International Monetary System

advertisement

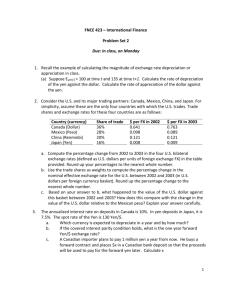

International Monetary System Each country has developed its own money system with its own currency Ours is the dollar World Currency Israel a. b. c. d. Ruges Pesos Shekels Pounds Egypt a. b. c. d. Punt Pounds Dollars Drachmas South Korea a. b. c. d. Yen Won Renminbi Rupee Poland a. b. c. d. Zloty Riyal Dinar Schilling France a. b. c. d. Pounds Euro Franc Lira Canada a. b. c. d. Peso Dollar Riyal Krone History By 1880’s, most countries had backed their currencies with gold, which was recognized throughout the world as having value During the time of 1914 (WWI) to WWII (1944), countries printed money to help finance war efforts Having depleted gold reserves, 44 countries met at Bretton Woods, New Hampshire in 1944 Bretton Woods Agreement Countries agreed to peg their currencies to the U.S. dollar, which would still be backed by gold at $35 per ounce Created the International Monetary Fund (IMF) to maintain order in the monetary system and the World Bank to promote economic development By the late 1960’s there were problems and in the early 1970’s the U.S. refused to continue to keep its exchange rate fixed It had depleted its gold reserves and President Nixon said that we would not continue 1976 Jamaica Agreement that lead to a floating exchange rate system where currencies are traded for each other Gold is no longer backing currencies Free floating currency Dirty float Currency value determined by market forces Gov’t influences value of currency by buying or selling but hasn’t declared it fixed Pegged or fixed currency Currency value tied to another currency Gov’t buys or sells currency to maintain rate Korean won tied to U.S. dollar Chinese yuan tied to basket of currencies How exchanging works Foreign exchange market Over $1 trillion exchanged each day Traders and government central banks buy and sell just like stock Exchange rates http://www.x-rates.com/d/USD/table.html Fluctuations in Currency Value U.S. dollar compared to the Japanese yen 1/1/2008 1/1/2009 $1 = 75 yen $1 = 85 yen U.S. dollar is increasing in value against the yen because it can buy more The yen is decreasing against the dollar because it’s worth less. 12/1/2008 12/1/2009 $1 = 75 yen $1 = 85 If you wanted to see a movie that cost 1,250 yen, what would it cost you in 2009 compared to 2008? What would happen to the cost of importing goods from Japan to the U.S.? What would happen to the cost of exporting from the U.S. to Japan? U.S. dollar compared to the Japanese yen 1/1/2009 1/1/2010 $1 = 85 yen $1 = 80 yen U.S. dollar is decreasing in value against the yen because it buys less The yen is increasing against the dollar because it’s worth more. 12/1/2009 12/1/2010 $1 = 85 yen $1 = 80 yen If you wanted to see a movie that cost 1,250 yen, what would it cost you in 20010 compared to 2009? What would happen to the cost of importing goods from Japan to the U.S.? What would happen to the cost of exporting from the U.S. to Japan? Currency 12/2/1997 Units/US$ South Korean Won Japanese Yen Great Britain Pound 12/1/2010 Units/US$ Percent Change in Value of Currency 931 1150.6 23.59% 112.3 84.03 (25.17%) 0.49 0.64 30.61% Source: Pacific FX Database, 12/2/2010 http://fx.sauder.ubc.ca/data.html Trade with Japan Impact (Figures in millions) Exports = $ 51,134.20 Imports = $95,803.70 Total Value of Goods Traded= $ 146,937.90 25% change in value of currency = $36,734.48 million ($36,734,480,000) worth of impact on goods Impact of currency value changes can be visually seen http://fx.sauder.ubc.ca/ What causes exchange rates to change? Supply and Demand for a currency Inflation rates Interest rates Strength of economy Political system Political events Companies use Foreign Exchange Payments for exports or foreign investments Purchase supplies Invest in another country Speculate on exchange rates JAL airlines Purchase airlines from Boeing Prices range from $35 – 160 million Order aircraft 2-6 years in advance 10% down and rest when aircraft delivered 1985, Boeing placed order for $100 million 747 aircraft $1= ¥240 in 1985 90,000,000 US$ = ¥ 21,600,000,000 What if exchange rate changed? Total cost of ¥2.4 billion If rate changes to $1= ¥300, price raises to ¥3.0 billion - a 25% increase! If rate changes to $1 = ¥200, price decreases to ¥2.0 billion. Exchange Rate Risk The chance of loss due to changing exchange rates Ideas on managing the risk Assume risk and deal in foreign currency Only deal in your currency Transfer risk to someone else through hedging Countertrade Hedging Buy a currency in the future at a price set today so the risk is minimized Example: Buy euros 120 days into the future – forward contract JAL Purchased right to buy dollars for next ten years for a set rate of $1 = ¥185 forward exchange contract Allows company to know what they will pay and plan ahead Looked like a great deal when $1 = ¥240 1994 contracts executed Yen had risen against dollar $1 = ¥99 JAL admitted that they were paying 86% more than necessary Mistake of $450 million or ¥45 million http://fx.sauder.ubc.ca/plot.html Countertrade Form of payment in which a seller accepts something other than money in compensation Types Barter – products exchanged 1990, State Trading Corp. of India exchanged wheat to Turkmenistan for cotton Pepsi sold soft drinks in China in exchange for mushrooms for Pizza Hut pizzas Counterpurchase Buyer and seller purchase goods from each other Business A sells to Business Z for cash. At the same time, Business A agrees to buy stuff from Business Z for an equal amount. Most common form of countertrade McDonnell Douglas has bought hams, irons, and rubber bumper guards Offset Part of exported good is produced in the importing country General Dynamics sold military jets to Belgium, Norway and Denmark and allowed them to offset the cost by producing 40% of the value of the aircraft in their countries Different risk is that of not getting paid Letter of credit is used to remove this risk Letter issued by a bank at the request of an importer Promise by the bank to pay a specified sum of money to a beneficiary (exporter) on presentation of certain documents Types of Letters of Credit Irrevocable – terms can only be modified if both exporter and importer agree Revocable – Issuing bank can modify terms without approval from the exporter or importer --Buy/sell goods-Exporter Exporter ships Importer Exporter Importer Bank checks delivers applies for LC documents and documents from its bank pays exporter I. Bank delivers Importer to E. bank pays for documents Bank E. Bank delivers to importer goods notifies documents to I. exporter that Bank Importer’s it has LC Exporter’s I. bank issues Bank Bank LC to E. Bank sends bankpayment to exporter’s bank Purchasing Power Parity Theory that a dollar should buy the same amount in all countries Economist measures with “Big Mac Index” NationMaster has index