ACCT 3304 Chapter 10 Homework: PP&E Accounting

advertisement

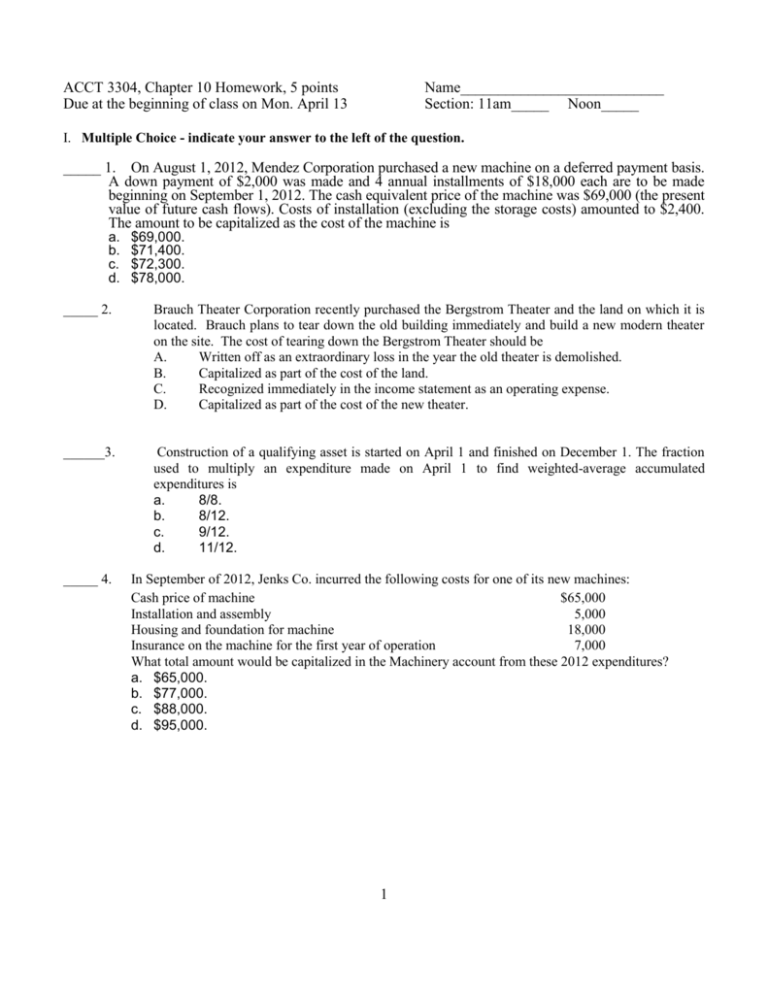

ACCT 3304, Chapter 10 Homework, 5 points Due at the beginning of class on Mon. April 13 Name___________________________ Section: 11am_____ Noon_____ I. Multiple Choice - indicate your answer to the left of the question. _____ 1. On August 1, 2012, Mendez Corporation purchased a new machine on a deferred payment basis. A down payment of $2,000 was made and 4 annual installments of $18,000 each are to be made beginning on September 1, 2012. The cash equivalent price of the machine was $69,000 (the present value of future cash flows). Costs of installation (excluding the storage costs) amounted to $2,400. The amount to be capitalized as the cost of the machine is a. b. c. d. $69,000. $71,400. $72,300. $78,000. _____ 2. Brauch Theater Corporation recently purchased the Bergstrom Theater and the land on which it is located. Brauch plans to tear down the old building immediately and build a new modern theater on the site. The cost of tearing down the Bergstrom Theater should be A. Written off as an extraordinary loss in the year the old theater is demolished. B. Capitalized as part of the cost of the land. C. Recognized immediately in the income statement as an operating expense. D. Capitalized as part of the cost of the new theater. ______3. Construction of a qualifying asset is started on April 1 and finished on December 1. The fraction used to multiply an expenditure made on April 1 to find weighted-average accumulated expenditures is a. 8/8. b. 8/12. c. 9/12. d. 11/12. _____ 4. In September of 2012, Jenks Co. incurred the following costs for one of its new machines: Cash price of machine $65,000 Installation and assembly 5,000 Housing and foundation for machine 18,000 Insurance on the machine for the first year of operation 7,000 What total amount would be capitalized in the Machinery account from these 2012 expenditures? a. $65,000. b. $77,000. c. $88,000. d. $95,000. 1 II. On March 1, 2012, Donner Company began construction on an office building. The following expenditures were incurred for construction: Date 3/1/12 4/1/12 5/1/12 12/31/12 Expenditures $150,000 200,000 300,000 100,000 The office was completed and ready for occupancy on July 1, 2013 (Note: you are only required to do the calculations through 2012). To help pay for construction, $300,000 was borrowed on January 1, 2012, on an 8%, three-year note payable. Other than the construction note, the only debt outstanding during 2012 was: $500,000, 8%, note payable (40,000 interest expense) $1,000,000, 6% bond payable (60,000 interest expense) Total $1,500,000 $100,000 interest expense Note: the average interest rate on these two notes is 100,000/1,500,000 = 6.67% A. Calculate average accumulated expenditures for 2012: $_____________________ B. Calculate avoidable interest for 2012: $_____________________ C. Prepare the journal entry to capitalize interest costs for 2012: D. Calculate the total capitalized value of the office building at 12/31/12: $____________________ 2 III. Exchange of property Company S owns equipment which it wishes to trade for new equipment. The old equipment is on the books at the following amounts: Cost $70,000 Accum. Depr. 40,000 Book Value $30,000 Prepare the journal entries for the following independent situations. Show your schedules to the right of the journal entry: A. Assume the fair value of the old equipment is $40,000 and that Company S trades for new equipment; the transaction does contain commercial substance; Company S receives $5,000 in the exchange. | FV Given BV Given | | | | | | | B. Assume the fair value of the old equipment is $18,000 and that Company S trades for new equipment; the transaction does not contain commercial substance. Company S pays $5,000 in the exchange. | FV Given BV Given | | | | | | | C. Assume the fair value of the old equipment is $40,000 and that Company S trades for new equipment; the transaction does not contain commercial substance; Company S receives $4,000 in the exchange. | FV Given BV Given | | | | | | | 3