Financial Analysis Group Project

advertisement

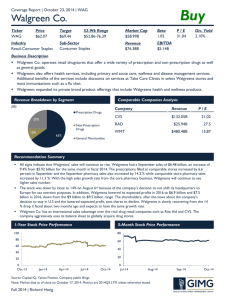

Running Head: LTP COMPREHENSIVE FINANCIAL ANALYSIS PAPER Learning Team Project: Comprehensive Financial Analysis Paper Team A George Bartus Sarah Farner Gina Gudowski Thomas Keith Siena Heights University LDR 640 Financial Systems Management Prof. Lihua Dishman May 26, 2014 1 LTP COMPREHENSIVE FINANCIAL ANALYSIS PAPER Abstract The Walgreen Co. was founded in 1901 by Charles R. Walgreen in Chicago, Illinois (Walgreens). Charles Walgreen built the Walgreen Co. from its initial 50 feet by 20 feet store to the 8,688 Walgreens stores in operation today (Walgreens: our past). The massive growth of Walgreens drug stores over the past century speaks to the overall financial strength of the company; however, through a comprehensive financial analysis, utilizing the five basic groups of financial ratios, this paper will examine the overall financial strength of the Walgreen Co. This process will demonstrate that Walgreen Co is expected to grow in future years and will continue to be a viable investment for investors of all types. 2 LTP COMPREHENSIVE FINANCIAL ANALYSIS PAPER 3 Regardless of the size, a corporation’s financial viability can be determined through financial statement analysis. The income statement, balance sheet and statement of cash flows are basic indicators of financial condition and are the end products of the financial accounting process (Hawawini & Viallet, 2011). The balance sheet shows what a company owns and what they owe at a given period of time (Hawawini & Viallet, 2011). The income statement is often referred to as the “profit-and-loss” statement and determines the difference between a firm’s revenues and expenses over a given period of time (Hawawini & Viallet, 2011). The statement of cash flows report a company’s cash transactions over a given period of time (Hawawini & Viallet, 2011). The three basic financial statements are utilized to determine financial ratios, which are tools used to compare the financial statements of various companies regardless of industry and firm size. Liquidity refers to a firm’s ability to turn assets into cash (Hawawini & Viallet, 2011). Liquidity ratios measure the capacity of the business to meet short term financial commitments as they become due (Small Business Development Corporation). Essentially, the higher the value of the ratio, the better the firm can cover its short term debts (Investopedia). There are two main types of liquidity ratios, the current ratio and the quick ratio. The current ratio is obtained by dividing a firm’s current assets by its current liabilities. (Hawawini & Viallet, 2011). The ratio determines whether a firm has enough current assets to meet its short term obligations. The larger the current ratio, the more liquid the firm; however, the current ratio should be at least greater than or equal to one (Hawawini & Viallet, 2011). The quick ratio also determines whether or not a firm has enough current assets to meet its short term obligations, however, this ratio excludes inventory (Hawawini & Viallet, 2011). As a result, the quick ratio is a more conservative measure of liquidity. LTP COMPREHENSIVE FINANCIAL ANALYSIS PAPER 4 Solvency is a firm’s ability to meet its long term cash obligations (Hawawini & Viallet, 2011). The solvency ratio quantifies the size of a company’s after tax income, excluding noncash depreciation expenses, and compares it to the total debt obligations of the firm (Hawawini & Viallet, 2011). Also, it provides an assessment of the likelihood of a company to continue congregating its debt obligations (Ready Ratios). The solvency ratio is calculated through adding the after tax net profit and depreciation and dividing by total liabilities (Ready Ratios). A firm with a solvency ratio of at least 20% is considered to be financially sound (Ready Ratios). Firms with lower solvency a ratios are more likely to default on their debt. Asset management ratios compare how well a firm uses its assets such as inventory, accounts receivable, and fixed assets to generate sales and revenue (Ready Ratios). There are multiple types of asset management ratios, including total asset turnover which determines how well a firm is managing all of their available assets in the form of sales generation. Accounts payable turnover ratios help to determine how fast a company pays off its creditors (Ready Ratios). The inventory turnover ratio is another asset management ratio that determines the number of times inventory is sold or used in a given time period (Ready Ratios). Profitability ratios refer to how successful a company is at running their business. They determine if a company is making money, whether or not their profitability is in line with the competition, and if their profit is going up or down (Morning Star, 2010). There are a few types of profitability ratios, one of the most basic being return on equity. Return on equity measures a firm’s return on investments by shareholders (Morning Star, 2010). It is calculated by dividing earnings after tax by owners’ equity (Hawawini & Viallet, 2011). Another basic profitability ratio is gross margin, which is the amount of each dollar of sales that a company keeps in the LTP COMPREHENSIVE FINANCIAL ANALYSIS PAPER form of profit (Morning Star, 2010). Gross margin is obtained by dividing gross profit by sales (Morning Star, 2010). The final basic group of financial ratios is market value ratios. Market value ratios determine the economic status of your company in the marketplace and are comprised of a few ratios including earnings per share, price to earnings ratio, and market to book ratio. The earnings per share ratio is a measure of a firms normalized earnings after tax (Hawawini & Viallet, 2011). This ratio is calculated by dividing earnings after tax by the number of shares outstanding (Hawawini & Viallet, 2011). The price to earnings ratio is the ratio of a firms current share price compared to its current share earnings and is obtained by dividing the share price by the earnings per share (Hawawini & Viallet, 2011). Finally, the market to book ratio allows investors to see how much a firm is actually valued relative to the market value and is obtained by dividing the share price by the book value per share (Hawawini & Viallet, 2011). 5 LTP COMPREHENSIVE FINANCIAL ANALYSIS PAPER Walgreens- Balance Sheet Cash and Equivalents Receivables Inventories Other Current Assets Total Current Assets Property, Plant & Equipment, Gross Accumulated Depreciation & Depletion Property, Plant & Equipment, Net Intangibles Other Non-Current Assets Total Non-Current Assets Total Assets Liabilities & Shareholder Equity Accounts Payable Short Term Debt Other Current Liabilities Total Current Liabilities Long Term Debt Deferred Income Taxes Other Non-Current Liabilities Minority Interest Total Non-Current Liabilities Total Liabilities Preferred Stock Equity Common Stock Equity Common Par Additional Paid In Capital Cumulative Translation Adjustment Retained Earnings Treasury Stock Other Equity Adjustments Total Capitalization Total Equity Total Liabilities & Stock Equity Total Common Shares Outstanding Preferred Shares Treasury Shares Basic Weighted Shares Outstanding Diluted Weighted Shares Outstanding 6 Aug-13 2,106.00 2,632.00 6,852.00 284 11,874.00 18,181.00 Aug-12 1,297.00 2,167.00 7,036.00 260 10,760.00 17,160.00 Aug-11 1,556.00 2,497.00 8,044.00 225 12,322.00 15,834.00 Aug-10 1,880.00 2,450.00 7,378.00 214 11,922.00 15,019.00 6,043.00 5,122.00 4,308.00 3,835.00 12,138.00 1,307.00 7,752.00 23,607.00 35,481.00 12,038.00 1,286.00 7,217.00 22,702.00 33,462.00 11,526.00 1,212.00 377 15,132.00 27,454.00 11,184.00 1,114.00 168 14,353.00 26,275.00 4,635.00 570 2,750.00 8,883.00 4,477.00 600 2,067.00 0 7,144.00 16,027.00 0 19,454.00 80 1,074.00 0 21,523.00 -3,114.00 -109 23,931.00 19,454.00 35,481.00 946.6 0 81.58 946 955.2 4,384.00 1,319.00 0 8,722.00 4,073.00 545 1,886.00 0 6,504.00 15,226.00 0 18,236.00 80 936 0 20,156.00 -2,985.00 49 22,309.00 18,236.00 33,462.00 944.06 0 84.12 874.7 880.1 4,810.00 13 674 8,083.00 2,396.00 343 1,785.00 0 4,524.00 12,607.00 0 14,847.00 80 834 0 18,877.00 -4,926.00 -18 17,243.00 14,847.00 27,454.00 889.29 0 136.11 915.1 924.5 4,585.00 12 73 7,433.00 2,389.00 318 1,735.00 0 4,442.00 11,875.00 0 14,400.00 80 684 0 16,848.00 -3,101.00 -111 16,789.00 14,400.00 26,275.00 938.61 0 86.79 981.7 987.9 LTP COMPREHENSIVE FINANCIAL ANALYSIS PAPER Walgreens-Income Statement Sales Cost of Sales Gross Operating Profit Selling, General, and Administrative Expenses Research & Development Operating Income before D & A (EBITDA) Depreciation & Amortization Interest Income Other Income – Net Special Income / Charges Total Income Before Interest Expenses (EBIT) Interest Expense Pre-Tax Income Income Taxes Minority Interest Net Income From Continuing Operations Net Income From Discontinued Operations Net Income From Total Operations Extraordinary Income/Losses Income From Cum. Effect of Acct. Change Income From Tax Loss Carryforward Other Gains / Losses Total Net Income Normalized Income (Net Income From Continuing Operations, Ex. Special Income / Charge) Preferred Dividends Net Income Available To Common Basic EPS from Continuing Ops. Basic EPS from Discontinued Ops. Basic EPS from Total Operations Basic EPS from Extraordinary Inc. Basic EPS from Cum Effect of Accounting Change Basic EPS from Tax Loss Carryf'd. Basic EPS from Other Gains (Losses) Basic EPS, Total Basic Normalized Net Income/Share EPS fr Continuing Ops. EPS fr Discontinued Ops 7 Aug-13 72,217.00 49,815.00 22,402.00 17,543.00 0 4,859.00 1,283.00 0 484 0 4,060.00 165 3,895.00 1,445.00 0 2,450.00 0 2,450.00 0 0 0 0 2,450.00 Aug-12 71,633.00 50,125.00 21,508.00 16,878.00 0 4,630.00 1,166.00 0 0 0 3,464.00 88 3,376.00 1,249.00 0 2,127.00 0 2,127.00 0 0 0 0 2,127.00 Aug-11 72,184.00 50,606.00 21,578.00 16,561.00 0 5,017.00 1,086.00 0 434 0 4,365.00 71 4,294.00 1,580.00 0 2,714.00 0 2,714.00 0 0 0 0 2,714.00 Aug-10 67,420.00 47,414.00 20,006.00 15,518.00 0 4,488.00 1,030.00 0 0 0 3,458.00 85 3,373.00 1,282.00 0 2,091.00 0 2,091.00 0 0 0 0 2,091.00 2,450.00 2,127.00 2,714.00 2,091.00 2,450.00 2.59 0 2.59 0 2,127.00 2.43 0 2.43 0 2,714.00 2.97 0 2.97 0 2,091.00 2.13 0 2.13 0 0 0 0 0 0 0 2.59 2.59 2.56 0 0 0 2.43 2.43 2.42 0 0 0 2.97 2.97 2.94 0 0 0 2.13 2.13 2.12 0 LTP COMPREHENSIVE FINANCIAL ANALYSIS PAPER Walgreens – Income Statement Cont’d EPS fr Total Ops. EPS fr Extraord. Inc. EPS fr Cum Effect of Accounting Change EPS fr Tax Loss Carfd. EPS fr Other Gains (L) EPS, Total Diluted Normalized Net Inc/Shr (Net Income From Continuing Operations, Ex. Special Income / Charge) Dividends Paid per Share 8 Aug-13 2.56 0 0 0 0 2.56 Aug-12 2.42 0 0 0 0 2.42 Aug-11 2.94 0 0 0 0 2.94 Aug-10 2.12 0 0 0 0 2.12 2.56 1.14 2.42 0.95 2.94 0.75 2.12 0.59 LTP COMPREHENSIVE FINANCIAL ANALYSIS PAPER Walgreens – Statement of Cash Flows Cash Flow From Operating Activities Net Income (Loss) Operating Gains/Losses Extraordinary Gains / Losses (Increase) Decrease In Receivables (Increase) Decrease in Inventories (Increase) Decrease In Other Current Assets (Decrease) Increase In Payables (Decrease) Increase In Other Current Liabilities (Increase) Decrease In Other Working Capital Other Non-Cash Items Net Cash From Continuing Operations Net Cash From Discontinued Operations Cash Provided By Investing Activities Net Cash From Total Operating Activities Sale of Property, Plant & Equipment Cash Used for Investing Activities Sale of Short-Term Investments Purchases of Property, Plant & Equipment Acquisitions Purchases of Short-Term Investments Other Cash from Investing Activities Cash Provided by Financing Activities Net Cash From Investing Activities Issuance of Debt Cash Used for Financing Activities Issuance of Capital Stock Repayment of Long-Term Debt Repurchase of Capital Stock Payment of Cash Dividends Other Financing Charges, Net Net Cash From Financing Activities Effect of Exchange Rate Changes Net Change in Cash & Cash Equivalents 9 Aug-13 Aug-12 Aug-11 Aug-10 2,450.00 2,127.00 2,714.00 2,091.00 -344 0 -434 0 0 0 0 0 -449 394 -243 124 321 1,083.00 -592 -307 18 -4 0 0 182 -439 384 167 527 -412 320 272 68 109 88 160 97 142 188 144 4,301.00 4,431.00 3,643.00 3,744.00 0 0 0 0 4,301.00 4,431.00 3,643.00 3,744.00 0 123 79 0 16 0 0 3,500.00 -1,212.00 1,550.00 1,213.00 1,014.00 -610 -536 -188 -779 -66 0 0 3,000.00 100 128 -203 19 -1,996.00 5,860.00 1,525.00 1,274.00 4,000.00 3,000.00 0 0 486 0 0 0 -4,300.00 0 -17 -576 -615 1,191.00 2,028.00 1,756.00 -1,040.00 -787 -647 -541 -27 148 250 196 -1,496.00 1,170.00 2,442.00 2,677.00 0 0 0 0 809 -259 -324 -207 LTP COMPREHENSIVE FINANCIAL ANALYSIS PAPER 10 Financial Ratio Analysis We calculated twelve financial ratios for Walgreens during the 2013 fiscal year. The ratios have been divided into five categories; liquidity, solvency, asset management, profitability, and market value ratios. We independently calculated the ratios and will analyze the ratios below. Financial Ratios Walgreens Current Ratio Current assets/current liabilities Quick Ratio Cash+Accounts Receivable Current Liabilities Debt to Equity Ratio Total Debt/Total Equity Times Interest Earned Ratio EBIT/Interest Expenses Inventory Turnover COGS/Ending Inventories Total Assets Turnover Ratio Sales/Total Assets Earnings Per Share EAT/# of shares of common stock outstanding Debt to Asset Ratio Total Debt/Total Assets Return on Sales EAT/Sales Return on Assets EAT/Total Assets Return on Equity EAT/Total equity Price to Earnings Ratio Price per share/Earnings per share 2013 1.336711 2012 1.234 2011 1.524 0.5333784 0.409 0.501 0.259432507 0.29568 0.16226 24.60606061 39.3636 61.4789 7.270140105 7.12408 6.29115 2.035371 2.14073 2.62927 2.588210437 2.25303 3.05187 0.377042277 0.50112 0.1955 0.03392553 0.02969 0.0376 0.069051041 0.06356 0.09886 0.12593811 0.11664 0.1828 22.4375 15.2934 11.2449 Liquidity ratios reflect an organizations ability to pay its debt. The current ratio divides the current assets by the liabilities. Walgreens has $1.33 of assets to every dollar of liability which is the current ratio. The quick ratio reflects an organizations ability to pay its current debt LTP COMPREHENSIVE FINANCIAL ANALYSIS PAPER as it due. The quick ratio excludes inventories and prepaid assets with Walgreens having a .53 to 1 quick ratio. Usually an organization can improve their quick ratio through better management of their product cycle. A quick ratio below zero is less than desirable (Porter, 2011). The debt to equity and times interested earned ratio were the solvency ratios used to describe an organizations long term financial stability beyond paying their short term debt. The debt to equity ratio was calculated by dividing the total debt by total equity which was .25 for 2013. For every dollar of capital the stock holders provided 25 cents was provided by creditors. Walgreens may be placing a special emphasis to keep their debt significantly lower than the past. The times earned interest ratio places an emphasis on payment owed on interest, specifically we mentioned the organizations ability to meet the interest on current year payments out of current year earning (Porter, 2011). The times interest earned ratio was 24.6 to 1. This means that for every dollar Walgreens pays in interest they earn 21 more dollars. This is more than enough to pay the interest for this current year. In the asset management category we calculated the inventory turnover, and total asset turnover ratios. The inventory turnover ratio represents how many times inventory is sold in a period. Walgreens on average sells their inventory seven times a period. The total asset turnover ratio for Walgreens was .2 and represents the relationship between net sales and total assets. Walgreens has two times the sales than their average assets. Profitability ratios calculated were return on sales, equity, and asset ratios. The return on sales was 3 percent. Walgreens is earning 3 cents on each dollar of sales. Return on equity expresses the amount earned on income from investments. The return on equity was 12 percent which explains profitability from the owner’s perspective. 11 LTP COMPREHENSIVE FINANCIAL ANALYSIS PAPER The market value ratios are expressed through the price per earnings and earnings per share ratios. Earnings per share was $2.58 which means that each investors earned 2.58 per share of stock that he or she purchased. The price to earnings ratio was calculated at 22.4 which means that Walgreens is trading at 22 times its current earnings (Hawawini, 2011. p. 159). Trend Analysis The financial ratios for Walgreens were calculated using data from the income statement, balance sheet and cash flow statement for the years 2011, 2012 and 2013. The current ratio dipped from a high of 1.52 in 2011 to 1.34 in 2012 with a recovery of sorts in the third year 2013. The quick ratio exhibited a similar dip in 2012 but was close to .5 in all three years. The current ratio should be above 1 and close to 2 to show profitability. The quick ratio is desired to be as close to 1 as possible. Walgreens debt to equity ratio averaged 24% for the fore mentioned three years with a low of 16% and a high of 30%. This could be due to a move to leverage debt for tax purposes. The Times Interest Earned ratio moved from a high of 66% in 2011 to a low of 25% in 2013 another trend based on borrowing. Inventory Turnover held steady at an average of 7.1 times per year which is indicative of steady sales. The Total Asset Turnover ratio did move from a high of 2.7 in 2011 to a low of 2.03 in 2013 showing a downward reduction. The recorded three years had a dipping trend for the Earning per Share with a high in 2011 dipping in 2012 and recovering in 2013. The Debt to Asset ratio showed an increase from the base year to the middle year from 20% to 50% indicating borrowing in 2012. The Return on sales held relatively steady at an average of 3.4% for the reported years. The Return on Assets and Return on Equity dipped in 2012 but recovered nicely in 2013. The P/E ratio increased nicely doubling from 2011 to 2013 to 22.4. 12 LTP COMPREHENSIVE FINANCIAL ANALYSIS PAPER 13 In conclusion, the indicators shown by the ratios discussed above describe a company with competent management, a well thought-out capital structure achieving a large sales volume with reasonable risk. The balance sheet shows steady earnings for the investors and an increasing stock price. Peer Group Analysis Liquidity ratios: Current Ratio Current assets/current liabilities Quick Ratio Cash+Accounts Receivable Current Liabilities 2013 1.336711 2012 2011 1.233662004 1.524434 0.533378363 0.408621876 0.501423 Liquidity Ratios Current Ratio Quick Ratio 1.71 Riteaid Corp 0.51 1.64 CVS Caremark Corp 0.93 1.33 Walgreens 0.53 (Market Watch, 2014) Walgreens is looking at a steady price to earnings ratio for the past three years. You will see that there was a slight change in 2012, and back up again in 2013. We can see future growth LTP COMPREHENSIVE FINANCIAL ANALYSIS PAPER 14 expected for the company as the Quick ratio numbers rise. CVS Caremark is more favored when compared to Walgreen in their liquidity. It is hard to determine if the differences are truly showing the firm’s assets to liabilities. The current ratios are not always the most defined reliability measure for liquidity (Viallet & Hawawini, 2011). Solvency: Debt to Equity Ratio Total Debt/Total Equity Times Interest Earned Ratio 2013 0.259432507 2012 2011 0.295678877 0.162255 24.60606061 39.36363636 61.47887 EBIT/Interest Expenses The Debt to Equity Ratio can be very informative on how a company is investing the growth of their company. Financially we do not want to see a high ratio, which would be showing much of the company is being funded with financing. This is clear sign that the company might be struggling. Walgreens ratio is in a very safe area, 0.25 in 2013, and .16 in 2011. When analyzing the financial statements in the industry, Walgreens compares fairly average and financially strong in today's market. The times interest earned ratio will indicate how many times the firms pretax operating profits are covering its interest expenses. (Viallet & Hawawini, 2011) In regards to the industry and Walgreens we would like to see Walgreens have the higher ratio because the higher the firms ratio the more capable it is to meet it it's interest payments according to MarketWatch.com. CVS Caremark has a lower ratio in 2013 at .13 which is comparable to other competitors (Market Watch, 2014). Asset Management: Inventory Turnover COGS/Ending Inventories Total Assets Turnover Ratio Sales/Total Assets 2013 7.270140105 2012 7.12407618 2011 6.291149 2.035371 2.140726795 2.629271 LTP COMPREHENSIVE FINANCIAL ANALYSIS PAPER 15 Asset-management is a very important aspect to look at when analyzing a company's financial statement and their financial ratios. When you look at a company’s asset-management we will be able to indicate how successful a company is in utilizing its assets to generate revenues verses that asset turnover ratios are most desired by a company. Companies with a higher ratio in the asset turnovers category the more sales the company is generating from its assets. (Viallet & Hawawini, 2011) Walgreens currently has an inventory turnover of the 7.27 and a total asset turnover ratio of 2.3. From measuring this we can see how efficiency and buying practices for inventory management is profiting the company. It wills also shows the gross profit which is earned each time inventory is turned over. According to CSI market.com Walgreens is currently number 3 within the industry. The website also stated that "Walgreens Co. inventory turnover ratio sequentially increased to a new company high in the last quarter (February 2014). (CSIMarket) Profitability: Return on Sales EAT/Sales Return on Assets EAT/Total Assets Return on Equity EAT/Total equity 2013 0.03392553 2012 2011 0.029693019 0.037598 0.069051041 0.06356464 0.098856 0.12593811 0.11663742 0.182798 LTP COMPREHENSIVE FINANCIAL ANALYSIS PAPER 16 Profitability Ratios 2014 10.1 Riteaid Corp 3.19 12.16 CVS Caremark Corp Return on Equity 6.69 Return on Assets 12.99 Walgreens 7.1 0 5 10 15 (Market Watch, 2014) The first area we will look at in the profitability ratios is the return on equity. Return on equity measures how efficiently a firm can use the money from shareholders to generate profits and grow the company. Walgreens return at equity ratio as 12.99. This is slightly higher than the CVS Caremark Corp. 12.16 and higher than Rite aid Corp. 10.1. What investors look at when analyzing this ratio is a high number ratio. Walgreens is currently staying strong in this category and compared to its top competitors are running the business on a equal level with return on equity. (Viallet & Hawawini, 2011)The next profitability ratio we are going to look at is the return on assets. According to Market Watch Walgreens is at a 7.1 CVS Caremark sits at a 6.69 and Rite aid corp. is at a 3.19 for 2014. This ratio measures the net income produced by total assets dear. This is done by comparing the income to the average total assets. (Market Watch, 2014)This will measure how efficiently a company can manage its assets to produce profits during a certain period. Similar to return on equity would like to also see high numbers and the return on assets category. Walgreens is again above the industry average. This means that LTP COMPREHENSIVE FINANCIAL ANALYSIS PAPER 17 Walgreens is currently effectively managing assets at this time to produce a greater amount of net income (Viallet & Hawawini, 2011). Market Ratios: 2013 2012 2011 Price to Earnings Ratio 22.4375 15.29338843 11.2449 Earnings Per Share 2.588210437 2.253034765 3.051873 EAT/# of shares of common stock outstanding P/E Price to Earning Riteaid Corp 33.48 CVS Caremark Corp 20.14 Walgreens Price to Earning 22.43 0 10 20 30 40 Walgreens is currently enjoying financial strength in the price-to-earnings ratios if you see the chart above the price-to-earnings ratio it will be the stock price divided by the last 12 months of earnings-per-share the P/E ratio used to measure the type of premium will be paying for a stock (Morning Star, 2014). This is also a good way to define future growth for the company. When we evaluate Walgreens and it's top competitors such a CVS Caremark and Rite Aid corporation we can see that Rite Aid has higher P/E Ratio while Walgreens and CVS have a lower P/E ratio compared to the industry average this is a high indication to the stockholders that LTP COMPREHENSIVE FINANCIAL ANALYSIS PAPER they might be paying a premium for the stocks future earnings we want to see the company sitting below both the industry average at this time (Viallet & Hawawini, 2011). Analytical Report When we evaluate Walgreens financial statement and compare it to the industry average we have found that Walgreens compares highly in many categories. The company is financially strong in today's market. If we look at the financial statements using the above charts and graphs complied for the Walgreens Company you will see that their sales growth rate has increased since this time last year. We are currently seen a gross margin of 29.24 and operating margin a 5.25. Both numbers are significant looking at the operating trends that Walgreens is currently experiencing. Market Watch has rated Walgreens with a .67% growth in the drug in retail industry and a 1.07% growth in the retail sector. With the uptrend that Walgreens is currently seeing we can expect that this next year will be a profitable year for Walgreens. (Market Watch, 2014) Assessment and Recommendations Walgreens has a strong position in the national drug store marketplace. The company has been moving into a more diverse retail posture by offering more than the prescription, health and beauty product lines. This movement into an increased component posture has not affected the major indicators of performance such as gross margin and operating margin. The management team has maintained a safe debt to equity ratio and a times interest earned ratio that are favorable when compared to the industry averages. The price to earnings ratio has steadily increased in the last four years while still remaining below the industry average. All ratios show that there is much to like for investors in Walgreens. 18 LTP COMPREHENSIVE FINANCIAL ANALYSIS PAPER The movement to a more diversified product offering has increased all financial indicators leading to the recommendation that management continue to try new offerings based on local buying habits. A trial location should be used to assess the concept of the neighborhood store, bringing back the old time personal service at the friendly drug store. This may create a movement branding the company as different from the competition and generating a competitive advantage. With the competent financial management shown and steady growth Walgreens should maintain a more competitive profile in marketplace. Conclusion The determination of Charles R. Walgreen grew a single Chicago drug store into a national chain, and his vision has enabled the Walgreens to become one of the largest drug store chains in the county. Walgreen’s marketing and creativity has contributed to their growth and success; however, it is their solid financial management that has enabled the chain to maintain their reputation as strong, stable and growing with a positive outlook for investors. 19 LTP COMPREHENSIVE FINANCIAL ANALYSIS PAPER References CSIMarket. (n.d.). Retrieved from http://csimarket.com/stocks/singleEfficiency it.php?code=WAG Hawawini, G. & Viallet, C. (2011). Finance for Executives. Managing for value creation. Mason: South-Western Cengage Learning Investopedia (n.d.). Liquity ratios. Retrieved from http://www.investopedia.com/terms/l/ liquidityratios.asp Market Watch. (2014, May). Retrieved from http://www.marketwatch.com Morning Star (2010) Profitability Ratios. Retrieved from http://news.morningstar.com/classroom2/course.asp?docId=145093&page=6 Morning Star. (2014, May). Retrieved from http://financials.morningstar. com/competitors/industry-peer.action?t=WAG&region=usa&culture=en-US&owner Country=USA Porter, G. A., & Norton, C. L. (2011). Using financial accounting information: the alternative to debits and credits (7th ed.). Mason, OH: South-Western/Cengage Learning. Small Business Development Corporation (n.d.) Liquidity Ratios. Retrieved from https://www.smallbusiness.wa.gov.au/liquidity-ratios Ready Ratios (n.d) Asset management. Retrieved from http://www.readyratios.com/reference/asset/ Ready Ratios (n.d). Solvency ratios. Retrieved from http://www.readyratios.com/reference /analysis/solvency.html Walgreens. (2010 to 2013). Retrieved from NASDAQ: http://www.nasdaq.com/symbol/ wag/financials 20 LTP COMPREHENSIVE FINANCIAL ANALYSIS PAPER Walgreens (n.d.) Walgreens: our past. Retrieved from http://www.walgreens.com/topic/about /history/hist5.jsp 21