Lesson 10 B - Under Construction

advertisement

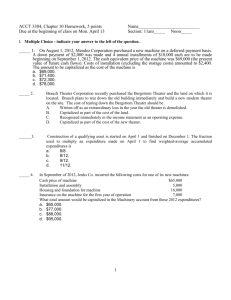

Accounting for Property, Plant and Equipment and Intangible Assets Acquisition and Disposition – Part 2 I N T ERMEDIATE ACCOU N T I NG I CHA PT ER 1 0 SELF-CONSTRUCTED ASSETS A company may construct an asset (such as a building) for its own use. Two challenges exist with regard to assigning costs to selfconstructed assets: • Determining the amount of overhead to allocate • Deciding on the proper treatment of interest incurred during construction Self-constructed Asset Costs The cost of a self-constructed asset includes identifiable materials and labor and a portion of the company’s manufacturing overhead costs. The full-cost approach is the generally accepted method used to determine the cost of a self-constructed asset. Interest costs incurred while financing the construction project should be capitalized as part of the asset cost INTEREST CAPITALIZATION Interest is capitalized during the construction period for (a) assets built for a company’s own use as well as for (b) assets constructed as discrete projects for sale or lease (a ship or a real estate development, for example). Excludes inventories routinely manufactured in large quantities on a repetitive basis and assets already in use or ready for intended use. The capitalization period starts with the first expenditure (materials, labor, or overhead) and ends either when the asset is substantially complete and ready for use or when interest costs no longer are being incurred. Interest costs incurred can pertain to borrowings other than those obtained specifically for the construction project. If material, the amount of interest capitalized during the period must be disclosed. Interest costs incurred during the productive life of the asset are expensed as incurred. (h) Exercise 10–23, page 570 Average accumulated expenditures: $6,000,000 = $3,000,000 2 Interest capitalized: $3,000,000 – 1,500,000 1,500,000 x 10% =$150,000 x 7%* = 105,000 $255,000 = interest capitalized * Weighted-average rate of all other debt: $2,000,000 x 4,000,000 x $6,000,000 $420,000 $6,000,000 9% =$180,000 6% = 240,000 $420,000 = 7% The interest of $255,000 is added to the cost of the building. The remaining interest cost incurred but not capitalized is expensed. Exercise 10–25, page 570 Average accumulated expenditures for 2013: January 1, 2013 $ 600,000 x 12/12 = $ 600,000 March 31, 2013 1,200,000 x 9/12 = 900,000 June 30, 2013 800,000 x 6/12 = 400,000 September 30, 2013 600,000 x 3/12 = 150,000 December 31, 2013 400,000 x 0/12 = -0$2,050,000 Interest capitalized: $2,050,000 – 1,500,000 x 8.0% = $120,000 550,000 x 10.5%* = 57,750 $177,750 = interest capitalized * Weighted-average rate of all other debt: $5,000,000 x 12% =$600,000 3,000,000 x 8% = 240,000 $8,000,000 $840,000 $840,000 = 10.5% $8,000,000 RESEARCH AND DEVELOPMENT All research and development costs are charged to expense in the period incurred. R&D costs entail a high degree of uncertainty of future benefits. It is difficult to match R&D costs with future revenues. Research is planned search or critical investigation aimed at discovery of new knowledge. Development is the translation of research findings into a plan for a new product or process or for a significant improvement to an existing product or process. R&D costs include labor costs, materials, depreciation and amortization of assets used in R&D activities, and a reasonable allocation of indirect costs related to those activities. In general, R&D costs pertain to activities that occur prior to the start of commercial production. GAAP requires disclosure of total R&D expense incurred during the period. R&D PERFORMED FOR OTHERS The principle requiring the immediate expensing of R&D does not apply to companies that perform R&D for other companies under contract. Under these situations, the R&D costs would be capitalized as inventory and carried forward into future years until the project is completed. Income from these contracts can be recognized using either the percentage-of-completion or completed contract method. Exercise 10–27, page 571 Research and development expense: Salaries and wages for lab research $ 400,000 Materials used in R&D projects 200,000 Fees paid to outsiders for R&D projects 320,000 Depreciation on R&D equipment 120,000 Total $1,040,000 The patent filing and legal costs are capitalized as the cost of the patent. The salaries, wages, and supplies for R&D performed for another company are included as inventory and expensed as cost of goods sold using either the completed contract or percentage-of-completion method. (h) Exercise 10–26, page 570 Correcting entry to expense R&D costs incorrectly capitalized: Research and development expenditures: Basic research to develop the technology Engineering design work Development of a prototype Testing and modification of the prototype Total $2,000,000 680,000 300,000 200,000 $3,180,000 Research and development expense Patent 3,180,000 3,180,000 Correcting entry to capitalize the cost of equipment incorrectly capitalized as patent: Equipment Patent 60,000 60,000 Entry to record depreciation expense on equipment used in R&D projects: Research and development expense Accumulated depreciation—equipment 10,000 10,000 No adjustment is necessary for the $40,000 legal and other fees for patent application or legal fees for successful defense of new patent. These items were correctly capitalized as costs of the patent. Accounting for Property, Plant and Equipment and Intangible Assets Acquisition and Disposition – Part 2 INTERMEDIATE ACCOUNTING I - CHAPTER 10 END OF PRESENTATION