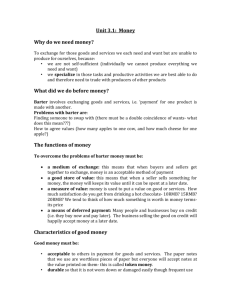

Money and Banking System 13.1

advertisement

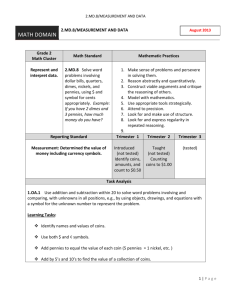

#45 Unit 4: Money, Banking, Monetary Policy . Unit 4: Warm Ups #46 Why Money? #47 Money and Banking System What do the following words have in common? – – – – – – Cheese Dead Presidents Dough FEDS Bones Benjamins Money and Banking Go to Dillards and buy a winter coat—Try to pay with a live chicken? How about: 12 oranges, a Walrus tusk, a coffee mug and a picture of your cousin? Then, you try to pay with a picture of an 18th century politician printed on green paper. What’s the difference???? Functions of Money Money—Anything that people commonly accept in exchange for goods and services. 3 Functions of Money: – A medium of exchange – A standard of value – A store of value Functions of Money Medium of Exchange—is any item that sellers accept as payment for goods and services. – Buyers know that sellers will accept money in payment for goods and services. – Restaurant workers are not paid in barbeque sauce. $$$$ – Teachers not paid in pencils. $$$$ Functions of Money Standard of Value—Money provides people with a way to measure the relative value of goods and services. – – – – What is a TV worth? Bicycle? DVD player? Helps consumers to compare prices Helps clarify opportunity costs Helps to compare businesses performance: • Profit of 300,000 bags of rice • Profit of 500,000 hamburgers • Profit of $100,000 Functions of Money Store of Value—2 things must be met – Money must be nonperishable – Money must keep its value over time • If both conditions are met, people can accumulate their wealth for later use. Characteristics of Money 5 Major Characteristics of Money – – – – – Durability Portability Divisibility Stability Acceptability 5 Characteristics of Money Durability—the ability to be used over and over again. – Eggs? Gold/Silver? U.S. Dollars? Portability—the ability to be carried from one place to another. – Small, lightweight 5 Characteristics of Money Divisibility—the ability for money to be divided into smaller units. – Exact price comparisons can be made Stability of Value—Must be stable in order to encourage saving. Acceptability—People are willing to accept money in exchange for their goods/services. Sources of Money’s Value Commodity Money—An item that has value of its own as a commodity and that can be used also as money. – Diamonds, gold, silver, even salt! Representative Money—Has value because it can be exchanged for something else of value. It has no intrinsic value. Bills that could be redeemed for gold/silver/ (Specie) Sources of Money’s Value Fiat Money—Coin, paper money have been decreed to have value by the government. – The value ultimately stems from the citizens faith in the U.S. gov’t. • Currency—Coins, paper bills, • used for trading. Money Supply 14.2 M1—Is all the currency in circulation, value of all travelers checks, all checking account deposits, in banks. M2—In addition to M1, M2 includes money market accounts, mutual fund shares, CD’s, plus all money in savings accounts. M3 and L—Includes M2 plus all CD’s over $100,000. Also includes, savings bonds. Drive Through Fun! Go to a drive through Ask the cashier the following question: – Will you accept a federal reserve note in payment for the food? If they say no, then explain that federal reserve notes are money Forms of Money Coins and Paper Money— – Coins minted by the U.S. Mint – Bills printed by the Bureau of Engraving Demand Deposits—Also known as checking accounts. Near Money—Assets such as savings accounts, and time deposits. Near money because they cannot be immediately used to buy goods or pay debts. What is it? Money, Near Money? Coins Interesting Facts Pennies: – Content: 90% Zinc; 10% Copper – Melted down: Penny worth @ 3 cents Nickels: – Content 70% Copper; 30% Zinc – Melted down: Nickel worth @ 8 cents Penalty for melting: – 10 years in prison and big fine – Cannot ship out of country > $100 in pennies/nickels The Six Characteristics of Money Durability Objects used as money must withstand physical wear and tear. Portability People need to be able to take money with them as they go about their business. Divisibility To be useful, money must be easily divided into smaller denominations, or units of value. Uniformity Any two units of money must be uniform, that is, the same, in terms of what they will buy. Limited Supply Money must be available only in limited quantities. Acceptability Everyone must be able to exchange the money for goods and services.