The Optimal Supply Chain in Large Aircraft

advertisement

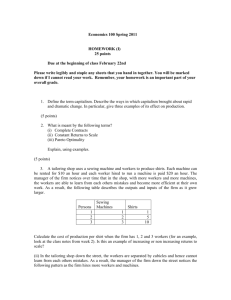

STUDENT PAPER SUBMISSION FORM This form must be completed in its entirety and must accompany the submission Author(s) highest education level: Graduate student ☒ Undergraduate student ☐ PLEASE PRINT OR TYPE Title of Submission The Optimal Supply Chain in Large Aircraft Manufacturing ______________________________________________________________________ Author(s) Please list all authors followed by their permanent e-mail address (1) Steve Krcek, stevekrcek@gmail.com (2) Rehan Jaliawala, rjaliawala@gmail.com Primary Author Name Steve Krcek Permanent Address 21527 Prairie Crest Dr. Richmond, TX 77406 ______________________________________________________________________ Permanent E-mail stevekrcek@gmail.com Permanent Telephone Number 832-312-5632 Educational Institution The University of Houston APICS Terra Grande - Heartland District Chapter Affiliation APICS – Houston Chapter The Optimal Supply Chain in Large Aircraft Manufacturing Steve Krcek 21527 Prairie Crest Dr. Richmond, TX 77406 +1-832-312-5632 Steve Krcek (Bachelor of Science in Meteorology, The Florida State University) is currently the Senior Regional Sales Manager at Wilkens Weather Technologies, a global provider of offshore weather forecast services. APICS Houston Student Chapter Professional MBA at C. T. Bauer College of Business, University of Houston Rehan Jaliawala 26927 Glacier Creek Dr. Katy, TX77494 +1-832-708-6619 Rehan Jaliawala (Bachelor in Textile Engineering, NED University) is currently a graduate student in the professional MBA program at C. T. Bauer College of Business, University of Houston APICS Houston Student Chapter Professional MBA at C. T. Bauer College of Business, University of Houston THE OPTIMAL SUPPLY CHAIN IN LARGE AIRCRAFT MANUFACTURING ABSTRACT In an era where the general public is demanding longer range, more fuel efficient aircrafts, maintaining an effective and efficient supply chain is critical to profitability. The future of optimal manufacturing in commercial aircrafts lies within the supplier, not the manufacturer. Large manufacturers, such as Boeing and Airbus should be focused on the end product, concerning themselves with research and development, design, and the final end assembly. The suppliers and their supply chains are critical to the future success of the major manufacturers. 1 THE OPTIMAL SUPPLY CHAIN IN LARGE AIRCRAFT MANUFACTURING INTRODUCTION The aviation industry is shaped by several market forces such as fuel prices, economic growth, environmental regulations, and alternative modes of transportation. Of these market forces, fuel has been the largest component of the airline cost structure for the past decade. As a result, Boeing and Airbus, who hold over 80% market share of the worldwide aircraft industry, will need to be strategic with their manufacturing strategies over the next decade. Specifically, these companies will need to ensure their supply chain is efficient and optimal as we move into the new wave of aircrafts. This paper will analyze current strategies, current setups, and future needs within these companies supply chains to ensure they maintain and increase their market share. CURRENT STATE Rising fuel costs and increased passenger traffic has caused the airline industry to alter future strategies as it pertains to aircraft design and manufacturing. Airline carriers have molded different strategies to combat this evolving landscape. Many U.S. airlines such as United or American replace outdated, older aircraft with new, more fuel-efficient models direct from the manufacturer. Delta Airlines instead prefers to purchase and update older, used aircrafts. While fuel costs are higher on older aircrafts, Delta has been able to offset this cost with the purchase of their own refinery in Trainer, Pennsylvania (4). This forward thinking has allowed the company to increase revenue and maintain costs over the past three years. This, however, is the exception in an industry which demands the latest and greatest technology. A large amount of the industry is seeking the newest, most economic models. This has driven the two largest aircraft manufacturers, Boeing and Airbus, to redefine their products and supply chains. 2 THE OPTIMAL SUPPLY CHAIN IN LARGE AIRCRAFT MANUFACTURING Boeing As fuel costs continued to rise in the early 2000s, Boeing aimed to reinvent long range air travel with the announcement of their Dreamliner 787 (“787”). The 787 aimed to create value for its customers (airlines) and their customers end users (passengers) by providing a luxurious flying experience, at a reduced cost. This innovative new concept by Boeing not only changed the future vision of aircrafts, but also how they were built. Prior to the 787, Boeing had a much different approach to their supply chain. With aircrafts such at the 737, Boeing would assemble different parts and subsystems from thousands of suppliers, operating in a traditional push system. The new approach for the 787 had Boeing establishing partnerships with approximately 50 tier-1 strategic partners. These tier-1 strategic partners are responsible for integration with the tier-2 suppliers. They ensure the different parts and subassemblies are completed prior to delivery to Boeing. These completed subsections are then delivered to Boeing for final assembly. As one aviation consultant noted, “All Boeing does is design it and glue to together.” (10, pg. 40). The final assembly time at Boeing’s plant in Everett, Washington is reduced by 27 days using this new system. Figure 1 illustrates the traditional supply chain at Boeing, while Figure 2 illustrates the new approach for the 787 (8). Figure 1: Standard Boeing Supply Chain Figure 2: Supply Chain for 787 3 THE OPTIMAL SUPPLY CHAIN IN LARGE AIRCRAFT MANUFACTURING This unconventional supply chain was designed to shorten development time and reduce development cost of the 787. The focus was to leverage suppliers’ and their ability to develop different parts simultaneously while depending on their expertise. Supply relationship management is critical with this new approach as the new Boeing supply chain runs much like the Toyota Production System, and depends on “just in time” manufacturing. Any issues downstream with the tier-2 and tier-1 suppliers will delay the end product substantially. Boeing manages their suppliers through a web-based tool called “Exostar.” Table 1 summarizes many of the large changes in the Boeing supply chain with the 787 versus the 737. Table 1: Comparison of the 737 and 787 Supply Chains (9) At a glance the changes implemented by Boeing for the 787 seem to make sense. However, this new system was unconventional and unproven in the airline industry when it was announced in the early 2000s. As such, each change that was implemented carried a new risk to the supply chain. These risks will be discussed in the following section. Airbus In 2004, Airbus announced its newest aircraft, the A350. This new wide body plane was established to compete directly with Boeing’s 787 while also satisfying demand for longer range, more fuel efficient aircrafts. Much like Boeing, Airbus decided to revamp their supply chain for 4 THE OPTIMAL SUPPLY CHAIN IN LARGE AIRCRAFT MANUFACTURING the A350. Traditionally, Airbus would award contracts to approximately 250 key contracts for each aircraft, the A350 supply chain reduced the supply network to 70 (6). The structural development of the A350 saw outsourcing of work packages increase from 30% to over 50% (8). While this was less than the 70% Boeing had established for the 787, Airbus had the unusual benefit of being behind Boeing in their new concept, allowing them to watch the mistakes their competitor made along the way. Seeing the issues Boeing had in the production phase of the 787, Airbus implemented a “freeze” period of nearly two years on the design details of the A350. This allowed engineers and suppliers’ additional time to identify potential kinks in the design, which would reduce production down time in the future. Another key change in the Airbus supply chain from years past has been the reliability on global sourcing. When the A350 was announced in 2004, China contributed virtually nothing in turnover in supply work. In 2015 the country is expected to contribute nearly US$500 million turnover in supply work, with over US$1billion predicted by 2020. These strategic partnerships in foreign nations are critical to the long term success of the supply chain due to the required raw materials. Russia, for example, holds 60-70% of the world’s supply of titanium (1). Airbus made additional changes to their supply chain with the appointment of new CEO Fabrice Bregier in 2012. While they had seen success with the initial changes brought on by the A350 system, Bregier wanted to focus on centralizing the nearly 1,500 employees throughout the procurement group. Airbus divides their procurement into five major sections: systems, cabin equipment, aerostructures, materials, and propulsion systems. Along with centralizing these five sections, Airbus also development an electronic hub for its supply chain called “Air Supply” (3). Air Supply is a collaborative hub and electronic exchange between the company and its suppliers. It is similar to Boeing’s Exostar system as it allows for digital collaboration during the 5 THE OPTIMAL SUPPLY CHAIN IN LARGE AIRCRAFT MANUFACTURING design phase. The focus of these changes in the company’s supply chain is to reduce missing parts along the supply chain, and shorten the overall development phase. While both Boeing and Airbus have made a fundamental change in their supply chains during the new millennium, moving from their traditional push strategies to a pull or just in time manufacturing plan, these changes did not come without risks or opportunities for further improvement. OPPORTUNITES FOR IMPROVEMENT While both Airbus and Boeing have made significant changes and improvements to their supply chain over the past decade, there remain additional opportunities for improvement. As these companies continue to move toward a just in time manufacturing process, they will want to address ways to mitigate suppliers, management, labor, and demand risks in the supply chain. Supplier Risks and Opportunities for Improvement The current state of the supply chain increases reliability on few suppliers, who in turn are responsible for providing completed portions of the end product through communications with an additional group of suppliers. This chain carries an adherent risk due to the complexity in the process. Any break of the chain can cause significant delays in the overall production. While Boeing and Airbus have control over their tier-1 suppliers, they begin to lose control as the tier-1 suppliers’ subcontract to tier-2 suppliers. An additional risk with this chain of suppliers is the potential cultural differences. These differences can impact the amount of accurate and timely data that is relayed through the supply chain, which impacts production. A third risk is the availability of suppliers’ and their loyalty to each company. For some product requirements, it is very possible that one company will supply both Boeing and Airbus, so how can one company ensure their supply is not impacted by the requirement of the other? 6 THE OPTIMAL SUPPLY CHAIN IN LARGE AIRCRAFT MANUFACTURING In order to mitigate the risk associated with tier-1 suppliers and their subcontractors, both Boeing and Airbus should implement a policy similar to Toyota and their Production System. Toyota’s production system is widely considered the most efficient and optimal supply chain in the automotive world. Their ability to teach their methods to strategic suppliers to ensure the two key principles of the system, just in time and jidoka, are met has led to their success. While Boeing and Airbus will not be able to fully replicate Toyota’s system, training their tier-1 suppliers in their methods is a starting point. The expectation will be that these suppliers then filter this knowledge down to the tier-2 suppliers in order to optimize the chain. This training will also help to improve the second risk mentioned above as it pertains to accurate and timely reporting. Tier-1 suppliers will need to be held accountable for their suppliers, but also rewarded for meeting deadlines and keeping on track. Incentive plans will be critical in establishing loyalty among suppliers, especially as the supply chain continues to evolve and place more risk on the suppliers. Both Airbus and Boeing should focus their early training efforts on any bottleneck suppliers before moving down the chain to the remainder of the suppliers. Management Risks and Opportunities for Improvement With the implementation of the 787 and A350 supply chains, both Airbus and Boeing made a critical mistake as it pertained to their management. No one at the senior levels had expertise on supply chain management risk. Without this expertise, both companies were assuming a large enterprise risk as they were making unprecedented changes without proper leadership. Boeing corrected their mistake in 2005 when they replaced the original 787 program director, Mike Bair, a proven marketing expert with Patrick Shanahan, a proven supply chain management expert (9). Airbus also made managerial changes during the A350 project, replacing their CEO in 2012 (3). Both companies should learn from these mistakes and 7 THE OPTIMAL SUPPLY CHAIN IN LARGE AIRCRAFT MANUFACTURING understand the importance of having the correct subject matter experts in place from the beginning as they move to make full scale changes in a process. These subject matter experts will not only assist in the execution of the new process, but will also play a key role in the design of the new process. Labor Risks and Opportunities for Improvement As both Airbus and Boeing continue to trend in a new direction, where over half of the design and production is outsourced, there will be a growing concern of job security within each company. These were real concerns felt at Boeing as 25,000 workers went on strike in 2008. This strike not only impacted operations at Boeing, but also other areas of the supply chain. Suppliers began to realize that the pending strike at Boeing would delay aircraft delivery, so in response many began to reduce their work week in order to conserve resources (9). This issue was not as large of an issue at Airbus, largely because their new supply chain only saw outsourcing increase 20% as opposed to Boeing’s 40%. This is the correct way to begin developing the new unconventional, optimal supply chain in this industry. Changes must be gradual, not drastic. This will ensure new processes are implemented correctly, efficiently, and effectively, without compromising the culture and trust of the workforce. Demand Risks and Opportunities for Improvement Excitement and demand are expected when new state of the art aircrafts such as the A350 and 787 are announced to the public. While both Airbus and Boeing undoubtedly want to fulfill demand, it is critical they do not overpromise and under deliver. Delivery delays and Stock-outs will reduce the confidence of your end customer (airlines) and impact future sales. It is also important to avoid an oversaturation in the market. This was a lesson that cost Boeing US $4 8 THE OPTIMAL SUPPLY CHAIN IN LARGE AIRCRAFT MANUFACTURING billion during the aviation boom of 1997-1998 (8). During this time Boeing took every order that came their direction and eventually ended up flooding the market with too many planes. With an abundance of inventory, Boeing was forced to sell the remaining 737s at highly reduced prices, leading to the losses. It is clear Boeing learned a valuable lesson from this error. In 2007 when approached by Southwest Airlines, their largest customer, Boeing refused to increase their requested order. As it pertains to the 787, Boeing stated that there will be no increase in production for the first two years, no matter how strong the market demand (8). Airbus has made similar adjustments with the A350 after taking in a US $6 billion loss with demand and production issues on the A380 (6). FUTURE STATE Airbus and Boeing have both significantly improved upon their supply chains. This improvement comes from increased outsourcing and substantial changes in how they do business. Both major players have significantly reduced their assembly process from assembling sections and then the final aircrafts, to outsourcing the assembly of their sections and just assembling the sections within their organization. Ultimately, the two organizations are transforming themselves into stronger supply chain managing companies to ensure that they have a resulting superior product for their customers. Airbus and Boeing need to realize that moving forward they need to establish strong and sustainable supply chains to remain market share leaders and provide customer satisfaction both in terms of quality of product and on time delivery. 9 THE OPTIMAL SUPPLY CHAIN IN LARGE AIRCRAFT MANUFACTURING RECOMMENDATIONS FOR OPTIMIZATION Airbus and Boeing have to make changes gradually and have to take future steps on a phase wise basis. We recommend a few additions and changes that can help the transformation process for Airbus and Boeing. Supplier Development and Training Program In order to strive and grow into a strong supply chain it is essential that knowledge and expertise accumulated over years be transferred to trusted suppliers. Programs must be developed to share technical expertise that is required for outstanding performance for both Tier1 and Tier-2 suppliers. This can to a large part mitigate supplier risks and can improve performance within the supply chain. These programs can further be developed to transfer some of the labor intensive workforce to suppliers rather than having to fire workers, mitigating the labor risk to some extent. As these training and development programs flourish and strengthen they result in two key achievements. Firstly, they improve supplier performance which ultimately means the organizations performance improves. Secondly, these programs create a bond of loyalty between the organization and the suppliers. Penetrating IT infrastructure to Tier-2 Suppliers The aircraft manufacturing industry has adopted IT to enhance visibility and efficiency in its supply chain. Airbus and Boeing in the future must extend their visibility and communication to reach the tier-2 suppliers. Increasing visibility and communication will allow the organization to take on a pro-active role of problem prevention rather than constantly finding themselves in a state of firefighting. 10 THE OPTIMAL SUPPLY CHAIN IN LARGE AIRCRAFT MANUFACTURING IT penetration to tier-2 suppliers can empower the organization to stay ahead of problems be better prepared to solve problems and ultimately have more control over the supply chain. Having a clear and open channel for communication within the supply chain greatly improves performance and can be the key to success. Developing Data Analytics With the introduction of IT comes a huge collection of data. Empowering the organization however requires the use of data analytics. Data analytics is relatively a newer field, but different organizations have adopted it early on. Data analytics provides key insights into the organization and its performance. The hardest step in data analytics is collecting data and knowing what you want with the data. Determination of the key performance indicators and constantly monitoring these KPIs will give the organization a better understanding of their performance and will empower management to make better decisions. Introducing Supply Chain Risk Management Identifying risks is an absolute necessity when it comes to business management and growth. More importantly, understanding and mitigating these risks is key to continuing, transforming and growing any business. In order for Airbus and Boeing to continue down the path of transformation, they need to develop strategies and departments that continuously identify supply chain risks and formulate strategies to avoid or lessen the impacts of these risks. Aircrafts are a high dollar item which undoubtedly means the risks involved are of great magnitude. 11 THE OPTIMAL SUPPLY CHAIN IN LARGE AIRCRAFT MANUFACTURING Strengthen Engineering and Design Airbus and Boeing have increased outsourcing to a great extent. In order to maintain their market share and niche, they must strengthen their Engineering and Design teams. The transformation from their traditional business to a more supply chain management focus can tend to transfer their core competency of aircraft manufacturing to their suppliers. To maintain their status of being the largest aircraft manufactures they need to focus their efforts on the Engineering and Design of aircrafts and continue to internally put together the final pieces that come together to form the finest and most technological advanced aircrafts in the world. 12 THE OPTIMAL SUPPLY CHAIN IN LARGE AIRCRAFT MANUFACTURING REFERENCES 1. Baker, Colin. "Global Sourcing." Asian Aviation August 2014: 1. 2. Balasescu, S. and M. Balasescu. "Optimization Methods for Supply Chain Activities." Bulletin of the Transilvania University of Brasov (2014): 9-16. 3. Canaday, Henry. "Tightening the Supply Chain." ATW August 2013: 32-33. 4. Carey, Susan. "Delta Flies New Route to Profits: Older Jets." The Wall Street Journal 15 November 2012. 5. Lemer, Jeremy. "Boeing and Airbus Focus on Supply Chain." FT.com 18 July 2011: 1. 6. Matlock, Carol. "What Airbus Leanered from the Dreamliner." Businessweel 28 April 2008: 92. 7. Micheau, Victoria A. "How Boeing and Alcoa Implemented a Successful Vendor Managed Inventory Program." The Journal of Business Forecasting (2005): 17-19. 8. Ranson, Lori. "Airbus Refines Supplier Selection Process." Aviation Daily 30 April 2007: 4. 9. Tang, Christopher S. and Joshua D. Zimmerman. "Managing New Product Develpment and Supply Chain Risks: The Boeing 787 Case." Supply Chain Forum (2009): 74-86. 10. Wayne, Leslie. "Boeing Reinvents its Supply Chain." World Trade April 2007: 36-40. 13