2007 vs. 2012/2014

advertisement

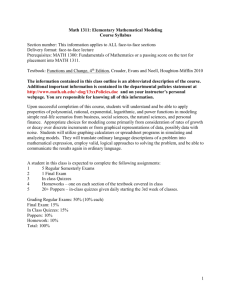

Are We Nearing the End of the Benign Credit Cycle & Is a Bubble Building In Credit? Dr. Edward Altman NYU Stern School of Business CIFR Seminar MacQuarie University Sydney, Australia November 19, 2015 1 1 Is It a Bubble? • Or, Just Opportunistic Debt Financing? • Focus on Default Rates in Credit Markets • Length of Benign Credit Cycles • Coincidence with Recessions: U.S. & European Scenarios • Comparative Health of High-Yield Firms (2007 vs. 2012/2014) • High-Yield and CCC New Issuance • LBO Statistics and Trends • Liquidity Concerns (Markets & Dealers) • Maturity Schedule of Leveraged Debt (Impact?) • Large Increase in the Distress Ratio • Possible Timing of the Bubble Burst 2 Historical H.Y. Bond Default Rates Straight Bonds Only Excluding Defaulted Issues From Par Value Outstanding, (US$ millions), 1971 – 2015 (10/15)) Year 2015 (10/15) 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 a Par Value Outstandinga ($) Par Value Defaults ($) Default Rates (%) 1,595,839 35,414 2.219 1,496,814 1,392,212 1,212,362 1,354,649 1,221,569 1,152,952 1,091,000 1,075,400 993,600 1,073,000 933,100 825,000 757,000 649,000 597,200 567,400 465,500 335,400 271,000 240,000 235,000 206,907 163,000 183,600 181,000 189,258 148,187 31,589 14,539 19,647 17,963 13,809 123,878 50,763 5,473 7,559 36,209 11,657 38,451 96,855 63,609 30,295 23,532 7,464 4,200 3,336 4,551 3,418 2,287 5,545 18,862 18,354 8,110 3,944 2.110 1.044 1.621 1.326 1.130 10.744 4.653 0.509 0.761 3.375 1.249 4.661 12.795 9.801 5.073 4.147 1.603 1.252 1.231 1.896 1.454 1.105 3.402 10.273 10.140 4.285 2.662 Weighted by par value of amount outstanding for each year. Year Par Value Outstanding* ($) Par Value Defaults ($) Default Rates (%) 1987 1986 1985 1984 1983 1982 1981 1980 1979 1978 1977 1976 1975 1974 1973 1972 1971 129,557 90.243 58,088 40,939 27,492 18,109 17,115 14,935 10,356 8,946 8,157 7,735 7,471 10,894 7,824 6,928 6,602 7,486 3,156 992 344 301 577 27 224 20 119 381 30 204 123 49 193 82 5.778 3.497 1.708 0.840 1.095 3.186 0.158 1.500 0.193 1.330 4.671 0.388 2.731 1.129 0.626 2.786 1.242 Standard Deviation (%) Arithmetic Average Default Rate (%) 1971 to 2014 3.117 3.097 1978 to 2014 3.340 3.273 1985 to 2014 3.843 3.416 Weighted Average Default Rate (%)* 1971 to 2014 3.491 1978 to 2014 3.496 1985 to 2014 3.513 Median Annual Default Rate (%) 1971 to 2014 1.664 Source: Author’s compilation and Citigroup/Credit Suisse estimates 3 Default Rates on High-Yield Bonds Quarterly Default Rate and Four-Quarter Moving Average 1989 – 2015 (3Q - Preliminary) 6.0% 16.0% 14.0% 5.0% Quarterly Default Rate 4.0% 10.0% 3.0% 8.0% 6.0% 2.0% 4.0% 1.0% 4 - Quarter Moving Average 12.0% 2.0% 0.0% 0.0% ( 15 20 14 20 13 20 12 20 11 20 10 20 09 20 08 20 07 20 06 20 05 20 04 20 03 20 02 20 01 20 00 20 99 19 98 19 97 19 96 19 95 19 94 19 93 19 92 19 91 19 90 19 89 19 ) 3Q Quarterly Moving Source: Author’s Compilations 4 Filings for Chapter 11 Number of Filings and Pre-petition Liabilities of Filing Companies 1989 – 2015 (10/09) Pre- Petition Liabilities, in $ billions (left axis) Median Liabilities Number of Filings (right axis) Median No. of Filings. $800 280 $700 240 2014 (10/09) $ Billion $600 200 $500 160 48 filings and liabilities of $88.3 billion 120 2015 (10/09) 80 51 filings and liabilities of $69.1 billion $400 $300 $200 40 Note: Minimum $100 million in liabilities Source: NYU Salomon Center Bankruptcy Filings Database 2015 (10/09) 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 $0 1989 $100 0 Mean 1989-2014: 74 filings Median 1989-2014: 54 filings 5 Energy/Mining Company Chapter 11 Filings* January – October 09, 2015 Company Allied Nevada Gold Corp. Alpha Natural Resources, Inc. American Eagle Energy Corp. Black Elk Energy Offshore Operations, LLC BPZ Resources, Inc. Cal Dive International, Inc. Dune Energy, Inc. ERG Intermediate Holdings, LLC Hercules Offshore, Inc. Hovensa, LLC Magnetation, Inc. Milagro Oil & Gas, Inc. Miller Energy Resources, Inc. Molycorp., Inc. Patriot Coal Corp. Quicksilver Resources, Inc. Sabine Oil & Gas Corp. Samson Resources Corp. Saratoga Resources, Inc. Walter Energy, Inc. Xinergy Ltd. Liabilities ($MM) Date 664 7,100 215 432 275 411 144 250 1,307 1,000 750 468 337 1,786 1,000 2,352 2,906 5,369 219 5,005 250 3/10/2015 8/3/2015 5/8/2015 9/1/2015 3/9/2015 3/3/2015 3/8/2015 4/30/2015 8/13/2015 9/15/2015 5/5/2015 7/15/2015 10/1/2015 6/25/2015 5/12/2015 3/17/2015 7/15/2015 9/16/2015 6/18/2015 7/15/2015 4/6/2015 Number of Energy/Mining Companies 21 Total Number of Filings (1/1 – 10/09) 51 Percent Energy/Mining Companies 41% Total Energy/Mining Company Liabilities ($MM) $32,242 *Liabilities of $100mm or more at time of filing. Source: NYU Salomon Center Bankruptcy Filings Database SIC 1040 1221 1311 1311 1311 1389 1389 1311 1381 1382 1011 1311 1311 1081 1221 1311 1311 1311 1382 1221 1221 6 Energy/Mining Company Bond Defaults January – October 09, 2015 Company Liabilities ($MM) Alpha Natural Resources, Inc. Alpha Natural Resources, Inc. American Eagle Energy Corp. American Energy-Woodford, LLC Black Elk Energy Offshore Operations, LLC Cliffs Natural Resources Connacher Oil and Gas Ltd. Dune Energy, Inc. Goodrich Petroleum Corp. Gran Colombia Gold Corp. Halcon Resources Corp. Halcon Resources Corp. Hercules Offshore, Inc. Lightstream Resources Ltd. Magnetation, Inc. Midstates Petroleum Co., Inc. Molycorp, Inc. Patriot Coal Corp. Quicksilver Resources, Inc. RAAM Global Energy Co. Sabine Oil & Gas Corp. SandRidge Energy, Inc. SandRidge Energy, Inc. SAExploration Holdings, Inc. Samson Resources Corp. Saratoga Resources, Inc. Venoco, Inc. Walter Energy, Inc. Warren Resources, Inc. Xinergy Corp. 443 2,268 175 340 139 675 550 68 158 79 252 1,566 1,204 464 425 628 650 282 1,173 238 1,150 49 525 10 2,250 180 192 2,102 70 195 Total of Energy/Mining Company Defaults $ 18,497 Total Defaults (1/1 – 10/09) $ 35,011 Percent Energy/Mining Companies 53% Default Rate 5.54% Source: NYU Salomon Center Master Default Database Date 4/1/15 8/3/15 5/8/15 6/22/15 9/1/2015 3/30/15 3/4/15 3/8/15 10/1/15 1/10/15 4/14/15 9/10/15 8/13/15 7/2/15 5/5/15 5/21/15 6/25/15 5/12/15 3/17/15 5/1/15 7/15/15 5/19/15 8/19/15 8/26/15 9/16/15 6/12/15 4/10/15 7/15/15 5/26/15 4/6/15 SIC 1221 1221 1311 1311 1311 1000 1311 1389 1311 1221 1311 1311 1381 1311 1011 1311 1081 1221 1311 1311 1311 1311 1311 1382 1311 1382 1311 1221 1311 1221 7 Historical Annual European High-Yield Default Rates 20% 18% 33.91% 17.28% 16% 14% Default Rate 12.43% 12% 10% 8% 6.56% 6% 3Q15 2014 2013 0.97% 0.70% 1.02% 0.69% 2011 2010 1.06% 2012 1.60% 2009 1.00% 2007 0.53% 2006 2004 2003 2002 2001 1999 1998 0.97% 2008 1.97% 1.20% 2005 2% 0% 3.20% 2.35% 2.60% 2000 4% Note: 3Q15 is LTM Source: Credit Suisse 8 Historical Default Rates and Recession Periods in the U.S. High-Yield Bond Market (1972 – 2015 (3Q - Preliminary)) 14.0% 12.0% 10.0% 8.0% 6.0% 4.0% 14 12 10 08 06 04 02 00 98 96 94 92 90 88 86 84 82 80 78 76 74 0.0% 72 2.0% Periods of Recession: 11/73 - 3/75, 1/80 - 7/80, 7/81 - 11/82, 7/90 - 3/91, 4/01 – 12/01, 12/07 - 6/09 *All rates annual, except 3Q 2015 which is the LTM. Source: E. Altman (NYU Salomon Center) & National Bureau of Economic Research 9 6/1/2007 7/27/2007 9/21/2007 11/16/2007 1/15/2008 3/11/2008 5/6/2008 7/1/2008 8/26/2008 10/21/2008 12/16/2008 2/12/2009 4/9/2009 6/4/2009 7/30/2009 9/24/2009 11/19/2009 1/18/2010 3/15/2010 5/10/2010 7/5/2010 8/30/2010 10/25/2010 12/20/2010 2/14/2011 4/11/2011 6/6/2011 8/1/2011 9/26/2011 11/21/2011 1/18/2012 3/14/2012 5/9/2012 7/4/2012 8/29/2012 10/24/2012 12/19/2012 2/15/2013 4/12/2013 6/7/2013 8/2/2013 9/27/2013 11/22/2013 1/21/2014 3/18/2014 5/13/2014 7/8/2014 9/2/2014 10/28/2014 12/23/2014 2/19/2015 4/16/2015 6/11/2015 8/6/2015 10/1/2015 YTM & Option-Adjusted Spreads Between High Yield Markets & U.S. Treasury Notes June 01, 2007 – October 13, 2015 Yield Spread (YTMS) 600 OAS Sources: Citigroup Yieldbook Index Data and Bank of America Merrill Lynch. Average YTMS (1981-2014) Average OAS (1981-2014) 2,200 12/16/08 (YTMS = 2,046bp, OAS = 2,144bp) 2,000 1,800 1,600 1,400 1,200 1,000 800 10/13/15 (YTMS = 603bp, OAS = 624bp) YTMS = 540bp, OAS = 545bp 400 200 6/12/07 (YTMS = 260bp, OAS = 249bp) 10 Comparative Health of High-Yield Firms (2007 vs. 2012/2014) 11 Z-Score Component Definitions and Weightings Variable X1 Definition Weighting Factor Working Capital 1.2 Total Assets X2 Retained Earnings 1.4 Total Assets X3 EBIT 3.3 Total Assets X4 Market Value of Equity 0.6 Book Value of Total Liabilities X5 Sales 1.0 Total Assets 12 Z” Score Model for Manufacturers, Non-Manufacturer Industrials; Developed and Emerging Market Credits Z” = 6.56X1 + 3.26X2 + 6.72X3 + 1.05X4 +3.25 X1 = Current Assets - Current Liabilities Total Assets X2 = Retained Earnings Total Assets X3 = Earnings Before Interest and Taxes Total Assets X4 = Book Value of Equity Total Liabilities 13 Median Z-Score by S&P Bond Rating for U.S. Manufacturing Firms: 1992 - 2013 Rating 2013 (No.) 2004-2010 1996-2001 1992-1995 AAA/AA 4.13 (15) 4.18 6.20* 4.80* A 4.00 (64) 3.71 4.22 3.87 BBB 3.01 (131) 3.26 3.74 2.75 BB 2.69 (119) 2.48 2.81 2.25 B 1.66 (80) 1.74 1.80 1.87 CCC/CC 0.23 (3) 0.46 0.33 0.40 D 0.01 (33) -0.04 -0.20 0.05 *AAA Only. Sources: Compustat Database, mainly S&P 500 firms, compilation by NYU Salomon Center, Stern School of Business. 14 Comparing Financial Strength of High-Yield Bond Issuers in 2007& 2012/2014 Number of Firms Z-Score Z”-Score 2007 277 383 2012 404 488 2014 558 760 Year Average Z-Score/ (BRE)* Median Z-Score/ (BRE)* Average Z”-Score/ (BRE)* Median Z”-Score/ (BRE)* 2007 1.89 (B+) 1.81 (B) 4.58 (B+) 4.61 (B+) 2012 1.66 (B) 1.59 (B) 4.60 (B+) 4.60 (B+) 2014 2.03 (B+) 1.80 (B) 4.67 (B+) 4.56 (B+) Difference in Means Test (2007 vs. 2012/2014) Model Average Difference (2012/2014) t-test (2012/2014) Significance Level (2012/2014) Significant at .05? (2012/2014) Standard Deviation (2007/2012/2014) Z-Score -0.23/+0.14 1.29 / 1.15/1.78 -2.38/+1.30 0.88%/9.70% Yes /No Z”-Score +0.02/+0.09 2.50 / 2.07/2.65 +0.13/+0.56 44.68%/28.78% No/No *Bond Rating Equivalent Source: Authors’ calculations, data from Altman and Hotchkiss (2006) and S&P Capital IQ. 15 Debt/EBITDA & Net Debt/EBITDA: U.S. High-Yield (HY) and Investment Grade (IG), (Median Levels, 2004-2014*) Debt/EBITDA HY Debt/EBITDA IG Net Debt/EBITDA HY 5.00 4.00 BB- B+ 4.50 4.00 (781 obs.) BB- Net Debt/EBITDA IG (796 obs.) 3.50 BB+ (1,126 obs.) (1,086 obs.) 3.00 3.50 2.50 3.00 2.50 2.00 BBB BBB- (837 obs.) (872 obs.) BBB 2.00 BBB+ 1.50 (876 obs.) (860 obs.) 1.50 1.00 1.00 0.50 0.50 0.00 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 0.00 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 *Bond Rating Equivalents (BRE) based on Aggregate S&P Statistics Sources: S&P Capital IQ and Ratings Direct and NYU Salomon Center calculations. 16 Debt/Debt + Equity & Debt/MV Equity : U.S. High-Yield (HY) and Investment Grade (IG), (Median Levels, 2004-2014) Debt/Debt + Equity HY Debt/Debt + Equity IG 0.70 0.60 Debt/MV Equity HY Debt/MV Equity IG 1.20 BB (1,280 obs.) BB(875 obs.) 1.00 0.50 0.80 0.40 BBB (978 obs.) BBB(711 obs.) (1,001 obs.) 0.60 0.30 (878 obs.) 0.40 0.20 0.10 0.00 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 0.20 (705 obs.) (747 obs.) 0.00 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Sources: S&P Capital IQ and Ratings Direct and NYU Salomon Center calculations. 17 EBITDA/Interest Expense : U.S. High-Yield (HY) and Investment Grade (IG), (Median Levels, 2004-2014) EBITDA/Int. Expense HY EBITDA/Int. Expense IG 10.00 9.00 BBB 8.00 (863 obs.) 7.00 BBB(841 obs.) 6.00 5.00 4.00 BB(821 obs.) 3.00 B+ (1,196 obs.) 2.00 1.00 0.00 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Sources: S&P Capital IQ and Ratings Direct and NYU Salomon Center calculations. 18 Distribution of Credit Ratios for U.S. High-Yield Bonds, (2007 vs. 2014) Decile Debt/EBITDA EBITDA/Interest Expense 2014 BRE 2007 BRE 2014 BRE 2007 BRE 10% 1.36x A+ 0.87x AA+ 1.03x CCC 0.91x CCC 20% 2.23x BBB 1.75x A- 1.93x B- 1.59x CCC+ 30% 2.90x BB+ 2.40x BBB 2.55x B 2.05x B- 40% 3.56x BB 3.07x BB 3.36x B+ 2.57x B 50% 4.43x B+ 3.84x BB- 4.14x BB- 3.24x B+ 60% 5.05x B+ 4.70x B+ 5.23x BB 4.21x BB- 70% 5.94x B 5.70x B 6.64x BBB- 6.06x BB+ 80% 7.08x CCC+ 7.01x B- 9.84x BBB+ 9.07x BBB 90% 10.16x CCC- 9.38x CCC- 17.86x AA- 19.35x AA Sources: S&P Capital IQ and Ratings Direct and NYU Salomon Center calculations. 19 New Issuance: U.S. High-Yield Bond Market 2005 – 2015 (3Q) Annual Ratings Total BB B CCC 2005 81,541.8 18,615.0 45,941.2 15,750.9 (19.3%) 1,234.7 2006 131,915.9 37,761.2 67,377.3 25,319.2 (19.2%) 1,458.2 2007 132,689.1 23,713.2 55,830.8 49,627.6 (37.4%) 3,517.5 2008 50,747.2 12,165.0 25,093.1 11,034.4 (21.7%) 2,454.6 2009 127,419.3 54,273.5 62,277.4 10,248.4 (8.0%) 620.0 2010 229,307.4 74,189.9 116,854.7 35,046.8 (15.3%) 3,216.1 2011 184,571.0 54,533.8 105,640.4 21,375.0 (11.6%) 3,021.8 2012 280,450.3 71,852.1 153,611.1 48,690.2 (17.4%) 6,297.0 2013 (1Q) 73,492.3 31,953.1 29,534.2 11,480.0 (15.6%) 525.0 (2Q) 62,135.0 24,380.0 23,665.0 13,790.0 (22.2%) 300.0 (3Q) 73,770.8 22,964.2 32,610.0 18,196.6 (24.7%) 0.0 (4Q) 60,936.8 24,050.0 22,686.8 14,175.0 (23.3%) 25.0 270,334.8 103,347.3 108,495.9 57,641.6 (21.3%) 850.0 2014 (1Q) 51,634.7 17,585.0 25,792.2 7,842.5 (15.2%) 415.0 (2Q) 74,629.6 23,893.7 30,852.3 19,363.6 (25.9%) 520.0 (3Q) 59,777.3 25,537.3 22,550.0 10,875.0 (18.2%) 815.0 (4Q) 52,721.1 21,975.0 28,906.1 1,840.0 (3.5%) 0.0 238,762.7 88,991.0 108,100.6 39,921.1 (16.7%) 1,750.0 2015 (1Q) 76,059.5 23,184.2 44,785.3 8,090.0 (10.6%) 0.0 (2Q) 74,048.0 21,219.0 40,656.8 12,052.1 (16.3%) 120.0 (3Q) 31,740.0 14,770.0 12,675.0 4,295.0 (13.5%) 0.0 ytd Totals 181,847.5 59,173.3 98,117.1 24,437.1 (13.4%) 120.0 2013 Totals 2014 Totals Source: Bank of America Merrill Lynch ($ millions) (CCC % H.Y.) NR 20 New Issuance: European High-Yield Bond Market Face Values (US$) 2005 – 2015 (3Q) Annual Currency Total BB B CCC (CCC % HY) NR USD EUR GBP 2005 19,935.6 1,563.3 11,901.0 5,936.6 (29.8%) 534.8 2,861.0 15,080.3 1,668.3 2006 27,714.6 5,696.2 16,292.1 5,020.5 (18.1%) 705.9 7,657.8 19,935.7 121.1 2007 18,796.7 5,935.3 11,378.5 562.0 (3.0%) 920.9 4,785.5 12,120.9 1,890.3 2008 1,250.0 1,250.0 25,093.1 2009 41,510.3 18,489.4 16,697.4 4,771.3 (11.5%) 1,552.2 12,315.0 28,696.9 498.3 2010 57,636.5 22,751.3 29,050.5 2,170.7 (3.8%) 3,663.9 12,775.0 43,147.7 1,403.3 2011 60,435.8 24,728.9 29,919.7 4,108.7 (6.8%) 1,678.6 16,720.0 33,758.0 8,842.4 2012 65,516.1 27,001.7 29,013.0 7,186.7 (11.0%) 2,314.6 28,198.0 32,270.4 2,929.3 2013 (1Q) 27,954.5 6,783.8 15,008.4 5,160.6 1,001.7 10,050.0 12,380.7 4,837.4 (2Q) 30,335.3 6,860.2 19,295.1 3,724.1 455.9 9,913.0 14,149.9 6,074.0 (3Q) 16,558.4 3,375.3 9,609.6 2,721.8 851.7 5,310.0 8,644.0 2,604.4 (4Q) 16,655.9 2,588.0 10,657.6 2,366.4 1,043.9 5,210.0 9,086.5 2,359.4 2013 Totals 91,504.1 19,607.3 54,435.2 13,972.9 (15.3%) 3,353.2 30,483.0 44,125.6 15,875.3 2014 (1Q) 27,169.2 12,565.7 11,685.2 1,230.0 (4.5%) 1,688.3 7,315.0 16,352.8 3,501.4 (2Q) 65,671.4 13,730.1 45,808.3 4,111.1 (6.2%) 2,021.9 23,150.0 36,009.0 6,096.7 (3Q) 15,980.5 3,586.3 10,593.2 1,241.3 (7.8%) 559.7 2,750.0 8,216.2 4,744.6 (4Q) 10,646.9 3,893.7 4,288.8 654.5 (6.1%) 1,810.0 6,305.0 4,341.9 119,468.0 33,775.8 72,375.4 7,236.9 (5.1%) 6,080.0 39,520.0 64,919.9 14,342.7 2015 (1Q) 30,535.5 15,387.8 10,054.6 938.7 (3.1%) 4,154.3 10,225.0 17,149.0 2,622.0 (2Q) 25,838.7 11,282.6 11,633.7 2,334.6 (9.0%) 587.8 12,465.0 11,124.8 1,782.2 (3Q) 12,605.5 2,068.1 10,125.9 411.5 (3.2%) 5,850.0 5,170.1 1,585.4 ytd Totals 68,979.8 28,738.6 31,814.2 3,684.8 (5.3%) 28,540.0 33,443.9 21 5,989.6 2014 Totals Source: BoAML Ratings 1,250.0 4,742.1 High-Yield Bond Market Proportional Outstandings by Seniority 1998 – 2014 Senior Secured Senior Unsecured Subordinated 90% 75% 60% 45% 30% 15% Sources: S&P Capital IQ LCD and NYU Salomon Center calculations. 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 0% 22 Default Rates by Seniority: 1998-2014 Default Rate (%) Year All Seniorities (%) Senior Secured (%) Senior Unsecured (%) Subordinated (%) 1998 1999 1.60 3.15 1.67 1.02 4.15 15.60 2.61 5.62 2000 5.07 18.82 2.47 7.41 2001 9.80 43.43 9.29 5.77 2002 12.79 50.68 12.74 1.87 2003 4.66 14.30 4.13 2.20 2004 1.25 4.44 0.78 0.16 2005 3.37 13.46 2.20 0.49 2006 0.76 1.35 0.69 0.55 2007 0.51 2.10 0.27 0.63 2008 4.65 12.14 3.87 4.61 2009 10.74 12.10 10.74 8.77 2010 1.13 2.29 0.79 1.48 2011 1.33 3.22 0.83 0.53 2012 1.62 3.11 1.17 1.51 2013 1.04 2.64 0.63 0.60 2014 2.11 5.51 1.37 0.74 Arithmetic Average Annual Default Rate (%) 3.92 12.26 3.31 2.59 Standard Deviation (%) 3.66 13.88 3.73 2.66 Weighted Average Annual Default Rate *(%) 3.52 6.70 2.97 2.56 Median Annual Default Rate (%) 2.11 5.51 1.67 1.48 Excluding Outlier Years of 2001 and 2002 Arithmetic Average Annual Default Rate (%) 2.93 7.62 2.28 2.42 Standard Deviation (%) 2.58 5.81 2.53 2.70 Weighted Average Annual Default Rate *(%) 2.80 5.44 2.26 2.40 Median Annual Default Rate (%) 1.62 4.44 1.37 1.02 *Weighted by par value amount outstanding in each seniority category, for each year. Sources: S&P Capital IQ LCD and NYU Salomon Center calculations. 23 U.S. & European High-Yield Bond Market: New Issuance ($ millions) 2005 – 2015 (3Q) 300,000 280,450.3 270,334.8 250,000 238,762.7 200,000 184,571.0 150,000 100,000 131,915.9 132,689.1 127,419.3 119,468.0 91,504.1 81,541.8 57,636.5 60,435.8 50,747.2 76,059.5 74,048.0 65,516.1 41,510.3 50,000 19,935.6 27,714.6 30,535.5 25,838.731,740.0 12,605.5 18,796.7 1,250.0 U.S. Source: Bank of America Merrill Lynch 3Q15 2Q15 1Q15 2014 2013 2012 2011 2010 2009 2008 2007 2006 0 2005 New Issuance ($ millions) 229,307.4 Europe 24 U.S. & European High-Yield Bond Market: CCC Rated New Issuance (%) 2005 – 2015 (3Q) 40% 30% 29.8% 25.9% 21.7% 20% 21.3% 19.3% 19.2% 18.1% 17.4% 15.3% 18.2% 16.3% 16.7% 15.3% 15.2% 13.5% 13.4% 11.6% 11.5% 10% 8.0% 3.0% 11.0% 10.6% 6.8% 5.1% 4.5% 3.8% n/a 9.0% 7.8% 6.2% 6.1% 5.3% 3.5% 3.2% 3.1% U.S. Source: Bank of America Merrill Lynch 3Q15 2Q15 1Q15 1Q-3Q15 4Q14 3Q14 2Q14 1Q14 2014 2013 2012 2011 2010 2009 2008 2007 2006 0% 2005 New Issuance Rated CCC (%) 37.4% Europe 25 New Issues Rated B- or Below, Based on the Dollar Amount of Issuance (1993 – 2015 (3Q)) 70.00% 60.00% 51.25% 50.00% 40.75% 39.06% 40.00% 33.57% 32.97% 33.00% 30.41% 27.27% 30.00% 23.35% 20.00% 31.95% 31.56% 29.22% 29.62% 29.19% 27.04% 26.73% 26.13% 29.55% 18.16% 21.48% 21.38% 19.40% 23.44% 26.34% 24.34% 20.71% 14.02% 13.73% 14.16% 12.13% 10.00% 0.00% 9 19 3 94 995 996 997 998 999 000 001 002 003 004 005 006 007 008 009 010 011 012 013 014 14 14 Q14 14 3Q) Q15 Q15 Q15 2 19 1 1 1 1 1 2 2 2 2 2 2 2 2 2 2 2 2 2 2 3 1 2 3 1Q 2Q 4 Q 15 ( 20 Source: S&P Capital IQ LCD 26 Mortality Rates by Original Rating All Rated Corporate Bonds* 1971-2014 Years After Issuance 1 2 3 4 5 6 7 8 9 10 AAA Marginal Cumulative 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.01% 0.01% 0.02% 0.03% 0.01% 0.04% 0.00% 0.04% 0.00% 0.04% 0.00% 0.04% AA Marginal Cumulative 0.00% 0.00% 0.00% 0.00% 0.22% 0.22% 0.08% 0.30% 0.02% 0.32% 0.01% 0.33% 0.01% 0.34% 0.01% 0.35% 0.02% 0.37% 0.01% 0.38% A Marginal Cumulative 0.01% 0.01% 0.03% 0.04% 0.13% 0.17% 0.14% 0.31% 0.11% 0.42% 0.07% 0.49% 0.02% 0.51% 0.26% 0.77% 0.08% 0.85% 0.05% 0.90% BBB Marginal Cumulative 0.34% 0.34% 2.38% 2.71% 1.28% 3.96% 1.01% 4.93% 0.51% 5.41% 0.23% 5.63% 0.27% 5.88% 0.15% 6.03% 0.15% 6.17% 0.35% 6.50% BB Marginal Cumulative 0.95% 0.95% 2.03% 2.96% 3.90% 6.75% 1.97% 8.58% 2.35% 10.73% 1.53% 12.10% 1.47% 13.39% 1.13% 14.37% 1.45% 15.61% 3.15% 18.27% B Marginal Cumulative 2.86% 2.86% 7.74% 10.38% 7.86% 17.42% 7.81% 23.87% 5.71% 28.22% 4.46% 31.42% 3.56% 33.86% 2.09% 35.24% 1.77% 36.39% 0.76% 36.87% CCC Marginal Cumulative 8.15% 8.15% 12.44% 19.58% 17.92% 33.99% 16.35% 44.78% 4.68% 47.37% 11.53% 53.43% 5.45% 55.97% 4.86% 58.11% 0.69% 58.40% 4.30% 60.19% *Rated by S&P at Issuance Based on 2,847 issues Source: Standard & Poor's (New York) and Author's Compilation 27 CCC New Bond Issuance by Purpose 2015 (3Q) U.S. Europe (2Q)* Refinancing 40.62% 51% M&A 29.65% 37% LBO 26.51% Recap/Dividends 3.23% Corporate Purpose 0.00% Project Financing 0.00% Total *All High-yield Source: Standard & Poor’s LCD & Credit Suisse 100% 12% 100% 28 Maturity Profile of Leveraged Debt – As of 12/31/14 250 228 228 200 200 184 $ (Billions) 171 156 155 150 106 100 98 84 72 59 50 35 22 18 0 58 19 1 13 0 0 0 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 Bonds Source: S&P Capital IQ LCD Institutional Loans 29 Distribution of Years to Default from Original Issuance Date: 1991 – 3Q 15 20% 18% % of All Defaulted Issues 16% 14% 12% 10% 8% 6% 4% 2% 0% 1 2 Source: NYU Salomon Center 3 4 5 6 # of Years to Default Since Issued 7 8 9 10+ 30 Purchase Price Multiples Purchase Price Multiple excluding Fees for LBO Transactions 14x 11.6 12x 9.9 10x 9.8 9.7 9.1 8.4 8x 8.3 8.1 7.4 7.4 7.5 6.9 6.7 6.7 6x 6.2 6.7 6.3 7.0 8.1 8.8 8.7 8.9 8.8 7.8 8.0 8.2 8.5 8.7 10.1 9.7 9.0 8.8 7.3 6.8 5.2 4x 2x N/A 0x 1998 (# obs.) (90) 1999 (133) 2000 (116) 2001 (51) 2002 (40) 2003 (66) 2004 (127) 2005 (134) 2006 (178) 2007 (207) 2008 (69) Public-to-Private Source: S&P Capital IQ LCD 2009 (23) N/A 2010 (78) 2011 (87) 2012 (97) 2013 (95) 2014 (136) 1Q3Q15 (101) 3Q15 (35) All Other 31 Average Total Debt Leverage Ratio for LBO’s: Europe and US with EBITDA of €/$50M or More 7.0x 6.6 6.2 5.8 5.8 6.0x 5.5 5.0x 4.5 4.4 4.7 4.8 5.4 5.5 5.3 4.9 4.9 4.6 4.5 4.1 4.7 5.4 5.3 5.2 5.3 5.0 4.9 4.8 5.7 4.5 4.0 4.0x 3.0x 2.0x 1.0x 0.0x 2002 2003 2004 2005 2006 2007 Europe Source: S&P Capital IQ LCD 2008 2009 2010 2011 2012 2013 2014 JanSep 15 US 32 LBO Statistics & Ratios: 2007 vs. 2014 (update 3Q 15) 2007 2014 1Q-3Q15 62% 47% 56% 9.1-9.9x 9.7-9.8x 9.7-11.6x Debt to EBITDA @ Inception 6.2x 5.8x 5.7x EBITDA to Cash Interest 2.1x 3.4x 3.0x Equity Contribution 31% 37% 41% M&A/LBO as a % of Total Issuance Purchase Multiple Source: Guggenheim Investments and S&P Capital IQ 33 Share of Large LBOs with Leverage More than 7x* 2004 – 3Q 2015 35% 30% 25% 20% 15% 10% 5% * Issuers with EBITDA >$50mm. Source: S&P Capital I.Q. 1Q-3Q15 2014 2013 2012 2011 N/A 2009 2008 2007 2006 2005 2004 N/A 2010 0% 34 Lenders Leave the Lite On 2003 – 2Q 2014 35