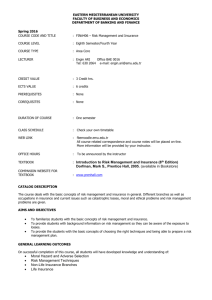

IMAC-CaptiveBasics-Week-2-UW-Reserving

advertisement

Introduction to Insurance Practice UNDERWRITING & CLAIMS RESERVING 1 Presentation Overview Personal Introduction Introduction to Insurance Insurance Coverage Types / Varieties Underwriting & insurance documentation Claims reserving 2 Personal Introduction Lori-Ann Maxwell - Manager FRM / Actuarial Services (KPMG in the Cayman Islands ) Helen Stephenson – VP & Senior Underwriter (Aon Cayman) 3 Module 1 Introduction to Insurance Introduction to Insurance #1 Insurance & Risk Risk – many definitions/meanings chance of having an accident possibility of winning on lottery hurricane affecting Cayman new restaurant succeeding will new apartment be worth more or less than you paid for it likelihood of car being broken into 5 Introduction to Insurance #2 Insurable Risks Financial / Non-Financial Pure / Speculative Particular / Fundamental Fortuitous event to the Insured Insurable Interest Not contrary to public policy Homogeneous exposures 6 Introduction to Insurance #3 Components of Risk Uncertainty Level of Risk – frequency / severity Peril – that which gives rise to a loss Hazard – that which influences effect of the peril Physical hazard Moral hazard 7 Introduction to Insurance #4 Pooling of risk Basic concept of insurance is that the losses of the few who suffer misfortune are met by contributions of the many who are exposed to similar potential loss Law of large numbers Equitable premiums 8 Introduction to Insurance #5 Function of insurance Primary function of insurance is to act as a risk transfer mechanism, i.e. to transfer a risk from one person, the insured, to another, the insurer. The insured exchanges a large unknown financial risk for a much smaller known premium. 9 Introduction to Insurance #6 Insurance Distinctions General / Non Life Life / Long Term Personal Business / Commercial Property Casualty / Liability Marine Non-Marine Statutory Non-Statutory 10 Introduction to Insurance #7 Classes of Insurance (Lines of Business) Personal insurances House / Home – buildings, contents, personal effects, valuables, liability Car / Auto – liability to third parties, damage to own vehicle Personal accident Life insurance Boat insurance - liability to third parties, damage to own vessel 11 Introduction to Insurance #8 Classes of Insurance (Lines of Business) Commercial insurances Auto Fleet Workers’ Compensation / Employer’s Liability Comprehensive General Liability & Products Liability Property – fire & perils; theft; engineering breakdown Pecuniary Covers – fidelity guarantee; legal expenses; credit; business interruption Marine - Cargo; Hull; War; Protection & Indemnity / Marine Liabilities Professional Indemnity; Medical Professional Liability Employee benefits - Accidental death & disablement; long term disability 12 Module 2 Insurance Coverage Types Reinsurance vs. Insurance Insurance contracts Transaction whereby Party A indemnifies Party B for loss covered under the terms of the contract. Uncertainty exists over the loss amount and when the loss will be paid (underwriting risk and timing risk). Losses covered must be insurable risks – losses sustained in gambling on a horse race is not deemed to be an insurable risk. Reinsurance contracts Transaction where reinsurer agrees to indemnify a ceding insurer against all or part of a loss that the ceding insurer sustains in an underlying insurance policy. In summary is insurance for insurers Retrocession involves reinsurance for reinsurers Flow of Insurance Insurable Risks Underwriting Insured Ceding Retrocede Insurance Reinsurance Company Company Retrocessionaire Why Reinsure? Stability – insurers may wish to retain risk of loss up to specific limits per occurrence or in aggregate, therefore reinsuring losses above these limits. Surplus relief – increases the capacity of the insurer to take on additional risks than it might prudently consider on a stand alone basis. Catastrophe Protection – special forms of reinsurance allow insurers obtain protection from excess losses arising from a single event (e.g: a hurricane). Underwriting Expertise – reinsurers deal with a variety of primary insurers and therefore accumulate apt knowledge of an industry, loss experiences as well as methods of underwriting and handling of claims. Withdraw from a Line of Business – to avoid serious costs of canceling policies and refunding premiums, insurers who wish to discontinue a line of business can reinsure the unwanted business. As a vehicle for off-shore Captives – this reason for reinsurance is more common for the Cayman Islands Insurance industry. Types of Reinsurance Facultative QuotaShare Excess of Loss Treaty/ Obligatory QuotaShare Excess of Loss Types of Reinsurance (continued) Facultative reinsurance: The ceding insurer is free to choose whether or not to offer an individual policy to a reinsurer and the reinsurer is free to choose whether or not to accept the policy on a policy by policy basis. Treaty/ Obligatory reinsurance: A treaty exists between the insurer and the reinsurer whereby the insurer agrees to cede and the reinsurer is obliged to accept all the policies consistent with the treaty. Treaties are renewed on a regular basis. Which of these two structures carries more risk? Basic Types of Reinsurance Excess of loss: Covers losses in excess of a specific limit or attachment point. Limits can be per claim, per occurrence and/or per aggregate/stop loss limit. Primary Coverage – First dollar losses up to prescribed per loss limit Excess coverage - Coverage provided above a prescribed limit Purpose is to stabilize severity of losses retained. Quota Share Reinsurance: The reinsurer accepts a stated percentage of each and every risk within a defined category of business on a pro-rata basis Participation in each risk is fixed and certain. Often used where the risk of variability is low. Premiums and losses are shared in the same proportion. Basic Types of Reinsurance Catastrophe: Covers large claims arising from infrequent events May be for a specific peril (hurricane) for general risks during a time period Provides protection against events that are low frequency, but have great magnitude of severity Coverage is event based and across insurer’s portfolio of policies Aggregate / Stop loss: Covers the insurers losses above a predetermined total amount for a specified period Applied to the entire book of business reinsured. Insurance Coverage Types Occurrence basis Insurable events occurring during a policy period are covered regardless of when they are reported. Losses under occurrence based contract are accounted for when incident arises. Difficult to determine when lengthy reporting lags exist, and unforeseen claim events are significant issues Claims-made basis Insurable events are covered in the period when they are reported, regardless of when they occurred (subject to retroactive dates). Losses under claims-made contracts are accounted for when claim is reported. Loss exposure increases in each renewal (as program matures). Insurance Coverage Types Claims-made contracts (cont) For claims reported in a policy period the retroactive date is a cut-off date in terms of how far back an occurrence date can be for the claim to be covered Extended reporting date (tail coverage) is an endorsement that covers claims reported after the policy expiry date for occurrences within the policy period up to a certain date in the future, if a claims contract was not renewed. Common concerns with claims-made and occurrence For claims-made tail coverage must be recognized on the Parent’s books. Use of retroactive dates and extended reporting dates have major impact on reserves. Gaps may arise for companies switching between claims-made and occurrence on subsequent renewals Consecutively renewed claims-made policies with same loss limits and consistent retro dates may yield very different loss exposures, and can impact ultimate loss levels. Module 3 Underwriting 23 Underwriting #1 Function of Underwriter Accepts risk on behalf of the insurer/reinsurer Assesses the risk of each insured/reinsured Decides whether to accept the risk / how much to accept Determines terms, conditions and scope of cover Calculates a premium to cover expected claims, provide a reserve, meet expenses and (generally) provide a profit 24 Underwriting #2 Determining the price Depends on class of insurance Car / auto insurance rate tables – Drivers: age, experience, driving record Vehicle: age, performance, cost/ease of repairs, crash test results In general Rate x exposure (payroll, sum insured, number of vehicles) Actuarially determined 25 Underwriting #3 Policy of insurance Insurance policy is a legally binding agreement between the insured and an insurance company. Unlike most contracts, it is a promise to fulfill obligations in future. Insured’s duty to disclose material facts – principle of Utmost good faith Insurer drafts and any ambiguity normally ruled in favour of insured (Contra proferentem) Wording therefore of utmost importance. 26 Underwriting #4 Typical insurance policy Declarations – Insured, Insurer, Period, Limits, Deductibles, Premium Definitions - Define important terms used in the policy language. Insuring agreement - Describes the covered perils, or risks assumed, or nature of coverage, or makes some reference to the contractual agreement between insurer and insured. It summarizes the major promises of the insurance company, as well as stating what is covered. Exclusions take coverage away from the Insuring Agreement by describing property, perils, hazards or losses arising from specific causes which are not covered by the policy. Conditions - Provisions, rules of conduct, duties and obligations required for cover to apply. If policy conditions are not met, the insurer may be able to deny the claim. Endorsements Signature 27 Underwriting # 5 Insurance Policy - Direct Contract between Insured and Insurer With captives typically no broker involved. Insurance Binder - Issued prior to policy. Superseded by Policy. Insurer to Broker. Reinsurance Agreement between Reinsured and Reinsurer - Contract Placement Slip - Temporary agreement of reinsurance terms and conditions arrangements for which coverage has been effected Cover Note - Issued prior to policy. Superseded by Policy. Broker to Insured. Insurance Certificate - Certificate evidences coverage. Does not provide cover in its own right. 28 Underwriting #5 Common Issues with Policies Policy Endorsements must be issued in respect of all amendments to cover (not only in respect of premium adjustments). Policy endorsements / contract addenda should be kept with and form part of the policy. Previously issued policies must be formally cancelled and replaced once the decision to issue a revised policy has been made. Where captive does not retain 100% exposure but cedes in part or in whole to reinsurers we need to be very careful about Difference in Conditions / Differences in Limits (DIC/DIL) exposure to captive. Stamp Duty Payments Signing Authority & Location 29 Underwriting #6 Insurance Certificates Certificates are used for informational purposes only. Certificates do not change coverage or terms of the insurance contract. Refrain from using “ … is added as additional insured” Party to which the Certificate of Insurance is given does not become a part of the insurance contract, they generally gain no rights as a result of receiving the insurance certificate. The certificate of insurance only informs them that the coverage existed at the time the certificate of insurance was issued. Most certificates read “THIS CERTIFICATE IS ISSUED AS A WRITTEN MATTER OF INFORMATION ONLY AND CONFERS NO RIGHTS UPON THE CERTIFICATE HOLDER. THIS CERTIFICATE DOES NOT AMEND, EXTEND OR ALTER THE COVERAGE AFFORDED BY THE POLICIES BELOW”. Notice of Cancellation - the certificate of insurance does not grant the holder of the certificate any rights (informational purposes only) therefore no notice of cancellation is required. Often a party with a valid insurable interest will request a certificate of insurance. Examples include additional interest insureds, lessors, mortgagees etc.. These interests need to be added to the policy by endorsement, if not already included. Issuing a certificate of insurance does not change the policy. 30 Module 4 Claims Cycle & Reserving Claims Cycle For an insurance company, claims develop through a claims cycle whose length and timing depends on the nature of the underlying risk and the type and level of coverage provided. The claims cycle is as follows: - Occurrence - Reporting - Establishing an initial reserve - Updating initial reserve estimates - Settlement - Closure Life Cycle of a Claim Case Evaluation and Reserving 150 Settlement Negotiation Value ($000s) 100 Investigation 75 Assignment Registration Report 15 Event 0 6 12 24 36 Loss Estimation At a given point in time (the evaluation date), there is less than complete information as claims are at various stages of the life cycle. Consequently, an insurance company or reinsurance company has to rely on estimates to determine the ultimate cost of claims that will be settled at future dates. Estimates of ultimate claims cost are important and are required to satisfy: Business Requirements – Premium / Funding & Loss Reserves Regulatory Reporting Accounting Standards /Financial Reporting Actuaries assist in providing estimates of ultimate claims settlement costs 34 Who Are Actuaries / What Do They Do? Actuaries apply mathematical & statistical models and business judgment to evaluate and quantify risk, as it pertains to the possible outcomes and consequences (financial and otherwise) associated with uncertain future events. An actuary is a business professional who analyzes the financial consequences of risk. Actuaries use mathematics, statistics, and financial theory to study uncertain future events, especially those of concern to insurance and pension programs. Key Terms in the Definitions of Actuaries • Risk • Financial Consequences • Mathematics and Statistics • Financial Theory • Uncertain Future Events Actuarial Studies Funding and Reserving Actuarial Studies for Insurance captives can take the form of either a funding study or a reserving study. Funding Study: - Prospective in nature. - Covers anticipated events that have not occurred. - Mainly used to set premiums for future periods. Reserve Study: - Retroactive in nature. - Covers events that have occurred and are reported but not settled, events that have occurred but not been reported and events that have been reported but not recorded. - Mainly used to assist in setting loss reserves for financial reporting purposes. Actuarial Estimates Ultimate Losses Are Made Up of Three Key Components Paid losses (reported and paid) Case reserves (reported and estimated) IBNR (unreported and estimated) A Critical Aspect of the Actuary’s Work is Estimating IBNR How do we value IBNR liability Actuary – projects ultimate losses. Total reserve = ultimate losses minus cumulative paid losses Total reserve = case reserves plus IBNR Components of IBNR Losses occurring but not reported as of an evaluation date Adverse development on case reserves Reported but unrecorded claims (pipeline claims) Reopened claims Actuarial Methods Paid Loss Development Reported (Incurred) Loss Development Case Reserve Development Frequency-Severity Bornhuetter-Ferguson Expected Loss -Loss rate per Exposure Unit Actuarial Assumptions & Estimation Issues INTERNAL Availability and reliability of Loss experience Data Consistency of Exposure EXTERNAL Loss and Exposure Trends and Leveraging Effect Judicial and Legislative Venues Economic Factors: Unemployment and Interest Rates Changes in Case Reserving and claims handling Claims reporting lags (significant for GL) Potential for Catastrophe- Property Terrorism Issue - Potential Casualty Catastrophe Benefit Changes / Statutory Benefits- Workers Comp Inherent volatility- Med-mal UNANTICIPATED Contract Interpretation- Asbestos, Pollution Unanticipated Claims- Mold, Pandemics