This assignment is part of the instructor designated points. A

advertisement

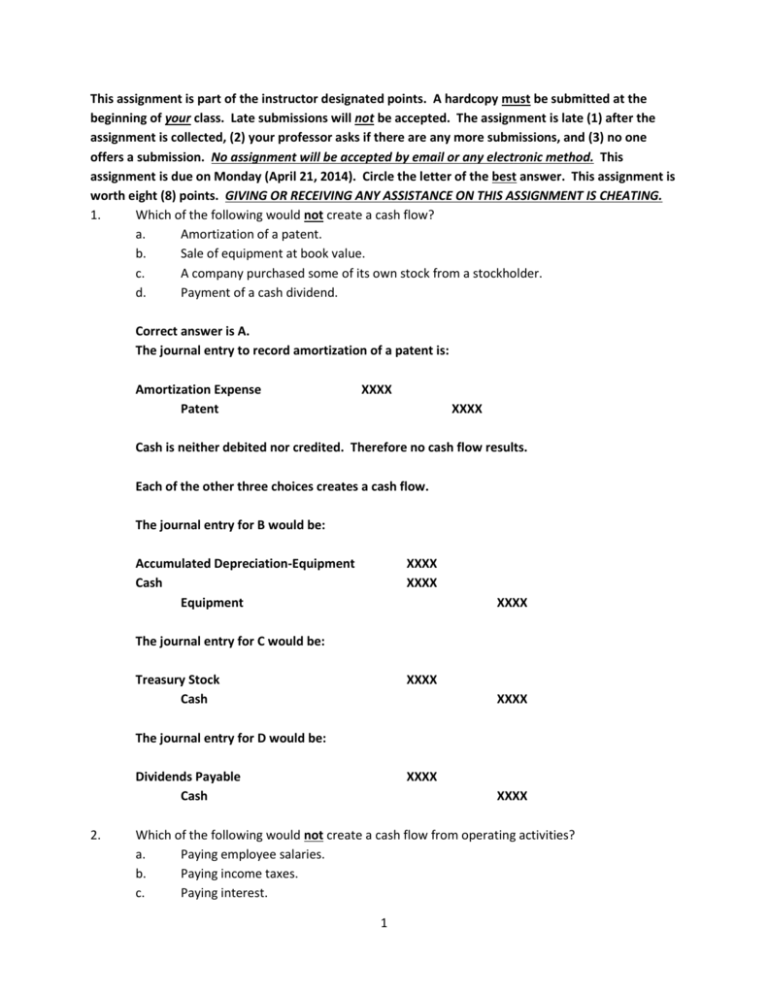

This assignment is part of the instructor designated points. A hardcopy must be submitted at the beginning of your class. Late submissions will not be accepted. The assignment is late (1) after the assignment is collected, (2) your professor asks if there are any more submissions, and (3) no one offers a submission. No assignment will be accepted by email or any electronic method. This assignment is due on Monday (April 21, 2014). Circle the letter of the best answer. This assignment is worth eight (8) points. GIVING OR RECEIVING ANY ASSISTANCE ON THIS ASSIGNMENT IS CHEATING. 1. Which of the following would not create a cash flow? a. Amortization of a patent. b. Sale of equipment at book value. c. A company purchased some of its own stock from a stockholder. d. Payment of a cash dividend. Correct answer is A. The journal entry to record amortization of a patent is: Amortization Expense Patent XXXX XXXX Cash is neither debited nor credited. Therefore no cash flow results. Each of the other three choices creates a cash flow. The journal entry for B would be: Accumulated Depreciation-Equipment Cash Equipment XXXX XXXX XXXX The journal entry for C would be: Treasury Stock Cash XXXX XXXX The journal entry for D would be: Dividends Payable Cash 2. XXXX XXXX Which of the following would not create a cash flow from operating activities? a. Paying employee salaries. b. Paying income taxes. c. Paying interest. 1 d. e. Paying a supplier. Paying a cash dividend. Correct Answer is E. Paying a cash dividend is a financing activity. The other four choices are all operating activities. 3. DMG Company provided the following information pertaining to its 2014 operations. Net Income Accounts receivable decreased Prepaid insurance increased Depreciation expense was Wages payable decreased Unearned revenue increased $100,000 30,000 2,000 5,000 4,000 10,000 DMG Company’s net cash inflow from operating activities is a. b. c. d. e. $ 61,000. $129,000. $139,000. $147,000. $151,000. Correct Answer is C. Net Income Plus decrease in accounts receivable Minus increase in prepaid insurance Plus depreciation expense Minus decrease in wages payable Plus increase in unearned revenue Net Cash Inflow from Operating Activities 4. $100,000 30,000 (2,000) 5,000 (4,000) 10,000 $139,000 DMG Company provided the following information for its 2014 operations: Cash inflow from operating activities Accounts receivable decreased Prepaid insurance increased Depreciation expense was Wages payable decreased Unearned revenue increased $100,000 30,000 2,000 5,000 4,000 10,000 2 What was DMG Company’s net income for 2014? a. b. c. d. e. $ 61,000. $129,000. $139,000. $147,000. $151,000. Correct Answer is A. Net Income Plus decrease in accounts receivable Minus increase in prepaid insurance Plus depreciation expense Minus decrease in wages payable Plus increase in unearned revenue Net Cash Inflow from Operating Activities ?????? 30,000 (2,000) 5,000 (4,000) 10,000 $100,000 Therefore Net Income = Net Cash Inflow from Operating Activities minus increase in unearned revenue plus decrease in wages payable minus depreciation expense plus increase in prepaid insurance minus decrease in accounts receivable. Net Income = $100,000 - $10,000 + $4,000 - $5,000 + $2,000 - $30,000 Net Income = $61,000 5. DMG Company had a balance in Accounts Receivable of $100,000 on January 1, 2014 and $90,000 on December 31, 2014. During 2014 DMG Company had total sales of $1,000,000. $800,000 of the sales were credit sales and $200,000 were cash sales. How much cash did DMG Company collect from customers during 2014? a. $ 790,000. b. $ 810,000. c. $ 990,000. d. $1,010,000. Correct answer is D. Cash collected from customers from credit sales = Credit Sales plus decrease in accounts receivable Cash collected from customers from credit sales = $800,000 + $10,000 = $810,000 3 Total cash collected from customers = Cash collected from customers from credit sales plus cash collected from customers for cash sales Total cash collected from customers = $810,000 + $200,000 = $1,010,000. 6. DMG Company had operating expenses (selling, general, and administrative expenses) of $1,000,000 in 2014. DMG Company’s balance sheet reported accrued liabilities of $1,000,000 and $1,300,000 for 2014 and 2013, respectively. DMG Company paid $400,000 in prepaid expenses during 2014. How much total cash was paid to employees and suppliers of services during 2014? a. $1,000,000. b. $1,100,000. c. $1,400,000. d. $1,700,000. Correct Answer is D. Cash paid to suppliers = Operating expenses plus the decrease in accrued liabilities plus cash paid for prepaid expenses Cash paid to suppliers = $1,000,000 + $300,000 + $400,000 = $1,700,000 7. DMG Company provided the following information for 2014 (all transactions are cash transactions). Purchase of Land Proceeds from Issuing Bonds Payable Inventory purchases Treasury stock purchases Dividends paid to preferred stockholders Proceeds from issuance of preferred stock Proceeds from sale of equipment Equipment purchases $300,000 400,000 900,000 50,000 100,000 800,000 700,000 900,000 The net cash provided (used) by investing activities in 2014 is a. $ (500,000). b. $ 500,000. c. $(1,050,000). d. $ 1,050,000. Correct Answer is A. Purchase of Land Proceeds from Issuing Bonds Payable $300,000 400,000 4 Investing Financing Inventory purchases Treasury stock purchases Dividends paid to preferred stockholders Proceeds from issuance of preferred stock Proceeds from sale of equipment Equipment purchases 900,000 50,000 100,000 800,000 700,000 900,000 Operating Financing Financing Financing Investing Investing Purchase of Land is an outflow (300,000) Proceeds from sale of equipment is an inflow 700,000 Equipment purchases is an outflow (900,000) Net Cash Outflow from Investing Activities $500,000 8. DMG Company provided the following information for 2014 (all transactions are cash transactions). Purchase of Land Proceeds from Issuing Bonds Payable Inventory purchases Treasury stock purchases Dividends paid to preferred stockholders Proceeds from issuance of preferred stock Proceeds from sale of equipment Equipment purchases $300,000 400,000 900,000 50,000 100,000 800,000 700,000 900,000 The net cash provided (used) by financing activities in 2014 is a. $ (500,000). b. $ 500,000. c. $(1,050,000). d. $ 1,050,000. Correct Answer is D. Purchase of Land Proceeds from Issuing Bonds Payable Inventory purchases Treasury stock purchases Dividends paid to preferred stockholders Proceeds from issuance of preferred stock Proceeds from sale of equipment Equipment purchases $300,000 400,000 900,000 50,000 100,000 800,000 700,000 900,000 5 Investing Financing Operating Financing Financing Financing Investing Investing Proceeds from Issuing Bonds Payable is a cash inflow Treasury Stock purchases is a cash outflow Dividends paid to preferred stockholders is an outflow Proceeds from issuance of preferred stock is an inflow Net Cash Inflow from Investing Activities 6 $ 400,000 (50,000) (100,000) 800,000 $1,050,000