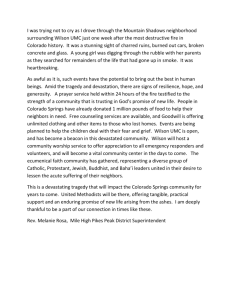

Exchange rate adjustment

advertisement

An Introduction to International Economics Chapter 13: Automatic Adjustments with Flexible and Fixed Exchange Rates Dominick Salvatore John Wiley & Sons, Inc. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 1 Focus of the chapter • How is a trade deficit automatically closed by price and income changes? – In this chapter private international capital flows are assumed to be passive responses to cover temporary trade imbalances. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 2 • Assume (1) only two nations (the U.S. and Japan) and (2) no capital flows. – Under these assumptions the demand for yen will be driven by U.S. demand for Japanese goods and services, or imports. $/¥ Exchange rate adjustment D¥ ¥/day Dale R. DeBoer University of Colorado, Colorado Springs 13 - 3 • Assume (1) only two nations (the U.S. and Japan) and (2) no capital flows. – Under these assumptions the demand for yen will be driven by U.S. demand for Japanese goods and services, or imports. – The supply of yen will be driven by Japanese demand for U.S. goods and services, or exports. Dale R. DeBoer University of Colorado, Colorado Springs $/¥ Exchange rate adjustment S¥ D¥ ¥/day 13 - 4 • If the exchange rate is at level A, the U.S. will have a trade deficit. $/¥ Exchange rate adjustment S¥ A D¥ ¥/day Dale R. DeBoer University of Colorado, Colorado Springs 13 - 5 • If the exchange rate is at level A, the U.S. will have a trade deficit. • If exchange rates in the U.S. are flexible, over time the exchange rate will move to its equilibrium value of B. $/¥ Exchange rate adjustment S¥ B A D¥ ¥/day Dale R. DeBoer University of Colorado, Colorado Springs 13 - 6 • If the exchange rate is at level A, the U.S. will have a trade deficit. • If exchange rates in the U.S. are flexible, over time the exchange rate will move to its equilibrium value of B. • As the exchange rate adjusts to B, the trade deficit will close. Dale R. DeBoer University of Colorado, Colorado Springs $/¥ Exchange rate adjustment S¥ B A D¥ ¥/day 13 - 7 • If instead of the original supply and demand curves, supply and demand are given by S¥* and D¥*, a depreciation of the dollar will still occur. • However, the depreciation will be much greater in this case (to level C). Dale R. DeBoer University of Colorado, Colorado Springs $/¥ Exchange rate adjustment S¥* S¥ C B A D¥* D¥ ¥/day 13 - 8 • The more significant depreciation of the dollar (from A to C) will have more severe inflationary effects on the U.S. economy. • This implication points to the importance of knowing the elasticity of the supply and demand curves. Dale R. DeBoer University of Colorado, Colorado Springs $/¥ Exchange rate adjustment S¥* S¥ C A D¥* D¥ ¥/day 13 - 9 Elasticity • Since the demand for foreign currency depends on the demand for imports, the elasticity depends on the price elasticity of the demand for imports (ηM). • ηM = %ΔQM ÷ %ΔPM • Similarly, the elasticity of supply depends on the price elasticity of supply for exports (ηX). • ηX = %ΔQX ÷ %ΔPX Dale R. DeBoer University of Colorado, Colorado Springs 13 - 10 • If the supply of foreign currency is negatively sloped and more elastic than the demand for foreign currency, the foreign exchange market will be unstable. $/¥ Unstable foreign exchange market S¥ D¥ ¥/day Dale R. DeBoer University of Colorado, Colorado Springs 13 - 11 • If the supply of foreign currency is negatively sloped and more elastic than the demand for foreign currency, the foreign exchange market will be unstable. • In this case, a trade deficit occurs at an exchange rate above the equilibrium value. Dale R. DeBoer University of Colorado, Colorado Springs $/¥ Unstable foreign exchange market A S¥ D¥ ¥/day 13 - 12 • In this case, a trade deficit occurs at an exchange rate above the equilibrium value. • At level A, the quantity demanded of foreign exchange (Z) exceeds the quantity supplied (Y). $/¥ Unstable foreign exchange market A S¥ D¥ Y Z Dale R. DeBoer University of Colorado, Colorado Springs ¥/day 13 - 13 • At level A, the quantity demanded of foreign exchange (Z) exceeds the quantity supplied (Y). • The excess demand puts upward pressure on the exchange rate and pushes the exchange market further from equilibrium. Dale R. DeBoer University of Colorado, Colorado Springs $/¥ Unstable foreign exchange market A S¥ D¥ Y Z ¥/day 13 - 14 The Marshall-Lerner condition • The unstable condition just depicted will be avoided if the Marshall-Lerner condition holds. • The Marshall-Lerner condition is that ηM + ηX > 1. • Empirical evidence indicates that this condition does hold. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 15 J-curve effect • A currency depreciation is expected to lessen a country’s trade deficit. • This improvement may take time to occur. • Initially, the depreciation may worsen the trade deficit since import prices will rise more quickly than the improvement in exports. • This generates a J-shaped pattern to exchange rate movements. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 16 The gold standard • The gold standard generates a system of fixed exchange rates. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 17 The gold standard • The gold standard generates a system of fixed exchange rates. • The gold standard for the international monetary system operated from 1880 to 1914. – This system is similar to the post-WWII Bretton Woods monetary system that collapsed in 1971. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 18 The gold standard • The gold standard generates a system of fixed exchange rates. • The gold standard for the international monetary system operated from 1880 to 1914. • Under the gold standard, each nation specified the gold content of its currency. – £1 gold coin contained 113.0016 grains of gold – $1 gold coin contained 23.22 grains of gold – This entails an exchange rate of 113.0016 ÷ 23.22 or $4.87/£. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 19 The gold standard • The gold standard generates a system of fixed exchange rates. • The gold standard for the international monetary system operated from 1880 to 1914. • Under the gold standard, each nation specified the gold content of its currency. • The exchange rate of $4.87/£ is known as mint parity. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 20 The gold standard • Under the gold standard, each nation specified the gold content of its currency. • The exchange rate of $4.87/£ is known as mint parity. • As the cost of shipping gold from New York to London was approximately 3 cents, the actual exchange rate would always lie between $4.84/£ and $4.90/£. – $4.84/£ is the gold import point. – $4.90/£ is the gold export point. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 21 Adjustment under the gold standard • Adjustment to equilibrium under the gold standard occurs via the price-specie-flow mechanism. – The concept of the price-specie-flow mechanism was initially introduced in 1752 by David Hume. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 22 Adjustment under the gold standard • Adjustment to equilibrium under the gold standard occurs via the price-specie-flow mechanism. • If a trade imbalance exists, gold will flow from the country with a trade deficit to the country with a trade surplus. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 23 Adjustment under the gold standard • Adjustment to equilibrium under the gold standard occurs via the price-specie-flow mechanism. • If a trade imbalance exists, gold will flow from the country with a trade deficit to the country with a trade surplus. • The fall in gold supplies in the trade deficit country reduces its money supply and pushes its price level lower; the increase in gold supplies in the trade surplus country increases its money supply and raises its price level. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 24 Adjustment under the gold standard • The fall in gold supplies in the trade deficit country reduces its money supply and pushes its price level lower; the increase in gold supplies in the trade surplus country increases its money supply and raises its price level. • The price level movement is seen via the equation of exchange: M • V = P • Y (where M is the money supply, V is the velocity of money, P is the price level, and Y is real output). Dale R. DeBoer University of Colorado, Colorado Springs 13 - 25 Adjustment under the gold standard • The price level movement is seen via the equation of exchange: M • V = P • Y (where M is the money supply, V is the velocity of money, P is the price level, and Y is real output). • As the price level falls in the country with a trade deficit, exports of its goods and services will be encouraged; as the price level increases in the country with a trade surplus, exports of its goods and services will be discouraged. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 26 Adjustment under the gold standard • As the price level falls in the country with a trade deficit, exports of its goods and services will be encouraged; as the price level increases in the country with a trade surplus, exports of its goods and services will be discouraged. • These changes in trade will decrease both the trade deficit and surplus leaving a situation of balanced international trade. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 27 Income determination in a closed economy • In a closed economy (without international trade) without a government sector, equilibrium output is determined by: Y=C+S=C+I where Y is income, C is planned consumption expenditures, I is planned business savings, and S is savings. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 28 Income determination in a closed economy • In a closed economy (without international trade) without a government sector, equilibrium output is determined by: Y=C+S=C+I where Y is income, C is planned consumption expenditures, I is planned business savings, and S is savings. • This yields an equilibrium condition of: S – I = 0. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 29 Income determination in a closed economy • This yields an equilibrium condition of: S – I = 0. • In words, this entails that at equilibrium leakages from the economy (S) must be balanced by injections into the economy (I). Dale R. DeBoer University of Colorado, Colorado Springs 13 - 30 Income determination in a closed economy • In words, this entails that at equilibrium leakages from the economy (S) must be balanced by injections into the economy (I). • If planned investment is autonomous but savings is determined by the marginal propensity to save (s), then: ΔS = sΔY. – The marginal propensity to save (s) is amount of additional savings that flows from each additional dollar of income. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 31 Income determination in a closed economy • If planned investment is autonomous but savings is determined by the marginal propensity to save (s), then: ΔS = sΔY. • Since S = I at equilibrium, this entails that: ΔI = sΔY or 1 ÷ s = ΔY ÷ ΔI. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 32 Income determination in a closed economy • Since S = I at equilibrium, this entails that: ΔI = sΔY or 1 ÷ s = ΔY ÷ ΔI. • If k = 1 ÷ s, then ΔY = k • ΔI. – k is the multiplier. – Any change in investment will induce a multiplied change in income as given by the above formula. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 33 Income determination in a closed economy • If k = 1 ÷ s, then ΔY = k • ΔI. • An example – s = 0.25 – ΔI = 300 – What is the value of k? • k = 1 ÷ 0.25 = 4 – What is the change in income? • ΔY = 4 • 300 = 1,200 Dale R. DeBoer University of Colorado, Colorado Springs 13 - 34 Income determination in an open economy • In an open economy, equilibrium is still determined by the condition that leakages must equal injections. – In an open economy, imports (M) are a new leakage. – In an open economy, exports (X) are a new injection. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 35 Income determination in an open economy • In an open economy, equilibrium is still determined by the condition that leakages must equal injections. • The new equilibrium equation is: S+M=I+X or ΔS + ΔM = ΔI + ΔX. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 36 Income determination in an open economy • The new equilibrium equation is: S+M=I+X or ΔS + ΔM = ΔI + ΔX. • If ΔM = mΔY, then the multiplier (k*) becomes: k* = 1 ÷ (s + m) – Where m is the marginal propensity to import. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 37 Income determination in an open economy • The new equilibrium equation is: S+M=I+X or ΔS + ΔM = ΔI + ΔX. • If ΔM = mΔY, then the multiplier (k*) becomes: k* = 1 ÷ (s + m) – Where m is the marginal propensity to import. • This leaves ΔY = k* • ΔI or ΔY = k* • ΔX. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 38 Income determination in an open economy • This leaves ΔY = k* • ΔI or ΔY = k* • ΔX. • An example – – – – s = 0.25 m = 0.25 ΔI = 400 What is the value of k*? • k = 1 ÷ (0.25 + 0.25) = 2 – What is the change in income? • ΔY = 2 • 200 = 800 Dale R. DeBoer University of Colorado, Colorado Springs 13 - 39 Foreign repercussions • Suppose Nation 1 experiences an increase in its planned autonomous investment. – Nation 1 will experience an increase in its domestic income of k* • ΔI. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 40 Foreign repercussions • Suppose Nation 1 experiences an increase in its planned autonomous investment. • The increase in Nation 1’s income will increase its imports by mΔY. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 41 Foreign repercussions • Suppose Nation 1 experiences an increase in its planned autonomous investment. • The increase in Nation 1’s income will increase its imports by mΔY. • Assuming only two countries, Nation 1’s increased imports will increase Nation 2’s exports leading to an expansion in Nation 2’s income by k2* • ΔX2. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 42 Foreign repercussions • The increase in Nation 1’s income will increase its imports by mΔY. • Assuming only two countries, Nation 1’s increased imports will increase Nation 2’s exports leading to an expansion in Nation 2’s income by k2* • ΔX2. • The increase in Nation 2’s income will lead to an increase in its imports, spurring a secondary expansion in Nation 1. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 43 Absorption approach • The absorption approach integrates the effect of induced income changes in the process of correcting a balance of payments disequilibrium by a change in the exchange rate. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 44 Absorption approach • The absorption approach integrates the effect of induced income changes in the process of correcting a balance of payments disequilibrium by a change in the exchange rate. • Domestic equilibrium is given by: Y = C + I + (X – M). Dale R. DeBoer University of Colorado, Colorado Springs 13 - 45 Absorption approach • Domestic equilibrium is given by: Y = C + I + (X – M). • Define A (domestic absorption) = C + I and B (foreign absorption) = X – M. Then: Y=A+B or Y – A = B. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 46 Absorption approach • Define A (domestic absorption) = C + I and B (foreign absorption) = X – M. Then: Y=A+B or Y – A = B. • A depreciation of the currency is expected to increase B. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 47 Absorption approach • A depreciation of the currency is expected to increase B. • This can only occur if A falls or Y increases. – If the economy is at full employment, Y cannot increase. – Therefore, a depreciation must result in a fall in A. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 48 Absorption approach • A depreciation of the currency is expected to increase B. • This can only occur if A falls or Y increases. • Forces that lead to a fall in domestic absorption (A). – Income is redistributed from wages to profits. – The depreciation increases prices and hence lowers domestic expenditures. – The depreciation pushes people into higher tax brackets and hence lowers disposable income. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 49 Synthesis • Flexible exchange rate adjustment – A trade deficit leads to a depreciation of the domestic currency. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 50 Synthesis • Flexible exchange rate adjustment – A trade deficit leads to a depreciation of the domestic currency. – The depreciation spurs an improvement in the balance of trade. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 51 Synthesis • Flexible exchange rate adjustment – A trade deficit leads to a depreciation of the domestic currency. – The depreciation spurs an improvement in the balance of trade. – The improvement in the balance of trade spurs increased domestic production. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 52 Synthesis • Flexible exchange rate adjustment – A trade deficit leads to a depreciation of the domestic currency. – The depreciation spurs an improvement in the balance of trade. – The improvement in the balance of trade spurs increased domestic production. – The increase in production generates increased domestic incomes that spur greater investment – partially offsetting the initial improvement in the trade balance. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 53 Synthesis • Flexible exchange rate adjustment – The improvement in the balance of trade spurs increased domestic production. – The increase in production generates increased domestic incomes that spur greater investment – partially offsetting the initial improvement in the trade balance. – If production cannot increase because the nation is already at full employment, domestic absorption must fall. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 54 Synthesis • Flexible exchange rate adjustment • Fixed exchange rate adjustment – A trade deficit spurs a decrease in the domestic money supply. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 55 Synthesis • Flexible exchange rate adjustment • Fixed exchange rate adjustment – A trade deficit spurs a decrease in the domestic money supply. – The fall in the money supply pushes the domestic price level lower. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 56 Synthesis • Flexible exchange rate adjustment • Fixed exchange rate adjustment – A trade deficit spurs a decrease in the domestic money supply. – The fall in the money supply pushes the domestic price level lower. – As domestic prices fall, exports are encouraged and imports discouraged moving the economy to a situation of balanced trade. Dale R. DeBoer University of Colorado, Colorado Springs 13 - 57