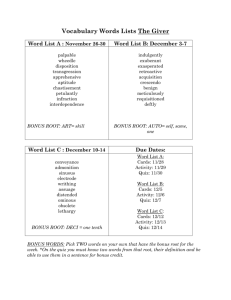

bonus shares - Cognizant College of Commerce

advertisement

BONUS SHARES

INTRODUCTION TO BONUS SHARES

The word Bonus means to pay extra due to good

PERFORMANCE.

Bonus paid to shareholders can either be

1. Cash bonus

2. Capital bonus

1. Cash bonus: it is paid to shareholders only when

the company has larger reserves and sufficient

cash to pay bonus. It is also seen that the

payment of cash bonus does not affect the

working capital of the company

2. Capital bonus : it is paid when the company wants

to share the accumulated reserves with the

shareholders but it is not in a position to pay cash

bonus because it adversely affects the working

capital of the company. Capital bonus is given by

making partly paid shares as fully paid shares

without getting cash from the shareholders or it is

given by the issue of free fully paid shares known

as bonus shares

When Bonus shares can be issued

following are the circumstances that warrant the

issue of bonus shares :

1. When a company has accumulated large

reserves (capital or revenue) and it wants to

capitalize these reserves by issuing bonus

shares

2. When the company is not in a position to give

cash bonus because it adversely affects its

working capital .

3. When the value of fixed assets far exceeds the

amount of capital.

4. When the higher rate of dividend is not

advisable

for

the

distribution

of

the

accumulated reserves because shareholders

will demand the same rate of dividend in

future which may not be possible.

5. When there is a big difference between the

market value and paid up value of shares of

the company

Provisions of companies Act 1956

Sec 205 (3) : it provides that a company

may capitalize its profits or reserves for

the purpose of issuing fully paid bonus

shares or pay up any amount, for the

time being un paid, or any shares held

by the members of the company

Sec 78 (2) : the securities premium may

be applied in paying up un issued

shares of the company to be issued to

members of the company as fully paid

bonus shares

Sec 80 (5) : it provides that the capital

redemption reserve account may be

applied by the company in paying up

unissued shares of the company to be

issued to members of the company as

fully paid bonus shares

GUIDELINES ISSUED BY SEBI

1. The company has to issue a certificate countersigned by

the statutory auditor to the effect that the terms and

conditions for issue of bonus shares have been complied out.

2. The issue will not dilute the value or right of the holders of

partly or fully convertible denbentures.

3. The bonus issue is made out of free reserves built of

genuine profits or share premium collected in cash only.

4. Reserves created by

revaluation

of assets

company

to be

issuedare

to not

members

capitalized.

of

the company as fully paid bonus shares

5. The bonus issue is not made unless the partly paid shares,

if any are made fully paid.

6. There is a provision in the article of association for

capitalization of reserves and if not, the company should

pass resolution making the provision in AOA of company

7. The company must implement the proposal within six

months from the date of approval, of the board of directors.

FREE RESERVES THAT CAN BE USED FOR BONUS ISSUE

1.

2.

3.

4.

SURPLUS IN P&L A/C

GENERALRESERVES

DIVIDEND EQUALISATION RESERVE

CAPITALRESERVE ARISING FROMPROFIT ON

SALE OF FIXED ASSETS RECEIVED IN CASH

5. BALANCE IN DEBENTURE REDEMPTION

RESERVE AFTER REDEMPTION OF

DEBENTURE.

6. CAPITAL REDEMPTION RESERVE A/C

CREATED AT THE TIME OF REDEMPTION OF

REDEEMBLE PREFERENCE SHARES OUT OF

THE PROFITS

7. SECURITIES PREMIUM COLLECTED IN CASH

ONLY

RESERVES NOT AVAILABLE FOR ISSUE

1. CAPITAL RESERVE ARISING DUE TO

REVALUATION OF ASSETS.

2. SECURITIES PREMIUM ARISING ON

ISSUE OF SHARES ON AMALGAMATION

OR TAKE OVER

3. INVESTMENT ALLOWANCE RESERVE

/DEVELOPMENT REBATE RESERVE

BEFORE EXPIRY OF 8 YEARS OF

CREATION

4. BALANCE IN DEBENTURE REDEMPTION

RESERVE A/C BEFORE REDEMPTION

TAKES PLACE

5. SURPLUS ARISING FROM A CHANGE IN

THE METHOD OF CHARGING

DEPRECIATION

ACCOUNTING TREATMENT

A) IFTHE BONUS IS UTILISED FOR MAKING PARTLY PAID

SHARES AS FULLY PAID SHARES

1) PROFITAND LOSS A/C

Dr

(OR) GENERAL RESERVE A/C

Dr

(OR) CAPITAL RESERVE A/C

Dr

TO BONUS TO SHAREHOLDERS A/C

{BEING AMOUNT TRANSFERRED TO BONUS TO SHAREHOLDERS

A/C}

2. SHARE FINALCALLA/C

TO SHARE CAPITAL A/C

{ BEING FINAL CALL DUE ON SHARES}

Dr

3. BONUS TO SHAREHOLDERS A/C Dr

TO SHARE FINAL A/C

{ BEING THE BONUS TO SHAREHOLDERS UTILZED TOWARDS

SHARE FINAL CALL A/C}

B. FOR ISSUING FULLY PAID BONUS SHARES

• 1. PROFIT AND LOSS A/C

Dr

•

(OR) GENERAL RESERVE A/C

Dr

•

(OR) CAPITAL RESERVE A/C

Dr

(OR) SECURITIES PREMIUM A/C

Dr

(OR) CAPITAL REDEMPTION RESERVE A/C

Dr

(OR) ANY OTHER RESERVE A/C

Dr

TO BONUS TO SHAREHOLDERS A/C

{BEING THE P&L A/C AND RESERVES TRANSFER TO BONUS TO

SHAREHOLDERS A/C}

2. BONUS TO SHAREHOLDERS A/C

Dr

TO SHARE CAPITAL A/C

TO SECURITIESPERMIUM A/C

{BEING THE ISSUE OF BONUS SHARES}

Definition of 'Debenture Redemption Reserve'

A provision that was added to the Indian Companies Act of 1956

during an amendment in the year 2000. The provision states that any

Indian company that issues debentures must create a debenture

redemption service to protect investors against the possibility of

default by the company

Under the provision, debenture redemption reserves will be funded

by company profits every year until debentures are to be redeemed.

If a company does not create a reserve within 12 months of issuing

the debentures, they will be required to pay 2% interest in penalty to

the debenture holders. Only debentures that were issued after the

amendment in 2000 are subject to the debenture redemption service.

Capital redemption reserve

A capital redemption reserve is an established fund that holds

money to protect a company from the loss of capital. A company

protects itself from such a loss by essentially setting aside the

amount of capital required for the specific transaction. By

maintaining the capital redemption reserve, the company can set

aside adequate funding to pay creditors in the event that it runs

into financial problems. It can use the capital redemption reserve

for

specific

purposes

with

court

approval

When to use CRR fund

• According to “Principles of Finance,” by Scott Besley and Eugene

Brigham, the most common situation that requires a company to

create a capital redemption reserve is a redemption of shares. Per

SEC regulations, any time a company buys back its own shares

with capital or with new shares, it must put the same amount of

money into a capital redemption reserve. The fund, therefore,

offsets the reduction of the company’s equity as a result of the

share buyback. The company must set aside the same amount of

capital in a capital redemption reserve fund when it purchases the

shares

with

company

profits

This means the company can use the funds for no purpose beyond

that of maintaining company equity or issuing bonus shares.

Ultimately, the capital redemption reserve protects a company’s

creditors.