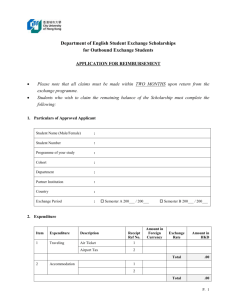

MRCS FIN REG (Final English Version)

advertisement