

302

401

622

650

Unadjusted

Adjusted

Trial Balance

Trial Balance

Adjustments

Dr.

Cr.

Dr.

Cr.

Dr.

Cr.

Cash

13,000

13,000

Accounts receivable

8,000

(a) 9,000

17,000

Land

85,000

85,000

Accounts payable

10,000

(b) 2,000

12,000

Long-term notes payable

33,000

33,000

Magic, Capital

75,000

75,000

Magic, Withdrawals

20,000

20,000

Fees earned

70,000

(a) 9,000

79,000

Salaries expense

54,000

(b) 2,000

56,000

Office supplies expense

8,000

8,000

Totals

188,000 188,000

11,000

11,000 199,000 199,000

Net income

Totals

Income

Statement

Dr.

Cr.

Balance Sheet

and Statement of

Owner's Equity

Dr.

Cr.

13,000

17,000

85,000

12,000

33,000

75,000

20,000

79,000

56,000

8,000

64,000

15,000

79,000

79,000 135,000 120,000

15,000

79,000 135,000 135,000

2. Use information from the completed work sheet in part 1 to prepare adjusting entries.

Date

General Journal

Dec. 31 Accounts Receivable

Debit

9,000

Fees earned

Dec. 31 Salaries expense

Accounts payable

Credit

9,000

2,000

2,000

Dec. 31 No journal entry required

P1

8

3. Prepare the income statement and the statement of owner’s equity for the year ended December 31 and

the unclassified balance sheet at December 31.

Debit

$13,000

17,000

85,000

Cash

Accounts receivable

Land

Accounts payable

Long-term notes payable

Magic, Capital

Magic, Withdrawals

20,000

Fees earned

Salaries expense

56,000

Office supplies expense

8,000

Totals

$199,000

Credit

$12,000

33,000

75,000

79,000

$199,000

Magic Company

Income Statement

For Year Ended December 31, 20X2

Fees earned

$79,000

Expenses

Salaries expense

$56,000

Office supplies expense 8,000

64,000

Net income

$15,000

Magic Company

Statement of Owner’s Equity

For Year Ended December 31, 20X2

Magic, Capital, Dec. 31 20X1

$75,000

Plus: Net income

15,000

Less: Magic, Withdrawals

(20,000)

Magic, Capital, Dec. 31 20X2

$70,000

Magic Company

Balance Sheet

December 31, 20X2

Assets

Cash

Accounts receivable

Land

P1

Total assets

$13,000

17,000

85,000

$115,000

Liabilities

Accounts payable

Long-term notes payable

Total liabilities

Equity

Magic, Capital

$12,000

33,000

45,000

Total liabilities and equity

115,000

70,000

9

04-C1: Closing Process

• An important step at the end of the accounting

period AFTER financial statements have been

completed.

• It prepares accounts for recording transactions

and events for the next period.

10

4 - 11

Recording Closing Entries

1. Resets revenue,

expense, and

withdrawal account

balances to zero at

the end of the period.

2. Helps summarize a

period’s revenues and

expenses in the

Income Summary

account.

C1

Identify accounts

for closing.

Record and post

closing entries.

Prepare post-closing

trial balance.

11

4 - 12

Temporary Accounts

Temporary

Accounts

Income

Summary

C1

Withdrawals

Expenses

Revenues

They are temporary because

the accounts are opened at

the beginning of a period,

used to record transactions

and events for that period,

and then closed at the end of

the period.

The closing process

applies only to

temporary accounts.

12

4 - 13

Permanent Accounts

C1

Liabilities

Permanent

Accounts

Owner’s

Capital

Permanent (or real)

accounts report on

activities related to one or

more future accounting

periods.

They carry their ending

balances into the next

period and generally

consist of all balance sheet

accounts.

Assets

The closing process

applies only to

temporary accounts.

13

4 - 14

Temporary and

Permanent Accounts

Income

Summary

C1

Liabilities

Permanent

Accounts

Owner’s

Capital

Temporary

Accounts

Assets

Withdrawals

Expenses

Revenues

The closing process

applies only to

temporary accounts.

14

04-P2: Recording Closing

Entries

15

4 - 16

Recording Closing Entries

1. Close Credit Balances in

Revenue Accounts to Income

Summary.

2. Close Debit Balances in

Expense accounts to Income

Summary.

3. Close Income Summary

account to Owner’s Capital.

4. Close Withdrawals to Owner’s

Capital.

P2

16

4 - 17

Income Summary Account

• A temporary account only used for the closing

process

• Contains a credit for the sum of all revenues

(and gains)

• Contains a debit for the sum of all expenses

(and losses)

• Balance equals net income/loss

• Transfer balance to capital account

17

NEED-TO-KNOW

Use the adjusted trial balance of Magic Company to prepare its closing entries.

Magic Company

Trial Balance

December 31, 20X2

Debit

Cash

$13,000

Accounts receivable

17,000

Land

85,000

Accounts payable

Long-term notes payable

Magic, Capital

Magic, Withdrawals

Fees earned

Salaries expense

Office supplies expense

Totals

P2

Credit

$12,000

33,000

75,000

20,000

79,000

56,000

8,000

$199,000

$199,000

18

Debit

$13,000

17,000

85,000

Cash

Accounts receivable

Land

Accounts payable

Long-term notes payable

Magic, Capital

Magic, Withdrawals

20,000

Fees Earned

Salaries expense

56,000

Office supplies expense

8,000

Totals

$199,000

Date

Dec. 31

Dec. 31

Dec. 31

Dec. 31

P2

Credit

Expenses

Closing

$12,000

33,000

75,000

79,000

Income summary

64,000

Revenues

Net income

15,000

79,000

15,000

0

Magic, Capital

12/31/20X1

Magic, Withdrawals 20,000 Net income

12/31/20X2

75,000

15,000

70,000

$199,000

General Journal

Fees Earned

Income summary

Debit

79,000

Credit

79,000

Income summary

Salaries expense

Office supplies expense

64,000

Income summary

Magic, Capital

15,000

Magic, Capital

Magic, Withdrawals

20,000

56,000

8,000

15,000

20,000

19

Cash

Accounts receivable

Land

Accounts payable

Long-term notes payable

Magic, Capital

Totals

Debit

$13,000

17,000

85,000

Credit

Expenses

Closing

$12,000

33,000

70,000

$199,000

$115,000

$199,000

$115,000

Income summary

64,000

Revenues

Net income

15,000

79,000

15,000

0

Magic, Capital

12/31/20X1

Magic, Withdrawals 20,000 Net income

12/31/20X2

75,000

15,000

70,000

Magic Company

Balance Sheet

December 31, 20X2

Assets

Cash

Accounts receivable

Land

$13,000

17,000

85,000

Liabilities

Accounts payable

Long-term notes payable

Total liabilities

Equity

Magic, Capital

Total assets

P2

$115,000

Total liabilities and equity

$12,000

33,000

45,000

70,000

115,000

20

04-P3: Post-Closing Trial

Balance

21

Post-Closing Trial Balance

List of permanent

accounts and their

balances after posting

closing entries.

Total debits and credits

must be equal.

P3

22

Post-Closing Trial Balance

P3

23

04-C2: Accounting Cycle

24

4 - 25

Accounting Cycle

C2

25

04-C3: Classified Balance

Sheet

26

4 - 27

Classified Balance Sheet

Current items are those expected to come due (both

collected and owed) within the longer of one year or

the company’s normal operating cycle.

C3

27

4 - 28

Current Assets

Current assets are expected to be sold,

collected, or used within one year or the

company’s operating cycle.

C3

28

4 - 29

Long-Term Investments

Long-term investments are expected to be held for

more than one year or the operating cycle.

C3

29

4 - 30

Plant Assets

Plant assets are tangible long-lived assets used to

produce or sell products and services.

C3

30

4 - 31

Intangible Assets

Intangible assets are long-term resources used to

produce or sell products and services and that

lack physical form.

C3

31

4 - 32

Current Liabilities

Current liabilities are obligations due within the longer of

one year or the company’s operating cycle.

C3

32

4 - 33

Long-Term Liabilities

Long-term liabilities are obligations not due within

the longer of one year or the company’s operating

cycle.

C3

33

4 - 34

Equity

Equity is the owner’s claim on the assets.

C3

34

NEED-TO-KNOW

Use the adjusted trial balance of Magic Company to prepare its classified

balance sheet as of December 31, 20X2.

Magic Company

Adjusted Trial Balance

December 31, 20X2

Debit

Cash

$13,000

Accounts receivable

17,000

Land

85,000

Accounts payable

Long-term notes payable

Magic, Capital

Magic, Withdrawals

20,000

Fees earned

Salaries expense

56,000

Office supplies expense

8,000

Totals

$199,000

C3

Credit

$12,000

33,000

75,000

79,000

$199,000

35

NEED-TO-KNOW

Use the adjusted trial balance of Magic Company to prepare its classified balance sheet as of

December 31, 20X2.

Magic Company

Adjusted Trial Balance

December 31, 20X2

Debit

Cash

$13,000

Accounts receivable

17,000

Land

85,000

Accounts payable

Long-term notes payable

Magic, Capital

Magic, Withdrawals

20,000

Fees earned

Salaries expense

56,000

Office supplies expense

8,000

Totals

$199,000

C3

Credit

$12,000

33,000

75,000

79,000

$199,000

Magic Company

Balance Sheet

December 31, 20X2

Assets

Current assets

Cash

Accounts receivable

Total current assets

Plant assets

Land

Total plant assets

Total assets

Liabilities

Current liabilities

Accounts payable

Total current liabilities

Long-term liabilities

Long-term notes payable

Total liabilities

Equity

Magic, Capital

85,000

85,000

$115,000

Total liabilities and equity

$115,000

$13,000

17,000

30,000

$12,000

12,000

33,000

$45,000

70,000

36

4 - 37

Global View

The definition of an asset is similar under U.S. GAAP and IFRS and

involves three basic criteria:

(1) the company owns or controls the right to use the item,

(2) the right arises from a past transaction or event, and

(3) the item can be reliably measured.

Both systems define the initial asset value as historical cost for

nearly all assets.

The definition of a liability is similar under U.S. GAAP and IFRS and

involves three basic criteria:

(1) the item is a present obligation requiring a probable future resource

outlay,

(2) the obligation arises from a past transaction or event, and

(3) the obligation can be reliably measured.

37

04-A1: Current Ratio

38

4 - 39

Current Ratio

Helps assess the company’s ability to pay its

debts in the near future

Current ratio =

Current assets

Current liabilities

Limited Brands, Inc.

A1

39

04-P4: Reversing Entries

40

4 - 41

Appendix 4A – Reversing Entries

Reversing entries are optional. They are recorded in

response to accrued assets and accrued liabilities that

were created by adjusting entries at the end of a

reporting period. The purpose of reversing entries is to

simplify a company’s recordkeeping.

Let’s see how the accounting for our payroll

accrual will be handled with and without

reversing entries.

P4

41

4 - 42

P4

42

4 - 43

Without Reversing Entries

P4

With Reversing Entries

43

4 - 44

End of Chapter 4

44