CD Investment Proposal

advertisement

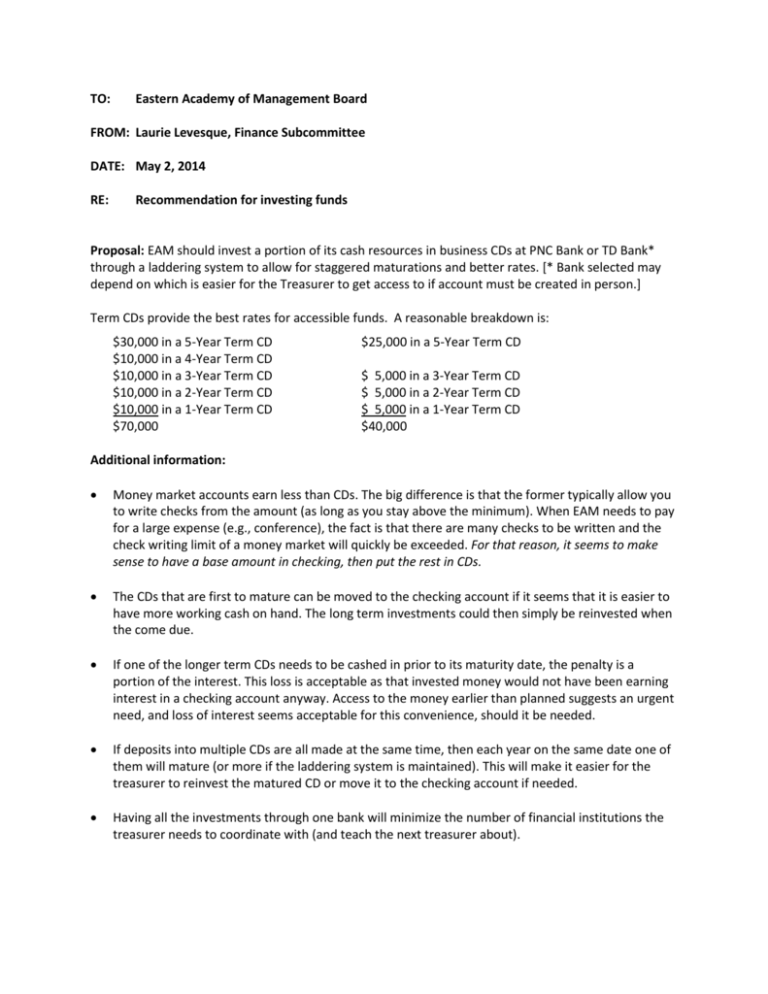

TO: Eastern Academy of Management Board FROM: Laurie Levesque, Finance Subcommittee DATE: May 2, 2014 RE: Recommendation for investing funds Proposal: EAM should invest a portion of its cash resources in business CDs at PNC Bank or TD Bank* through a laddering system to allow for staggered maturations and better rates. [* Bank selected may depend on which is easier for the Treasurer to get access to if account must be created in person.] Term CDs provide the best rates for accessible funds. A reasonable breakdown is: $30,000 in a 5-Year Term CD $10,000 in a 4-Year Term CD $10,000 in a 3-Year Term CD $10,000 in a 2-Year Term CD $10,000 in a 1-Year Term CD $70,000 $25,000 in a 5-Year Term CD $ 5,000 in a 3-Year Term CD $ 5,000 in a 2-Year Term CD $ 5,000 in a 1-Year Term CD $40,000 Additional information: Money market accounts earn less than CDs. The big difference is that the former typically allow you to write checks from the amount (as long as you stay above the minimum). When EAM needs to pay for a large expense (e.g., conference), the fact is that there are many checks to be written and the check writing limit of a money market will quickly be exceeded. For that reason, it seems to make sense to have a base amount in checking, then put the rest in CDs. The CDs that are first to mature can be moved to the checking account if it seems that it is easier to have more working cash on hand. The long term investments could then simply be reinvested when the come due. If one of the longer term CDs needs to be cashed in prior to its maturity date, the penalty is a portion of the interest. This loss is acceptable as that invested money would not have been earning interest in a checking account anyway. Access to the money earlier than planned suggests an urgent need, and loss of interest seems acceptable for this convenience, should it be needed. If deposits into multiple CDs are all made at the same time, then each year on the same date one of them will mature (or more if the laddering system is maintained). This will make it easier for the treasurer to reinvest the matured CD or move it to the checking account if needed. Having all the investments through one bank will minimize the number of financial institutions the treasurer needs to coordinate with (and teach the next treasurer about). Suggested banks: We need to select a bank that supports business accounts. The rates below were updated on May 2, 2014: 7-Year Term CD rate 5-Year Term CD rate 4-Year Term CD rate 3-Year Term CD rate 2-Year Term CD rate 1-Year Term CD rate PNC 1.19 1.00 0.75 0.40 0.35 0.20 TD 0.90 0.65 0.50 0.30 0.20 Chase 0.55 0.55 0.40 0.40 0.25 0.15 Wells 0.35 0.35 (for $25k) 0.25 (for $10k) 0.20 (for $10k) 0.15 (for $10k) 0.05 (for $10k) BANKS PNC – small business CDs require only $1K minimum deposit. To open an account, must do so in person, therefore treasurer would need to have a branch in his/her state. www.pnc.com 800-762-5684 TD – small business CDs require $5K minimum deposit. Tried to steer us away from 5 year CD since it would lock us in and rates may be rising. But earning 0.20% for a few years in case rates go up seems like a smaller loss compared to five years at 0.90% where the last two might be lower than market if there’s a huge improvement. www.tdbank.com Chase – Rates are for $10K minimum and require any linked business checking account except Public Funds Checking, Chase Nonprofit BusinessClassicSM Checking, IOLTA/COLTAF/CARHOF and Client Funds Checking at account opening and at each renewal. Wells Fargo - Business Time Account CD earns a guaranteed rate of interest for the term you select. Business CDs require a minimum opening deposit of $2,500. The rates above are related to a special offer if opening CD with $5K. https://www.wellsfargo.com/biz/products/accounts/savings/time_account GE Capital Bank – organizations invest in “commercial accounts” and those CDs each require a minimum of $25,000. This would not work for our laddering proposal. CIT Bank - the online consumer bank of CIT Group Inc. does not allow organizations to invest in CDs, only individuals. Bank of America – Standard Business Longer Term CD seem restricted to 0.01-0.15% . Other CDs offered to business are 1 year or shorter. https://www.bankofamerica.com/smallbusiness/cd-savings-accounts.go#CDs_Heading US Bank – has business CDs. The terms included this, which didn’t seem in keeping with other banks that let you roll over the CD with same terms or choose another term/rate: “Offer good for the initial term only. CD is automatically renewed for the same term into a Standard CD based on the published rate for the closest standard term that is equal to or less than term of the CD.” https://www.usbank.com/small-business/savings/business-cds.html