The Production Possibilities Frontier

advertisement

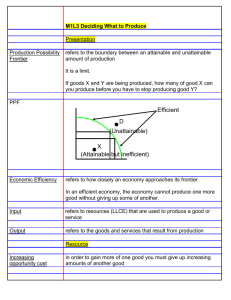

The Production Possibilities Frontier Adapted from Time and Money: The Macroeconomics of Capital Structure by Roger W. Garrison London: Routledge, 2001 The Consumption-Investment Tradeoff And the Essence of Economic Growth 2009 45o INCOME EXPENDITURES EXPENDITURES C+I C = a + bY 45o Yeq INCOME Equilibrium in the simple Keynesian framework means only that income equals expenditure. The economy may be in recession or experiencing inflation. EXPENDITURES C = a + bY YeqY =Y eqfe INCOME Equilibrium in the simple Keynesian framework means only that income equals expenditure. The economy may be in recession or experiencing inflation. CONSUMPTION C+I INVESTMENT We assume, though, that this economy is enjoying full employment without inflation—if only by good luck. The Production Possibilities Frontier (PPF) depicts these alternatives during a given time period, typically one year. CONSUMPTION In any economy, some resources are devoted to producing consumables, the remaining resources being available for maintaining and expanding the economy’s productive capacity. INVESTMENT The Production Possibilities Frontier The tradeoff between CONSUMPTION (in the present) and INVESTMENT (for the future) should be an integral part of our macroeconomic thinking. Under favorable conditions, a fully employed market economy allocates resources to both uses, making the most of the trade-off. A “fully employed market economy” allows for a so-called “natural rate of unemployment,” which is about five or six percent. That is, frictional and structural unemployment are characteristic of even a healthy economy. CONSUMPTION If resources were characterized by perfect homogeneity, such that each unit of input is equally suitable for producing either kind of output (consumption goods or investment goods), then the PPF would be linear. But raw materials and capital equipment are heterogeneous. Riverboats and river barges are not readily substitutable one for the other. A PPF with heterogeneous homogeneous inputs INVESTMENT The heterogeneity of equipment and materials implies a convex PPF. As the tradeoff is made away from consumption and toward more investment, the scope for still more investment diminishes. Microeconomists would describe this feature of the PPF in terms of a diminishing marginal rate of substitution. Typically, the investment needed just to replace worn out or obsolete capital is substantial but something less than gross investment. The extent to which gross investment exceeds the “replacement” magnitude constitutes net investment and allows for the expansion of the economy. CONSUMPTION “Investment” in this construction represents gross investment, which includes replacement capital. INVESTMENT Replacement Capital Net Investment Gross Investment Positive net investment means that the economy is growing. The PPF shifts outward from year to year, permitting increasing levels of both consumption and investment. This outward shifting of the PPF represents sustainable economic growth. Four periods of growth are shown—with consumption, as well as investment, increasing in each period. The actual rate of expansion of the PPF depends upon many factors. For instance, with economic expansion, more resources are needed for capital replacement. And the desired trade-off between consuming and investing can itself change as the economy generates more wealth. CONSUMPTION Watch the economy grow. YEAR 4 0 1 2 3 INVESTMENT Replacement Capital Net Investment Gross Investment Four periods of growth are shown—with consumption, as well as investment, increasing in each period. The actual rate of expansion of the PPF depends upon many factors. For instance, with economic expansion, more resources are needed for capital replacement. And the desired trade-off between consuming and investing can itself change as the economy generates more wealth. CONSUMPTION Watch the economy grow. INVESTMENT Watch the movement along the PPF. Importantly, we note that forgoing some consumption with an eye toward consuming more in the future triggers a movement along the initial PPF and hence affects the rate at which the PPF expands outward. Increased thriftiness makes the difference. CONSUMPTION Now watch the economy grow. YEAR 4 0 1 2 3 Let’s compare the high-growth economy with the original low-growth economy. INVESTMENT CONSUMPTION CONSUMPTION INVESTMENT INVESTMENT Note the difference that an initial trading off of consumption for investment makes in the subsequent pattern of consumption and investment. Without an initial increase in investment, consumption and investment increase modestly from period to period. With an initial increase in investment at the expense of consumption, both consumption and investment increase dramatically from period to period. By the fourth period, that initial increase in investment pays off as a higher level of consumption than would otherwise have been possible. We can add to our understanding if we represent time explicitly on a horizontal axis and then keep track of consumption on the vertical axis. CONSUMPTION The time dimension is represented by the sequence of shifts of the PPF. CONSUMPTION INVESTMENT TIME Explicitly In both representations, tracking the level of consumption consumptionover is seen timetoallows fall us asto the see economy that theistradeoff adapting is essentially to a higheran growth intertemporal rate, after tradeoff. which consumption rises more rapidly than before… Consumption in the present and eventually surpasses the and near future is traded for old projected growth path. greater consumption in the more distant future. Suppose that gross investment in the economy is just enough to replace worn out and obsolete capital—which means that net investment is zero. The levels of consumption and (gross) investment would be maintained, but the economy would not grow. Watch the economy not grow. CONSUMPTION There is nothing pre-ordained about the economy actually having a positive rate of growth. YEAR 4 0 1 2 3 INVESTMENT Replacement Capital Net Investment Net Investment =0 Gross Gross Investment Investment Yes, there is still some scope for movement along the PPF in the direction of more consumption and less investment. CONSUMPTION In a no-growth economy (meaning no net investment), would it be possible for people to increase consumption? YEAR 4 0 1 2 3 INVESTMENT Replacement Capital But what would be the consequences for the PPF in subsequent years? Watch the economy experience negative growth, i.e., watch it contract. Gross Investment Notice that consumption rises initially and then falls as the economy’s productive capacity diminishes over time. CONSUMPTION As in the case of a clockwise movement along the PPF, we can add to our understanding of this counterclockwise movement by representing time explicitly on a horizontal axis and then keeping track of consumption on the vertical axis. INVESTMENT CONSUMPTION In both representations, consumption is consumption seen to rise The increase in thepresent economy adapting inasthe andisnear future to a negative growth rate, comes at the expense of a after which consumption declining rate of consumption —soon falling below indeclines the more distant future. the initial level. TIME CONSUMPTION If gross investment exceeds replacement capital, the economy expands. CONSUMPTION TIME If gross investment falls short of replacement capital, the economy contracts. TIME On what Each PPF basis is broadly can you descriptive make a of two particular prediction about countries the sizes at of thethe end of World two economies, War II. say, two or three decades after the war? Apart from their differing sizes, one Japan grew much difference faster thanisthe possibly relevant that United States—not had the small country’s because economyithad been because to thea beenbombed, wrecked but by bombing consumption-investment much greater extent thantradeoff the large incountry’s post-wareconomy. Japan was made in favor of a high level of investment. In What the United two countries States,are the these? tradeoff was made in the opposite direction by the consumption-oriented Americans. CONSUMPTION INVESTMENT Post-war United States CONSUMPTION Consider two separate economies, one large and one small. INVESTMENT Post-war Japan Suppose, though, that during a given year, some market malfunction (or some perverse policy) takes the economy off its PPF. CONSUMPTION To this point, we’ve assumed that the economy is either on its PPF or is being expeditiously moved by market forces toward a point on its shifting PPF. INVESTMENT If the economy is pushed beyond the PPF, its unemployment rate being driven below the 5-6 percent band, we say the economy is “overheated.” Points very far beyond the PPF are simply out of reach (in real terms). Strong market forces pushing in this direction will impinge on prices rather than on quantities. The economy will experience price and wage inflation. In extreme cases, it can experience hyper-inflation. Suppose, though, that during a given year, some market malfunction (or some perverse policy) takes the economy off its PPF. CONSUMPTION To this point, we’ve assumed that the economy is either on its PPF or is being expeditiously moved by market forces toward a point on its shifting PPF. INVESTMENT If the economy is pushed beyond the PPF, its unemployment rate being driven below the 5-6 percent band, we say the economy is “overheated.” Points very far beyond the PPF are simply out of reach (in real terms). Strong market forces pushing in this direction will impinge on prices rather than on quantities. The economy will experience price and wage inflation. In extreme cases, it can experience hyper-inflation. If the economy is pushed inside its PPF, its unemployment rate rising above the 5–6 percent band, we say that the economy is in a recession. If the economy is pushed far inside its PPF for an extended period of time, we say that the economy is in a depression. CONSUMPTION Notice that, together with the locus of the fully employed economy, the various possible market malfunctions (or consequences of perverse policy) are arrayed along a linear path: A depressed economy A recessed economy A fully employed economy An over-heated economy An inflated economy A hyper-inflated economy What do you suppose is the significance of the straight line that passes through these points? INVESTMENT Economists who believe that the “markets market economy work” argue is inherently that market argue flawed forcesthat canmarket move the forces economy will move along the economy the PPFalong in the response linear pathtoproducing changes in periodic intertemporal bouts of unemployment preferences. and inflation. They argue that movements off the PPF They argue arethat largely “stimulus a consequence packages” andofinterest-rate perverse macroeconomic manipulation arepolicy. needed to restore macroeconomic health. EXPENDITURES C = a + bY INCOME Yfe CONSUMPTION C+I INVESTMENT The nature of the Keynesian-styled spiraling associated with recession, depression and inflation becomes more transparent with the production possibility frontier in play. W S Also, the PPF helps to show how the Keynesian framework is related to pre-Keynesian Dideas. N EXPENDITURES C = a + bY Yfe INCOME CONSUMPTION C+I INVESTMENT A waning of animal spirits causes investment to decrease and with it income and consumption. The economy falls inside its PPF. W S D N C = a + bY Yfe INCOME CONSUMPTION EXPENDITURES C+I INVESTMENT Note that if investment A further were towaning fall to zero, sendsthe theeconomy economywould settle into an income-expenditure deeper into the equilibrium PPF’s interior. with Y = C. Movements inside the frontier (and beyond Thus, the vertical intercept of the Keynesian demand constraint W it) trace out a linear relationship, showing is aligned withS the intersection of the consumption function and how consumption varies with investment. the 45o line. D The straight line that passes through these N points is the Keynesian demand constraint. CONSUMPTION Y = C + I C = a + bY C = a + b(C + I) C = a + bC + bI C – bC = a + bI (1–b)C = a + bI INVESTMENT a b C = + I (1-b) (1-b) The straight line that passes through these points is the Keynesian demand constraint. EXPENDITURES C+I C = a + bY CONSUMPTION a b C = (1 – b) + (1 – b) I b 1–b a (1 – b) Yfe INCOME INVESTMENT For simplicity, let a = 0 and b = 0.90. Then C = a + bY becomes C = 0.90Y. And C = a/(1-b) + b/(1-b) I becomes C = 9(I), which led Keynes to write: “If, forformula example, the public are in the so habit of spending of their “The is not, of course, quite simple as in thisnine-tenths illustration…. But income consumption goods, entrepreneurs to of there is on always a formula, more itorfollows less ofthat this ifkind, relating thewere output produce consumption goods at a cost more than nine timesofthe cost of consumption goods which it pays to produce to the output investment the investment goods theyappears are producing, partbeyond of their dispute. output could goods…. This conclusion to me tosome be quite Yet the not be sold at awhich price which itsat cost production.” consequences follow covered from it are theofsame time unfamiliar and of the greatest possible importance.” The Production Possibilities Frontier Adapted from Time and Money: The Macroeconomics of Capital Structure by Roger W. Garrison London: Routledge, 2001 The Consumption-Investment Tradeoff And the Essence of Economic Growth 2009