Grants

advertisement

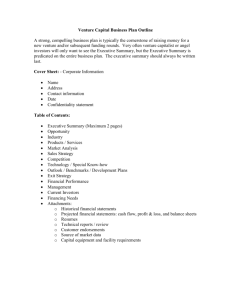

The Relevance of IP for Acquiring/Securing Financing: Making Intangibles More Tangible Dr. Guriqbal Singh Jaiya Director Small and Medium-Sized Enterprises Division World Intellectual Property Organization www.wipo.int/sme Managing IP Assets -Denise Raybould, Associate, BDO Kendalls Stages of Technology Transfer: From Research Support to Economic Growth Federal Corporate Startups State Research Support More in Tax Revenues Inventions Disclosure Endowment Patents Licenses New Products Higher Standard of living Economic Growth New Jobs IS A COMPANY READY? • Business plan? • Stage of development of the company • Type of investment? • Valuation? • Management team ready? • Has the management team enough time and energy to raise funds? • Is the team shaped to talk to investors? • Does the company know where to go? Positioning for a Capital Injection PEOPLE Strategy MARKET •Business model •Resourcing •Target investors TECHNOLOGY Valuation / Building value Capital Injection Add value before raising capital ►Documentation and Presentation ►Government grants ►Intellectual Property Protection ►R&D Partners ►In principle agreements ►Licences ►Customers The “Ask and Offer” ►Financial Projections ►Business and IP valuation ►Critical negotiating tools ►Justifies assumptions ►Forces in depth research ►Forces decision making ►Makes you strong and confident SOURCES OF START-UP CAPITAL (USA) OTHERS (3,9%) GOVERNMENT LOANS (1,1%) MORTGAGED PROPERTY (4,0%) VENTURE CAPITALISTS (6,3%) FRIENDS (9,0%) EMPLOYEES / PARTNERS FAMILY MEMBERS BANK LOANS PERSONAL SAVINGS (12,45) (12,9%) (14,4%) (78,5%) Other ways of raising money through IP ►Licensing ►Sale ►Auctions ►Donation ►Grants Methods of Valuing ►Market Approach ►Cost Approach ►Income Approach Market Approach ►What are others paying for a similar IP? What is the market value? ►Extensive knowledge of comparable data required Cost Approach ►Economic principle of substitution ►Reproduction cost (Exact replica) ►Replacement cost (Different form or appearance) Income Approach Present value of future income stream ►Future Income Stream (Economic Income) ►Duration (Life: Legal, contractual, judicial, physical, technological, functional, analytical, economic) ►Risk (Uncertainty of receiving expected income; interest rates and investment climate) IP Due Diligence ► In order to obtain financing whether debt or equity those who are providing the financing will need to be satisfied as to whether the company is worthy of it. ► Important to be “investor ready”. That is show that you have taken all possible steps to identify, protect and manage your IP assets. START-UP CAPITAL ►25% start with less than $5,000 ►50% start with less than $25,000 ►75% start with less than $75,000 ►Less than 5 % with $ 1,000,000 or more The Paradox of Access to Finance ►Banks ►Venture Capitalists ►Stock Exchange have money But argue that there aren’t enough good projects What is a good project? A Good Project! A good project is a project presenting in the eyes of an investor: ► acceptable risk profile ► a good perspective of return this means: ► access to market = innovation ► profits Source of High Risks Money Which are today these sources ? we may regroup these in 3 major groups: Business Angels: we are basically talking here about rich private individuals who are ready to invest much needed “seed capital” at a very early stage of development of a company, i.e. for new and speculative projects. Their role is extremely important, when we talk about raising money between USD 0.5 and 2 million. Venture capital investors: these are usually private equity funds managed by professionals. They seek to identify and finance the rapid growth of high potential young firms that embrace innovative products, processes or technologies. This way, they generate substantial rewards from successfully overtaking existing business paradigms. Note that very often, traditional finance institutions do invest a small part of their funds into alternative investments such as these V.C. funds. Last but not least, Governments: The first computers, the first commercial jet planes were built in the U.S.A. as funded by DoD contracts. The U.S.A and Europe have set up specific programs to promote new science and technology businesses. These are key tools in helping scientists to engage into new business ventures. N.B: A business environment – laws, taxes, etc… – which encourages private and commercial investors to invest into risk taking ventures is an absolute prerequisite. Government First: U.S.A. The U.S. example – the Small Business Innovation Research program SBIR awards take the form of contracts for the development of technologies required by agencies of the US Government. They provide 100% of the funding needed plus a small profit element. The “norm” is USD 850 K for each project. Small business can win and run multiple projects in parallel. The SBIR analysis below is done for the UK Government in an attempt to copy and adapt it: Government First: U.S.A. The U.S. example – the Small Business Innovation Research program Established in 1982, it is the World’s largest seed capital program for science and technology business. The law stipulates that 2.5% of all federal agencies’ external R&D research must be done through SBIR. Furthermore, the US has established a very large set of policies to favor small US businesses in government procurement. Government First: The European Union The first program in Europe: COST – an international framework for European Co-operation in the field of Basic Scientific and Technical Research ( www.cost.esf.org ) Established in 1971, COST allows the co-ordination of nationally funded research by maximising European synergy and raising the level of scientific interaction at the scale of Europe. Its budget for the period of 2002-2006 was of 1.5 Billion Euro. COST Actions cover basic and precompetitive research. Ukraine as a NonCOST country took part in 15 actions. From March 2006, Ukraine initiated consultation to discuss potential full membership. Government First: The European Union EUREKA – an international framework for European Cooperation in the field of Marketable Scientific and Technical Research ( www.eureka.be ) The primary goal of EUREKA has always been to raise the productivity and competitiveness of European industry and national economies through its ‘bottom-up’ approach to technological innovation. Since its inception in 1985, substantial public and private funding has been mobilized to support the research and development carried out within the EUREKA framework. Through its flexible and decentralized Network, EUREKA offers project partners rapid access to a wealth of knowledge, skills and expertise across Europe and facilitates access to national public and private funding schemes. The internationally recognized EUREKA label adds value to a project and gives participants a competitive edge in their dealings with financial, technical and commercial partners. Through a EUREKA project, partners develop new technologies for which they agree the Intellectual Property Rights and build partnerships to penetrate new markets. Ukraine was granted full membership on 9 June 2006. Currently a total of 15 projects have been developed with Ukrainian participants for a total of 1.1 M. Euro. Public Interventions Mix of non-financial and financial support services This means that intermediaries have to (1) provide value-added services; and (2) become more professional Finding Innovation Funding Innovation 25 April 2007 Access to finance for West Midlands SMEs Patrick Palmer – Head of Access to Finance at Advantage West Midlands What sort of initiatives are there? ►Demand side initiatives Provision of better information of what is available; Investment Readiness programmes. ►Supply side initiatives Grants to support Research and Development and certain “Proof of Concept” activity; The Research and Development Tax Credit; Grants for capital investment in certain areas; A range of venture capital funds; Encouragement of Business Angel activity; Small Firms Loan Guarantee Scheme; Community Development Finance Institutions. Demand Side Actions ►Better information www.westmidlandsfinance.com; ►Investment programmes Readiness Route to Investment (R2i); CONNECT / InvoRed. R2i ►Provided through the Business Link network and funded by Advantage West Midlands and the ERDF ►Comprising four stages: Increasing Awareness of funding sources; Education of businesses in funders’ requirements; Developing applications and businesses to ensure they are “investment ready” (Complex Development); Post Investment Support. ►Access through Business Link West Midlands Telephone 0845 113 1234 website www.businesslinkwm.co.uk InvoRed A tailored programme delivered across the West Midlands that helps technology based businesses from pre-incorporation to 2nd or 3rd stage funding: •Get ‘Investor-ready’; •Understand finance options ; •Make the pitch; •Find investment •Flexible programme with 2 streams Amber Stream – for early stage companies Green Stream - Fast-track grooming for later stage companies Supply Side Actions - Grants ►DTI Grants operated by AWM – Selective Finance for Investment in England and Grant for Research and Development ►Grants available through Business Link – Diversification, Accelerate ►Mercia Spinner, Technology Transfer Fund Grant for Research and Development ►Grant is available under four categories: Micro projects; Research projects; Development projects; Exceptional development projects. • Grant is only available to SMEs; • Available throughout the West Midlands; • AWM have secured ERDF money to support this grant scheme. Grant for Research and Development Type of grant Employee numbers Grant as % of eligible expenditure Grant range Micro (small development projects) < 10 50% £2,500 £20,000 Research < 50 60% - 65% Development < 250 35% - 40% £20,000 £75,000 £20,000 £200,000 Exceptional development < 250 Up to 35% £200,000 £500,000 Grant for Research and Development Key criteria are: ►Technologically innovative; ►Technical risks and R & D challenge; ►Commercial potential and market need; ►Exploitation prospects; ►Management and project team abilities; ►Commercial and financial viability; ►Intellectual property secure; ►Additionality; ►Wider aspects – sustainability and design considerations. Technology Transfer Fund ►Available in the Central Technology Belt, but extending its area of activity; ►Provides proof of concept funding (ranging from £5k - £25k) for new start-ups and existing SMEs; ►Currently confined to medical technologies and advanced materials technologies; ►Delivered by Birmingham Research and Development Ltd with AWM and ERDF funding Supply side actions Small Firms Loan Guarantee Scheme ►Provides Government guarantees on loans from private sector providers to small firms under 5 years old with viable business proposals but insufficient security for conventional finance; ►Loans may range from £5,000 to £250,000 and for periods from 2 to 10 years; ►Guarantee is for 75% of the loan; ►Operated through commercial banks and administered by the Small Business Service; ►“Small” = less than 200 employees, turnover less than £5 million (non-manufacturing £3 million) Supply side actions - Loan Funds/ Community Development Finance Institutions (CDFIs) Source Range Location Princes Trust -18-30yrs £250-£5k Region Halal Fund –non interest based £7.5k -£35k Region Arrow Fund £1k -7.5k B’ham & Solihull Aston Reinvestment Trust £2k-50k B’ham&NSolihull 3b Up to £20k B’ham & Black Country Black Country Enterprise Loan Fund Up to 5k Black Country Black Country Reinvestment Society Up to £50k Black Country Impetus – Marches Rural Reinvestment Trust Up to £50k Rural Marches North Staffordshire Risk Capital Fund £10-50k North Staffs Michelin Development Fund £5k+ Stoke-on-Trent Coventry&Warwickshire Reinvestment Trust Up to 50k Coventry& Warks Regional Financial and Equity Value Chain Public funding Entrepreneur’s own resources and reinvestment capacities - Grants - Micro-credits - Guarantees - Proof of concept FFF Pre-seed University spin off Equity Private funding - Banks - Guarantees - Leasing - Loans - Loans on trust - Reimbursable advance Corporate Venturing, Seed capital Business Angels Mezzanine VC - Factoring - Micro-credits - Export credits Prerequisites Risk taking investors: private, public Infrastructure: business angels networks, incubators, etc. Intermediaries: advice, investment readiness, tutorship Human capital: professional fund managers, state aids experts FFF : Family, Friends, Founders; BA : Business angels; VC : Venture capital; IPO : Initial Public Offering IPO Regions and Access to Finance Case Study of the Rhône-Alpes (France) TRAINING – ADVICE- SUPPORT « Venture Capital » (National or International) (Sudinnova, Siparex Venture, Banexi, Partech) Incubators CREALYS GRENOBLE INNOEXPERT (CCI Lyon) BUSINESS CENTRE (EM Lyon) Sup. de Co. Grenoble Business development and reception service (CCI) L O C A L FINANCING BUSINESS INCUBATORS (NOVACITES FRAC CREATION) PROJECTS High-tech (strong potential) INDUSTRY AND INDUSTRIAL SERVICES €300,000 + « Seed capital » - National (thematic) (I Source, Emertec, BioAm,…) - Regional ANVAR (Amorçage Rhône Alpes) (product- or process-based innovation) « Business development venture capital » Rhône-Alpes Création Banque Pop., Crédit Agricole Rhône-Dauphiné Développement SMALL INDUSTRIES (CAPACITY SUBCONTRACTING) SERVICES AND TRADE Business Angels « Réseau Entreprendre » (Loans on trust + Sponsorship) « ARJE » (Regional repayable short-term loans for new businesses—1-5 years) €300,000 to €45,000 €45,000 to €15,000 (traditional, moderately innovative activities) Sponsorship Local platforms Entreprendre en France Banks + Comité Sofaris CCI + professionals Chartered accountants (ATEN) MICRO BUSINESSES TRADE CRAFTS « Local platforms » (Loans on trust) Local initiative platform ADIE €15,000 to « P.C.E. » (BDPME loans) F U N D I N G R E Q U I R E M E N T S S C A L E €7,500 « Mille et Un Talents » (Regional grants) « 3 hours – 3 days » DEVELOPMENT TYPES Source: RHONE-ALPES CREATION Case Study Wales (United Kingdom) The region of Wales (UK) re-organised all its financial services around a single organisation called Finance Wales (www.financewales.co.uk) to provide the following financial services and products: ► ► ► ► ► ► Community loans amounting to US$ 10.000 to US$ 100.000 for the social economy Xenos: its business angels network Spinout: unsecured loans without interest of up to US$ 50.000 for university spinouts Venture capital: up to US$ 1.500.000 per financial pool and US$ 3.000.000 in total Mezzanine: US$ 20.000 to US$ 800.000 Loans: from micro-credit of US$ 2000 to US$ 20.000 to loans of up to US$ 1.200.000 Roadmap to Financing Options Founders Sweat equity Science for Hire On Spec Federal Corporations Debt Equity Profit Licensing Partnerships IP sale Family, friends Personal credit banks Business angels Fed,State loans Venture Capital Referral network Accountants Attorneys Successful entrepreneurs, etc Corporations Investment banker Financing Options as a Function of Application & Resources Required •Spin-off •Joint venture •Equity investment A lot •Joint R&D •Licensing •Strategic alliance •Equity investment $ REQUIRED •Bootstrap •Angel investment •Debt financing •Partnerships •Licensing •Angel investment A little Few Many APPLICATIONS THE ENTERPRISE FINANCING PROCESS Grow th Financing needs High Risk .O I.P MARKET GAP MARKET GAP IES T N RA A GU nk Ba ans Lo ss e n si ls Bu nge A ; ur e en ep , r t ily s En m d F a ien r F SEED s lic b Pu al m r re Fo ntu al Ve pit ca ec ra to ed l Se ita p Ca y uit q E id Low Risk STAR T-UP PH ASE E ARLY GROWTH EXP ANSION Financing stage THE ENTERPRISE FINANCING PROCESS Efforts made by financiers Risk Cash flow Time Commercial and Savings Banks Innovation Seed Capital Funds and Public funding Idea Private Investors and Business Angels Start-Up Market introduction Corporate Fund and Venture Capital Growth Maturity Transfer THE ENTERPRISE FINANCING PROCESS Stage in Cycle Type of Funding R&D Start-up Proof of Concept Funding Seed Corn Early growth First Round Accelerating growth Second Round Sustaining growth Maturity growth Development Capital Replacement Capital MBO / MBI Development Capital Public Sector Founders, family and friends Source of Funding Business angels Venture capital funds Corporate venturing Public listing / IPO Investment Continuum High Founder, friends and family Business Angels Level of Investment Risk Assumed by Investor Venture Capitalists Corporate VC Equity Markets Commercial banks Low Seed * “Angel Investing” Osnabrugge & Robinson Start-Up Early Growth Established Angel market addresses the $500K investment gap between love money and serious money VENTURE CAPITAL (Formal & Informal) ► Institutional operators (formal venture capital) Private subjects ► Banks ► Insurance ► Corporate venture capital ► ► Non-institutional operators (informal venture capital) ► Business Angels FORMAL AND INFORMAL EQUITY PROVIDERS Business Angels Formal venture capital * Personnel Entrepreneurs Investors Firms funded Small, early stage Large, mature Due diligence Minimal Extensive Investment's location Of concern Not important Contracts used Simple Comprehensive Monitoring ex-post Active 'hands-on' Strategic Exiting the firm Of lesser concern Highly important Rates of return Of lesser concern Highly important Source: van Osnabrugge, 1998, p.2 FORMAL AND INFORMAL EQUITY PROVIDERS VC – Easy to find via directories BA – Difficult to find – Your request is only one among many hundred a VC receives – Request often strong personal involvement – Can often via syndication provide large investment – Limited amount to invest – Thorough and formal due diligence and investment process – Exit route very important – Investment decisions often quick and less formal – Syndication more and more usual – Exit route less in focus BUSINESS ANGEL (BA) - Definition “A Business Angel is a middle aged male with reasonable net income, personal net worth, previous start up experience, who makes one investment a year, usually close to home or office, prefers to invest in high technology and manufacturing ventures with an expectation to sell out in three to five years time”. (Kelly and Hay, 1996) ”Business angels (informal investors, independent investors) are investors who provide risk capital directly to new and growing businesses in which they have no prior connection”. (Harrison and Mason, 1996) BUSINESS ANGEL (BA) Attitudes, behaviour and characteristics: • male, rarely female • successful experience as an entrepreneur or manager • high net worth individual and / or sophisticated investor • have a declared propensity to invest and to risk in a start-up firm • invest their own money (around 50K – 250K euro) (part of their cash capital: 20 - 30 %) • Seeking profit, but also fun (seeking minimum 20% return) • are willing to share their managerial skills and their enterprise background • often invest in their region of residence • make one investment a year • prefer high-technology and manufacturing • take a minor participation – medium term investment • are willing to wait for an exit for 3-5 years ANGEL’S – Success Stories Company name Angel Investor Business Investment Value at Exit Apple Computer (Name Witheld) Computer hardware $91.000 $154 million Amazon.com Thomas Alberg Online bookshop $100.000 $26 million Blue Rhino Andrew Filipowski Propane $500.000 cylinder replacements $24 million Lifeminders.com Frans Kok Internet e-mail $100.000 reminder service $3 million Body Shop Ian McGlinn Body care products £4.000 £42 million ML Laboratories Kevin Leech Kidney medical treatment £50.000 £71 million Matcon Ivan Semenenko Bulk containers £15.000 £2.5 million Source: partially adapted from unpublished data provided by Amis Ventures in 1999 ANGEL STRATEGY High-growth start-ups: new businesses that are likely to see sales grow to around € 1M and employment to between 10 and 20 people in early years and export oriented. Key selection criteria of risk capital investors (generally): • New products or technological improved products in an existing market • A product or service that can be taken to market without further development (i.e., past the initial concept stage) • Creation of new markets • Company’s growth should be expected to be higher than market growth • Increase of market share against competitors • Superiority regarding competitors ANGEL DUE DILIGENCE PROCESS Technology Technology development Product development Process development Product supply Deliveries Market Marketing Sales PR Competitors Organization Recruitment Board Network of service suppliers Office Economy / Finance Cash forecast Finance activities Cost estimate Budget IPR Angel Motivations ► Altruistic - willing to provide: ► Advice - financial and management Contacts - broad range to assist in development of venture Hands-on Involvement - at basic level, if required Governance - Board of Directors / Advisors Credibility - sends good signals to customers, partners & investors Pragmatic Will hand off involvement to next level of investors … Therefore will use same criteria as VC to evaluate opportunity 57% of companies with angel investment achieve VC funding Dr. Allan Riding, Carleton University research on Ottawa angels 10% of companies with no angels achieve VC funding Types of Business Angels ► Professional Doctors, lawyers, accountants ► Micromanagement Very hands on with lots of experience, but may be toxic ► Enthusiast Usually retired, investing is a hobby, little value add ► Corporate Retired senior managers looking to support their investments or create a new senior job for themselves “Millions of years of evolution, and that’s the latest model?!?” ► Entrepreneurial Most active, successful entrepreneurs looking to diversify portfolio or expand current business Investing Approaches Sprinkle and Sprout Approach - Investors make many smaller investments Bet on management Follow-on investment in successful sprouts Fewer than 25% of the “sprinkled seeds” sprout successfully * Heavy Lifting Approach - Investors make fewer, larger investments - Understand market - Active involvement, Advisory Board - 75% of investees succeed * * ONSET Ventures research THE U.S. ENTREPRENEURSHIP SUCCESS STORIES FIRST COMPANY WHICH ACHIEVED $ 100 MILLION SALES IN THE FIRST YEAR: COMPAQ INC. ► PRODUCT: PORTABLE PC’S ► HEADQUARTERS: HOUSTON, TEXAS ► FIRST COMPANY WHICH ACHIEVED $1 BILLION SALES IN THREE YEARS: SUN MICROSYSTEMS INC. ► PRODUCT: WORKSTATIONS + SOFTWARE ► HEADQUARTERS: MOUNTAIN VIEW, CALIFORNIA ► ► ► FIRST COMPANY WHICH ACHIEVED $4 BILLION SALES AT INITIAL PUBLIC OFFERING NETSCAPE COMM. CORP. (BOUGHT BY AOL IN 1999) HEADQUARTERS: MOUNTAIN VIEW, CA www.home.netscape.com A Financial Chronology of Google.com Price/share (in US $) 1995 Larry Page & Sergey Brin@Stanford University 1997 0.06 0.50 15 000 US $ creditcards 100 000 US $ B.A. Andy Bechtolstein (Sun Microsystems) Patent OTL fin 1998 mai 1999 2.34 85 25 000 000 US $ 2 V.C. Kleiner Perkins (Sequoia) 2001 15 000 000 US $ of which Yahoo août 2004 295 NB: 960 000 US $ 3 B.A. OTL receives2 % of the shares 2005 2 718 281 828 US $ I.P.O. 4 000 000 000 US $ Capital increase turnover. 200 000 US $ 1999 8 000 000 000 US $ 2006 Source: Hervé Lebert Amgen: A Capital Venture ►World’s largest biotech company ►Founded 1980 $19 million venture capital investment ►2007 Financial Year $14.8 billion revenues $4.8 billion profit (before tax) ►Market capitalisation: $51 billion 58 Venture Capital ► Invest in: Private companies with high growth potential Launch, early development, or expansion Management buy-outs and buy-ins ► Raise funds for investment from: Private and public pension funds Endowment funds Foundations, corporations, wealthy individuals ►Looking for >5-fold return on investment within 5 years 59 Venture Capital ► Profit and risk sharing (high risk – high return) ► 10 to 15% of portfolio will give very high returns ► Detailed due diligence ► High level of hand holding ► Ownership and control of business shared ► Patient, flexible financing (5-7 years to exit) ► Highly selective financing – importance of deal flow 60 Exit Strategy ►Exit through the stock exchanges (“IPO”) ►Sell to another VC company/strategic investor ►Strategic mergers and acquisitions ►Issues in Exit : Minimum return expected by VC fund. Minimum equity size for public issue 61 Venture Capital Drivers Fund Providers Money Venture Capital Firms Limited Partners 2.5% Annual Fee General Partners 20% capital gains Pension Funds Individuals Corporations Ins Companies Foreign Sources Endowments 80% of capital gains + principal Customer (Revenue to VC firms) Portfolio Companies Money Entrepreneurs IPOs and Mergers Equity Management (SG&A) Supplier (Cost of Goods Sold) Venture Capital is a money distribution business where entrepreneurs compete for “shelf space” and where only 1 in 100 companies get funded! What VCs are Looking for Products A novel biological or chemical hypothesis ► A well understood mechanism of action ► Proof of principle ► Significant unmet need ► A strong IP position (both freedom to operate and power to exclude) ► A strategy for partnering so that the risks associated with the timing of FDA approval can be passed on to someone else (although clear clinical endpoints are a plus) ►