Accounting Exercises: Capitalizing Costs & Interest

advertisement

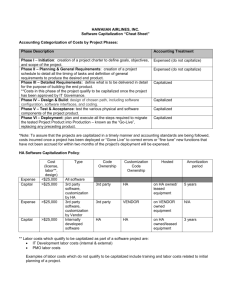

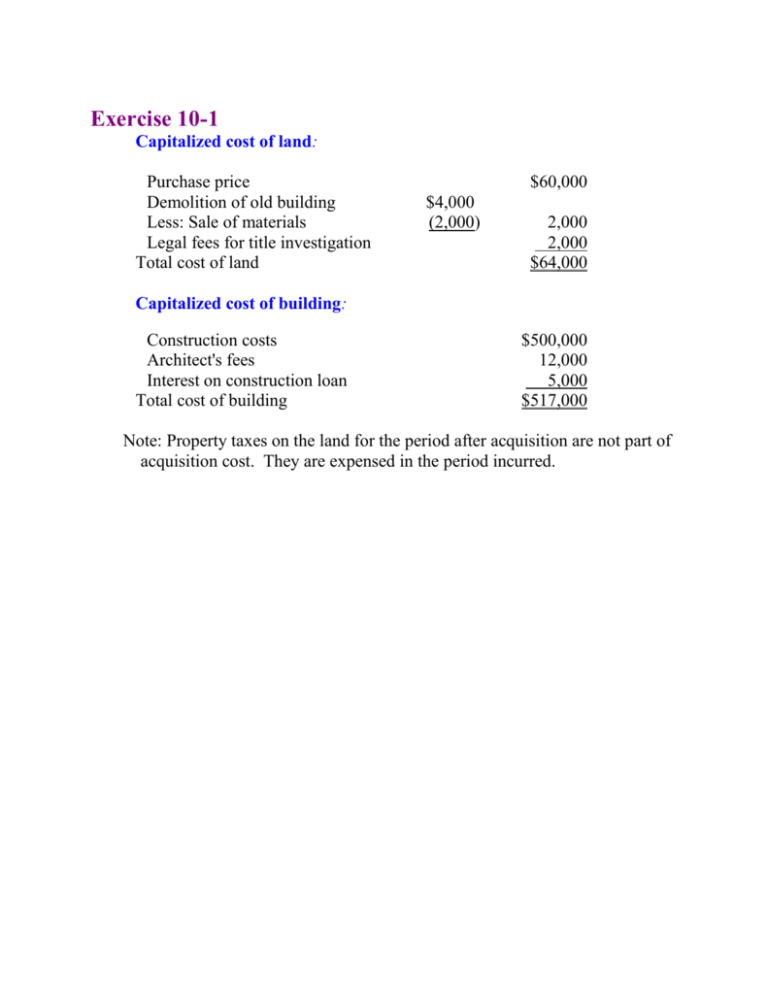

Exercise 10-1 Capitalized cost of land: Purchase price Demolition of old building Less: Sale of materials Legal fees for title investigation Total cost of land $60,000 $4,000 (2,000) 2,000 2,000 $64,000 Capitalized cost of building: Construction costs Architect's fees Interest on construction loan Total cost of building $500,000 12,000 5,000 $517,000 Note: Property taxes on the land for the period after acquisition are not part of acquisition cost. They are expensed in the period incurred. Exercise 10-10 To record the acquisition of land in exchange for common stock. February 1, 2006 Land ................................................................................ Common stock (5,000 shares x $18) ............................... 90,000 90,000 To record the acquisition of a building through purchase and donation. November 2, 2006 Building .......................................................................... 600,000 Cash ........................................................................... 400,000 Revenue - donation of asset (difference) ....................... 200,000 Exercise 10-20 Average accumulated expenditures for 2006: January 2, 2006 March 1, 2006 July 31, 2006 September 30, 2006 December 31, 2006 $500,000 x 600,000 x 480,000 x 600,000 x 300,000 x Interest capitalized: $1,350,000 x 8% = $108,000 12/12 10/12 5/12 3/12 0/12 = $ 500,000 = 500,000 = 200,000 = 150,000 = -0$1,350,000 Exercise 10-21 Average accumulated expenditures for 2006: January 2, 2006 March 31, 2006 June 30, 2006 September 30, 2006 December 31, 2006 $ 600,000 1,200,000 800,000 600,000 400,000 x 12/12 x 9/12 x 6/12 x 3/12 x 0/12 = $ 600,000 = 900,000 = 400,000 = 150,000 = -0$2,050,000 Interest capitalized: $2,050,000 - 1,500,000 x 8.0% = $120,000 550,000 x 10.5%* = 57,750 $177,750 = interest capitalized * Weighted-average rate of all other debt: $5,000,000 x 12% = 3,000,000 x 8% = $8,000,000 $840,000 = 10.5% $8,000,000 $600,000 240,000 $840,000 Exercise 10-22 To expense R&D costs incorrectly capitalized. Research and development expense (below).................... 3,180,000 Patent .......................................................................... 3,180,000 Research and development expenditures: Basic research to develop the technology Engineering design work Development of a prototype Testing and modification of the prototype Total $2,000,000 680,000 300,000 200,000 $3,180,000 To capitalize cost of equipment incorrectly capitalized as patent. Equipment ....................................................................... Patent .......................................................................... 60,000 60,000 To record depreciation on equipment used in R&D projects. Research and development expense ............................... Accumulated depreciation - equipment ...................... 10,000 10,000