Ch 10

advertisement

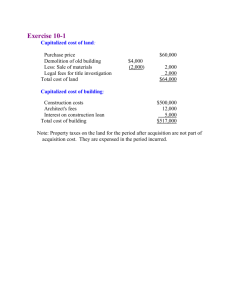

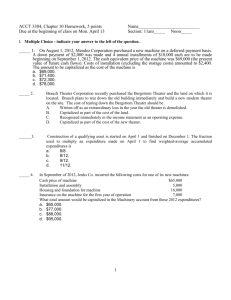

Operational Assets - Property, Plant, and Equipment Chapter 10 Kieso, Weygandt, Warfield Capital Expenditures vs Revenue Expenditures Capital Expenditures – Cash outflows for goods and services that will provide future economic benefit beyond the current period. Assets Cash XXXX XXXX Revenue Expenditures – Cash Outflows for goods and services beneficial only to the current period Expense Cash XXXX XXXX Operational [Tangible] Assets 1. 2. 3. 4. 5. Acquired for use in Operations Not held for resale Expected lives are long-term Must have physical substance Used to generate revenue ** Examples include Equipment, Land, Building Costs to be Capitalized General Rule The initial cost of an operational asset includes the purchase price and all expenditures necessary to bring the asset to its desired condition and location for use. Costs to be Capitalized ---Equipment Net purchase price Taxes Transportation costs Installation costs Modification to building necessary to install equipment Testing and trial runs Costs to be Capitalized ---Land Purchase price Real estate commissions Attorney’s fees Title search Title transfer fees Title insurance premiums Removing old buildings Material costs of improvements that are permanent in nature Land is not depreciable. Costs to be Capitalized ---Land Improvements Separate identifiable costs of Driveways Parking lots Fencing Private roads Costs to be Capitalized ---Buildings Purchase price Architectural fees Cost of permits Excavation costs Construction costs The following expenditures and receipts are related to land, land improvements, and buildings acquired for use in a business enterprise. Identify each expenditure as part of the cost of the land, building, or land improvements asset account. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. Payment for construction from note proceeds - $275,000 Cost of land fill and clearing - $8,000 Delinquent real estate taxes on property assumed by purchaser - $7,000 Architect’s fee on building - $22,000 Cost of real estate purchased as a plant site - [land $200,000 and building $50,000] Commission fee paid to real estate agency - $9,000 Installation of fences around property – $4,000 Cost of razing and removing old building - $11,000 Proceeds from salvage of demolished building - $5,000 Cost of parking lots and driveways - $19,000 Cost of trees and shrubbery planted (permanent in nature) - $14,000 Ground excavation costs for basement of new building - $3,000 Interest paid during construction on money borrowed for construction $13,000 Answer to Question from Previous Slide Land Cost of fill and clearing Delinquent taxes Cost of Land and old Bldg Commission to Realtor Cost of removing old Bldg Proceeds fr old Bldg salvage Cost of trees & shrubs $8,000 $7,000 250,000 $9,000 $11,000 ($5,000) $14,000 $294,000 Building Pmt for construction $275,000 Architect Fee $22,000 Excavation costs $3,000 Interest during construction $13,000 $313,000 Land Improvements Fences $4,000 Parking lots and driveways $19,000 $23,000