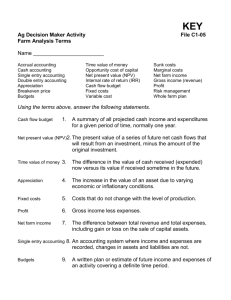

Financial Statements in Agriculture

advertisement

Financial Statements Annie’s Project January 30, 2007 Coweta Oklahoma What are financial statements? Financial statements are the written reports on the financial condition of a business. There are three major types of financial statements. Types of Financial Statements 1. Balance Sheet A statement that shows the wealth of the business at a given date. 2. Cash Flow Statement A summary of the cash inflows and outflows for a business over a given time period. 3. Income Statement A summary of income and expenses for a business over a given time period. Balance Sheet A balance sheet is a summary sheet of everything that is owned and owed by the operation. A balance sheet should be done at the beginning and end of each fiscal time period. A balance sheet can be done using the market value or cost basis methods. Which Method to Use? Market Value Typically used by most lending institutions Easiest to determine Easiest to over or under estimate Due to rapidly changing markets, could overstate or understate net worth. Cost Basis Must have good records Must know depreciation of assets Probably gives a truer picture of the value of the business Parts of a Balance Sheet A balance sheet has three components 1. Assets – what is owned Current and non-current 2. Liabilities – what is owed Current and non-current 3. Net Worth – Assets minus Liabilities Current Assets Current assets are assets that will be used up or sold during the next twelve months. Examples include: Cash, checking accounts, savings Investments Accounts receivable Prepaid expenses Cash investments in growing crops Inventories Market livestock, stored crops, purchased feed, supplies Non-Current Assets Non-current assets are assets that have a useful life of more than 1 year. Examples include: Breeding livestock Machinery, equipment Vehicles Investments in capital leases Land Buildings and improvements Current Liabilities Accounts payable Notes payable Current portion of term debt Accrued interest Taxes payable Deferred taxes Non-current Liabilities Notes payable, non-real estate Notes payable, real estate Deferred taxes Net Worth Net worth of the business is the difference between the total value of the assets and the total value of the liabilities. Net Worth = (Current Assets + Non-current Assets) − (Current Liabilities + Non-current Liabilities) Balance Sheet Exercise Cash Flow Statement A cash flow statement is a summary of cash inflows and outflows divided into equal time periods usually monthly. Cash Inflows Operating receipts Crop and livestock sales, government payments, other farm income Capital sales Contributed capital Cash Outflows Operating expenses (feed, fertilizer, etc.) Capital purchases Family living and other withdrawals Uses of a Cash Flow Statement Establishes target levels for income and expenses which can be used in monitoring progress towards goals Points out potential problems in meeting financial obligations Indicates when cash is available for new investments Cash Flow Exercise Income Statement There are two methods of doing an income statement. 1. Cash Cash receipts and expenses are recorded when the they are paid. Most non-cash expenses are not included. 2. Accrual Records receipts and expenses when they occur. Inventory changes are included. Difference Between Cash Flow and Income Statement Income statement does not include: Capital sales and contributed capital Principal payments Family living expenses Cash flow statement does not include: Depreciation The Accrual Adjusted Income Statement Revenues Livestock and crop sales Changes in inventories Government payments & other farm income Gain/loss from sale of culled breeding stock Change in value due to change in raised breeding livestock numbers Accrual adjustments in asset accounts Changes in Inventories Market livestock Raised crops/feed inventories Gains/Losses on Sale of Culled Breeding Livestock Purchased breeding stock: subtract cost basis from the sale proceeds Raised breeding stock: subtract base value from the sale proceeds Change in Value Due to Change in Raised Breeding Livestock Numbers Number of head transferring from one classification to another, e.g., replacement heifers to cows Differences in base values of the two classifications Accrual Adjustments (Assets) Change in: Accounts receivable Prepaid expenses Cash investment in growing crops Supplies Contracts and notes receivable Investment in cooperatives The Accrual Adjusted Income Statement Expenses Purchased market livestock Cash operating expenses Changes in feed inventories Accrual adjustments for liability accounts Depreciation Cash interest paid Change in accrued interest Accrual Adjustments Changes in: Purchased feed inventories Accounts payable Ad valorem taxes Employee payroll withholdings Accrued expenses Accrued interest Depreciation There are different methods of depreciation. Modified Accelerated Cost Recovery System (MACRS) General Depreciation System (GDS) Alternative Depreciation System (ADS) Which one depends type of property Straight Line Depreciation Cost – Salvage Value Years of Life The Accrual Adjusted Income Statement Net Farm Income, Accrual Adjusted = Gross Farm Revenues - Total Operating Expenses - Total Interest Expense +/- Gain/Loss on Sale of Farm Capital Assets Gains/Losses on Sale of Farm Capital Assets Difference between the value for which the items is sold and the adjusted basis (cost minus depreciation taken) Look at an Income Statement Measuring Financial Stress Liquidity Ability to pay bills as they come due and cover unanticipated events Solvency Ability to cover all debts if the business were sold Profitability Returns to labor and management generated by the operation Financial efficiency Efficiency with which assets generate income Repayment capacity Ability to repay term debt in a timely fashion Measuring Liquidity Current ratio = Total current farm assets Total current farm liabilities 2 Low Stress 1 High Stress Measuring Solvency Debt/asset ratio = Total farm liabilities Total farm assets 40% Low Stress 70% High Stress Measuring Profitability Net Farm Income = Gross farm revenue - all farm operating expenses incurred to create those revenues +/- gains/losses on sale of capital assets Low Stress High Stress Measuring Profitability Rate of Return on Farm Assets = (Net farm income from operations + farm interest expense - value of unpaid labor & management) (Average total farm assets) 5% Low Stress 1% High Stress Measuring Profitability Rate of Return on Farm Equity = (Net farm income from operations - value of unpaid labor & management) (Average total farm equity) 10% Low Stress 5% High Stress Measuring Efficiency and Repayment Capacity Interest Expense Ratio = Total farm interest expense Gross farm revenues 10% Low Stress 20% High Stress Measuring Efficiency Asset Turnover Ratio = Gross farm revenues Average total farm assets 40% Low Stress 20% High Stress Stress Test Exercise