cirlab introduction

advertisement

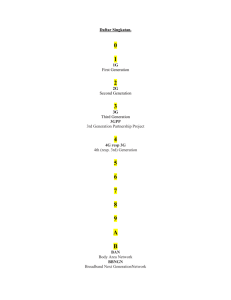

Mobile Internet Startups predicting the next big win Sanjay Jhawar Vice President, Wireless, cirlab! 1 July 2001 The Parent: CIR Group CIR = Compagnie Industriali Riunite one of Italy’s most significant industrial groups, founded in 1976 publicly traded in Milan (CIRX) FY2000 : revenues €2.52 billion, capital employed €1.05 billion, net income €86 million controlled by the De Benedetti family mission: create shareholder value through dynamic management of investment portfolio and taking an active role in management of operating companies focus on media, utilities, telecom and automotive components some major telecom and new media investments by CIR: L’Espresso/Kataweb (49.6%) leading Italian portal with 256 million monthly page views & 6.6m unique users (March 2001) H3G (12.9%) 3G wireless license winner in Italy, currently building mobile network. JV with Hutchison Whampoa (who owns 78.3%) broadband access providers : eVia and CasaWeb 2 De Benedetti Group Success Stories (Hutchison, CIR) • recently awarded 3G-UMTS operator license in Italy • Europe’s largest wireless market with 73% penetration (now part of Vodafone Group) • established in 1994 within Olivetti • 2nd wireless operator in Italy and Europe with 10+m customers, 43% market share • largest value creation in Italy since WW II (now owned by ENEL/Wind) • established in 1995 within Olivetti • the 2nd fixed line operator in Italy with +5MM customers • acquired by Vodafone in Mannesmann takeover, recently sold to Wind for $6.5bn Corporate Venture Capital Fund • established in 1985 to focus on emerging technologies • total investments for $200MM • 29% IRR since inception, 35% IRR since 1992 3 Who is cirlab? cirlab! is a seed and early-stage value-added venture investor founded in 1999 and funded to €30m by CIR Group, focused on wireless Internet services, applications and software technology digital media and broadband content other software and services Objectives invest in European, US and Israeli businesses where Europe is the major market exploit Italy’s mobile market size and our connections here and elsewhere be active partners in building the business, spending a lot of time outside of board meetings working closely with management Team backgrounds seasoned entrepreneurs, technologists, marketers and finance professionals with toplevel operational experience in the US and Europe in our chosen sectors extensive personal networks in Italy, UK, US, France, Sweden, Israel and elsewhere 4 cirlab! mobile portfolio 5 Current outlook for mobile Internet 3G delayed, slow start to GPRS Operators with high debt and declining ARPU cutting all non-essential spending, looking to share 3G radio access networks Nokia, Ericsson, Motorola, Siemens, Lucent, Alcatel cut earnings estimates, downsize and cut back vendor financing. Comverse warns but so far nothing from Openwave. Market slump causing venture investment slowdown : many startups struggling to raise money. European wireless startup investments (data from Tornado Insider): €171m invested in March €227m invested in April €127m invested in May €92m invested in June 6 Active mobile Internet subscribers DoCoMo 23.0m BT Cellnet 1.5m KDDI 7.2m France Telecom 0.7m J-Phone 6.7m Telefonica 0.5m Omnitel 0.1m TIM 0.1m Shinsegi (Korea) 0.5m Sprint PCS 1.3m Verizon 1.0m AT&T Wireless 0.6m Nextel 1.1m Others 1.65m Total 46.0m Source: Motorola 5/01 7 Current outlook for mobile Internet Regular mobile Internet users in Europe growing from 2.5m in 2000 to 170m in 2004 (Forrester, 9/2000) GPRS commercial network launches in several countries, many in soft launch GPRS smart phones finally coming at the end of this year to Europe? NTT DoCoMo on track for October 3G commercial launch High hopes for XHTML (WAP/iMode convergence), Java phones, instant messaging, MMS Killer app is still mobile email – but now for enterprises. Momentum behind standardised mobile middleware from IBM, Microsoft, Oracle 2nd generation operator mobile portals rolling out European mobile ASP’s iTouch (UK), Acotel (Italy) & Aspiro (Sweden) had successful IPOs in last 12 months. No shortage of VC funds waiting the right mobile investment opportunity 8 Predicting the next big win Complete solution partners already spending big money promoting the category – but missing the piece that unlocks the whole value chain they bet their business on Compelling business driver buyers take risks to spend money with a startup that was budgeted elsewhere Gatekeeper position with few current competitors and with technology and other barriers to entry End users actually care solves a real (not imagined) need. Structurally improves value for money. Go with the wind not against it leverage long term investments made by others. Market timing is critical. Advanced technology is not enough 9 2.5G operators spend money on? Subscriber acquisition in highly penetrated markets and for newer entrants Subscriber retention and ARPU protection for established players Manage GPRS expectation gap – optimized applications Avoiding SMS > GPRS revenue transition issues Threat from internet portals – subscriber ownership Migration of legacy architectures to Internet accessibility Voicemail, IN, billing Working with their portal partners, introduce new applications on Internet time yet integrate with an existing telecom architecture Integration of user experience across architecture 10 3G operators spend money on? build brand - new technology image rapid time to market start generating cashflow asap to cover interest payments new entrants must get established before incumbents can migrate legacy systems fill bandwidth price to stimulate demand, maximum possible proportion of data revenue minimize costs of providing commodity voice services capture customers from 2.5G new entrants encourage number portability allow users to migrate existing services with better QoS new terminal types to support new applications reduce costs of software upgrades open services mode for new entrants differentiated middleware, external apps improve periods of under utilization 11 Other motivated buyers MVNO’s Service differentiation without Radio Access Network Subscriber acquisition Cross branding tie-ins Well funded mobile portals and ASP’s Especially operator owned entities eg Vizzavi etc. Application integration with telecom services, to capture operator revenue sharing Large enterprises Mobile office Mobile business process support - vertical applications 12 End-user value-for-money + special device personalized dynamically context aware (relevant, appropriate) airtime community value entertainment anywhere anytime productivity urgent extra monthly fee Reduce airtime needs, device costs Allocate bandwidth to higher value services Increase dynamic personalization Address intrusion Careful with easy of configuration and use, intelligent design for latency etc. personalization content adaptation difficult to configure difficult to use intrusion - delay 13 cost Value chain location based services Still evolving Several pieces not yet in place Issues not yet well addressed cost of location sampling push services privacy/availability positioning location technology middleware CPS Snaptrack Cellpoint Signalsoft Xypoint privacy & proximity availability detection control InirU iProx Teltier Personity Phone.com 14 app platform Microsoft IBM Sun apps Webraska Akumitti ItsAlive GeePS Airflash uBmobile transaction and billing Portal s/w Geneva Value chain mobile advertising Early days Many pieces not yet in place Issues not yet well addressed privacy anti-spam reverse billing to advertiser, or credits to users balance between richness of media and cost of delivery integrating multiple touch points – TV, billboards, Bluetooth, web, print brand advertising owners/ agencies retailers Nike P&G Starbucks McCann JWT media buyers Initiative Media profile targeting Mediatude Lumeria context privacy availability awareness control control (e.g location) Privada Ayeca Angara interactivity Teltier Personity Teltier CMG, Hiugo, Iteru 15 content transformation Phone.com IBM Oracle push services Phone.com CMG Ecrio Airflash Value chain mobile media distribution Still evolving Several pieces not yet in place Issues not yet well addressed billing other than for traffic QoS broadcast and point-to-multipoint to reduce spectrum needed for distribution media creators Disney Atomfilms CNN Universal BMG Sony digital rights mgmnt Microsoft content transaction transform and billing -ation Real Networks Microsoft pt-to-pt, multicast, radio broadcast equipment gateway Celltick Fantastic Ericsson Nokia Motorola Streaming Lucent vendors 16 DSP CPU Client software Real Networks ARM Microsoft TI Motorola Intel Analog Dev Technology Megatrends Signalling: telecom protocols >> Internet Parlay SIP OSA Internet megaservices – distributed component services, usable by 3rd party general internet applications SOAP .NET/Hailstorm AOL IM, ICQ, Yahoo Messenger, MSN Mobile mass storage 512MB compact flash cards 1GB CF size microdrives 17 Log(performance) Moore’s Law not the whole story Processor power at constant cost 2X in 18mo Hard disk storage capacity at constant cost 2X in 12mo 1GB 340MB 9.6kbps CSD 14kbps CSD Mobile WAN bandwidth at constant cost: 2X in 30 mo 40kbps GPRS 144kbps UMTS CSD 384kbps UMTS packet 2Mbps UMTS low mobility, few users Mobile WAN’s and 3G phones will be client-server NOT network computers t 18 Insights for potential startups Critical gaps needing solutions Cached media, overnight delivery, digital rights management Server management of rich clients Internet applications accessing telecom functions Integrated voice/visual interface; billing; network presence Quality of Service management on 2.5G IP multicast/broadcast over 3G Cross application megaservices application pre-rating proximity detection, cellular positioning and Bluetooth mobile media distribution over multiple operators: a mobile “Akamai” dynamic personalization bridging internet and telecom 19